Revised Proxy Soliciting Materials (definitive) (defr14a)

07 April 2021 - 6:49PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. 2)

x Filed by the Registrant ¨ Filed by a party other than the Registrant

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to 240.14a-12

M.D.C. Holdings, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1)Title of each class of securities to which transaction applies:

(2)Aggregate number of securities to which transaction applies:

(3)Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4)Proposed maximum aggregate value of transaction:

(5)Total fee paid:

¨ Fee paid previously with preliminary materials.

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1)Amount Previously Paid:

(2)Form, Schedule or Registration Statement No.:

(3)Filing Party:

(4)Date Filed:

EXPLANATORY NOTE

This amendment is made to revise the effect of broker non-votes set forth in the vote required table on page 8 and modify the "Potential Payments Upon Termination or Change in Control" table on page 45.

AMENDMENT TO PROXY STATEMENT

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proposal

|

|

Vote Required

|

|

Effect of Broker Non-Votes, Withhold Votes and Abstentions

|

|

1.

|

Election of Directors

|

|

The three nominees who receive the most votes will be elected.

|

|

Broker non-votes and withhold votes have no effect.

|

|

2.

|

Advisory vote to approve executive compensation (Say on Pay)

|

|

Affirmative vote of the holders of a majority of the shares of common stock represented and entitled to vote at the Meeting.

|

|

Broker non-votes and abstentions have the same effect as a vote against the proposal.

|

|

3.

|

Approval of the 2021 Equity Incentive Plan

|

|

Affirmative vote of the holders of a majority of the shares of common stock represented and entitled to vote at the Meeting.

|

|

Broker non-votes and abstentions have the same effect as a vote against the proposal.

|

|

4.

|

Selection of Auditor

|

|

Affirmative vote of the holders of a majority of the shares of common stock represented and entitled to vote at the Meeting.

|

|

Abstentions have the same effect as a vote against the proposal.

|

POTENTIAL PAYMENTS UPON TERMINATION OR CHANGE IN CONTROL

The following table shows potential payments to our named executive officers under existing contracts for various scenarios involving a change in control or termination of employment, assuming a triggering event on the last business day of 2020. Please see the narrative above under "Employment Agreements" and "Certain Other Change in Control Agreements" for a description of payments contemplated by these agreements.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

Benefit

|

Termination

w/o Cause or

Material

Change

|

|

Change in

Control

|

|

After Change

in Control –

Material

Change or w/o

Cause1

|

|

Voluntary

Termination

|

|

Death

|

|

Disability

|

|

|

Larry A. Mizel

|

Severance Pay

|

$

|

3,000,000

|

|

2

|

|

|

$

|

3,000,000

|

|

2

|

|

|

$

|

3,000,000

|

|

2

|

$

|

3,000,000

|

|

2

|

|

|

Ann. Incentive Comp.

|

$

|

18,000,000

|

|

3

|

|

|

$

|

18,000,000

|

|

3

|

|

|

$

|

18,000,000

|

|

3

|

$

|

18,000,000

|

|

3

|

|

|

Stock/Option Vesting

|

$

|

47,966,467

|

|

4

|

|

|

$

|

47,966,467

|

|

4

|

|

|

$

|

47,966,467

|

|

11

|

$

|

47,966,467

|

|

11

|

|

|

Health Care Benefits

|

$

|

222,032

|

|

5

|

|

|

$

|

222,032

|

|

5

|

$

|

222,032

|

|

5

|

$

|

90,704

|

|

5

|

$

|

222,032

|

|

5

|

|

David D. Mandarich

|

Severance Pay

|

$

|

2,490,000

|

|

2

|

|

|

$

|

2,490,000

|

|

2

|

|

|

$

|

2,490,000

|

|

2

|

$

|

2,490,000

|

|

2

|

|

|

Ann. Incentive Comp.

|

$

|

12,000,000

|

|

3

|

|

|

$

|

12,000,000

|

|

3

|

|

|

$

|

12,000,000

|

|

3

|

$

|

12,000,000

|

|

3

|

|

|

Stock/Option Vesting

|

$

|

47,966,467

|

|

4

|

|

|

$

|

47,966,467

|

|

4

|

|

|

$

|

47,966,467

|

|

11

|

$

|

47,966,467

|

|

11

|

|

|

Health Care Benefits

|

$

|

297,968

|

|

5

|

|

|

$

|

297,968

|

|

5

|

$

|

297,968

|

|

5

|

$

|

90,704

|

|

5

|

$

|

297,968

|

|

5

|

|

Robert N. Martin

|

Severance Pay

|

|

|

|

|

$

|

1,600,000

|

|

6

|

|

|

|

|

|

|

|

|

Bonus Payment

|

|

|

|

|

$

|

800,000

|

|

7

|

|

|

|

|

|

|

|

|

Stock/Option Vesting

|

$

|

9,812,875

|

|

8

|

$

|

831,595

|

|

9

|

$

|

8,981,280

|

|

13

|

|

|

$

|

9,812,875

|

|

11

|

$

|

9,812,875

|

|

11

|

|

|

Health Care Benefits

|

|

|

|

|

$

|

28,389

|

|

10

|

|

|

|

|

|

|

|

Rebecca B. Givens

|

Severance Pay

|

|

|

|

|

$

|

900,000

|

|

6

|

|

|

|

|

|

|

|

|

Bonus Payment

|

|

|

|

|

$

|

400,000

|

|

7

|

|

|

|

|

|

|

|

|

Stock/Option Vesting

|

$

|

249,901

|

|

8

|

$

|

249,901

|

|

9

|

|

|

|

|

|

|

|

|

|

|

Health Care Benefits

|

|

|

|

|

$

|

148

|

|

10

|

|

|

|

|

|

|

|

Michael Touff

|

Severance Pay

|

$

|

240,000

|

|

12

|

|

|

$

|

240,000

|

|

12

|

|

|

|

|

|

|

|

|

Stock/Option Vesting

|

$

|

190,852

|

|

8

|

$

|

190,852

|

|

9

|

|

|

|

|

$

|

190,852

|

|

11

|

$

|

190,852

|

|

11

|

1 Following both a change in control and termination without cause or a material change, Messrs. Mizel, Mandarich and Martin and Ms. Givens may elect to terminate employment and receive the identified benefits.

2 Calculated as the aggregate base salary earned by the executive during the prior three years. This amount does not include any amount that may be payable upon a two-tier tender offer that results in a change of control. See footnote 4 below.

3 Under the executive's employment agreement, this is calculated as of December 31, 2020 at 300% for Mr. Mizel and 200% for Mr. Mandarich of the "Annual Incentive Compensation" paid for 2019. To the extent a portion of the Annual Incentive

Compensation is paid in restricted stock, that portion of the Annual Incentive Compensation is included and considered in addition to the cash portion.

4 Amount is the value of unvested restricted stock at December 31, 2020 plus an amount representing the difference between MDC’s stock price at December 31, 2020 and the exercise price of unvested options, to the extent that the stock price exceeds the exercise price. Under the executive's employment agreement, the vesting of all options, dividend equivalents and other rights granted under equity incentive plans and any other Company plans would be accelerated so as to permit the executive to fully exercise all outstanding options and rights, if any, granted to the executive. In the event a change in control involves a two-tier tender offer, the Company would pay the executive (at the executive's election) the difference between the exercise price of the otherwise unvested options and the price offered in the first tier, or adjust the option terms to provide the executive with an equivalent value. In addition, this amount also includes the value of all unvested performance share units pursuant to the terms of the performance share unit grant agreement.

5 The amount shown is the total projected medical insurance benefit obligation for the executive, which would provide medical benefits that are at least comparable to those provided to the executive at the time his employment agreement was signed. After the end of his employment term, the date the executive becomes totally disabled, the date of the executive's termination without cause or the executive's election to terminate his employment following a change in control (but not in the event of termination for cause), the Company will pay the medical insurance benefit for the duration of the executive's life. The medical insurance benefit also provides comparable coverage for the executive's spouse for duration of the executive's life and, if she survives him, for an additional 60 months after his death. This amount is estimated based on 2020 costs incurred by the Company.

6 Upon the occurrence of the specified event, Mr. Martin and Ms. Givens shall be entitled to receive an amount equal to 200% of their respective annual base salaries.

7 For each of Mr. Martin and Ms. Givens the amount is calculated as two times the amount equal to each named executive’s last regular annual bonus, provided that for these purposes, such regular annual bonus amount shall not exceed 50% of their annual base salary at the rate in effect immediately before the change in control event.

8 Represents the value of all unvested restricted stock and performance share unit awards, which would become fully vested upon a termination by the Company without cause, pursuant to the terms of the restricted stock award and performance share unit agreement.

9 Amount is the value of unvested restricted stock at December 31, 2020, plus an amount representing the difference between MDC’s stock price at December 31, 2020 and the exercise price of unvested options, to the extent that the stock price exceeds the exercise price. If a change in control occurs, all options, dividend equivalents and other rights granted to the employee under any Company equity incentive plans shall be accelerated and shall become exercisable immediately prior to the closing of the change in control so as to permit the employee fully to exercise all outstanding options and rights.

10 The employee shall also be entitled to continue to participate in each of the Company's employee benefit plans, policies or arrangements which provide insurance and medical benefits on the same basis as was provided to the employee prior to the change in control event for a period of 12 months after the date of termination of employee's employment. This amount is estimated based on 2020 costs incurred by the Company.

11 Represents the value of all unvested restricted stock, performance share unit awards plus an amount representing the difference between MDC’s stock price at December 31, 2020 and the exercise price of unvested options, to the extent that the stock price exceeds the exercise price., which would become fully vested upon death or disability, pursuant to the terms of the respective agreement.

12 Represents Mr. Touff's remaining salary through the end of his employment term.

13 Represents the value of all unvested performance share units pursuant to the terms of the performance share unit grant agreement.

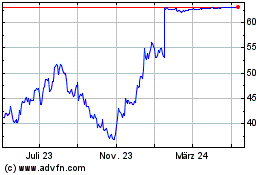

M D C (NYSE:MDC)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

M D C (NYSE:MDC)

Historical Stock Chart

Von Apr 2023 bis Apr 2024