Dollar Muted After Strong ADP Private Payrolls Data; Fed Decision In Focus

01 Mai 2019 - 11:01AM

RTTF2

The U.S. dollar showed muted trading against its major

counterparts in the European session on Wednesday, after ADP

private sector employment surged up more than expected in April,

while investors awaited the outcome of the Fed meeting for

indications on the future trajectory of interest rates.

Data from payroll processor ADP showed that private sector

hiring overwhelmed expectations in April following a much weaker

than expected job growth in the previous month.

ADP said private sector employment surged up by 275,000 jobs in

April after climbing by an upwardly revised 151,000 jobs in

March.

Economists had expected employment to increase by about 180,000

jobs compared to the addition of 129,000 jobs originally reported

for the previous month.

The Federal Reserve is widely expected to leave interest rates

unchanged when it ends a two-day policy meeting later in the

day.

Traders are likely to keep a close eye on the accompanying

statement and Fed Chairman Jerome Powell's subsequent press

conference for clues on the outlook for interest rates.

As Fed officials gathered for their two-day meeting that kicked

off on Tuesday, Trump urged the central bank to cut interest rates

by a full percentage point and inject bond-buying stimulus it

launched after the Great Recession.

"Our Federal Reserve has incessantly lifted interest rates, even

though inflation is very low, and instituted a very big dose of

quantitative tightening," Trump said in a post on Twitter.

The ADP report serves as a useful precursor to the Labor

Department' monthly payrolls data, due Friday.

Economists expect the economy to have added 187,000 jobs in

April, with a jobless rate of 3.8 percent.

The currency held steady against its major counterparts in the

Asian session.

The greenback declined to more than a 2-week low of 1.3077

against the pound shortly before the data and held steady

thereafter. Next key support for the greenback is seen around the

1.32 level.

Survey data from IHS Markit showed that UK manufacturing

expansion slowed to a two-month low in April amid a decline in

export business and an easing in the robust pace of

stock-building.

The IHS Markit/CIPS Purchasing Managers' Index, or PMI, fell to

53.1 in April from March's 13-month high of 55.1. The score was in

line with economists' expectations.

The greenback held steady against the Japanese yen, after having

retreated to 111.26 from a high of 111.55 hit at 3:00 am ET. The

pair ended Tuesday's trading at 111.42.

The greenback slid to 1.1240 against the euro, an 8-day low, at

5:30 am ET and moved sideways in subsequent deals. The pair was

valued at 1.1215 when it closed deals on Tuesday.

After falling to an 8-day low of 1.0152 against the franc around

6:20 am ET, the greenback traded steadily during the course of

session. The greenback-franc pair closed yesterday's deals at

1.0191.

The U.S. construction spending for March and ISM manufacturing

for April will be released at 10:00 am ET.

The Fed announces its interest rate decision at 2:00 pm ET.

Economists widely expect the fed funds rate to remain in a range

between 2.25 percent and 2.50 percent.

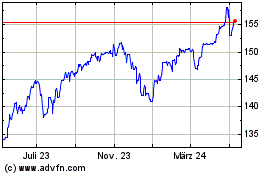

US Dollar vs Yen (FX:USDJPY)

Forex Chart

Von Mär 2024 bis Apr 2024

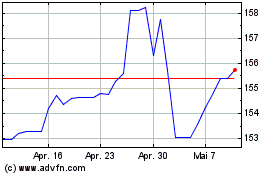

US Dollar vs Yen (FX:USDJPY)

Forex Chart

Von Apr 2023 bis Apr 2024