Bitcoin Market in Disarray, But Optimism Prevails With Two Narratives

03 Mai 2023 - 11:00PM

NEWSBTC

The price of Bitcoin has seen a small uptick during today’s trading

session, but the cryptocurrency has been unable to break the

sideways trend. Today, the U.S. Federal Reserve (Fed) announced a

25 basis points (bps) rate hike, but uncertainty in the financial

world remains king. Related Reading: More Dip To Come: Bitcoin

Liquidity On The Move Ahead Of Major Event As of this writing,

Bitcoin (BTC) trades at $28,600 with sideways movement across the

board. Other major cryptocurrencies in the top 10 by market

capitalization have experienced similar price action except for XRP

and Cardano (ADA), which record small losses in the past 24 hours.

Bitcoin Stun By Economic Uncertainty, But Bulls Could Take The

Upper Hand According to a report from the trading desk QCP Capital,

Bitcoin, and the crypto market have been in an 8 week long

confusion phase. As a result, the nascent industry experienced a

decline in its Implied Volatility (IV), leading to the current

sideways price action. Volatility, as measured by the VIX Index, is

crashing to levels last seen during the 2022 bearish phase. This

dynamic might trigger an aggressive move in the coming weeks, but

the direction of such price action is unclear. However, two key

events could support Bitcoin in reclaiming higher levels. Both

scenarios will operate on the macroeconomic board, which keeps

exercising a strong influence over BTC and other financial assets.

First, QCP Capital argues that in the next two months, the U.S.

banking crisis will still be relevant, along with the debt ceiling

in the country. These narratives create the perception that the

fiat system is weak, which could lead to further bank runs. BTC

Bull Run Imminent? Thus, the Fed must continue bailing out

banking institutions and injecting liquidity into the financial

markets. The debt ceiling presents a similar issue; the federal

government might be forced to intervene because the U.S. is

unlikely to default on its debt. As a result, more and more

liquidity could enter financial markets allowing Bitcoin to breathe

and resume its bullish momentum. According to QCP Capital, this

phenomenon is already happening. Due to the banking crisis in the

U.S., the Fed has been forced to intervene, increasing the side of

its balance sheet by almost $500 billion over the past two weeks,

as seen in the chart below. The Fed last injected this much

liquidity during the COVID-19 crisis. At that time, the price of

Bitcoin recorded a massive profit and entered price discovery for

at least 12 months. The trading firm stated the following about

BTC’s potential to see similar profits: The analog compares BTC

price action now (red line) vs. BTC during the 2020 cycle (yellow

line) by lining up the March 2020 and March 2022 lows. It shows

that while we are likely in for a period of consolidation here, the

underlying trend ahead is still strongly to the upside. Related

Reading: Polygon (MATIC) Price Shows Vigor, Are Bulls Up To

Something? Charts from QCP Capital and Tradingview

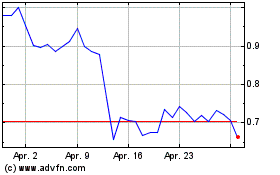

Polygon (COIN:MATICUSD)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Polygon (COIN:MATICUSD)

Historical Stock Chart

Von Dez 2023 bis Dez 2024