If 2017 saw the rise and fall of the cryptocurrency, it was also

the year in which a newly minted class of super-rich emerged —

individuals who through impeccable foresight, sheer luck or a

combination of the two happened to buy in at the right time.

While most people were struggling to understand what bitcoin was,

the cryptocurrency’s value exploded during the second half of the

year, followed shortly by surges in the price of Ethereum, Ripple

and a host of others.

Amid talk of mania, the 1,000 per cent year-on-year returns

produced a clutch of crypto-millionaires and billionaires seemingly

overnight. “This has definitely changed my net worth a bit,” says

Roger Ver, an early evangelist who has been promoting the

cryptocurrency since it was valued at less than $1, earning him the

nickname Bitcoin Jesus.

The price of bitcoin fluctuated between $6,000 and $10,000 last

month, according to the CoinDesk Bitcoin Price Index, having

reached a high of $19,343 in late 2017.

But this group of wealthy individuals extends far beyond the

activist cryptographers and anti-central bank types who were

instrumental in bitcoin’s development and promotion a decade ago.

Newcomers of all stripes have since piled in, from clean-cut

mainstream actors such as the Winklevoss twins — who reportedly

boast a crypto-fortune of $1.3bn — to corporate executives and

teenagers trading in their spare time.

While all may not fully grasp the nuances of the underlying

technology, they are drawn to its allure as an alternative to fiat

capital and as a new, more accessible asset class.

In 2012, when Erik Finman was 12 years old, he repurposed a $1,000

gift from his grandmother for his university fund to buy 100

bitcoin at roughly $10 each. Three years later, after a dramatic

upswing in price, he dropped out of secondary school to trade

cryptocurrencies, start a business and ultimately become a

millionaire by the time he turned 18 last year.

“It’s definitely a 21st-century millennial, Generation Z kind of

story,” he explains, adding that today he spends his time

investing, travelling the world and working on a project with Nasa

to launch a mini-satellite that will catalogue modern culture for

future generations — or other worlds — to discover (like the

Voyager Golden Record launched in 1977).

"I still work all day, because I’m excited about the underlying

changes this is going to bring to the way societies work"

Roger Ver

Globetrotting lifestyles aside, these holders of crypto-wealth

aren’t quick to rest on their laurels. Many hold the sincere belief

that the decentralised technologies have the potential to reconcile

many of the inequities and institutional failures that they see as

having plagued history.

“I still work all day, every day, seven days a week because I’m

excited about the underlying changes that this is going to bring to

the way societies work worldwide,” says Ver, who splits his time

between Japan and the Caribbean island of St Kitts.

He has shifted his focus to promoting bitcoin cash, a new

cryptocurrency that spun off bitcoin last August. He argues that it

has the capacity to process transactions much faster than bitcoin

and is therefore a better candidate to realise the vision of the

global decentralised peer-to-peer payment rail laid out in 2008 by

Satoshi Nakamoto, the elusive founder of the cryptocurrency.

----

Dan Conway, a self-described “failing executive” at US telecoms

group AT&T turned crypto-millionaire, was not trying to get

rich as much as he was trying to send a message in 2016 when he

invested his net worth in Ethereum — priced below $10 at the time

and now worth $1,300.

He saw the cryptocurrency as a disrupter of the modern companies in

which he had spent his career miserably climbing the corporate

ladder. “I invested because I wanted the underdogs to win for once

— losers like me who didn’t make the rules and didn’t have the

money,” says Conway, who is in the process of publishing a book

about his experiences.

“We aren’t Wall Street traders staring at our Bloomberg terminals

trying to make a quick buck. We’d been forced to tweet corporate

philanthropy hashtags and we weren’t going to take it any more,” he

continues. “We have scores to settle and getting rich is just the

first milestone.”

Cryptocurrency mining computers on

sale in Hong Kong © Alex Hofford/EPA

Cryptocurrency mining computers on

sale in Hong Kong © Alex Hofford/EPA

But joining the crypto-millionaire class is not always a ticket to

a care-free life. As the December 2017 kidnapping of the head of a

Ukraine-based bitcoin exchange illustrates, there are risks far

beyond a drop in the price of bitcoin. (Pavel Lerner was released

after a $1m bitcoin ransom was paid.)

“Those types of things are not so fun,” says Ver, who says he has

often been threatened. Indeed, many crypto-holders prefer to remain

anonymous. “If I were a crypto-millionaire, the last thing I would

want to do is tell you about it,” says one investor.

An advert for the Bananacoin

cryptocurrency, which is linked to banana prices ©

Bloomberg

An advert for the Bananacoin

cryptocurrency, which is linked to banana prices ©

Bloomberg

More prosaically, stories have emerged from the UK of banks,

fearful of breaching money-laundering regulations, refusing to

accept windfalls from bitcoin investors. Banks need to be able to

establish an audit trail to ensure funds they accept are

legitimate, but the very nature of cryptocurrencies makes this hard

to provide.

Ultimately, though, most investors are worried about the volatility

of crypto-markets, where double-digit price swings are a regular

occurrence.

Underlying structural and regulatory issues are also a concern.

News of clampdowns by authorities — in China and Europe, for

example — have regularly caused prices to plummet. A full crash —

triggered by market sentiment, if not national regulators — could

happen at any moment, Ver warns. “You could have this cascading

effect where everybody’s running for the exit, and it could be the

death spiral for bitcoin.”

Copyright

The Financial Times Limited

2018. All rights reserved.

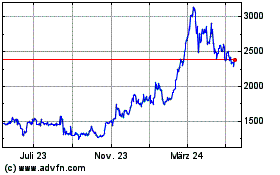

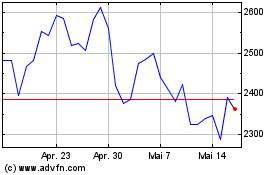

Ethereum (COIN:ETHGBP)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Ethereum (COIN:ETHGBP)

Historical Stock Chart

Von Jul 2023 bis Jul 2024