Lion One Metals Limited (TSXV: LIO) (ASX: LLO) (OTCQX:

LOMLF) (“Lion One” or the “Company”), is pleased to

announce that the Company has closed the bought deal offering (the

“

Offering”) previously announced on May 3, 2023 by

issuing 29,350,000 units of the Company (the

“

Units”) at a price of $0.92 per Unit (the

“

Offering Price”) for aggregate gross proceeds of

$27,002,000 pursuant to the terms of an underwriting agreement (the

“

Underwriting Agreement”) dated as of May 5, 2023,

among the Company, Eight Capital (the “

Lead

Underwriter”), Canaccord Genuity Corp., Raymond James Ltd.

and Roth Canada Inc. (together with the Lead Underwriter, the

“

Underwriters”).

Each Unit consists of one common share (a

“Common Share”) in the capital of the Company and

one-half (1/2) of one common share purchase warrant (each whole

common share purchase warrant, a “Warrant”) of the

Company. Each Warrant shall be exercisable to acquire one Common

Share (a “Warrant Share”) at a price per Warrant Share of C$1.25

for a period of 30 months from the closing date of the

Offering.

The Company has applied to list the Warrants on

the TSX Venture Exchange (the “TSXV”) and the TSXV

has conditionally approved such listing, subject to receipt of

final documentation. It is expected that the Warrants will commence

within three days following closing.

The Company intends to use the net proceeds to

advance the exploration and development activities at its Tuvatu

Alkaline Gold Project in Fiji by: (i) acquiring additional mining

and process plant equipment, including infrastructure; (ii)

advancing mine development including initial mining of high grade

material; (iii) commissioning the process plant equipment; (iv)

constructing the tailings dam storage facility; and (v) continuing

its infill and deep feeder drilling programs. The Company will also

use a portion of the net proceeds for working capital and general

corporate purposes.

The Units issued pursuant to the Offering were

concurrently qualified for distribution by way of an offering

document in the form of National-Instrument 45-106F19 with respect

to an offering of up to 10,869,562 Units at the Offering Price

under the listed issuer financing exemption in Section 5A.2 of

National Instrument 45-106 (the “LIFE Exemption”)

and a prospectus supplement of the Company dated May 5, 2023 (the

“Prospectus Supplement”) to the Company’s existing

short form base shelf prospectus dated May 13, 2022 (the

“Base Shelf Prospectus”) filed in the Provinces of

British Columbia, Alberta and Ontario, and offered and sold to

eligible purchasers by way of available prospectus exemptions in

certain jurisdictions outside of Canada. 28,742,500 Units were

issued pursuant to the Prospectus Supplement and 607,500 Units were

issued pursuant to the LIFE Exemption. The Base Shelf Prospectus,

the Prospectus Supplement, the documents incorporated by reference

therein and the Underwriting Agreement are available on the

Company’s profile on SEDAR at www.sedar.com.

The securities referred to herein have not been

and will not be registered under the United States Securities Act

of 1933, as amended (the “U.S. Securities Act”),

or any U.S. state securities laws, and may not be offered or sold

in the “United States” (as such term is defined in Regulation S

under the U.S. Securities Act) unless registered under the U.S.

Securities Act and applicable U.S. state securities laws or an

exemption from such registration is available. This news release

shall not constitute an offer to sell or the solicitation of an

offer to buy nor shall there be any sale of the securities in any

jurisdiction in which such offer, solicitation or sale would be

unlawful.

About Lion One Metals

Limited

Lion One’s flagship asset is 100% owned, fully

permitted high grade Tuvatu Alkaline Gold Project, located on the

island of Viti Levu in Fiji. Lion One envisions a low-cost

high-grade underground gold mining operation at Tuvatu coupled with

exciting exploration upside inside its tenements covering the

entire Navilawa Caldera, an underexplored yet highly prospective 7

km diameter alkaline gold system. Lion One’s CEO Walter Berukoff

leads an experienced team of explorers and mine builders and has

owned or operated over 20 mines in 7 countries. As the founder and

former CEO of Miramar Mines, Northern Orion, and La Mancha

Resources, Walter is credited with building over $3 billion of

value for shareholders.

On behalf of the Board of Directors

of Lion One Metals Limited “Walter

Berukoff” Chairman and CEO

For further information Contact Investor

Relations Toll Free (North America) Tel: 1-855-805-1250 Email:

info@liononemetals.com Website: www.liononemetals.com

Neither the TSX Venture Exchange nor its

Regulation Service Provider accepts responsibility for the adequacy

or accuracy of this release. This press release may

contain statements that may be deemed to be “forward-looking

statements” within the meaning of applicable Canadian securities

legislation. All statements, other than statements of historical

fact, included herein are forward looking information. Generally,

forward-looking information may be identified by the use of

forward-looking terminology such as “plans”, “expects” or “does not

expect”, “proposed”, “is expected”, “budget”, “scheduled”,

“estimates”, “forecasts”, “intends”, “anticipates” or “does not

anticipate”, or “believes”, or variations of such words and

phrases, or by the use of words or phrases which state that certain

actions, events or results may, could, would, or might occur or be

achieved. This forward-looking information reflects Lion One Metals

Limited’s current beliefs and is based on information currently

available to Lion One Metals Limited and on assumptions Lion One

Metals Limited believes are reasonable. These assumptions include,

but are not limited to, the actual results of exploration projects

being equivalent to or better than estimated results in technical

reports, assessment reports, and other geological reports or prior

exploration results. Forward-looking information is subject to

known and unknown risks, uncertainties and other factors that may

cause the actual results, level of activity, performance or

achievements of Lion One Metals Limited or its subsidiaries to be

materially different from those expressed or implied by such

forward-looking information. Such risks and other factors may

include, but are not limited to: the stage development of Lion One

Metals Limited, general business, economic, competitive, political

and social uncertainties; the actual results of current research

and development or operational activities; competition; uncertainty

as to patent applications and intellectual property rights; product

liability and lack of insurance; delay or failure to receive board

or regulatory approvals; changes in legislation, including

environmental legislation, affecting mining, timing and

availability of external financing on acceptable terms; not

realizing on the potential benefits of technology; conclusions of

economic evaluations; and lack of qualified, skilled labour or loss

of key individuals. Although Lion One Metals Limited has attempted

to identify important factors that could cause actual results to

differ materially from those contained in forward-looking

information, there may be other factors that cause results not to

be as anticipated, estimated or intended. Accordingly, readers

should not place undue reliance on forward-looking information.

Lion One Metals Limited does not undertake to update any

forward-looking information, except in accordance with applicable

securities laws.

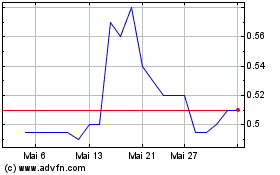

Lion One Metals (TSXV:LIO)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Lion One Metals (TSXV:LIO)

Historical Stock Chart

Von Jan 2024 bis Jan 2025