Paramount Resources Ltd. Provides Initial Estimates of Its Hoole Oil Sands Resources

27 Oktober 2008 - 12:48AM

Marketwired Canada

Paramount Resources Ltd. (TSX:POU) ("Paramount" or the "Company") has received

the results from an initial evaluation of its 100 percent-owned in-situ oil

sands leases covering approximately 48 contiguous sections (30,680 acres) in the

Hoole area of Alberta (the "Oil Sands Properties"), situated within the western

portion of the Athabasca Oil Sands region.

To view map of the Hoole area, click the following link:

http://media3.marketwire.com/docs/1026pou.pdf

The initial evaluation was conducted by the Company's independent reserves

evaluator, McDaniel & Associates Consultants Ltd. ("McDaniel"), who estimates

that the Oil Sands Properties contain approximately 458 million barrels of

contingent bitumen resources within the Grand Rapids formation (Best Estimate

(P50)). Potentially exploitable bitumen accumulations within other prospective

formations were not included in McDaniel's initial evaluation.

The tables below summarize the estimated volumes and net present values

attributable to Paramount's 100 percent interest in the contingent bitumen

resources associated with the Grand Rapids formation within the Oil Sands

Properties, as evaluated as of August 1, 2008 by McDaniel, and the Company's

current estimates of potential initial and fully developed daily production from

such interests.

Fully

Contingent Initial Developed

Category / Level of DPIIP(1) Resources(2)(3) Production Production

Certainty(6) (MBbl)(4) (MBbl)(4) (Bbl/d)(5) (Bbl/d) (5)

-------------------- ---------------------------------------------------

High Estimate 1,326,000 645,000 30,000 70,000

Best Estimate 1,040,000 458,000 20,000 50,000

Low Estimate 767,000 294,000 15,000 30,000

Notes:

(1) DPIIP means discovered petroleum initially-in-place. Discovered

petroleum initially-in-place is the gross volume of petroleum estimated,

as of a given date, to be initially contained in known accumulations

prior to production without regard for the extent to which volumes will

be recovered. There is not certainty that it will be commercially viable

to produce any portion of the resources.

(2) Represents the Company's share of recoverable volumes before deduction

of royalties.

(3) Contingent resources are those quantities of bitumen estimated, as of a

given date, to be potentially recoverable from known accumulations using

established technology or technology under development, but are

classified as a resource rather than a reserve due to one or more

contingencies, such as the absence of regulatory approvals, detailed

design estimates or near term development plans.

(4) MBbl means thousands of barrels.

(5) Bbl/d means barrels per day. These estimates assume that initial

production will commence in 2012 and fully developed production will be

reached in 2014.

(6) A low estimate means high certainty (90 percent probability), a best

estimate means most likely (50 percent probability) and a high estimate

means low certainty (10 percent probability).

NPV(1) of Future Net Revenue ($MM)(2) NPV(1)

Discounted At Discounted

Category / Level of --------------------------------------- at 10%

Certainty(4) 0% 5% 8% 10% ($/Bbl) (3)

-------------------- --------------------------------------- -----------

High Estimate 9,152 3,425 1,933 1,309 2.03

Best Estimate 5,440 1,890 968 585 1.28

Low Estimate 2,457 671 221 39 0.13

Notes:

(1) NPV means net present value and represents the Company's share of future

net revenue, before the deduction of income tax. The calculation

considers such items as revenues, royalties, operating costs,

abandonment costs and capital expenditures. Royalties have been

calculated based on Alberta's New Royalty Framework applicable to oil

sands projects in Alberta, expected to take effect January 1, 2009, as

it is understood as at August 1, 2008. The calculation does not

consider financing costs and general and administrative costs. All NPVs

are calculated assuming natural gas is used as a fuel for steam

generation. Revenues and expenditures were calculated based on

McDaniel's forecast prices and costs as of July 1, 2008.

(2) $MM means millions of Canadian dollars.

(3) $/Bbl means Canadian dollars per barrel.

(4) A low estimate means high certainty (90 percent probability), a best

estimate means most likely (50 percent probability) and a high estimate

means low certainty (10 percent probability).

Contingent bitumen resources and the associated net present value were

determined based on exploitation using a conventional Steam-Assisted Gravity

Drainage development scenario. The evaluation by McDaniel is as of August 1,

2008 and the evaluation is subject to Paramount board review and approval.

Paramount has drilled seven oil sands evaluation wells at Hoole over the past

five years to evaluate the Wabiskaw and Grand Rapids formations. In connection

with the evaluation, over 190 other wells, located on Paramount's acreage and

third party oil sands acreage analogous to the Oil Sands Properties, were

examined by McDaniel to evaluate the reservoir formation and bitumen recovery.

Paramount plans to drill an additional 15 oil sands evaluation wells during the

first half of 2009 to further delineate the reservoir and contingent bitumen

resources in the Grand Rapids formation. The Company anticipates the additional

drilling will result in material increases to contingent bitumen resource

estimates.

In addition to the Hoole area, Paramount owns another 224 sections (143,360

acres) of oil sands leases within the Athabasca Oil Sands region, the majority

of which are prospective for bitumen from the Grosmont formation in the

Carbonate Bitumen Trend. These leases have not been independently evaluated.

Paramount is a Canadian oil and natural gas exploration, development and

production company with operations focused in Western Canada. Paramount's common

shares are listed on the Toronto Stock Exchange under the symbol "POU".

Forward-Looking Statements Advisory

This news release contains statements concerning estimated resources, the net

present values of estimated resources, estimated initial and fully developed

production from the oil sands leases and the expected timing thereof, plans for

drilling on the oil sands leases and the timing and costs thereof, management's

expectation that additional drilling will result in material increases to

contingent bitumen resource estimates, or other expectations, plans, goals,

objectives, assumptions, information or statements about future events,

conditions, results of operations or performance that may constitute

forward-looking statements or information under applicable securities

legislation. Such forward-looking statements or information are based on a

number of assumptions which may prove to be incorrect. Such assumptions include,

among other things: oil and gas prices, Paramount obtaining drilling success

consistent with expectations, regulatory approvals being obtained and estimated

timelines being met when expected in respect of the oil sands project, and the

estimated input and labour costs in respect of the oil sands project.

Although Paramount believes that the expectations reflected in such

forward-looking statements or information are reasonable, undue reliance should

not be placed on forward-looking statements because Paramount can give no

assurance that such expectations will prove to be correct. Forward-looking

statements or information are based on current expectations, estimates and

projections that involve a number of risks and uncertainties which could cause

actual results to differ materially from those anticipated by Paramount and

described in the forward-looking statements or information. These risks and

uncertainties include, but are not limited to: oil and gas prices, fluctuations

in currency and interest rates, product supply and demand, risks inherent in

Paramount's operations, imprecision of resource estimates, Paramount's ability

to access external sources of debt and equity capital, imprecision in estimating

the timing, costs and levels of production and drilling, the results of

exploration, development and drilling, imprecision in estimates of future

production capacity, Paramount's ability to secure adequate product

transportation, uncertainty in the amounts and timing of royalty payments,

imprecision in estimates of product sales, changes in environmental and other

regulations or the interpretation of such regulations, the ability to obtain

necessary regulatory approvals, weather and general economic and business

conditions.

The forward-looking statements or information contained in this news release are

made as of the date hereof and Paramount undertakes no obligation to update

publicly or revise any forward-looking statements or information, whether as a

result of new information, future events or otherwise, unless so required by

applicable securities laws.

Oil and Gas Advisory

The estimated net present values disclosed in this press release do not

represent fair market value.

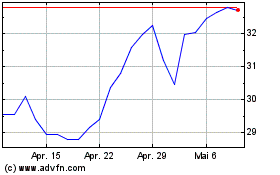

Paramount Resources (TSX:POU)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Paramount Resources (TSX:POU)

Historical Stock Chart

Von Jul 2023 bis Jul 2024