Though some concerns have dampened the appeal of dividend stocks

and ETFs over the past couple of months, investors are still

praising the space thanks to the Fed’s decision to hold off on the

taper.

Further, with the appointment of Janet Yellen as the likely next

Fed Chairperson, many are speculating that easy monetary policies

might be kept intact. As such, many are starting to believe that

lower rates could prevail longer than expected, compelling

investors to return to the dividend space (read: Yellen as Fed

Chairwoman is Great News for These ETFs).

Faster Dividend Growth

Over the longer term (say over the past 80 years), dividends have

accounted for more than 40% of total returns. The number of

companies paying dividend in the S&P 500 has risen to 83%, the

highest level seen in 15 years. The payout ratio stands at 31.8%,

the highest since mid 2010.

As per S&P, dividend net increases (increases less decreases)

grew 8.2% during Q3 as 475 companies reported dividend hikes. The

trend is expected to continue in the coming months as most large

companies have huge cash piles on their balance sheet and are in a

position to increase payouts to shareholders.

Currently, investors are optimistic on high growth sectors like

technology and finance on improving global economies and consistent

increase in dividends. Over the past one year, technology has been

the best dividend paying sector in the S&P 500 and would

continue to lead the way higher (read: No Taper? No Problem for

These Dividend ETFs).

How to Play

In such a backdrop, investors are again cycling their exposure to

the dividend space as a way to achieve equity appreciation with a

lower level of risk. The ETFs with a dividend-growth focus are

expected to perform better over the long term compared to funds

that focus on high dividend yields (see: all the Large Cap ETFs

here).

Below, we have highlighted four dividend ETFs that offers excellent

dividend growth potential, any of which could be a solid pick for

investor in the long term:

SPDR S&P Dividend ETF

(SDY)

This fund provides exposure to the 85 U.S. stocks that have been

consistently increasing their dividends every year for at least 25

years. This is done by tracking the S&P High Yield Dividend

Aristocrats Index.

SDY is easily one of the most popular and liquid ETF in the

dividend space with AUM of over $12.4 billion and average daily

volume of less than one million shares. The product is widely

diversified across sectors and securities.

Each security accounts for less than 2.62% of total assets, with

AT&T (T), HCP Inc. (HCP) and Consolidated Edison as the top

three firms. The highest sector allocations go to consumer staples

(17.81%), financials (16.96%) and industrials (14.10%).

The fund charges 35 bps in fees per year and yields 2.35% in 30-day

SEC terms. The ETF has added nearly 22.7% so far this year.

Vanguard Dividend Appreciation ETF

(VIG)

This is the largest and most popular ETF in the dividend space with

AUM of $17.45 billion and average daily volume of more than 1.1

million shares. The fund follows the Dividend Achievers Select

Index, which is composed of stocks of high quality companies that

have a record of increasing dividends for at least 10 years.

Holding 146 stocks in its basket, the product is pretty spread out

across various securities as none holds more than 4% of total

assets. PepsiCo (PEP), Procter & Gamble (PG) and Wal-Mart

Stores (WMT) are the top three elements in the basket. However,

from a sector look, the ETF is heavily weighted toward consumer

goods (23%), industrials (22%) and consumer services (16.50%).

With an expense ratio of 0.10%, VIG is one of the cheapest funds in

this space. The 30-day SEC yield comes at 2.11%. The fund has

gained nearly 21.2% in the year-to-date time frame (read: 4

Unbeatable ETF Strategies for Q4).

WisdomTree U.S. Dividend Growth ETF

(DGRW)

This fund tracks the WisdomTree U.S. Dividend Growth Index and

offers diversified exposure to 294 dividend-paying stocks from

various sectors with growth characteristics. It has gathered $56.1

million in AUM since its debut earlier in the year and it trades in

volumes of nearly 43,000 shares per day.

The product provides double-digit allocation to four sectors –

industrials (20.62%), information technology (20.49%), consumer

discretionary (19.79%) and consumer staples (18.09%). Apple (AAPL),

Microsoft (MSFT) and PG are the top three holdings making up for a

combined 12.82% share (read: 3 ETFs to Watch on Microsoft Dividend

Hike).

The fund has a 30-day SEC yield of 2.04% and charges 28 bps in fees

per year from investors. DGRW is up 8.4% since inception.

First Trust NASDAQ Technology Dividend Index

(TDIV)

Since the technology sector is expected to be a major contributor

to the overall increase in dividends, investors could find TDIV an

intriguing option. This fund seeks to focus on dividend payers

within the technology sector by tracking the Nasdaq Technology

Dividend Index.

The fund has accumulated $215.2 million in its asset base and

trades in volume of roughly 92,000 shares a day on average. In

total, the fund holds 87 securities in its basket. Intel (INTC),

MSFT and International Business Machines (IBM) occupy the top three

positions in the basket with nearly 24% of assets.

In terms of sector exposure, about one-fourth of the portfolio is

tilted toward semiconductor and semiconductor equipment while

software, and computer and peripherals make up for 14% share

each.

The ETF sports a 30-day SEC yield of 2.90% and has an expense

ratio of 0.50%. TDIV gained 20% so far this year.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

WISDMTR-US DV G (DGRW): ETF Research Reports

SPDR-SP DIV ETF (SDY): ETF Research Reports

FT-NDQ TECH DIF (TDIV): ETF Research Reports

VANGD-DIV APPRC (VIG): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

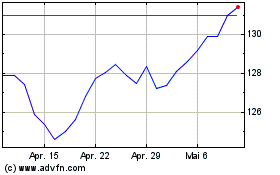

SPDR S&P Dividend (AMEX:SDY)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

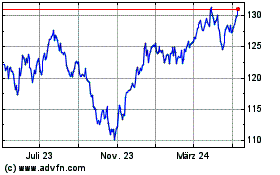

SPDR S&P Dividend (AMEX:SDY)

Historical Stock Chart

Von Mai 2023 bis Mai 2024