Injective Market-Shaking News Drives INJ Price Up By 7% – Details

07 Juni 2024 - 1:00AM

NEWSBTC

Injective, a Layer 1 (L1) protocol, emerged as one of the standout

performers in the crypto market on Thursday, with its native token

INJ experiencing a substantial 7% surge within the past 24

hours. Accompanying this surge, the protocol’s market

capitalization is inching closer to the significant milestone of $3

billion. The price movement coincides with notable announcements by

the Injective protocol regarding its token and ecosystem. Injective

Users To Burn 6 Million INJ One of the key announcements unveiled

by the protocol is the release of a comprehensive paper on the

Injective Token, INJ. The paper delves into the token’s core

utilities and mechanisms that power a programmable token economy,

specifically focusing on deflationary acceleration. Related

Reading: Crypto Analyst Predicts XRP At $0.75 In July Despite

Year-Long Slump Additionally, Injective disclosed that INJ token

burn auctions are “steadily increasing in size,” with 12,266 tokens

being burned indefinitely on the announcement day. Injective users

are set to burn a cumulative total of 6 million INJ by next

week. This burning mechanism plays a key role in reducing the

total supply of tokens in circulation, thereby increasing scarcity

and potentially driving up the value of the remaining tokens.

Ultimately, this benefits token holders by establishing a

deflationary mechanism and controlling inflation within the

protocol. Injera And USDi Launch Injective also revealed that

the anticipated launch of the Injera protocol is scheduled for the

end of June, marking the beginning of “a new era for Injective,”

according to the protocol. As announced, in collaboration

with DojoSwap, a decentralized exchange (DEX) on Injective, the

community will build Injera and USDi, the Injective Synthetic

Dollar aimed at powering the Web3 ecosystem. The objective is to

create a decentralized synthetic dollar token fully backed by

Injective’s finance infrastructure. The Injera money market

is at the core of the Injera protocol and USDi, designed as a

collaterized debt position (CDP) market. This market optimizes

capital efficiency for the USDi synthetic dollar by enabling

sensible leveraging of USDi to borrow “market-making assets.” USDi,

the native synthetic dollar, will be governed by the Injera token

(ERA). It is a stable synthetic USD generated through delta-neutral

positions, ensuring stable yields ranging from 10% to 90% for USDi

holders. For DojoSwap, this development ensures a continuous

increase in TVL and trading volume, generating fee amounts for

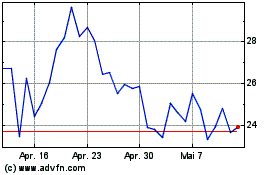

ecosystem participants. Bullish Sentiment Returns As these

announcements were made, the INJ token successfully reclaimed the

$28.68 price level, reigniting its bullish momentum after

experiencing a price correction to the $20 mark in April.

This correction occurred following the token’s remarkable

achievement of reaching a new all-time high (ATH) of $52 in March.

Related Reading: VanEck Revises Ethereum Prediction To Put Price At

$22,000, Here’s Why In the immediate term, the $29 level may act as

a hurdle for the token, representing a significant resistance point

that has persisted for the past two months. However, if the

bullish momentum continues, the token could surpass this resistance

and retest the $31 and $35 resistance levels on the INJ/USD daily

chart. Ultimately, the ongoing advancements within the Injective

ecosystem have generated anticipation regarding the token’s future

trajectory. Market participants are keen to see whether these

developments can fuel a sustained upward trend and potentially

surpass the previously achieved record levels. Featured image from

DALL-E, chart from TradingView.com

Injective Token (COIN:INJUSD)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Injective Token (COIN:INJUSD)

Historical Stock Chart

Von Nov 2023 bis Nov 2024