Almadex Minerals Ltd. ("Almadex" or the "Company")

(TSX-V: “DEX) is pleased to announce completion of its updated

mineral resource estimate (MRE) with respect to the Logan

Zinc/Silver project (“Logan”, or the “Project”) located in Yukon

Territory, Canada.

Highlights:

- Indicated Mineral Resource

of 2.6 million tonnes grading 5.1% zinc and 23.1 g/t

silver;

- Inferred Mineral Resource

of 16.9 million tonnes grading 4.3% zinc and 18.2 g/t

silver;

- At-surface high grade zone;

amenable to open pit mining;

- Potential for resource

expansion at depth and along strike.

The Logan Project is located 108 km northwest of

Watson Lake in south central Yukon. The Project consists of 156

contiguous quartz mining claims located in the Watson Lake Mining

District, covering over 3,200 hectares. The Project is located on

the traditional territory of the Ross River Dena Council and Liard

First Nation, 38 km north of the Alaska Highway (Figure 1).

J. Duane Poliquin, Chairman of Almadex

commented, “We are pleased to provide this updated resource

estimate for Logan, which is a significant mineral endowment of a

critical mineral located near infrastructure. This resource

provides an excellent basis for continued study of Logan, as a

potential new source of critical minerals to support a lower carbon

future.”

The Logan deposit consists of fracture and vein

hosted zinc-silver mineralization within a granitic intrusion. The

Main Zone occurs along an 8,000m long NE-trending fault-related

structure. The Main Zone is tabular, dips 70 degrees to the NW,

extends for 1,100m along strike, varies from 50m to 150m in width,

and has been traced to depths of 275m and remains open. The

mineralization is up to 90 metres thick in relatively gentle

terrain and minimal overburden, making it potentially attractive

for open pit mining (see Figures 2 and 3). Recent drill core

re-analysis indicated potentially economically significant values

of the critical metal indium (In), not historically assayed for,

averaging 35 parts-per-million (ppm) In and up to 273 ppm In.

Indium is integral to solar panel manufacturing and a key input in

semiconductors and many materials needed for advanced vehicle

manufacturing.

The Mineral Resource Estimate (MRE) and NSR

cut-off sensitivities are presented in Table 1 and Table 2,

respectively.

Table 1 – Logan Project Open Pit Constrained Mineral

Resource Estimate

|

Classification |

Zn Cutoff(%) |

Tonnes |

Zn(%) |

Ag(g/t) |

Zn(Mlb) |

Ag(Moz) |

|

Indicated |

1.6 |

2,620,000 |

5.1 |

23.1 |

294 |

1.94 |

|

Inferred |

1.6 |

16,930,000 |

4.3 |

18.2 |

1622 |

9.98 |

Notes:

- Mr. Mike Dufresne, P.Geol., P.Geo.

of APEX Geoscience Ltd., who is deemed a qualified person as

defined by NI 43-101 is responsible for the completion of the

updated mineral resource estimation, with an effective date of

January 17, 2023.

- Mineral Resources that are not

Mineral Reserves do not have demonstrated economic viability.

- The estimate of Mineral Resources

may be materially affected by environmental, permitting, legal,

title, taxation, socio-political, marketing, or other relevant

issues.

- The Inferred Mineral Resource in

this estimate has a lower level of confidence than that applied to

an Indicated Mineral Resource and must not be converted to a

Mineral Reserve. It is reasonably expected that the majority of the

Inferred Mineral Resource could potentially be upgraded to an

Indicated Mineral Resource with continued exploration.

- The Mineral Resources were

estimated in accordance with the Canadian Institute of Mining,

Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources

and Reserves, Definitions (2014) and Best Practices Guidelines

(2019) prepared by the CIM Standing Committee on Reserve

Definitions and adopted by the CIM Council.

- The cut-off grade of 1.6% Zn is

based on metal prices of US$1.30/lb Zn and US$19/oz Ag and 0.77 US$

per C$, with process recoveries of 95% Zn and 80% Ag .

- The constraining pit optimization

parameters assumed C$3.50/t mineralized and waste material mining

cost, 45° pit slopes and a process + G&A cost of C$35/t, using

a 1.5 revenue factor that equates with metal price assumptions of

US$1.95/lb Zn, US$28.50/Oz Ag and 0.77 US$ per C$.

- The effective date of the Mineral

Resources Estimate is January 17, 2023, and a technical report on

the Logan project will be filed by the Company on SEDAR within 45

days of the date of this News Release.

Table 2 – Logan Property Open Pit

Constrained Mineral Resource Estimate Sensitivity

|

Classification |

Zn Cutoff(%) |

Tonnes |

Zn(%) |

Ag(g/t) |

Zn(Mlb) |

Ag(Moz) |

|

Indicated |

0.5 |

2,780,000 |

4.8 |

21.5 |

298 |

1.96 |

|

1.0 |

2,700,000 |

5.0 |

22.5 |

296 |

1.96 |

|

1.6 |

2,620,000 |

5.1 |

23.1 |

294 |

1.94 |

|

2.0 |

2,520,000 |

5.2 |

23.5 |

290 |

1.91 |

|

3.0 |

2,060,000 |

5.8 |

26.1 |

264 |

1.73 |

|

4.0 |

1,490,000 |

6.7 |

29.7 |

220 |

1.42 |

|

Inferred |

0.5 |

36,640,000 |

2.4 |

10.7 |

2046 |

13.20 |

|

1.0 |

25,680,000 |

3.2 |

14.1 |

1864 |

11.84 |

|

1.6 |

16,930,000 |

4.3 |

18.2 |

1622 |

9.98 |

|

2.0 |

13,960,000 |

4.9 |

20.3 |

1505 |

9.13 |

|

3.0 |

10,020,000 |

5.8 |

23.5 |

1292 |

7.56 |

|

4.0 |

6,800,000 |

7.0 |

26.3 |

1045 |

5.73 |

Mineral Resource Estimation

Methodology

Modeling was conducted in the Universal

Transverse Mercator (UTM) coordinate space relative to the North

American Datum (NAD) 1983, and UTM zone 9N. The mineral resource

block model utilized a block size of 6 m (X) x 6 m (Y) x 6 m (Z) to

honour the mineralization wireframes. The percentage of the volume

of each block below the bare earth surface, below the modeled waste

overburden surface and within each mineralization domain was

calculated using the 3D geological models and a 3D surface model.

For the open pit optimisation, block values were diluted. The MRE

is reported as undiluted with an effective date of January 17,

2023.

The Logan Property drillhole database consists

of 58 drill holes that intersected the interpreted mineralization

wireframes. The zinc and silver assays were composited to 2-meter

composites lengths and the estimation utilized 2,651 composited

samples. A total of 1.2% of the total drilled meters inside the

interpreted mineralization wireframes were not sampled, assumed to

be waste, and assigned a nominal waste value of half the detection

limit of modern assay methods (0.0005% Zn, 0.3429 g/t Ag).

Zinc and silver estimation was completed using

Ordinary Kriging. The search ellipsoid size used to estimate the Zn

and Ag grades was defined by the modelled variograms. Block grade

estimation employed locally varying anisotropy, which uses

different rotation angles to define the principal directions of the

variogram model and search ellipsoid on a per-block basis. Blocks

within estimation domains are assigned rotation angles using a

modelled 3D mineralization trend surface wireframe, which allows

structural complexities to be reproduced in the estimated block

model. The number of variogram structures, contributions of each

structure, and their ranges are set per estimation domain and do

not vary within the estimation domain.

A total of 201 bulk density samples are

available from the Logan Property drillhole database. APEX

personnel performed exploratory data analysis of the bulk density

samples available and the density was assigned for each domain in

the Logan Property. The density of the deposits ranged from 2.63

g/cm³ to 2.66 g/cm³. The non-mineralized zones were assigned

density based on lithological unit. The modeled overburden was

assigned a density of 1.8 g/cm³ and the remaining country rock was

assigned a density of 2.57 g/cm³.

The unconstrained resource block model was

subjected to several open pit optimization scenarios to establish

that the Logan Project has the potential for future economic

extraction. Blocks partially outside the mineralized wireframes

were diluted with a nominal waste value of 0.0005% Zn and 0.3429

g/t Ag based on the volume of the block outside of the mineralized

wireframes. The process + G&A cost of C$NSR cutoff of $35/t is

used to determine potential mill feed and is approximately

equivalent to a 1.6% Zn cutoff grade. Mr. Dufresne considers the

parameters reasonable to constrain the mineral resource estimate

and establish that the Logan Project has the potential for future

economic extraction. The overall strip ratio for the Logan Property

Open Pit is approximately 5.3:1.

There are no other known factors or issues known

by the QP that materially affect the MRE other than normal risks

faced by mining projects. The Logan Project is subject to the same

types of risks that large base metal projects experience at an

early stage of development in Canada. The nature of the risks

relating to the Project will change as the Project evolves and more

information becomes available. The Company has engaged experienced

management and specialized consultants to identify, manage and

mitigate those risks.

Comparison of Current and Historical

Logan Deposit MRE

The current and historical 2012 Logan Deposit

MRE use the same drill hole database (see Almadex news release

dated May 26, 2022). The Current Logan Deposit MRE differs from a

previously disclosed 2012 historical mineral resource in that was

based on additional specific gravity (SG) data collected by APEX

Geoscience Ltd. personnel during 2022 which resulted in a change in

the SG used in the MRE from 2.95 g/cm³ for mineralized

material and 2.7 g/cm³ for waste (2012) to 2.66 g/cm³ for

the high-grade domain, 2.63 g/cm³ for the main zone

mineralization, and 2.57 g/cm³ for waste, and 1.8

g/cm³ for overburden (2023). The 2023 Logan mineral resource

SG data is based on a total of 204 SG samples collected during 2022

(see Almadex news release dated September 13, 2022).

In addition, mineralization wireframes for the

deposit were re-modeled based on lithology, alteration, and

structural geology logging to include a central high grade zinc

estimation domain (based on drill composite grades greater than

approximately 3.5% zinc) and peripheral lower grade zinc estimation

domain (based on drill composite grades greater than approximately

0.5% zinc). The 2012 historical Logan Deposit mineral resource

utilized a single estimation domain also constrained by lithology,

alteration, and structural geology logging of drill cores and drill

composite grades greater than approximately 0.5% zinc.

Both the current and historical MRE both

utilized ordinary kriging (OK) to estimate zinc and silver into 6 m

(X) x 6 m (Y) x 6 m (Z) blocks in comparison to 10 m (X) x 10 m (Y)

x 10 m (Z) employed during 2012.

The 2023 MRE incorporated an updated mineral

resource cut-off of 1.6% zinc in comparison to 1% zinc cut-off

utilized in 2012. Significantly, the 2012 historical mineral

resource was not pit constrained. Open pit optimization parameters

used in the current MRE are outlined above in the notes to Table

1.

Next Steps

The Logan Zn-Ag Deposit is considered to exhibit

significant potential for mineral resource expansion with

mineralisation open at depth on multiple drill sections, in

addition to exploration potential remaining along strike. Given

that exploration and delineation drilling of the Deposit occurred

during the 1980’s, Almadex is assessing advances in geophysical

survey equipment and 3D inversion methods; including but not

limited to IP/resistivity, gravity, magnetic and electro-magnetic

surveys that may assist in targeting the expansion of mineral

resources and potential discovery of new exploration targets.

About the Logan Project

The Logan Project has been explored by means of

sequential programs of mapping, soil sampling, geophysics, and

diamond drilling since the 1980s. Access for past major work

programs was facilitated with a 52 km long winter road from the

Alaska Highway. In 1987, a 700 m long by 20 m wide gravel airstrip

was established on the Property which would likely require surface

re-levelling in order to be used now, but small, short runway

aircraft may be able to land at this time. The winter road permit

was not renewed past 2009 and re-opening the road would require

further permitting. Currently, the Project can be accessed via

helicopter.

Work on the Project completed by previous

operators is briefly summarised as follows:

|

1979: |

Staking of Logan 1 to 36 quartz mining claims to cover new

zinc-silver-tin-copper gossan. Geological mapping, soil and stream

sediment geochemistry, hand trenching, and test IP, EM and

magnetometer geophysical surveys. |

| 1980-85: |

Additional soil geochemistry, claim staking, hand trenching, and

geophysical surveys were completed. |

| 1986-89: |

Exploration drilling of 103 holes totalling 16,438 metres. Fifteen

trenches totalling 2,412 metres and ongoing soil geochemistry and

geophysical surveys. Metallurgical testwork at Lakefield Research

Laboratories under supervision of Strathcona Mineral Services

Limited. Flotation of both high- and low-grade zinc samples

indicated that recoveries of 93-95% zinc and 85-90% silver could be

projected to a zinc concentrate. |

| 2003: |

Additional staking and completion of a baseline environmental

survey conducted in and around the Project. |

| 2006: |

Bell Geospace conducted an Air Full Tensor Gravity (Air-FTG)

survey. |

| 2012: |

Wardrop, a Tetra Tech Company (Tetra Tech) was retained to prepare

a Technical Report, including an historical mineral resource

estimate, on the Project. The 2012 Tetra Tech Technical Report is

treated as a historical mineral resource as a Qualified Person has

not done sufficient work to classify the historical estimate as a

current mineral resource and Almadex is not treating this

historical estimate as current mineral resources. |

QAQC and Reporting

Almadex is currently preparing the NI 43-101

Logan Project Technical Report, which will contain details of the

MRE. This report is required to be announced and filed on SEDAR and

the Almadex website within 45 days of this news release.

The historical zinc and lead analyses which

underpin the MRE were carried out at Bondar Clegg and ALS Chemex

Laboratories at North Vancouver, British Columbia. Preparation of

samples for assaying is assumed to have involved standard crushing,

grinding and pulverization to produce pulps for assaying via hot

aqua-regia and analysis via atomic absorption.

The QP’s conducted re-assaying of select

mineralized intervals (approximately 5% of the drill database) and

collected a suite of samples for specific gravity (density)

determination to verify the historic drilling results. In total 232

verification samples were collected from representative mineralized

intercepts geographically separated across the deposit (including

15% QA/QC duplicate, standard and blank samples) comprising 231

metres of half drill core from three separate holes from the 1986,

1987 and 1998 historical drill campaigns. Replicate samples were

submitted for analysis to ALS Canada Ltd. (“ALS”) at their

Whitehorse, YT (sample preparation) and Vancouver (ICP-MS), B.C.

facilities. ALS is an ISO-IEC 17025:2017 and ISO 9001:2015

accredited geoanalytical laboratory and is independent of the

Almadex and the QP. Drill core samples were subject to crushing at

a minimum of 70% passing 2 mm, followed by pulverizing of a

250-gram split to 85% passing 75 microns. A 0.1-gram sample pulp

was then subject to multi-element ICP-MS analysis via four acid

digestion to determine individual metal content (ME-MS61). Zinc and

silver values greater the 1% and 100 ppm, respectively were subject

to overlimit analysis via four-acid ICP-AES (ME-OG62). The QP

followed industry standard procedures for the work carried out on

the Logan Project, with a quality assurance/quality control

(“QA/QC”) program. Blank, duplicate, and standard samples were

inserted into the sample sequence sent to the laboratory for

analysis. The QP detected no significant QA/QC issues during review

of the data. Almadex and the QP’s are not aware of any drilling,

sampling, recovery, or other factors that could materially affect

the accuracy or reliability of the data referred to herein.

The scientific and technical information

contained in this news release has been reviewed and approved by

Michael Dufresne, M.Sc., P.Geol., P.Geo. (AB-BC), Kristopher J.

Raffle, P.Geo. (BC) and Alfonso Rodriquez, M.Sc. P.Geo. (BC),

President, Principal and Consultant, and Senior Geologist, of APEX

Geoscience Ltd. of Edmonton, AB, and are independent “Qualified

Persons” as defined in National Instrument 43-101 – Standards of

Disclosure for Mineral Projects. Mr. Dufresne, Mr. Raffle and Mr.

Rodriguez verified the data disclosed which includes a review of

the analytical and test data underlying the information and

opinions contained therein.

About AlmadexAlmadex Minerals

Ltd. is an exploration company that holds a large mineral portfolio

consisting of projects and NSR royalties in Canada, the U.S., and

Mexico. This portfolio is the direct result of many years of

prospecting and deal-making by Almadex's management team. The

Company owns a number of portable diamond drill rigs, enabling it

to conduct cost effective first pass exploration drilling in

house.

On behalf of the Board of Directors,

“J. Duane Poliquin”J. Duane Poliquin,

P.Eng.ChairmanAlmadex Minerals Ltd.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in policies

of the TSX Venture Exchange) accepts responsibility for the

adequacy or accuracy of this release. This news release includes

forward-looking information that is subject to risks and

uncertainties. All statements within this news release, other than

statements of historical fact, are to be considered forward

looking. Although the Company believes the expectations expressed

in such forward-looking information are based on reasonable

assumptions, such as those set forth in this news release, such

statements are not guarantees of future performance and known and

unknown risks, uncertainties, and other factors may cause actual

results or developments to differ materially from those as

expressed or implied in forward-looking information. Factors that

could cause actual results to differ materially from those

expressed or implied in forward-looking information include those

stated in the news release, and, among others, market prices,

exploitation and exploration successes, risks related to

international operations, continued availability of capital and

financing, and general economic, market or business conditions.

There can be no assurances that such statements will prove accurate

and, therefore, readers are advised to rely on their own evaluation

of such uncertainties. The Company does not assume any obligation

to update any forward-looking statements, other than as required

pursuant to applicable securities laws.

Contact Information:Almadex Minerals Ltd.Tel.

604.689.7644Email:

info@almadexminerals.comhttp://www.almadexminerals.com

Figure

1:https://www.globenewswire.com/NewsRoom/AttachmentNg/bc74a1fa-55c0-48e2-a489-82b975dc77d1

Figure

2:https://www.globenewswire.com/NewsRoom/AttachmentNg/a368c1c1-d506-4800-9145-c4b407f7b6b7

Figure

3:https://www.globenewswire.com/NewsRoom/AttachmentNg/21f1ba0d-5747-488d-88f1-5b7642c184b8

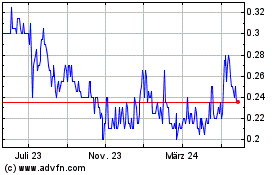

Almadex Minerals (TSXV:DEX)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

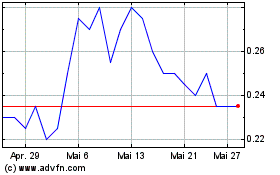

Almadex Minerals (TSXV:DEX)

Historical Stock Chart

Von Jan 2024 bis Jan 2025