Gold Bull Resources Corp. (TSX-V: GBRC) (“

Gold

Bull” or the “

Company”) is pleased to

report that drilling intercepts at the North Hill deposit have

confirmed the continuity of an internal high-grade zone and

extended the known shallow mineralization to the east, and hole

SA-0049 at Abel Knoll has confirmed continuity of an eastern

extension to the Mineral Resource Estimate.

Highlights & Update:

- North Hill

SA-0037: 32 m at 1.31 g/t gold (Au) from 42.7 m,

including 1.5 m at 9.34 g/t Au

- North Hill

SA-0039: resource extended by about 80m to the

east

- All

mineralization at North Hill is oxidized, and the resource remains

open at depth

- Abel Knoll

mineralization intersected outside of Mineral Resource and remains

open

- 3450 m (11315

ft) for 17 holes completed during current program with 1550 m (5090

ft) remaining for 5 holes

- More

assay results expected soon, and drilling continues onsite at

Sandman

Gold Bull CEO, Cherie Leeden commented:

The more we drill, the more ounces we

are defining outside the known resource at Sandman. In addition to

adding ounces, the consistent grades returned from within the North

Hill deposit including 32m of near-surface oxidized mineralization

grading 1.31g/t Au (including a high-grade zone going 9.34 g/t gold

over 1.5m) make for a compelling case to investigate the economics

of a start-up operation. We have circa half a million ounces of

gold sitting at or near the surface and intend to commence a

Scoping Study after receiving the lab results from this drill

program.

Background

North Hill

Recent Hole SA-0037 returned 32 m (105 ft) at

1.31 g/t Au from 42.7 m (140 ft), including 1.5 m (5 ft) at 9.34

g/t Au from 59.4 m (195 ft), confirming the continuity of a

high-grade zone defined within the Mineral Resource Estimate by

earlier drilling (refer to press release “Gold Bull drills several

shallow high-grade intercepts including 13.7m @ 10.95 g/t Au from

41.1m; Extends North Hill high-grade gold mineralization at

Sandman” dated March 29, 2021). Hole SA-0037 also intersected 1.5 m

(5 ft) at 0.26 g/t Au from 77.7 m (255 ft) and 1.5 m (5 ft) at 0.2

g/t Au from 160 m (525 ft).

Hole SA-0039 was collared 80 m east of the

nearest edge of the current Mineral Resource Estimate to test for

down-dip extensions to the North Hill shallow strata-bound

mineralization. Hole SA-0027, drilled in 2021 beneath the eastern

edge of the Mineral Resource Estimate, had returned three

mineralized intervals: 19.8 m (65 ft) @ 0.6 g/t Au from 4.6 m (15

ft), (including: 6.1 m (20 ft) @ 1.18 g/t Au from 9.1 m (30 ft)),

15.2 m (50 ft) @ 0.39 g/t Au from 30.5 m (100 ft), and 21.3 m (70

ft) @ 0.44 g/t Au from 51.8 m (170 ft), all of which lie within 65

m (213 ft) vertical depth below surface, which is within range of a

possible open pit design. (Refer to press release “Gold Bull

Reports Sandman Drill Holes at North Hill and Silica Ridge

Intersect Gold Mineralization Outside of Current Resource” dated

July 21, 2021.) These intersections, located near the Mineral

Resource Estimate boundary, indicated that the mineralization

remained open to the east and SA-0039 was planned as a significant

step-out. Hole SA-0039 returned 4.6 m (15 ft) at 0.94 g/t Au from

39.6 m (130 ft), confirming that opportunities to discover further

shallow (potential open-pit) extensions to the Mineral Resource

Estimate exist in this sparsely drilled area to the east of North

Hill.

https://www.globenewswire.com/NewsRoom/AttachmentNg/ffcd05db-aaea-4ca5-8beb-454fe099bbd5Figure

1. Sandman location map showing 2021 mineral resources and targets.

Drill holes returned at North Hill for SA-0035 to SA-0039 are

labelled.

https://www.globenewswire.com/NewsRoom/AttachmentNg/ca108363-c2e2-4583-941a-acf5b9ecd6dfFigure

2. Location map of North Hill drill holes showing A-A’ cross

section. Drill hole collars SA-0035 to SA-0039 are shown. Note:

Holes SA-0035 and SA-0036 were included in prior announcement dated

April 19, 2022. Holes SA-0037 to SA-0039 are new results.

https://www.globenewswire.com/NewsRoom/AttachmentNg/7535dc93-4dd1-4555-b06f-2bb5d7000cd6Figure

3. Cross-section of North Hill drill results SA-0035 through to

SA-0039. Gold intersections >0.1 g/t gold are shown in blue and

intersections >0.2g/t gold are shown in red. The results shown

in red are Included In the significant Intersections table below.

Note: Holes SA-0035 and SA-0036 were included in prior announcement

dated April 19, 2022. Holes SA-0037 to SA-0039 are new results.

Abel Knoll

Hole SA-0049 was drilled to test the continuity

of mineralization intersected in resource extension holes SA-0031

(refer to press release “Gold Bull Reports Significant New Gold

Mineralization Outside of Current Resource at Sandman Including:

90m at 0.6 g/t Au” dated July 28, 2021) and SA-0050 (refer to press

release “Gold Bull drilling intersects high-grade gold

mineralization at Sandman, up to 13g/t gold (over 1.5m) at Silica

Ridge” dated April 19, 2022). These two holes, located to the east

of the current Mineral Resource Estimate, had intersected several

intervals returning average gold grades above the 0.2 g/t Au

resource cut-off, with SA-0031 returning 89.9 m (295 ft) averaging

0.6 g/t Au from 76.2 m (250 ft) to 166.1 m (545 ft), including

small intervals of internal waste at an average grade of 0.13 g/t

Au. The recent hole SA-0049 returned 56.4 m (185 ft) at 0.2 g/t Au

from 103.6 m (340 ft). The result confirms the continuity of the

mineralized zone east of the Mineral Resource Estimate, which

remains open to the north and south.

Drill Summary Table

The table below provides summary of results for this

announcement with SA-0037 to SA-0039 drilled at North Hill and

SA-0049 drilled at Abel Knoll.

|

Hole ID |

From (m) |

To (m) |

Width (m) |

From (ft) |

To (ft) |

Width (ft) |

Avg. grade (g/t Au) |

|

SA-0037 |

42.7 |

74.7 |

32 |

140 |

245 |

105 |

1.31 |

|

including |

42.7 |

62.5 |

19.8 |

140 |

205 |

65 |

1.56 |

|

including |

59.4 |

60.9 |

1.5 |

195 |

200 |

5 |

9.34 |

|

and |

67.1 |

74.7 |

7.6 |

220 |

245 |

25 |

1.4 |

|

SA-0037 |

77.7 |

79.2 |

1.5 |

255 |

260 |

5 |

0.26 |

|

SA-0037 |

160 |

161.5 |

1.5 |

525 |

530 |

5 |

0.2 |

|

SA-0038 |

4.6 |

6.1 |

1.5 |

15 |

20 |

5 |

0.32 |

|

SA-0038 |

36.6 |

39.6 |

3 |

120 |

130 |

10 |

0.72 |

|

SA-0038 |

83.8 |

91.4 |

7.6 |

275 |

300 |

25 |

2.35 |

|

including |

88.4 |

91.4 |

3 |

290 |

300 |

10 |

5.7 |

|

including |

88.4 |

89.9 |

1.5 |

290 |

295 |

5 |

9.3 |

|

SA-0039 |

39.6 |

44.2 |

4.6 |

130 |

145 |

15 |

0.94 |

|

including |

39.6 |

41.1 |

1.5 |

130 |

135 |

5 |

2.24 |

|

SA-0049 |

76.2 |

77.7 |

1.5 |

250 |

255 |

5 |

0.41 |

|

SA-0049 |

103.6 |

160 |

56.4 |

340 |

525 |

185 |

0.2 |

About Sandman

In December 2020, Gold Bull purchased the

Sandman Project from Newmont. Gold mineralization was first

discovered at Sandman in 1987 by Kennecott and the project has been

intermittently explored since then. There are four known pit

constrained gold resources located within the Sandman Project,

consisting of 21.8Mt at 0.7g/t gold for 494,000 ounces of gold;

comprising of an Indicated Resource of 18,550kt at 0.73g/t gold for

433kozs of gold plus an Inferred Resource of 3,246kt at 0.58g/t

gold for 61kozs of gold. Several of the resources remain open in

multiple directions and the bulk of the historical drilling has

been conducted to a depth of less than 100m. Sandman is

conveniently located circa 25-30 km northwest of the mining town of

Winnemucca, Nevada.

Qualified Person

Cherie Leeden, B.Sc Applied Geology (Honours),

MAIG, a “Qualified Person” as defined by National Instrument

43-101, has read and approved all technical and scientific

information contained in this news release. Ms. Leeden is the

Company’s Chief Executive Officer. Cherie Leeden relied on resource

information contained within the Technical Report on the Sandman

Gold Project, prepared by Steven Olsen, a Qualified Person under NI

43-101, who is a Qualified Persons as defined by the National

Instrument NI 43-101. Mr. Olsen is an independent consultant and

has no affiliations with Gold Bull except that of an independent

consultant/client relationship. Mr. Olsen is a member of the

Australian Institute of Geoscientists (AIG) and is the Qualified

Person under NI 43-101, Standards of Disclosure for Mineral

Projects.

Quality Assurance – Quality Control

Samples are submitted to American Assay

Laboratories’ analytical facility in Sparks, Nevada for preparation

and analysis. The AAL facility is ISO-17025 accredited by IAS. The

entire sample is dried, weighed and crushed, with 70% passing -10

mesh, then riffle split to 250 g aliquots, which are fine

pulverized with 90% passing -150mesh. Analysis for gold is by 30 g

fire assay lead collection with Inductively Coupled Plasma Optical

Emission Spectroscopy (ICP-OES) finish with a lower limit of 0.003

ppm. Samples were also analyzed using a 36 multi-element

geochemical package by 5-acid digestion, followed by Inductively

Coupled Plasma Optical Emission Spectroscopy (ICP-OES) for the 36

elements.

About Gold Bull Resources Corp.

Gold Bull’s mission is to grow into a US-focused

mid-tier gold development Company via rapidly discovering and

acquiring additional ounces. The Company’s exploration hub is based

in Nevada, USA, a top-tier mineral district that contains

significant historical production, existing mining infrastructure

and established mining culture. Gold Bull is led by a Board and

Management team with a track record of exploration and acquisition

success.

Gold Bull’s core asset is the Sandman Project,

located in Nevada which has a 494,000 oz gold

resource as per the 2021 43-101 Resource Estimate. Sandman is

located 23 km south of the Sleeper Mine and boasts excellent

large-scale exploration potential. Drilling at Sandman is currently

underway.

Gold Bull is driven by its core values and

purpose which include a commitment to safety, communication &

transparency, environmental responsibility, community, and

integrity.

Cherie LeedenPresident and CEO, Gold Bull Resources Corp.

For further information regarding Gold Bull

Resources Corp., please visit our website at www.goldbull.ca or

email admin@goldbull.ca.

Cautionary Note Regarding Forward-Looking

StatementsNeither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

This news release contains certain statements

that may be deemed “forward-looking statements” with respect to the

Company within the meaning of applicable securities laws.

Forward-looking statements are statements that are not historical

facts and are generally, but not always, identified by the words

“expects”, “plans”, “anticipates”, “believes”, “intends”,

“estimates”, “projects”, “potential”, “indicates”, “opportunity”,

“possible” and similar expressions, or that events or conditions

“will”, “would”, “may”, “could” or “should” occur. Although Gold

Bull believes the expectations expressed in such forward-looking

statements are based on reasonable assumptions, such statements are

not guarantees of future performance, are subject to risks and

uncertainties, and actual results or realities may differ

materially from those in the forward-looking statements. Such

material risks and uncertainties include, but are not limited to,

the Company’s ability to raise sufficient capital to fund its

obligations under its property agreements going forward, to

maintain its mineral tenures and concessions in good standing, to

explore and develop its projects, to repay its debt and for general

working capital purposes; changes in economic conditions or

financial markets; the inherent hazards associates with mineral

exploration and mining operations, future prices of copper and

other metals, changes in general economic conditions, accuracy of

mineral resource and reserve estimates, the potential for new

discoveries, the ability of the Company to obtain the necessary

permits and consents required to explore, drill and develop the

projects and if obtained, to obtain such permits and consents in a

timely fashion relative to the Company’s plans and business

objectives for the projects; the general ability of the Company to

monetize its mineral resources; and changes in environmental and

other laws or regulations that could have an impact on the

Company’s operations, compliance with environmental laws and

regulations, dependence on key management personnel and general

competition in the mining industry. Forward-looking statements are

based on the reasonable beliefs, estimates and opinions of the

Company’s management on the date the statements are made. Except as

required by law, the Company undertakes no obligation to update

these forward-looking statements in the event that management’s

beliefs, estimates or opinions, or other factors, should

change.

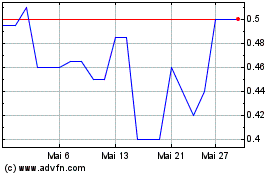

Gold Bull Resources (TSXV:GBRC)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Gold Bull Resources (TSXV:GBRC)

Historical Stock Chart

Von Dez 2023 bis Dez 2024