Crypto Suffers $1.6 Billion Liquidations As XRP, DOGE Down 10%

11 Dezember 2024 - 6:00AM

NEWSBTC

Data shows the cryptocurrency market has registered large

liquidations in the past day as altcoins like Dogecoin and XRP have

crashed. Cryptocurrency Derivatives Market Has Just Seen Massive

Long Liquidations According to data from CoinGlass, a mass amount

of liquidations have piled up over on the derivatives side of the

cryptocurrency sector during the last 24 hours. “Liquidation” here

refers to the forceful closure that any open contract undergoes

when its bet fails enough to accumulate losses equal to a certain

degree (the exact value of which may differ between platforms).

Related Reading: Bitcoin HODLing Rewards: Long-Term Holders Selling

At 326% Profit Below is a table that breaks down the relevant

numbers related to the liquidations from the past day. As is

visible, there have been total liquidations of

cryptocurrency-related contracts worth a whopping $1.56 billion in

the past day. The long holders were involved in an overwhelming

majority of this flush, with liquidations associated with them

standing at $1.39 billion (almost 90% of the total). The reason

behind the large liquidations is the crash that the altcoin market

has faced during this window, with many popular coins like XRP and

Dogecoin being down double digits. It would appear that many

traders had set up bullish positions on the market, hoping that the

recent momentum led by Bitcoin’s exploration to new highs would

continue shortly. BTC has interestingly managed to limit its losses

to just 2%, but evidently, the rest of the market hasn’t been so

lucky. As for which of the assets was responsible for the most

liquidations, the below heatmap shows it. Usually, Bitcoin leads

the market liquidations, but it appears the second largest

cryptocurrency by market cap, Ethereum has instead contributed the

most towards the flush with $229 million in positions. Dogecoin and

XRP have followed BTC’s $173 million liquidations with flushes of

$88 million and $68 million, respectively. Their large liquidations

are likely due to their popularity and the notable scale of

drawdown they have seen. It would also seem that the speculative

interest in the sector has been so deep recently that the small cap

assets (referred to as ‘others’ in the heatmap) have added up to a

massive $496 million liquidation. Related Reading: Analyst Sets

$4.40 XRP Target As 3rd-Straight Bull Pennant Forms Mass

liquidation events aren’t particularly rare in the cryptocurrency

sector, but today’s flush has been extraordinary even for the

market’s standards. These events happen from time to time because

coins across the board generally display notable volatility, and a

lot of speculators opt for risky amounts of leverage. These two

conditions have been particularly pronounced recently, which is why

the derivatives sector has exploded in this fashion. XRP Price At

the time of writing, XRP is trading around $2.09, down almost 15%

in the last seven days. Featured image from Dall-E, CoinGlass.com,

chart from TradingView.com

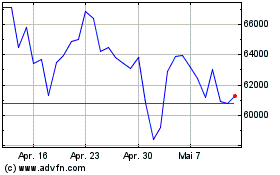

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

Von Dez 2023 bis Dez 2024