NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE

UNITED STATES OR ITS POSSESSIONS. ANY FAILURE TO COMPLY WITH THIS RESTRICTION

MAY CONSTITUTE A VIOLATION OF U.S. SECURITIES LAW.

Northland Power Inc. ("Northland" or "the Company")

(TSX:NPI)(TSX:NPI.PR.A)(TSX:NPI.PR.C)(TSX:NPI.DB.A) -

2013 Highlights:

-- Completed $900 million in construction projects, which will provide

future, sustainable cash flows;

-- 104% increase in free cash flow from 2012, even with only a partial year

of operation from North Battleford and the ground-mounted solar

facilities in 2013;

-- Upgraded credit rating by Standard & Poor's to 'BBB' stable;

-- Advancement of development portfolio, including Gemini, the largest

offshore wind farm in the North Sea, provides visibility on Northland's

continued growth in value for shareholders; and

-- Successfully raised over $1 billion in project financings.

Fourth Quarter Highlights:

-- 91% increase in quarterly adjusted EBITDA from $43.5 million in 2012 to

$83.0 million in 2013, primarily due to contributions from the newly

operating North Battleford and ground-mounted solar facilities;

-- 115% increase in quarterly free cash flow over the same period in 2012;

from $17.7 million to $38.1 million, commensurate with the higher

adjusted EBITDA; and

-- Quarterly payout ratio was 72% of free cash flow (93% excluding the

effect of dividends reinvested through the Dividend Reinvestment Plan)

compared to 127% in the fourth quarter of 2012.

Northland reported its financial results today for the full year and quarter

ended December 31, 2013. The following comments are made with reference to the

attached unaudited consolidated financial statements of Northland.

"We are very pleased with our performance in 2013," said John Brace, Chief

Executive Officer. "We have demonstrated our world class development

capabilities by securing the rights to the largest offshore wind farm in the

North Sea with the Gemini project. We have also continued our tradition of

engineering and construction excellence by completing both North Battleford and

our ground-mounted solar facilities on time and on budget. These results show

our team's ability to balance strong growth with excellent financial results,

providing continuing dividends to our shareholders today and well into the

future. Our financial performance confirms that our business plan is sound; the

capital that we have deployed into construction is now achieving the operational

results we have promised. With proven success developing projects in Canada, we

are well-positioned to expand the focus of our development program to

international markets, in order to continue delivering growth while preserving

Northland's value for shareholders."

Subsequent Events

Two of the three ground-mounted solar phase II projects, representing 20 MW,

reached commercial operations by February 2, 2014. Northland now has a total of

80 MW of ground-mounted solar sites in operation.

On January 8, Northland announced the addition of Sean Durfy to its executive

team as President and Chief Development Officer. Mr. Durfy had been a member of

Northland's Board of Directors for almost three years. Mr. Durfy is the former

President and CEO of WestJet airlines, and was previously President of ENMAX

Energy Corporation, an electricity and natural gas company headquartered in

Calgary, Alberta. He also held senior roles at Honeywell Limited and TransAlta.

Sam Mantenuto, Northland's current Chief Development Officer has, been appointed

Vice Chair and will continue as Chief Operating Officer. John Brace will

continue to lead Northland's executive team as Chief Executive Officer.

On January 29, 2014, Northland announced that it has entered into an agreement

for the right to acquire an additional 5% interest in Gemini; this would bring

Northland's total equity interest to 60%. Gemini is a 600 MW offshore wind

project located 85 km off the coast of the Netherlands in the North Sea.

Northland's partners in the project include affiliates of Siemens AG, Van Oord

Dredging and Marine Contractors BV, and HVC, a Dutch public utility company. The

project's total cost is projected to be EUR2.8 billion, and is expected to be

financed with a combination of non-recourse project debt, mezzanine financing

and equity from the consortium. As further disclosed in investor day materials

in September 2013, Northland expects to fund the investment with funds on hand,

its corporate facility, and expects to access the capital markets in the form of

preferred shares, convertible debentures, subscription receipts, or common

shares for approximately $275 million. As always, management's objective is to

minimize the amount of dilutive equity raised while prudently maintaining

healthy credit metrics.

Gemini is well advanced, and has received commitments for EUR1.25 billion in

senior secured construction and term debt from 12 international commercial

banks. These commitments are in excess of the amounts the project requires to be

funded by the commercial banks. In association with a EUR500 million facility

previously announced by the European Investment Bank and loans under negotiation

with three European export credit agencies (Denmark's EKF, Germany's Euler

Hermes and Belgium's ONDD) for the balance of the project debt, management

expects the EUR2.2 billion of senior debt required for Gemini to be fully

committed late in the first quarter of 2014 or early in the second quarter of

2014.

Summary of Financial Results

----------------------------------------------------------------------------

3 Months Ended 12 Months Ended

Dec. 31 Dec. 31

2013 2012 2013 2012

----------------------------------------------------------------------------

FINANCIAL (in thousands of

dollars, except per share and

energy unit amounts)

Sales 174,331 93,177 557,238 361,682

Gross profit 113,364 59,984 354,759 230,190

Adjusted EBITDA(1) 82,986 43,462 263,296 178,620

Operating income 60,973 28,598 182,338 114,479

Net income (loss) 22,008 (2,538) 167,019 (9,913)

Free cash flow(1) 38,068 17,733 130,117 63,723

Cash Dividends paid to Common and

Class A Shareholders 27,385 22,458 98,908 88,734

Total Dividends declared to Common

and Class A Shareholders(2) 35,758 31,232 133,200 123,834

Per Share

Free cash flow 0.29 0.15 1.05 0.55

Dividends declared to

Shareholders(2) 0.27 0.27 1.08 1.08

----------------------------------------------------------------------------

Energy Volumes

Electricity sales volume

(megawatt hours) 1,653,355 777,443 4,439,908 3,139,031

----------------------------------------------------------------------------

(1) See "Non-IFRS measures" for a detailed description.

(2) Total dividends to Common and Class A Shareholders represent cash

dividends plus share dividends issued as part of Northland's dividend

reinvestment plan.

Full Year 2013 Results

Adjusted earnings before interest, taxes, depreciation and amortization

("adjusted EBITDA")

Northland's 2013 consolidated adjusted EBITDA of $263.3 million was $84.7

million or 47% higher than the prior year largely due to the inclusion of North

Battleford and the Ground-mounted Solar Phase I projects, overall favourable

results from Northland's operating facilities, higher performance incentive fees

earned from Northland's managed facilities, partially offset by increased

corporate management and administration costs.

Free Cash Flow, Payout Ratio and Dividends to Shareholders

Free cash flow for the year of $130.1 million was $66.4 million (104%) higher

than in 2012; significant factors increasing and decreasing free cash flow in

2013 are described below.

Factors increasing free cash flow over 2012 were:

-- $86.1 million higher adjusted EBITDA from Northland's operating and

managed facilities;

-- $1.6 million increase in other income in 2013 related to the sale of

Northland's South Kent wind development project announced in 2011 and a

cost reimbursement associated with one of Northland's other early stage

development prospects;

-- $2 million decrease in scheduled debt repayments as a result of the full

repayment of Kingston's debt in January 2013;

-- $2.1 million favourable variance associated with milestone payments to

GE related to Kingston's gas turbine maintenance contract;

-- $5.7 million lower operations-related capital expenditures due to

Kingston's planned major outage in 2012; and

-- $1.5 million positive variance related to funds that were set aside in

2012 pending the closing of the British Columbia wind development

assets.

Factors offsetting the net increase in free cash flow over 2012 were:

-- $19.9 million net interest expense increase (excluding Northland's

managed facilities; Kirkland Lake and Cochrane) primarily due to the

inclusion of North Battleford and Ground-mounted Solar Phase I;

-- $6.7 million increase in funds set aside for future major maintenance;

-- $3 million higher net corporate management and administration costs,

which included increased development prospecting expenditures; and

-- $3 million increase in preferred share dividends and related taxes due

to a full year of the Series 3 Preferred Share dividends in 2013.

For 2013, Northland's dividend payout ratio was 76% of free cash flow 101%

(excluding the effect of dividends reinvested through the Dividend Reinvestment

Plan (DRIP)) compared to 139% and 191%, respectively in 2012. This payout in

excess of free cash flow largely reflects the level of spending on growth

initiatives and payments of dividends and interest on capital raised for

construction projects for which corresponding cash flows will not be received

until the underlying projects are completed.

Net income

Net income for 2013 at $167.0 million was $176.9 million higher than the

previous year. This was primarily driven by the consolidation of Kirkland Lake

and Cochrane facilities after the acquisition of Canadian Environmental Energy

Corporation (CEEC) on April 1, 2013 and the increase in adjusted EBITDA

described above and a number of non-cash fair value gains associated with

Northland's financial derivative contracts.

Fourth Quarter Results

Adjusted EBITDA

In the fourth quarter of 2013, adjusted EBITDA at $83.0 million increased by

$39.5 million as described below.

Thermal Facilities

Gross profit and adjusted EBITDA during the quarter were higher than the same

period in 2012 due to the inclusion of results from North Battleford, an

additional month of financial results at Kingston (due to a one-month scheduled

outage in October 2012), a revenue increase at Iroquois Falls due to a Direct

Customer Rate "true-up", and lower gas transportation tolls. Plant operating

costs exceeded 2012 largely due to the inclusion of North Battleford and

additional GE maintenance costs at Iroquois Falls, partly offset by lower costs

at Thorold due to fewer operating hours, and additional maintenance costs in

2012.

Renewable Facilities

Electricity production, revenue and adjusted EBITDA during the quarter exceeded

the same period in 2012 due to significantly higher output at all three wind

projects combined with the inclusion of results from the Ground-mounted Solar

Phase I projects. Plant operating expenses for the quarter exceeded the prior

year due to the inclusion of the Ground-mounted Solar Phase I projects and

higher contracted maintenance and royalty payments at Jardin, which are tied to

production, partially offset by lower costs at Mont Louis due to the expiry of

the turbine warranty agreements and replacement with a lower-cost service

agreement.

Other Sales

Prior to the CEEC acquisition on April 1, 2013, other sales included management

and incentive fees earned from services provided to Cochrane and Kirkland Lake,

which decreased $6.8 million from 2012 due to those fees now considered as

intercompany and eliminated on consolidation. However, in the calculation of

adjusted EBITDA and free cash flow, Northland includes the fees and dividends

earned rather than all adjusted EBITDA and free cash flow generated by these

entities. Adjusted EBITDA contributed from Cochrane and Kirkland Lake of $5.9

million was $1.2 million lower than 2012 due to lower performance fees from

Kirkland Lake.

Corporate Management and Administration Costs

Northland's corporate management and administration costs were $1.4 million

lower than the same period in 2012. Increased operational costs attributable to

increased headcount and other administrative functions in 2013 were offset by

reduced development expenditures in 2013 relative to 2012. Development

expenditures in the fourth quarter of 2012 included a $1.7 million write-off of

deferred development costs and significant expenditures towards wind and hydro

projects in British Columbia and Quebec.

Free Cash Flow, Payout Ratio and Dividends to Shareholders

Fourth-quarter free cash flow at $38.1 million was $20.3 million higher than the

same period last year. The factors affecting the quarter were: higher adjusted

EBITDA from all existing facilities, the addition of North Battleford and the

Ground-mounted Solar Phase I projects, lower non-expansionary capital

expenditures, partially offset by lower performance incentive fees from Kirkland

Lake, higher net finance costs and increased scheduled debt repayments and

restricted cash funding for future major maintenance.

For the three month period ending December 31, 2013, common share and Class A

Share dividends declared for the quarter totalled $0.27 per share. This is

equivalent to a payout ratio of 72% (93% excluding the effect of dividends

reinvested through the Dividend Reinvestment Plan (DRIP)) compared to 127% in

the fourth quarter of 2012.

Net Income

Fourth quarter net income of $22.0 million ($24.5 million higher than 2012) was

primarily driven by the increase in adjusted EBITDA described above and a number

of non-cash fair value gains associated with Northland's financial derivative

contracts.

Outlook

Northland actively pursues new power development opportunities that encompass a

range of clean technologies, including natural gas, wind, solar and hydro.

During 2013 and through the date of this press release, Northland continued to

execute on its strategy of expanding its earlier-stage development pipeline in

its targeted traditional Canadian market as well as moving into the United

States and other jurisdictions that meet the Company's investment criteria. A

number of opportunities in these jurisdictions have been identified and are in

addition to several projects Northland already has under development.

Northland's approach continues to be one of ensuring the balance between

progressing development opportunities which meet the Company's investment

criteria, while prudently managing the Company's cost exposure to earlier-stage

projects.

In 2014, management expects Northland to generate adjusted EBITDA of

approximately $345 to $355 million compared with $263.3 million in 2013, a 31%

to 35% increase. This estimate primarily reflects the following expected

factors:

-- $22 to $25 million in additional adjusted EBITDA from the McLean's wind

project and the Ground-mounted Solar Phase II projects once they reach

commercial operations;

-- $55 to $58 million in additional adjusted EBITDA from a full year of

North Battleford and the Ground-mounted Solar Phase 1 projects because

they were operational for only part of 2013;

-- $4 to $6 million lower adjusted EBITDA from Northland's operating

facilities primarily due to Kingston's lower PPA prices as a result of

the 2013 decrease in Trans Canada toll rates and higher natural gas

costs and operating expenditures at Iroquois Falls and Thorold,

respectively;

-- $3 to $5 million higher adjusted EBITDA from additional incentive fees

earned from Cochrane, and additional one-time payment from Panda-

Brandywine offset by lower performance fees from Kirkland Lake which had

lower operating expenses in 2013;

-- $10 million higher adjusted EBITDA from investment income on the Gemini

junior debt facility in which Northland intends to invest at the time

the project achieves financial close; and

-- A net reduction in adjusted EBITDA from management and administration

and other sales and income of $2 million, because other sales and income

are anticipated to be lower and management expects slightly higher

corporate management and administration costs.

Management continues to expect adjusted EBITDA of $380 to $400 million in 2015

based on the current completion schedules for Northland's development projects

with power contracts.

Northland's 2014 dividend payments, on a total dividend basis, are expected to

exceed free cash flow due largely to the level of spending on growth initiatives

and payments of dividends and interest on capital raised for construction

projects for which corresponding cash flows will not be received until the

projects for which the capital is raised are completed. For 2014, management

expects the cash dividends to be 75% to 85% of free cash flow including the

impact of reinvested dividends through the DRIP, and 105% to 120% of free cash

flow excluding the impact of reinvested dividends through the DRIP (compared

with 76% and 101%, respectively, in 2013). Prior to its investment in Gemini,

management expected that the payout ratio would drop below 100% in 2014

(including the impact of reinvested dividends through the DRIP), based on the

successful conclusion of a period of significant growth and capital expenditures

for Northland. Due to the significant capital costs for Northland's investment

in Gemini, additional corporate capital will be required in 2014 to fund the

project and as a result, the payout ratio may exceed 100% until Gemini is

completed in 2017. Northland has sufficient liquidity to bridge the payout of

the current dividend in excess of free cash flow during this period. Management

expects the payout ratio during Gemini's construction to be significantly lower

than during the growth period experienced by Northland from 2009 to 2013.

The 2014 payout ratio reflects the higher forecasted adjusted EBITDA as

described previously, along with the following expected changes in free cash

flows and dividend payments:

-- $10 to $15 million in additional free cash flow from the McLean's and

Ground-mounted Solar Phase II projects;

-- $15 to $20 million in additional free cash flow from North Battleford

and Ground-mounted Solar Phase 1 projects because they were operational

for only part of 2013;

-- $5 to $10 million lower free cash flow from the current operating

facilities due to lower adjusted EBITDA as described previously,

combined with higher reserve funding and capital expenditures;

-- $3 to $5 million higher free cash flow from Cochrane and Panda-

Brandywine offset by Kirkland Lake as noted above;

-- $11 to $12 million lower free cash flow from interest expense on the

Gemini term loan facility entered into at the time the project achieves

financial close as further disclosed in Northland's investor day

materials in September 2013;

-- An increase in cash and share dividends as a result of the additional

equity investment for Gemini and recognizing a full year of all

Replacement Rights, Class B and C Shares and LTIPs from North Battleford

and the Ground-mounted Solar Phase 1 projects reaching commercial

operations; and

-- Other items, including higher corporate and interest costs and renewal

fees on the corporate facility that are expected to negatively affect

free cash flow up to approximately $4 to $5 million.

Northland's Board and management are committed to maintaining the current

monthly dividend of $0.09 per share ($1.08 per share on an annual basis).

Northland's management and Board have anticipated the impact of growth on the

payout ratio and are confident that Northland has adequate access to funds to

meet its dividend commitment, including operating cash flows, cash and cash

equivalents on hand and, if necessary, use of its line of credit or external

financing. Management expects to continue its DRIP to provide an additional

source of liquidity.

Non-IFRS Measures

This press release includes references to Northland's free cash flow and

adjusted EBITDA (previously reported as EBITDA) which are not measures

prescribed by International Financial Reporting Standards (IFRS). Free cash flow

and adjusted EBITDA, as presented, may not be comparable to similar measures

presented by other companies. These measures should not be considered

alternatives to net income, cash flow from operating activities or other

measures of financial performance calculated in accordance with IFRS. Rather,

these measures are provided to complement IFRS measures in the analysis of

Northland's results of operations from management's perspective. Management

believes that free cash flow and adjusted EBITDA are widely accepted financial

indicators used by investors to assess the performance of a company and its

ability to generate cash through operations.

Earnings Conference Call

Northland will hold an earnings conference call on February 20 at 10:00 am EST

to discuss its 2013 annual financial results. John Brace, Northland's Chief

Executive Officer and Paul Bradley, Northland's Chief Financial Officer will

discuss the financial results and company developments before opening the call

to questions from analysts and members of the media.

Conference call details are as follows:

Date: Thursday, February 20, 2014

Start Time: 10:00 a.m. eastern standard time

Phone Number: Toll free within North America: 1-800-709-0218 or Local: 416-

641-6202

For those unable to attend the live call, an audio recording will be available

on Northland's website at (www.northlandpower.ca) from the afternoon of February

20 until March 13, 2014.

ABOUT NORTHLAND

Northland is an independent power producer founded in 1987, and publicly traded

since 1997. Northland develops, builds, owns and operates facilities that

produce 'clean' (natural gas) and 'green' (wind, solar, and hydro) energy,

providing sustainable long-term value to shareholders, stakeholders, and host

communities.

The Company owns or has a net economic interest in 1,349 MW of operating

generating capacity, with an additional 110 MW (80 MW net to Northland) of

generating capacity currently in construction, and another 150 MW (79 MW net to

Northland) of wind, solar and run-of-river hydro projects with awarded power

contracts. In addition, Northland has acquired the rights to a majority equity

stake in Gemini. Northland's cash flows are diversified over five geographically

separate regions and regulatory jurisdictions in Canada, Europe and the United

States.

Northland's common shares, Series 1 and Series 3 preferred shares and

convertible debentures trade on the Toronto Stock Exchange under the symbols

NPI, NPI.PR.A, NPI.PR.C and NPI.DB.A, respectively.

FORWARD-LOOKING STATEMENTS

This release contains certain forward-looking statements which are provided for

the purpose of presenting information about management's current expectations

and plans. Readers are cautioned that such statements may not be appropriate for

other purposes. Forward-looking statements include statements that are

predictive in nature, depend upon or refer to future events or conditions, or

include words such as "expects," "anticipates," "plans," "believes,"

"estimates," "intends," "targets," "projects," "forecasts" or negative versions

thereof and other similar expressions, or future or conditional verbs such as

"may," "will," "should," "would" and "could." These statements may include,

without limitation, statements regarding future adjusted EBITDA, free cash

flows, dividend payment and dividend payout ratios, the construction,

completion, attainment of commercial operations, cost and output of development

projects, plans for raising capital, and the operations, business, financial

condition, priorities, ongoing objectives, strategies and outlook of Northland

and its subsidiaries. These statements are based upon certain material factors

or assumptions that were applied in developing the forward-looking statements,

including the design specifications of development projects, the provisions of

contracts to which Northland or a subsidiary is a party, management's current

plans, its perception of historical trends, current conditions and expected

future developments, as well as other factors that are believed to be

appropriate in the circumstances. Although these forward-looking statements are

based upon management's current reasonable expectations and assumptions, they

are subject to numerous risks and uncertainties. Some of the factors that could

cause results or events to differ from current expectations include, but are not

limited to, construction risks, counterparty risks, operational risks, foreign

exchange rates, regulatory risks, maritime risks for construction and operation,

and the variability of revenues from generating facilities powered by

intermittent renewable resources and the other factors described in the "Risks

and Uncertainties" section of Northland's 2012 Annual Report and Annual

Information Form, both of which can be found at www.sedar.com under Northland's

profile and on Northland's website www.northlandpower.ca. Northland's actual

results could differ materially from those expressed in, or implied by, these

forward-looking statements and, accordingly, no assurances can be given that any

of the events anticipated by the forward-looking statements will transpire or

occur.

The forward-looking statements contained in this release are based on

assumptions that were considered reasonable on February 19, 2014. Other than as

specifically required by law, Northland undertakes no obligation to update any

forward-looking statements to reflect events or circumstances after such date or

to reflect the occurrence of unanticipated events, whether as a result of new

information, future events or results, or otherwise.

NORTHLAND POWER INC.

Consolidated Balance Sheets

(unaudited, stated in thousands of Canadian dollars)

ASSETS

Dec. 31, 2013 Dec. 31, 2012

Current

Cash and cash equivalents 138,460 31,715

Restricted cash 74,365 27,285

Trade and other receivables 124,606 125,816

Inventories 12,793 7,468

Prepayments 7,595 11,169

Investment in Panda-Brandywine 3,100 -

Finance lease receivable 2,530 2,989

----------------------------------------------------------------------------

Total current assets 363,449 206,442

----------------------------------------------------------------------------

Finance lease receivable 161,235 163,764

Investment in Panda-Brandywine - 3,500

Equity accounted investment 4,941 5,317

Property, plant and equipment 2,094,262 1,717,470

Contracts and other intangible assets 187,121 199,608

Other assets 8,845 -

Goodwill 220,167 222,574

----------------------------------------------------------------------------

Total assets $ 3,040,020 $ 2,518,675

----------------------------------------------------------------------------

LIABILITIES AND SHAREHOLDERS' EQUITY

Current

Bank indebtedness - 1,071

Trade and other payables 84,993 92,882

Interest-bearing loans and borrowings 59,173 39,998

Dividends payable - non-controlling interest 3,460 -

Dividends payable 11,968 10,430

----------------------------------------------------------------------------

Total current liabilities 159,594 144,381

----------------------------------------------------------------------------

Interest-bearing loans and borrowings 1,762,397 1,225,132

Convertible debentures 15,992 26,668

Other liabilities 3,050 2,056

Provisions 16,205 12,437

Deferred income tax liability 83,422 44,890

Derivative financial instruments 46,622 215,566

----------------------------------------------------------------------------

Liabilities excluding those attributed to

shareholders 2,087,282 1,671,130

----------------------------------------------------------------------------

Convertible shares - 146,429

----------------------------------------------------------------------------

Liabilities attributed to shareholders - 146,429

----------------------------------------------------------------------------

Total liabilities 2,087,282 1,817,559

Shareholders' equity

Preferred shares 261,737 262,195

Common shares 1,637,480 964,311

Long-term incentive plan reserve 7,319 9,391

Convertible shares 14,615 499,033

Replacement Rights - 11,098

Accumulated other comprehensive income 204 1,018

Deficit (1,041,872) (1,045,930)

----------------------------------------------------------------------------

Equity attributable to shareholders 879,483 701,116

----------------------------------------------------------------------------

Non-controlling interests 73,255 -

----------------------------------------------------------------------------

Total shareholders' equity 952,738 701,116

----------------------------------------------------------------------------

Total liabilities and shareholders' equity $ 3,040,020 $ 2,518,675

----------------------------------------------------------------------------

NORTHLAND POWER INC.

Consolidated Statements of Income (Loss)

(unaudited, stated in thousands of Canadian dollars except per share

amounts)

Three Months Ended Twelve Months Ended

Dec. 31, Dec. 31,

2013 2012 2013 2012

Sales

Electricity 173,992 82,524 535,206 325,728

Steam, natural gas and other 339 10,653 22,032 35,954

----------------------------------------------------------------------------

Total sales 174,331 93,177 557,238 361,682

Cost of sales 60,967 33,193 202,479 131,492

----------------------------------------------------------------------------

Gross profit 113,364 59,984 354,759 230,190

----------------------------------------------------------------------------

Expenses

Plant operating costs 19,390 10,653 64,235 40,438

Management and administration

costs - operations 5,316 3,888 15,620 13,736

Management and administration

costs - development 4,332 5,044 17,512 13,714

Depreciation of property,

plant and equipment 27,323 15,500 89,879 62,307

----------------------------------------------------------------------------

56,361 35,085 187,246 130,195

----------------------------------------------------------------------------

Investment income 523 189 939 355

Finance lease income 3,447 3,510 13,886 14,129

----------------------------------------------------------------------------

Operating income 60,973 28,598 182,338 114,479

Finance costs 25,529 15,294 84,885 63,966

Equity investment (gain) loss 9 6 (262) (312)

Amortization of contracts and

other intangible assets 5,053 4,855 19,930 19,422

Write-off of deferred

development costs - 1,661 - 1,661

Impairment of contracts and

other intangible assets - 1,684 - 1,684

Impairment of goodwill 2,407 19,269 2,407 19,269

Foreign exchange (gain) (1,932) (690) (3,787) (55)

Finance (income) (493) (215) (1,207) (815)

Fair value (gain) loss on

derivative contracts 1,696 (13,603) (102,072) (1,955)

Fair value (gain) loss on

convertible shares - (888) (27,834) 14,199

Writedown in Panda-Brandywine

equity investment 400 2,100 400 2,100

Lease accounting (gain) - (2,964) - (2,964)

Other (income) - - (1,526) -

----------------------------------------------------------------------------

Income (loss) before income

taxes 28,304 2,089 211,404 (1,721)

----------------------------------------------------------------------------

Provision for (recovery of)

income taxes:

Current 2,917 1,448 8,780 4,990

Deferred 3,379 3,179 35,605 3,202

----------------------------------------------------------------------------

6,296 4,627 44,385 8,192

----------------------------------------------------------------------------

Net income (loss) for the year 22,008 (2,538) 167,019 (9,913)

----------------------------------------------------------------------------

Net income (loss) attributable

to:

Non-controlling interests 8,111 - 15,885 -

Common shareholders 13,897 (2,538) 151,134 (9,913)

----------------------------------------------------------------------------

22,008 (2,538) 167,019 (9,913)

----------------------------------------------------------------------------

Weighted average number of

shares outstanding - basic 132,979 120,855 126,719 120,538

Weighted average number of

shares outstanding - diluted 132,979 120,855 133,478 120,538

Net gain (loss) per share -

basic $ 0.08 $ (0.05) $ 1.08 $ (0.18)

Net gain (loss) per share -

diluted $ 0.08 $ (0.05) $ 1.03 $ (0.18)

NORTHLAND POWER INC.

Consolidated Statements of Cash Flows

(unaudited, stated in thousands of Canadian dollars except per share

amounts)

Three Months Ended Twelve Months Ended

Dec. 31, Dec. 31,

2013 2012 2013 2012

Operating activities

Net income (loss) for the year 22,008 (2,538) 167,019 (9,913)

Items not involving cash or

operating activities:

Depreciation of property,

plant and equipment 27,323 15,500 89,879 62,307

Amortization of contracts and

other intangible assets 5,053 4,855 19,930 19,422

Write-off and impairment of

property, plant and

equipment, intangible assets

and goodwill 2,407 22,614 2,407 22,614

Writedown in Panda-Brandywine

equity investment 400 2,100 400 2,100

Finance costs, net 24,473 19,187 78,402 64,118

Fair value (gain) loss on

derivative contracts 1,696 (13,603) (102,072) (1,955)

Fair value (gain) loss on

convertible shares - (888) (27,834) 14,199

Finance lease 599 643 2,988 2,606

Lease accounting (gain) - (2,964) - (2,964)

Unrealized foreign exchange

(gain) loss (1,864) (364) (3,620) 271

Equity loss (gain), net of

distributions 9 6 376 (312)

Other 931 161 1,548 (1,489)

Deferred income taxes 3,379 3,179 35,605 3,202

----------------------------------------------------------------------------

86,414 47,888 265,028 174,206

Net change in non-cash working

capital balances related to

operating activities (7,930) (2,450) (7,950) (11,808)

----------------------------------------------------------------------------

Cash provided by operating

activities 78,484 45,438 257,078 162,398

----------------------------------------------------------------------------

Investing activities

Purchase of property, plant and

equipment (59,901) (132,088) (335,312) (303,738)

Cash reserves (funding) (51,373) 18,501 (46,546) (17,672)

Increase in intangible assets (13,541) (5,529) (84,401) (60,705)

Interest received 493 215 1,207 815

Acquisition of CEEC, net - - 10,865 -

Net change in working capital

related to investing activities (29,130) 4,824 10,031 7,200

----------------------------------------------------------------------------

Cash used in investing

activities (153,452) (114,077) (444,156) (374,100)

----------------------------------------------------------------------------

Financing activities

Proceeds from borrowings 185,486 103,300 462,234 327,617

Net proceeds from bond offerings (528) - 816,001 -

Repayment of borrowings (13,384) (15,012) (719,552) (80,360)

Settlement of interest rate

swaps - - (65,409) -

Decrease in bank indebtedness (12,000) 1,071 (1,071) (7,186)

Issuance of preferred shares - - - 116,037

Interest paid (23,705) (18,278) (74,857) (60,620)

Dividends to non-controlling

interest (1,668) - (11,683) -

Preferred share dividends (3,469) (3,469) (13,876) (11,484)

Common and Class A share

dividends (27,385) (22,458) (98,908) (88,734)

Other - - 804 -

----------------------------------------------------------------------------

Cash provided by financing

activities 103,347 45,154 293,683 195,270

----------------------------------------------------------------------------

Effect of exchange rate

differences on cash and cash

equivalents 97 40 140 (4)

----------------------------------------------------------------------------

Net change in cash and cash

equivalents during the year 28,476 (23,445) 106,745 (16,436)

Cash and cash equivalents,

beginning of year 109,984 55,160 31,715 48,151

----------------------------------------------------------------------------

Cash and cash equivalents, end

of year 138,460 31,715 138,460 31,715

----------------------------------------------------------------------------

PER SHARE

Dividends declared to

shareholders $ 0.27 $ 0.27 $ 1.08 $ 1.08

NORTHLAND POWER INC.

FREE CASH FLOW AND DIVIDENDS TO SHAREHOLDERS

(stated in thousands of Canadian dollars except per share amounts)

----------------------------------------------------------------------------

Three Months ended Twelve Months ended

Dec. 31, Dec. 31,

2013 2012 2013 2012

----------------------------------------------------------------------------

Cash provided by operating

activities 78,484 45,438 257,078 162,398

Northland adjustments:

Net change in non-cash working

capital balances related to

operations 7,930 2,450 7,950 11,808

Capital expenditures, net-non-

expansionary (863) (5,140) (1,339) (6,281)

Interest paid, net (23,212) (18,063) (73,650) (59,805)

Scheduled principal repayments on

term loans (11,866) (15,012) (30,467) (34,720)

Funds utilized (set aside) for

quarterly scheduled principal

repayments (607) 9,653 (607) 1,669

Restricted cash utilization

(funding) for major maintenance (3,766) 2,731 (4,716) 1,986

Write-off of deferred development

costs - (1,661) - (1,661)

Consolidation of managed facilities (4,621) - (10,899) -

Equity accounting 58 56 (107) 563

Funds set aside for asset purchase - 750 750 (750)

Preferred share dividends (3,469) (3,469) (13,876) (11,484)

----------------------------------------------------------------------------

Free cash flow 38,068 17,733 130,117 63,723

Cash Dividends paid to common and

Class A shareholders 27,385 22,458 98,908 88,734

Free cash flow payout ratio 72% 127% 76% 139%

----------------------------------------------------------------------------

Total Dividends paid to common and

Class A shareholders 35,486 31,138 131,553 121,551

Free cash flow payout ratio 93% 176% 101% 191%

Free cash flow payout ratio since

inception 105% 105%

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Average number of shares - basic

(thousands of share) 132,612 115,288 123,482 115,058

Average number of shares - fully

diluted (thousands of shares) 132,612 115,288 123,482 115,058

----------------------------------------------------------------------------

Per share ($/share)

Free cash flow - basic 0.29 0.15 1.05 0.55

Free cash flow - fully diluted 0.29 0.15 1.05 0.55

----------------------------------------------------------------------------

FOR FURTHER INFORMATION PLEASE CONTACT:

Northland Power Inc.

Barb Bokla

Manager, Investor Relations

647-288-1438

Northland Power Inc.

Adam Beaumont

Director of Finance

647-288-1929

(416) 962-6266 (FAX)

investorrelations@northlandpower.ca

www.northlandpower.ca

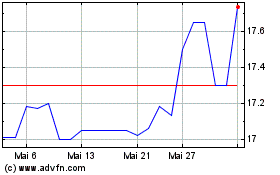

Northland Power (TSX:NPI.PR.A)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Northland Power (TSX:NPI.PR.A)

Historical Stock Chart

Von Mai 2023 bis Mai 2024