ALPS Launches Sector Dividend Dogs ETF (SDOG) - ETF News And Commentary

02 Juli 2012 - 12:17PM

Zacks

ALPS, the small ETF issuer best known for its commodity

products, appears to be continuing its expansion in the U.S. sector

market with its newest fund. The brand new product, the

Sector Dividend Dogs ETF (SDOG), looks to provide

exposure to 50 firms that are among the highest yielders in the

U.S. market, potentially giving investors another option for

current income in today’s yield starved environment.

This looks to be done by tracking the S-Network Sector Dividend

Dogs Index which is a benchmark of U.S. large cap equities that

have above average dividend yields. This index uses a fresh take on

the ‘Dogs of the Dow Theory’ in which investors annually select the

ten DJIA stocks that have the highest yields at the start of every

calendar year (read 11 Great Dividend ETFs).

ALPS uses this idea and expands upon it with SDOG, going beyond

the 30 Dow stocks and into the broad S&P 500 instead. In this

approach, the index takes the top five dividend yielders in each of

the ten S&P 500 sectors for inclusion in the final fund.

For this service, the product does charge investors 40 basis

points a year in fees. While this is in line with many other

dividend focused ETFs in the market, this is a bit higher than many

other broad ETFs like those tracking the S&P 500 index (see

Inside The SuperDividend ETF).

Investors should also note that the product uses an equal weight

methodology both in terms of individual securities and sectors. As

a result, each company takes up about 2% of the total while each of

the sectors has a roughly 10% weighting.

For those who are curious as to some of the holdings in the

product, it is definitely tilted towards large caps, although some

medium size firms also find their way into the fund as well. Some

of the more famous constituents include Chevron

(CVX), AT&T (T), Intel

(INTC), Johnson & Johnson (JNJ), and

DuPont (DD), just to name a few.

In terms of investment metrics, many of the most important

ratios are favorable for SDOG’s index when comparing them to the

broad S&P 500. According to ALPS, the yield on the index is

approaching 5% while the S&P 500 has one of just over 2%.

However, the PE for SDOG’s index is slightly higher than the

S&P 500, although Price/Cash Flow, Price/Book, and Price/Sales

are all in SDOG’s favor (read Invest Like The One Percent with

These Three ETFs).

While SDOG may have some favorable metrics, the ETF will be

facing some stiff competition for assets in the dividend-focused

ETF market. Two of the most popular products in the space, the

SPDR S&P Dividend ETF (SDY) and the

PowerShares High Yield Equity Dividend Achievers ETF

(PEY), both have robust daily trading volume levels and a

great deal of assets under management.

While both of these products have a big head start in terms of

assets and volume, investors should note that SDOG looks to beat

out both in terms of yield. According to issuer websites, SDY pays

out roughly 3.3% while PEY has a 4.2% yield, meaning that both pale

in comparison to SDOG’s nearly five percent payout (see Health Care

ETFs in Focus on Obamacare Supreme Court Decision).

Given this higher yield, some investors may be able to shake off

the worries over wider bid ask spreads and the low volume and give

SDOG a shot. ALPS has had mixed luck so far with its products—some

have been huge winners while others have failed to catch on—so it

will be interesting to see which way SDOG goes in the months ahead

and if investors are ready and willing to apply a ‘Dogs of the Dow’

approach to the S&P 500.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

Follow @Eric Dutram on Twitter

CHEVRON CORP (CVX): Free Stock Analysis Report

INTEL CORP (INTC): Free Stock Analysis Report

PWRSH-HY EQ DV (PEY): ETF Research Reports

(SDOG): ETF Research Reports

SPDR-SP DIV ETF (SDY): ETF Research Reports

AT&T INC (T): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

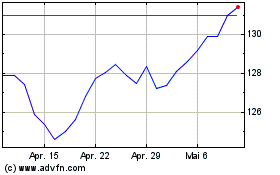

SPDR S&P Dividend (AMEX:SDY)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

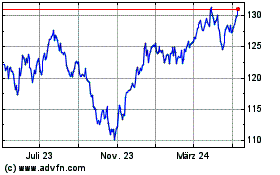

SPDR S&P Dividend (AMEX:SDY)

Historical Stock Chart

Von Dez 2023 bis Dez 2024