Gold Bull Resources Corp. (TSX-V: GBRC) (“

Gold

Bull” or the “

Company”) is pleased to

report excellent reverse circulation (RC) drill results from its

100% owned Sandman Project, located in Humboldt County, Nevada USA.

Two drill holes were completed at Silica Ridge (Figure 1), and both

holes successfully hit high-grade gold intersections. The recent

drill results returned 83.8m (275 ft) @ 1.50 g/t gold (Au) from

0m/surface in hole SA-0052 and 47.2m (155 ft) @ 1.54 g/t Au from

1.5m (5 ft) in hole SA-0044. Of note, a high-grade intersection of

3m @ 14.67 g/t Au from only 1.5m below the surface was successfully

hit. These results demonstrate the significant extent of gold

mineralization from surface at the Sandman gold project and provide

confidence for the Company to initiate a Scoping Study that will

investigate the economic viability of various near-term production

scenarios at Sandman upon completion of the current drill program.

Highlights & Update:

- Targeted structures returned significant drill intersections of

83.8m of gold mineralization grading 1.50g/t Au

from surface (0m) including very high-grade interval of 3m

@ 14.67 g/t Au from 1.5m in hole SA-0052

- Hole SA-0044 returned 47.2m of gold mineralization

grading 1.54g/t Au from 1.5m including 6.1m @

8.01g/t Au from 3m

- Gold-bearing fault structures were targeted, and further

drilling is warranted to further define the geometry of these

mineralized faults

- The depths and grades for a potential open-pit extraction

method remain encouraging with mineralization from surface and this

will be investigated via a Scoping Study in Q3, 2022

- Drilling is ongoing and the Company remains fully funded

Gold Bull CEO, Cherie Leeden commented:

The

consistency of high-grade oxide mineralization over tens of meters

at Silica Ridge is very encouraging and is reason to investigate

near-term production scenarios at Sandman. The high-grade intervals

in these two holes, such as 3m at 14.67 g/t Au in one hole and 6.1m

@ 8.01 g/t Au in the other hole - both within the top 10m from the

surface indicates sweet spots that will be investigated in a

Scoping Study for potential mine start-ups. Both holes hit zones

grading 8 g/t gold over 6-meter widths! I feel that Gold Bull is

significantly undervalued given the quality of the Sandman gold

project which continues to deliver via our ongoing drill

program.

Background

Drill hole SA-0052 was planned with a twofold

objective of testing interpreted mineralizing fluid conduits at

depth near the Tertiary unconformity for high-grade veins and

providing improved definition of a high-grade zone within the

current Mineral Resource Estimate. The high-grade zone had been

intersected by SA-0044, which returned 47.2 m (155 ft) @ 1.54 g/t

Au from 1.5 m (5 ft), including 6.1m (20 ft) @ 8.01 g/t Au from 3m

(10 ft) and 1.5 m (5 ft) @ 1.15 g/t from 24.4m (80 ft), as well as

1.5 m (5 ft) @ 0.21 g/t Au from 114.3 m (375 ft). Drill hole

SA-0052 extended this zone, returning 83.8 m (275 ft) @ 1.50 g/t Au

from 0 m (0 ft), including 13.7 m (45 ft) @ 4.52 g/t Au from 0 m (0

ft), which includes 3 m (10 ft) @ 14.67 g/t Au from 1.5 m (5 ft),

and 1.5m (5ft) @ 15.53 g/t Au from 1.5m (5 ft), as well as 3 m (10

ft) @ 2.75 g/t Au from 36.6 m (120 ft), 16.8 m (55 ft) @ 3.05 g/t

Au from 65.5 m (215 ft), and 6.1 m (20 ft) @ 8.24 g/t Au from 71.6

m (235 ft).

Below these high-grade intersections in hole

SA-0052 are numerous narrow, low-grade mineralized intersections

within a zone extending over most of the lower part of the drill

hole, into the Triassic basement rocks (refer to the cross-section

in Figure 2). This broad zone of gold mineralization supports our

belief that high-grade feeder structures exist below the current

Mineral Resource estimate close to this drill hole. Further

drilling is needed to define these structures, particularly below

the current Mineral Resource Estimate.

Figure 1. Silica Ridge drill hole collar location plan for

SA-0044 and SA-0052 as well as 2021 Resource Outline surface

projection, interpreted faults and drill

collars.https://www.globenewswire.com/NewsRoom/AttachmentNg/410e8a4a-1e0c-4e69-ae19-e06c890a7a68

Figure 2. Cross-section showing drill hole SA-0044 and

SA-0052 gold intercepts. Mineralization in hole SA-0052 extends

beneath the existing resource outline to the basement contact at

192m hole

depth.https://www.globenewswire.com/NewsRoom/AttachmentNg/ebb9ef7c-099e-4a29-93d6-c0518c579c34

Table 1 Significant intercepts from SA-0044 and SA-0052

|

Hole ID |

From(m) |

To(m) |

Width(m) |

From(ft) |

To(ft) |

Width(ft) |

Gold gradeg/t |

|

SA-0052 |

0 |

83.8 |

83.8 |

0 |

275 |

275 |

1.5 |

|

including |

0 |

13.7 |

13.7 |

0 |

45 |

45 |

4.52 |

|

Including |

1.5 |

4.5 |

3 |

5 |

15 |

10 |

14.67 |

|

and |

36.6 |

39.6 |

3 |

120 |

130 |

10 |

2.75 |

|

and |

65.5 |

82.3 |

16.8 |

215 |

270 |

55 |

3.05 |

|

and |

71.6 |

77.7 |

6.1 |

235 |

255 |

20 |

8.24 |

|

SA-0052 |

112.8 |

115.8 |

3 |

370 |

380 |

10 |

0.27 |

|

SA-0052 |

134.1 |

135.6 |

1.5 |

440 |

445 |

5 |

0.53 |

|

SA-0052 |

140.2 |

141.7 |

1.5 |

460 |

465 |

5 |

0.23 |

|

SA-0052 |

160 |

161.5 |

1.5 |

525 |

530 |

5 |

0.22 |

|

SA-0052 |

166.1 |

169.2 |

3 |

545 |

555 |

10 |

0.30 |

|

SA-0052 |

170.7 |

172.2 |

1.5 |

560 |

565 |

5 |

0.32 |

|

SA-0052 |

189 |

190.5 |

1.5 |

620 |

625 |

5 |

0.21 |

|

SA-0044 |

1.5 |

48.7 |

47.2 |

5 |

160 |

155 |

1.54 |

|

including |

3 |

9.1 |

6.1 |

10 |

30 |

20 |

8.01 |

|

and |

24.4 |

25.9 |

1.5 |

80 |

85 |

5 |

1.15 |

|

SA-0044 |

114.3 |

115.8 |

115.8 |

375 |

380 |

5 |

0.21 |

Figure 3. Sandman project location map showing location of

Silica Ridge deposit and results from recently drilled holes

SA-0044 and

SA-0052.https://www.globenewswire.com/NewsRoom/AttachmentNg/acaa6c49-2f63-423a-a603-f904bad3c47a

Next steps

- The current

5,000 m drilling program at Sandman is ongoing. Assays will be

received over the next several months and the deposits will be

re-evaluated for additional ounces.

- Upon receipt of

all

- the assay

results, the Company intends to commence a Scoping/Concept Study

that will investigate the economic viability of various near term

production scenarios, with the aim of providing a focussed approach

for a PEA and/or PFS.

About Sandman

In December 2020, Gold Bull purchased the

Sandman Project from Newmont. Gold mineralization was first

discovered at Sandman in 1987 by Kennecott and the project has been

intermittently explored since then. There are four known pit

constrained gold resources located within the Sandman Project,

consisting of 21.8Mt at 0.7g/t gold for 494,000 ounces of gold;

comprising of an Indicated Resource of 18,550kt at 0.73g/t gold for

433kozs of gold plus an Inferred Resource of 3,246kt at 0.58g/t

gold for 61kozs of gold. Several of the resources remain open in

multiple directions and the bulk of the historical drilling has

been conducted to a depth of less than 100m. Sandman is

conveniently located circa 25-30 km northwest of the mining town of

Winnemucca, Nevada.

Qualified Person

Cherie Leeden, B. Sc Applied Geology (Honors),

MAIG, a “Qualified Person” as defined by National Instrument

43-101, has read and approved all technical and scientific

information contained in this news release. Ms. Leeden is the

Company’s Chief Executive Officer. Cherie Leeden relied on resource

information contained within the Technical Report on the Sandman

Gold Project, prepared by Steven Olsen, a Qualified Person under NI

43-101, who is a Qualified Persons as defined by the National

Instrument NI 43-101. Mr. Olsen is an independent consultant and

has no affiliations with Gold Bull except that of an independent

consultant/client relationship. Mr. Olsen is a member of the

Australian Institute of Geoscientists (AIG) and is the Qualified

Person under NI 43-101, Standards of Disclosure for Mineral

Projects.

Quality Assurance – Quality Control

Samples are submitted to American Assay

Laboratories’ analytical facility in Sparks, Nevada for preparation

and analysis. The AAL facility is ISO-17025 accredited by IAS. The

entire sample is dried, weighed and crushed, with 70% passing -10

mesh, then riffle split to 250 g aliquots, which are fine

pulverized with 90% passing -150mesh. Analysis for gold is by 30 g

fire assay lead collection with Inductively Coupled Plasma Optical

Emission Spectroscopy (ICP-OES) finish with a lower limit of 0.003

ppm. Samples were also analyzed using a 36 multi-element

geochemical package by 5-acid digestion, followed by Inductively

Coupled Plasma Optical Emission Spectroscopy (ICP-OES) for the 36

elements.

About Gold Bull Resources Corp.

Gold Bull’s mission is to grow into a US-focused

mid-tier gold development Company via rapidly discovering and

acquiring additional ounces. The Company’s exploration hub is based

in Nevada, USA, a top-tier mineral district that contains

significant historical production, existing mining infrastructure

and established mining culture. Gold Bull is led by a Board and

Management team with a track record of exploration and acquisition

success.

Gold Bull’s core asset is the Sandman Project,

located in Nevada which has a 494,000 oz gold

resource as per the 2021 43-101 Resource Estimate. Sandman is

located 23 km south of the Sleeper Mine and boasts excellent

large-scale exploration potential. Drilling at Sandman is currently

underway.

Gold Bull is driven by its core values and

purpose which include a commitment to safety, communication &

transparency, environmental responsibility, community, and

integrity.

Cherie LeedenPresident and CEO, Gold Bull Resources Corp.

For further information regarding Gold Bull

Resources Corp., please visit our website at www.goldbull.ca or

email adminatgoldbull.ca.

Phone: 778.899.3050

Cautionary Note Regarding Forward-Looking

StatementsNeither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

This news release contains certain statements

that may be deemed “forward-looking statements” with respect to the

Company within the meaning of applicable securities laws.

Forward-looking statements are statements that are not historical

facts and are generally, but not always, identified by the words

“expects”, “plans”, “anticipates”, “believes”, “intends”,

“estimates”, “projects”, “potential”, “indicates”, “opportunity”,

“possible” and similar expressions, or that events or conditions

“will”, “would”, “may”, “could” or “should” occur. Although Gold

Bull believes the expectations expressed in such forward-looking

statements are based on reasonable assumptions, such statements are

not guarantees of future performance, are subject to risks and

uncertainties, and actual results or realities may differ

materially from those in the forward-looking statements. Such

material risks and uncertainties include, but are not limited to,

the Company’s ability to raise sufficient capital to fund its

obligations under its property agreements going forward, to

maintain its mineral tenures and concessions in good standing, to

explore and develop its projects, to repay its debt and for general

working capital purposes; changes in economic conditions or

financial markets; the inherent hazards associates with mineral

exploration and mining operations, future prices of copper and

other metals, changes in general economic conditions, accuracy of

mineral resource and reserve estimates, the potential for new

discoveries, the ability of the Company to obtain the necessary

permits and consents required to explore, drill and develop the

projects and if obtained, to obtain such permits and consents in a

timely fashion relative to the Company’s plans and business

objectives for the projects; the general ability of the Company to

monetize its mineral resources; and changes in environmental and

other laws or regulations that could have an impact on the

Company’s operations, compliance with environmental laws and

regulations, dependence on key management personnel and general

competition in the mining industry. Forward-looking statements are

based on the reasonable beliefs, estimates and opinions of the

Company’s management on the date the statements are made. Except as

required by law, the Company undertakes no obligation to update

these forward-looking statements in the event that management’s

beliefs, estimates or opinions, or other factors, should

change.

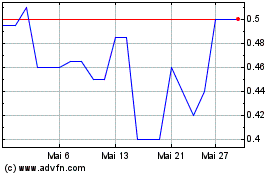

Gold Bull Resources (TSXV:GBRC)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Gold Bull Resources (TSXV:GBRC)

Historical Stock Chart

Von Dez 2023 bis Dez 2024