Huobi (HTX) Troubles Mount: Justin Sun Accused Of $2.4B Shortfall In User Funds

27 September 2023 - 12:00AM

NEWSBTC

HTX (formerly known as Huobi), one of the leading cryptocurrency

exchanges, has been embroiled in a new controversy as Justin Sun,

Tron’s founder and BitTorrent’s CEO, faces allegations of a

staggering $2.4 billion shortfall in user funds. Adam

Cochran, Managing Partner at Cinneamhain Ventures, has shed light

on the intricate details of the alleged malpractice, revealing a

web of “financial manipulations.” Related Reading: Maker (MKR)

Price Continues to Climb Higher Level, Will It Surpass $1500? Huobi

Crisis Unveiled? Cochran’s analysis raises concerns over Huobi’s

financial stability, questioning the integrity of the exchange’s

claims regarding its holdings of Ethereum (ETH) and USDT, a

stablecoin pegged to the US dollar. As seen in the chart

above, while Huobi asserts assets worth $200 million in ETH,

Cochran’s investigation, corroborated by defillama data, reveals a

discrepancy, with the actual value amounting to under $113 million,

even when considering wrapped ETH (WETH) and staked ETH (stETH).

The situation further unravels when examining Huobi’s purported

$624 million USDT holdings. However, Cochran’s findings indicate

that only $119 million of USDT resides within the exchange, while

the remaining balance is in staked USDT (stUSDT). What raises

suspicion is that Justin Sun has enabled staked USDT (stUSDT) a

staking feature, which allows users to stake either USDT or TUSD

(TrueUSD) to earn stUSDT, as reported by NewsBTC. Allegations

Mount Against Justin Sun Instead of following the expected

protocol of burning staked assets to claim the cash and take it

offline, these funds are redirected to Justin Sun’s addresses or

utilized to support JustLend, a lending platform associated with

the Huobi ecosystem. Contrary to Huobi’s claim that it burns the

stUSDT with Tether, Cochran’s investigation reveals that the

counterparties for USDT on Huobi are the exchange’s deposit wallets

or Binance. This suggests that Justin Sun may utilize USDT

from user balances on Huobi to generate stUSDT, subsequently

leveraging the underlying USDT to support JustLend or repurchase

TUSD on Binance. Cochran concludes that this complex financial

arrangement, including TUSD deposits into stUSDT, effectively mints

“fake assets” against an unknown equity. As a result, Cochran

estimates that Justin Sun’s alleged debt to users across the Huobi

and Tron ecosystems amounts to approximately $2.4 billion, all

while users remain unaware of the situation. Related Reading:

BULLISH: Bloomberg Analyst Points Out Two Key Bitcoin Metrics

Demonstrating Historic Strength Huobi has not yet formally

responded to these allegations, leaving the situation’s outcome

uncertain. However, the possibility of Huobi’s insolvency raises

significant concerns regarding the security of user funds and the

overall trustworthiness of the exchange. It remains to be seen how

this situation will develop and what actions will be taken to

address these concerns effectively. Related Reading: Bitcoin Mega

Whales Return To Selling Mode, More Downside Soon? Featured image

from Shutterstock, chart from TradingView.com

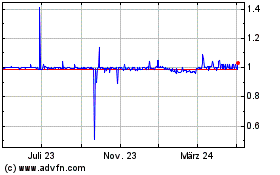

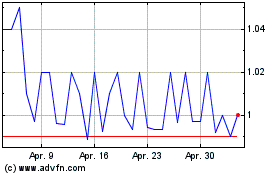

TrueUSD (COIN:TUSDUSD)

Historical Stock Chart

Von Jan 2025 bis Feb 2025

TrueUSD (COIN:TUSDUSD)

Historical Stock Chart

Von Feb 2024 bis Feb 2025