Lion One Metals Limited (TSX-V:LIO) (ASX:LLO)

(OTCQX:LOMLF) (FSE:LY1)

(the

“Company”) is pleased to announce important news on the

continued progress of the development of its 100% owned and fully

permitted Tuvatu Gold Project in Fiji. The Company has issued

a tender for underground mining services and has received competing

bids for the EPC contract and fabrication of the Tuvatu processing

plant and construction of the supporting infrastructure.

The Company expects to award the Underground

Mining Contract following agreement of final terms and conditions.

The Mining Contract will be for an initial period of 18 months to

perform the following activities:

- Enlarge the exploration portal and construct a new production

portal

- Slash the existing exploration decline

- Complete the majority of the decline and level development

including ventilation raises

- Stope production in available levels

The Company also announces that in addition to the ongoing

detailed engineering design by Yantai Jinpeng Engineering (see news

release dated May 9, 2017), it has received three competing bids

for final engineering, procurement, and construction (EPC) services

for the Tuvatu processing plant and supporting infrastructure.

The bids are for the construction of a new 210,000 tonne per

annum carbon-in-leach (CIL) gold ore processing facility to be

fabricated in China to western standards and Fijian Building

Code. In addition to the processing plant, the EPC contract

is expected to include the following supporting infrastructure:

- The dry stack tailings storage

- Primary diesel power generation system

- Assay lab

- Water supply and water treatment infrastructure

- Truck shop, warehouse, dry, and other operations

infrastructure

- Central administration complex

It is envisaged that the EPC contract will be signed as soon as

agreement is achieved on final terms and conditions to allow work

to proceed quickly. The Company is currently completing the final

bulk earthworks design as it intends to start excavation on the

mill site to be followed by commencement of mining.

“These developments have run concurrently with our efforts to

conclude funding arrangements for the project and will enable

full-scale mining, stockpiling, and underground development to

begin in tandem with critical path components of the EPC contract,”

said Lion One CEO Walter Berukoff. “We look forward to providing

further guidance with respect to scheduling in due course.”

Exploration and infill drilling continues with two drills on

site. Assay results are pending in the next few weeks.

About TuvatuThe Tuvatu Gold

Project is located 17 km from the Nadi International Airport on the

main island of Viti Levu in Fiji. Discovered in 1987, Tuvatu is a

high grade, low sulphidation, epithermal gold deposit hosted inside

a South Pacific style volcanic caldera. The deposit occurs

along the Viti Levu lineament, Fiji’s own corridor of high grade

gold deposits. Tuvatu is situated upon a 5 hectare footprint inside

a larger 384 hectare mining lease. The project contains numerous

high grade prospects proximal to Tuvatu, at depth, and up to 1.50

km along strike from the resource area, giving near-term production

potential and further discovery upside inside of one of Fiji’s

underexplored volcanic goldfields.

Tuvatu was advanced by previous owners through

underground exploration and development from 1997 through to the

completion of a feasibility study in 2000. Acquired by Lion

One in 2011, the project has over 100,000 meters of drilling

completed to date in addition to 1,600 meters of underground

development.

In January 2016 the Hon. Prime Minister of Fiji,

Mr. V. Bainimarama, formally presented the previously granted

Tuvatu Mining Lease to Lion One. This concluded the

permitting process for the development of an underground gold mine

and processing plant at Tuvatu, demonstrating strong government

support for Fiji’s 85 year-old gold mining industry.

As per its independent June 1, 2015 NI 43-101

PEA Technical Report on the Tuvatu Gold Project, the Company

envisages a low cost underground gold mining operation producing

352,931 ounces of gold at head grades of 11.30 g/t Au over an

initial 7 year mine life. This includes production of 262,000

ounces at 15.30 g/t through to the end of year three.

Estimated cash cost is US$567 per ounce with all-in sustaining cost

of US$779 per ounce. Total capex of US$48.6 million includes a

contingency of US$6.1 million with an 18 month preproduction

schedule and 18 month payback on capital. At a US$1,200 gold

price, the project generates net cash flow of US$112.66 million and

an IRR of 52% (after tax). The Company is not basing its

production decision on a feasibility study of mineral reserves

demonstrating economic and technical viability; as a result there

is increased uncertainty and economic and technical risks

associated with its production decision.

Ian Chang, M.A.Sc., P.Eng., Chief Development

Officer, is the Qualified Person ("QP") responsible for Tuvatu Mine

development. Stephen Mann, Managing Director, member of The

Australasian Institute of Mining and Metallurgy, is the Qualified

Person (“QP”) responsible for the Tuvatu Mine exploration

program.

For more information on Lion One including

technical reports please visit the Company’s website at

www.liononemetals.com or the SEDAR website at www.sedar.com .

On behalf of Lion One Metals

Limited“Walter H. Berukoff”Chief Executive

Officer

Neither the TSX Venture Exchange nor its

Regulation Service Provider accepts responsibility for the adequacy

or accuracy of this release.

This press release may contain "forward-looking

information" within the meaning of applicable Canadian securities

legislation. All statements, other than statements of historical

fact, included herein are forward looking information. Generally,

forward-looking information may be identified by the use of

forward-looking terminology such as "plans", "expects" or "does not

expect", "proposed", "is expected", "budget", "scheduled",

"estimates", "forecasts", "intends", "anticipates" or "does not

anticipate", or "believes", or variations of such words and

phrases, or by the use of words or phrases which state that certain

actions, events or results may, could, would, or might occur or be

achieved. This forward-looking information reflects Lion One Metals

Limited’s current beliefs and is based on information currently

available to Lion One Metals Limited and on assumptions Lion One

Metals Limited believes are reasonable. These assumptions include,

but are not limited to, the actual results of exploration projects

being equivalent to or better than estimated results in technical

reports, assessment reports, and other geological reports or prior

exploration results. Forward-looking information is subject to

known and unknown risks, uncertainties and other factors that may

cause the actual results, level of activity, performance or

achievements of Lion One Metals Limited or its subsidiaries to be

materially different from those expressed or implied by such

forward-looking information. Such risks and other factors may

include, but are not limited to: the early stage development of

Lion One Metals Limited, general business, economic, competitive,

political and social uncertainties; the actual results of current

research and development or operational activities; competition;

uncertainty as to patent applications and intellectual property

rights; product liability and lack of insurance; delay or failure

to receive board or regulatory approvals; changes in legislation,

including environmental legislation, affecting mining, timing and

availability of external financing on acceptable terms; not

realizing on the potential benefits of technology; conclusions of

economic evaluations; and lack of qualified, skilled labor or loss

of key individuals. Although Lion One Metals Limited has attempted

to identify important factors that could cause actual results to

differ materially from those contained in forward-looking

information, there may be other factors that cause results not to

be as anticipated, estimated or intended. Accordingly, readers

should not place undue reliance on forward-looking information.

Lion One Metals Limited does not undertake to update any

forward-looking information, except in accordance with applicable

securities laws.

For further information please contact

Stephen Mann, Managing Director (Perth, Australia) Tel: 604-973-3007

Hamish Greig, Vice President (North Vancouver, BC) Tel: 604-973-3008

Joe Gray, Investor Relations (North Vancouver, BC) Tel: 604-973-3004

Toll Free IR Line (North America) Tel: 1-855-805-1250

Email: info@liononemetals.com

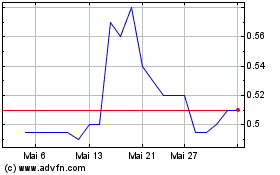

Lion One Metals (TSXV:LIO)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Lion One Metals (TSXV:LIO)

Historical Stock Chart

Von Jan 2024 bis Jan 2025