Why These Experts Believe The Ethereum Price Could Soar to $5,000

12 Oktober 2022 - 6:30PM

NEWSBTC

The Ethereum price has been trending to the downside after its

successful implementation of “The Merge” and its transition to a

Proof-of-Stake (PoS) consensus. Launched back in September on

mainnet, ETH’s price has been losing bullish momentum since then.

Related Reading: This Expert Suggests How Ripple Price Will Trend

Amid Expansion In Europe At the time of writing, the Ethereum price

trades at $1,298 with sideways movement during today’s trading

session and a 5% loss in the last 7 days. The second cryptocurrency

by the market has been following the general sentiment in the

market as the nascent asset class is pushed down due to

macroeconomic factors. There Is Hope For The Ethereum Price, How

Long Should You Hold ETH? According to a survey conducted by Finder

with 5 experts, the Ethereum price has limited bullish potential

for 2022. The experts believe that this cryptocurrency will likely

continue moving sideways for the rest of the year. In tandem with

current macroeconomic conditions, the Ethereum price will be

limited by tightened financial conditions and liquidity. Thus, ETH

is likely to stay at its current levels or rise by $1,360 to $1,377

by the end of 2022. As seen below, the cryptocurrency might pick up

its bullish momentum in 2023 and 2024. This would take ETH’s price

from its current levels to its previous all-time high north of

$4,000. After that, Ethereum’s upside trajectory will be much

steeper, according to the experts with a potential to reach a new

all-time high in late 2024 or in early 2025. Over the next decade,

the cryptocurrency could soar to $11,700, according to the most

conservative experts. Others believe the Ethereum price could climb

to as much as $14,000, $23,300, and even $26,000 over the same time

period. The experts believe that the U.S. Federal Reserve (Fed) and

its interest rates hike program will be its biggest obstacle to

future appreciation. CEO and Co-Founder of Osom Finance, Anton

Altement, stands among the bullish experts. He told Finder the

following: All round market pessimism driven by Fed’s actions and

still locked ETH staking are the key factors holding back the

price. Former should disappear by December, latter by next spring –

those 2 events will unlock the next legs of the rally. Can ETH Go

Lower In 2022? In that sense, the majority of experts claimed that

the Ethereum price might find a bottom at around $1,000 to $900 in

2022. These might be good levels for long-term holders looking to

profit for future appreciation. Related Reading: Why ApeCoin

Traders Should Expect The Next Coming Days To Be Tough For APE

However, the Ethereum price is likely to remain limited as long as

the U.S. Federal Reserve maintains its tightening agenda. The low

ETH prices are, for 48% of respondents, an opportunity to buy

cryptocurrency. Senior Analyst at FxPro, Alexander Kuptsikevich

said: Ethereum has found itself in an area where it receives

support from long-term investors. Crypto investors may remain

cautious for a few more months or a couple of quarters, but we can

expect an active bull market to return as soon as next year.

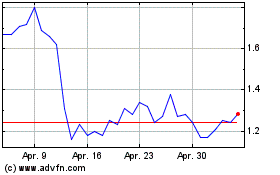

ApeCoin (COIN:APEUSD)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

ApeCoin (COIN:APEUSD)

Historical Stock Chart

Von Dez 2023 bis Dez 2024