Regulatory News:

IMPLANET (Euronext Growth: ALIMP, FR0013470168, eligible for

PEA-PME equity savings plans) (Paris:ALIMP), a medical technology

company specializing in implants for orthopedic surgery and the

distribution of technological medical equipment, today announced

its 2023 annual revenue and its cash position as of December 31,

2023.

Ludovic Lastennet, IMPLANET’s Chief Executive Officer,

stated: “While we closed 2023 with a good performance on the French

market, our annual revenue had been impacted by the slowdown of our

international activity. Against this backdrop, and as previously

announced, we actively worked to reorganize our US subsidiary, both

by investing in our local sales force and by registering new

solutions in this territory. 2024 should see an acceleration in the

marketing of products resulting from the commercial partnership

signed with Sanyou Medical in June 2022. This will include the

launch of a new range of hybrid posterior fixation system, and the

distribution in our various markets of new medical devices

resulting from collaboration between the French and Chinese R&D

teams. Finally, the commercial launch of our JAZZ® range in China

should start in the coming months, paving the way for a new

territory with significant growth potential. These achievements

will enable us to consolidate Implanet's position as an innovative

player in spinal surgery, both in France and internationally. We

recently announced a fundraising operation to ensure the commercial

development of our solutions and finance our cash requirements for

the next 12 months, for which Sanyou Medical has already committed

€5 million. This operation, open to all our shareholders, will be

launched on January 17, with preferential subscription rights.”

Fourth quarter 2023

In € thousands - IFRS1

2023

2022

Change

France

932

849

+10%

United States

318

389

-18%

Rest of the World

359

743

-52%

Spine revenue

1,608

1,981

-18%

Medical equipment (SMTP)

24

0

-

Services (MADISON)

11

72

-

Total fourth-quarter revenue

1,643

2,053

-20%

Spine activity recorded revenue of €1.64 million in the fourth

quarter of 2023, down 20% compared with the €2.05 million recorded

in the fourth quarter of 2022.

Activity in France grew by 10%, with revenue of €0.93 million

for the quarter, compared with €0.85 million for the same period in

2022. In the United States, following a reorganization of the

subsidiary's sales management in response to poor performance

recorded in this region, revenue came to €0.32 million for the

fourth quarter of 2023, compared with €0.39 million for the same

period in 2022. Export revenue to the Rest of the World came to

€0.36 million for the fourth quarter of 2023, compared with €0.74

million for the same period the previous year, down 52%, mainly due

to a decline in activity in Latin America.

The Company is also pursuing the deployment of its medical

equipment distribution activity with the ultrasound scalpel from

SMTP, a subsidiary of Sanyou Medical. Revenue generated by this

activity in the fourth quarter of 2023 amounted to €0.02

million.

2023 annual revenue

In € thousands - IFRS2

2023

2022

Change

Total first-quarter revenue

2,208

2,016

+10%

Total second-quarter revenue

2,060

2,096

-2%

Total third-quarter revenue

1,537

1,862

-17%

Total fourth-quarter revenue

1,643

2,053

-20%

Total 12 months

France

3,448

3,342

+3%

United States

1,364

1,667

-18%

Rest of the World

2,255

2,926

-23%

Annual Spine revenue

7,067

7,934

-11%

Annual medical equipment (SMTP)

303

-

Annual services (MADISON)

79

93

-

Total annual revenue

7,448

8,027

-7%

Overall, the Company reported revenue of €7.45 million in 2023,

compared with annual revenue of €8.03 million in 2022.

Spine activity recorded revenue of €7.07 million in 2023,

compared with €7.93 million in 2022. Revenue in France remained

stable at €3.45 million. Revenue in the United States in 2023

amounted to €1.36 million, down 18% from €1.67 million in the

previous year, due to the poor performance in the second half of

2023. Export revenue in the Rest of the World also fell by 23% over

the period, to €2.26 million in 2023 from €2.93 million in

2022.

The medical equipment distribution activity generated €0.30

million in 2023.

Cash position

As of December 31, 2023, the Company’s cash position stood at

€0.25 million. Based on current cash forecasts, the Company points

out that this level of cash will enable it to be financed until

February 2024.

As described in its press release of January 4, 2024, the

Company announced the launch of a €6.38 million issue of new shares

with preferential subscription rights, to which Sanyou (HK)

International Medical Holding Co., limited is committed to

subscribing up to €5.0 million.

Based on current business assumptions and anticipated commercial

developments with Sanyou Medical, the Company estimates that the

capital increase, for a minimum amount of €5 million, would provide

it, once completed, with financial visibility of more than 12

months3.

Reminder of 2023

highlights

- Commercial launch of the SMTP (Sanyou Medical subsidiary)

ultrasound scalpel;

- FDA clearance of the SqualeTM range of anterior cervical cages

in the United States;

- Commercial launch in Europe of the MIS range, a minimally

invasive pedicle screw positioning system;

- Launch of the surgeon training program with a view to marketing

the JAZZ® range in China.

Upcoming financial

publication

- 2023 Annual Results, on March 5, 2024, after market

About IMPLANET

Founded in 2007, IMPLANET is a medical technology company that

manufactures high-quality implants for orthopedic surgery and

distributing medical technology equipment. Its activity revolves

around a comprehensive innovative solution for improving the

treatment of spinal pathologies (JAZZ®) complemented by the product

range offered by Orthopaedic & Spine Development (OSD),

acquired in May 2021 (thoraco-lumbar screws, cages and cervical

plates). Implanet’s tried-and-tested orthopedic platform is based

on the traceability of its products. Protected by four families of

international patents, JAZZ® has obtained 510(k) regulatory

clearance from the Food and Drug Administration (FDA) in the United

States, the CE mark in Europe and ANVISA approval in Brazil. In

2022, IMPLANET entered into a commercial, technological and

financial partnership with SANYOU MEDICAL, China's second largest

medical device manufacturer. IMPLANET employs 43 staff and recorded

a consolidated revenue of €8.0 million in 2022. Based near Bordeaux

in France, IMPLANET opened a US subsidiary in Boston in 2013.

IMPLANET is listed on the Euronext Growth market in Paris.

For further information, please visit www.Implanet.com.

Disclaimer

This press release contains forward-looking statements about

Implanet and its business. Implanet believes that these

forward-looking statements are based on reasonable assumptions.

However, no assurance can be given that the forecasts expressed in

these forward-looking statements will materialize, as they are

subject to risks, including those described in Implanet's reference

document filed with the Autorité des marchés financiers (AMF) on

April 16, 2018 under number D.18-0337 and in the annual financial

report for December 31, 2022, which are available on the Company's

website (www.implanet-invest.com), and to changes in economic

conditions, financial markets and the markets in which Implanet

operates. The forward-looking statements contained in this press

release are also subject to risks that are unknown to Implanet or

that Implanet does not currently consider material. The occurrence

of some or all of these risks could cause Implanet's actual

results, financial condition, performance or achievements to differ

materially from those expressed in the forward-looking statements.

This press release is for information purposes only and does not

and shall not under any circumstances constitute an offer to sell

or subscribe, or the solicitation of an order to buy or subscribe,

Implanet securities in any country.

_______________

1 Unaudited 2 Unaudited 3 The Company reminds that

the interim financing in the form of dry bonds from which it

benefited in October 2023, subject to two tranches, representing a

nominal amount of €1,300,000, subscribed at 77% of the nominal

value of the bond, will have to be repaid at the latest within five

business days following the earlier of (i) April 30, 2024 and (ii)

the completion of the Capital Increase (press release of October

11, 2023).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240115665417/en/

IMPLANET Ludovic Lastennet, CEO David Dieumegard, CFO

Tél. : +33 (0)5 57 99 55 55 investors@Implanet.com

NewCap Investor Relations Mathilde Bohin Nicolas Fossiez

Tél.: +33 (0)1 44 71 94 94 Implanet@newcap.eu

NewCap Media Relations Arthur Rouillé Tél.: +33 (0)1 44

71 94 94 Implanet@newcap.eu

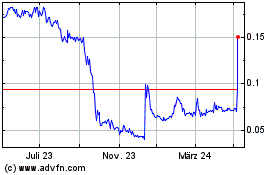

Implanet (EU:ALIMP)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

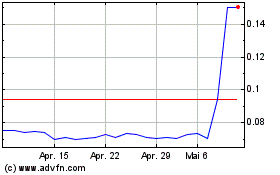

Implanet (EU:ALIMP)

Historical Stock Chart

Von Apr 2023 bis Apr 2024