Xali Gold Corp. (TSXV:XGC) (“

Xali Gold” or the

“

Company”) is pleased to provide an update on the

Company’s activities in Mexico and Peru. In Mexico, the focus is

partnerships with third parties to deliver near-term cash flows and

in Peru the focus is returning to exploration. Currently, the

Company has excellent progress on four fronts.

“While we continue actively progressing

near-term cash flow opportunities from our Mexican assets, we are

also very excited to advance our growth strategy by actively

seeking out gold and silver projects with promising exploration

potential in Peru,” says Joanne Freeze, President and CEO of Xali

Gold.

El Oro Tailings Project

Mexico

Recent test work on the Mexican Mine Tailings

Reprocessing Project at El Oro (the “El Oro Tailings

Project”) in Mexico, indicates excellent potential for 75%

recovery of the gold and silver using a new process being

introduced by Kappes, Cassiday and Associates

(“KCA”).

KCA’s test work was recently conducted on two

near-surface bulk samples collected by backhoe and sent to the KCA

laboratory in Reno, Nevada. KCA reported an average of 72% recovery

on gold and 80% recovery of silver from the tailings using a

proprietary process. This process would allow the gold and silver

to be produced in the form of Dore, which enhances the value of the

royalty stream agreed with Xali Gold. Overall recoveries will need

further testing to establish a better estimate for overall

recoveries of gold and silver, but KCA is very optimistic about the

process.

KCA’s plans are to remove the tailings from

their present location and process them at a distant site which

would not require any further permitting and hence, the Company is

optimistic about a shorter timeline to production than previously

thought possible.

As per the Company’s April 15, 2024 News

Release, Xali Gold entered into a Letter of Intent to enter a

Purchase Agreement with KCA on the El Oro Tailings Project. Once

production begins on the El Oro Tailings Project, KCA will pay Xali

Gold a gross royalty equal to 4% of the sales income received from

all gold and silver produced, less any royalties due and payable to

others (the Municipality of El Oro), but in no case less than a 3%

gross royalty.

SDA Plant Mexico

Grupo Minero WIYA (“WIYA”), who

have signed a Modification to the Rent to Purchase Agreement on the

San Dieguito de Arriba (“SDA”) Plant in Nayarit,

Western Mexico (see News Release dated April 25, 2024), are

conducting modifications on the SDA Plant in order to produce a

single bulk concentrate and have commenced shipping mineralized

material from their mine to the SDA Plant. Approximately 550 tons

of mineralized rock has been received at the SDA Plant in

preparation for the restart of the mill, once 1500 tons has been

delivered.

El Oro Gold Hard Rock

Project

Xali Gold is in discussions with a local

experienced mining group who has proposed an agreement whereby they

would open up some of the historic workings to extract and process

previously untreated mineralized backfill from the underground

workings of the historic San Rafael mine at El Oro, Mexico. Profits

from the recovery of gold and silver bearing materials would be

shared and in addition, the underground work would give Xali Gold

underground access for drilling the previously developed targets

for new mineralized zones. Previous drilling from surface has

proven that the gold and silver mineralization continues at depth

underneath historic workings from which 5 million

(“M”) ounces (“oz”) gold

equivalent (4M oz gold and 44 M oz silver) was produced. Drilling

from underground would be much less expensive than drilling from

surface due to the occurrence of up to 300 metes of volcanic rocks

above the gold and silver bearing veins.

Peru

Xali Gold is in discussions with several other

companies to acquire additional gold and silver exploration

projects in Peru. The exploration projects are either high or low

sulphidation systems, where Xali Gold’s technical team has

extensive experience.

Shares for Debt

The Company also advises that it has entered

into an agreement pursuant to which the Company has agreed to issue

2,927,000 common shares of the Company at Cdn$0.05 to Lotz CPA Inc,

in order to cover the debt of Cdn$146,350, due for CFO consulting

fees over 5 years. The Common Shares issued pursuant to the shares

for debt settlement will be subject to a four month hold period.

This transaction is in compliance with applicable corporate and

securities laws and is subject to TSX Venture approval.

About Xali Gold

Xali Gold has gold and silver projects in Peru

and Mexico. The Company’s flagship project El Oro is a district

scale gold project encompassing a well-known prolific high-grade

gold dominant gold-silver epithermal vein system in Mexico. The

project covers 20 veins with past production and more than 57 veins

in total, from which approximately 6.4 million ounces of gold and

74 million ounces of silver were reported to have been produced

from just two of these veins (Ref. Mexico Geological Service

Bulletin Nr. 37, Mining of the El Oro and Tlapujahua Districts.

1920, T. Flores).

Modern understanding of epithermal vein systems

indicates that several of the El Oro district’s veins hold

excellent discovery potential, particularly below and adjacent to

the historic workings of the San Rafael Vein, which was mined to an

average depth of only 200m.

Xali Gold is dedicated to being a responsible

Community partner.

Joanne C. Freeze, P.Geo., President and CEO is

the Qualified Person as defined by National Instrument 43-101 for

the projects discussed above. Ms. Freeze has reviewed and approved

the contents of this release.

Neither the TSX Venture Exchange nor its

Regulation Services Provider accepts responsibility for the

adequacy or accuracy of this release.

Forward-looking InformationThis

news release may contain forward-looking information (as such term

is defined under Canadian securities laws) including but not

limited to historical production records. While such

forward-looking information is expressed by Xali Gold in good faith

and believed by Xali Gold to have a reasonable basis, they may

address future events and conditions and are therefore subject to

inherent risks and uncertainties including those set out in Xali

Gold’s MD&A. Factors that cause the actual results to differ

materially from those in forward-looking information include,

without limitation, gold prices, results of exploration and

development activities, regulatory changes, defects in title,

availability of materials and equipment, timeliness of government

approvals, potential environmental issues, availability of capital

and financing and general economic, market or business conditions.

Xali Gold expressly disclaims any intention or obligation to update

or revise any forward-looking information, whether as a result of

new information, future events or otherwise, except in accordance

with applicable securities laws.

On behalf of the Board of Xali Gold

Corp.

“Joanne Freeze” P.Geo.President, CEO and

Director

For further information please contact:Joanne

Freeze, President &

CEO

Tel:

+ 1 (604) 689-1957

info@xaligold.com

NR 130

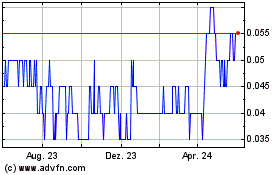

Xali Gold (TSXV:XGC)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

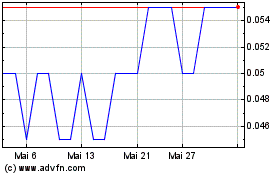

Xali Gold (TSXV:XGC)

Historical Stock Chart

Von Dez 2023 bis Dez 2024