Ethereum Tests Massive Falling Wedge – Breakout Could Target $4K Cycle Highs

26 Januar 2025 - 10:50AM

NEWSBTC

Ethereum (ETH) has been trading within a narrow 4-hour range

between $3,150 and $3,500, leaving investors frustrated with its

lackluster performance in recent weeks. As other assets in the

crypto market make strides, Ethereum’s sideways movement has caused

many to question whether it can regain its momentum this year. The

prolonged consolidation has dampened sentiment, with some investors

beginning to lose patience and faith in ETH’s ability to deliver

substantial returns. Related Reading: Cardano Consolidates In A

Symmetrical Triangle – Analyst Expects A 40% Move However, optimism

remains among technical analysts who see Ethereum nearing a

critical inflection point. Top crypto analyst Daan recently shared

a technical analysis on X, highlighting a massive falling wedge

pattern forming on Ethereum’s chart. This setup is widely

considered a bullish reversal indicator, with the potential to

spark significant upward movement if the price breaks out.

According to Daan, a breakout from this falling wedge would likely

pave the way for Ethereum to test the $4,000–$4,100 level, offering

a glimmer of hope for bullish investors. Such a move could

reinvigorate market confidence and set the stage for Ethereum to

reclaim its status as a leading altcoin. For now, all eyes are on

ETH as traders await confirmation of the next big move in this

highly-watched range. Ethereum Facing Serious Risks Ethereum has

remained in a downtrend since late December, struggling to regain

momentum as bearish sentiment continues to dominate the market. The

lackluster price action has left investors and analysts

increasingly concerned about the possibility of a deeper

correction, as ETH consolidates near critical support levels. While

some remain hopeful for a turnaround, the current outlook suggests

Ethereum faces significant challenges ahead. Top crypto analyst

Daan recently shared his insights on X, highlighting a massive

falling wedge pattern on Ethereum’s chart. This pattern is often

regarded as a bullish reversal signal, with the potential to

trigger a significant breakout if confirmed. According to Daan, a

successful breakout could propel ETH toward the $4,000–$4,100

range, revisiting its cycle highs. However, he also expressed

caution, suggesting that if ETH does manage to reach this level, it

may encounter strong resistance, potentially leading to another

sharp rejection. Daan emphasized the importance of monitoring the

falling wedge trendline, noting that it will play a crucial role in

determining Ethereum’s next move. For now, the market remains in a

wait-and-see mode, with ETH navigating a precarious balance between

bullish breakout potential and the risk of further downside.

Related Reading: XRP Forms A Bullish Pattern In 4-Hour Chart –

Analyst Expects $4.20 After Breakout As Ethereum hovers around key

levels, traders and investors are closely watching for signs of a

definitive move. A breakout above the falling wedge could breathe

new life into ETH and reignite optimism, while failure to hold

support may lead to an extended period of consolidation or even a

deeper correction. The coming days will be critical in shaping

Ethereum’s trajectory, with its performance likely to influence

broader market sentiment. ETH Consolidates Above Key Demand

Ethereum (ETH) is trading at $3,322 after enduring several days of

choppy price action, reflecting the broader uncertainty in the

crypto market. The price has struggled to gain momentum as it

remains stuck in a tight range, testing the patience of investors

and traders alike. To ignite an uptrend, bulls must hold the

critical $3,300 support level, which has served as a key demand

zone in recent sessions. A decisive push above the $3,500

resistance level, which has capped ETH’s upward movement for weeks,

is essential to confirm a bullish breakout. Clearing this level

would likely reinvigorate market sentiment and attract fresh buying

interest, setting the stage for Ethereum to target higher price

levels in the coming days. Related Reading: Hedera Successfully

Retests Key Demand Level – Expert Says The Next Stop Could Be $0.52

However, the downside risks are significant. If ETH fails to hold

the $3,300 mark, it could trigger a wave of selling pressure,

leading to a deeper correction. Such a move could also cause

capitulation among investors who have grown disillusioned with

Ethereum’s underperformance compared to Bitcoin and other altcoins.

Featured image from Dall-E, chart from TradingView

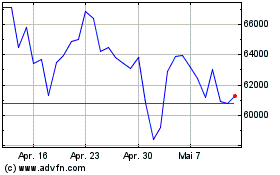

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

Von Jan 2024 bis Jan 2025