Euphoria Or False Dawn? Why The Ethereum $4,000 Party Might End Soon

14 März 2024 - 11:03AM

NEWSBTC

Amidst the tumultuous seas of the crypto market, Ethereum (ETH)

finds itself navigating through waves of uncertainty after a period

of bullish fervor. Investors who once rode high on the tide of

optimism now brace themselves for potential stormy weather ahead.

Related Reading: Zooming NEAR: Solid 75% Growth Sparks Crypto

Frenzy The Bearish Shadow Looms The once bright horizon for

Ethereum has dimmed as indicators point towards a shift in

sentiment. A surge in interest in put options hints at growing

apprehension among traders, seeking refuge from potential losses in

speculative ventures. The rise in demand for these protective

measures serves as a cautionary tale, signaling a departure from

the exuberance that once characterized the Ethereum landscape.

Ethereum’s Dencun Upgrade As the Ethereum community anticipates the

much-awaited Dencun upgrade, optimism clashes with apprehension.

Scheduled to deploy on the Ethereum mainnet, the upgrade promises

to usher in a new era with EIP-4844, colloquially known as

“protodanksharding,” poised to lower transaction costs on Layer 2.

While this advancement holds promise, echoes of past

disappointments linger, reminding investors of the unpredictability

that accompanies major network upgrades. Influx of Capital Amidst

Uncertainty Despite the looming shadows of uncertainty, the crypto

market witnesses a significant influx of capital, with Bitcoin and

Ethereum commanding the lion’s share of the pie. An infusion of

approximately $83 billion into the market underscores the enduring

allure of cryptocurrencies, even in times of ambiguity. Yet, amidst

the influx, Ethereum’s fate hangs in the balance, teetering between

the forces of optimism and apprehension. Ether market cap currently

at $478 billion. Chart: TradingView.com The Ethereum ETF Conundrum

Now, the looming specter of Ethereum ETF approval casts a shadow

over the market, with odds dwindling according to Bloomberg ETF

analysts. Despite waning prospects, the prospect of an ETF remains

a beacon of hope for Ethereum enthusiasts, promising increased

adoption and legitimacy. Yet, as the odds fluctuate, uncertainty

pervades, leaving investors on edge, unsure of what the future

holds. Related Reading: Bitcoin Hodlers Eye Long Term: $520 Million

BTC Go To Cold Storage Analyst’s Insight In the midst of

uncertainty, popular crypto analyst Ali Martinez offers insights

into the shifting currents of the market. Martinez reveals a

massive influx of roughly $83 billion, with Bitcoin and Ethereum

accounting for $75 billion of the total money inflow, according to

Glassnode. Current Market Snapshot Ethereum’s price charts reflect

the ebb and flow of market sentiment. With a 2% increase in the

past 24 hours, stands at $3,966, a testament to the

resilience of the cryptocurrency amidst turbulent times. Yet,

fluctuations persist, with trading volume surging by 20% in the

last 24 hours, underscoring the volatility that defines the crypto

market. Source: Santiment Meanwhile, new addresses were still

becoming interested in Ether. Alongside that, the overall count of

holders who were amassing ETH had also increased, as shown in the

chart above. Featured image from Polina Tankilevitch/Pexels, chart

from TradingView

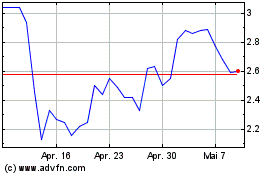

Optimism (COIN:OPUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Optimism (COIN:OPUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024