Bitcoin to Enter Final Bull Phase? Key Indicator Hints at Major Price Movement

03 Dezember 2024 - 1:30AM

NEWSBTC

Bitcoin, the world’s leading cryptocurrency, appears to be on the

brink of a potential sharp rise. According to a CryptoQuant

analyst, Crypto Dan, the market could experience a significant

upward trend within the next two months. This insight, shared on

the CryptoQuant QuickTake platform, is based on a critical market

indicator that has historically signaled major price rallies.

Related Reading: Data Shows Selling Pressure Mounts On Bitcoin: Is

The Bull Run at Risk? Bitcoin Market Outlook: Sharp Rise Incoming

In the post titled “Strong Rise in Bitcoin is Expected Within 1-2

Months”, Crypto Dan highlights the emergence of a “golden cross” in

the Spent Output Profit Ratio (SOPR) indicator. This occurrence, he

notes, is a rare event that typically happens only once or twice

during an entire bull market cycle. As part of the current bullish

cycle that began in January 2023, its reappearance is being seen as

a strong precursor to a substantial market move. For further

context, the SOPR Ratio indicator measures realized profits and

losses in the Bitcoin market, offering insight into investor

sentiment. The “golden cross” identified by Crypto Dan signifies a

pivotal moment in the bull cycle. Historically, this signal has

been followed by strong price increases within two months of its

appearance. Crypto Dan explained that the market is likely entering

the final phase of the current upward cycle, a stage characterized

by steeper price gains and shorter periods of consolidation. This

means that while Bitcoin’s ascent might accelerate, the

opportunities for investors to accumulate at lower prices could

diminish rapidly. Furthermore, he projected that if the anticipated

rise materializes by the end of 2024 or the first quarter of 2025,

it could draw significant new capital into the market. The inflow

of additional funds is expected to fuel Bitcoin’s momentum,

potentially driving the market to its peak during this cycle. Dan

wrote: As the market moves towards the later stages of the cycle,

the magnitude of the rise tends to be larger, and the periods of

decline/adjustment are shorter. If a steep rise occurs as implied

by this indicator within the end of 2024 to the first quarter of

2025, it can be expected that new inflows and additional funds will

enter the market, bringing it to its peak. BTC Market Performance

Meanwhile, Bitcoin continues to maintain stability above the

$95,000 price mark. At the time of writing, the asset currently

trades for $96,296, down by 1% in the past day but still up by

nearly 40% in the past month. According to a renowned crypto

analyst known as Ali on X, while some in the community expect a

major retracement in Bitcoin’s price, BTC could do the opposite.

The analyst projected BTC could surge to as high as

$120,000-$150,000 before the first 30% price correction. Given the

fact that #Bitcoin tends to do the opposite of what the crowd

believes, there is potential for $BTC to go higher. If the current

cycle behaves like the last two, #BTC could go to $120,000-$150,000

before the first 30% price correction. https://t.co/xTHJMITqJa —

Ali (@ali_charts) December 2, 2024 Featured image created with

DALL-E, Chart from TradingView

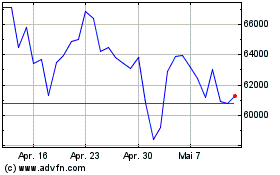

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

Von Dez 2023 bis Dez 2024