Melcor Developments Ltd. (TSX: MRD), an Alberta-based real estate

development and asset management company, today reported results

for the third quarter and nine months ended September 30,

2021. Company year-to-date revenue was up 13% to

$165.03 million compared to 2020.

Community

Development division revenue increased 30% over the same

period in 2020.

Investment properties grew by 22,865 sf or 1% year-to-date as a

result of properties transferred from our Property Development

division. Revenue in our income-producing divisions

(Investment Properties and REIT)

was down 1% over Q3-2020 and up 1% year-to-date. Vacancy rates are

up slightly due to challenging markets.

Year-to-date net income was impacted by non-cash fair value

losses of $26.31 million on REIT units related to unit price

appreciation compared to December 31, 2020 resulting in a net

income of $11.54 million or $0.35 per share (basic) compared with a

net income of $11.58 million or $0.35 per share (basic) in the same

period of 2020.

Funds from operations (FFO) decreased 13% to $12.52 million

or $0.38 per share over Q3-2020 and increased 32% to

$39.02 million or $1.17 per share year-to-date. Changes to FFO

are the result of significant swings in fair value adjustments on

REIT units and investment properties.

Darin Rayburn, Melcor’s President and Chief Executive Officer,

commented on the quarter: "We are pleased with our results through

the first nine months of 2021. Year-to-date, we sold 408

single-family lots in Canada compared to 290 in 2020. In the prior

year, we also sold 229 single-family lots in the USA.

While COVID-19 has had a modest impact on our business through

the past year, our income-generating divisions have been the most

sensitive to changes in consumer behaviour and work from home

orders. We continue to work with our tenants to support them

through this time. As of September 30, we had collected 99% of

year-to-date rent. Revenue and occupancy have remained relatively

stable in these divisions throughout the past year. Leasing

activity through the period was stable and trending to

positive.

Recreational Properties achieved record revenue and margin

through the first three quarters as a result of early opening dates

and favourable weather throughout the golf season.

Gross margin improved to 48% year-to-date compared to 43% in

2020 due to higher gross margin in most operating divisions, most

notably the Community Development Division and the REIT.

Finally, a few acknowledgments in my final quote as president

and CEO of Melcor. I am so incredibly proud of our entire Melcor

team for their commitment, perseverance and resilience. The success

of Melcor, and the REIT, is attributable to all the facets of the

Melcor team coming together to achieve a common goal.

I’m grateful to the board, the Melcor team, our shareholders and

all stakeholders for your guidance, support and friendship over the

years. I look forward to watching Melcor continue to succeed."

CEO SUCCESSION PLAN AND EXECUTIVE CHANGES

Melcor Developments Ltd. today announced that its Board of

Directors has appointed Mr. Tim Melton as Chief Executive Officer

and Executive Chairman of the Board effective immediately. In

addition, Naomi Stefura, Melcor’s Chief Financial Officer, has been

promoted to the new role of Executive Vice President in addition to

her continuing role as CFO, effective immediately. Darin Rayburn

will continue to work with Melcor and assist with this transition

until his retirement December 31, 2021.

Third Quarter Results

Given the longer term nature of real estate development,

comparison of any three-month period may not be meaningful.

Revenue in Q3-2021 was down 23% compared to Q3-2020 due to the

bulk sale of 196 single-family lots in Harmony (Aurora, CO) in the

prior period and 41% fewer single-family lots sold in Canada in

Q3-2021 compared to the prior year, partially offset by the sale of

293 paper lots (79 acres) for $13.84 million (USD$10.99

million). The US community development model differs from Canadian

markets, resulting in the majority of revenue occurring in a single

quarter. In Harmony, where Melcor is developing in much the same

way as we do in our Canadian markets, production builders buy lots

in bulk to build homes to sell to homeowners. Demand for additional

lots in Harmony remains high and we are completing the third phase

for sale to builders. In other US assets, Melcor advances land

through the municipal approval process and then sells the land as

paper lots, typically to a single builder, without doing any

development. Paper lot sales transactions result in a quick return

on equity, with transactions typically occurring within 18 to 24

months from land purchase to sale.

Revenue was up 13% year-to-date as a result of the 30% increase

in Community Development revenue and record revenue for

Recreational Properties division. The Community Development

division sold 22.69 acres of commercial and industrial land for

$4.68 million year-to-date (2020 - 0.80 acres, $0.42 million) in

addition to the 293 paper lots sold in Q3-2021. We usually see the

most revenue from lot sales in the third and fourth quarters as

that is when plans typically register.

Investment properties gross leasable area (GLA) grew by 22,865

sf or 1% year-to-date as a result of properties transferred from

our Property Development division in 2021. Revenue from our

income-generating Investment Properties and REIT divisions was flat

in the quarter and year-to-date. Growth in revenues from PD

transferred assets, including properties awaiting lease-up which

have not yet transferred, but where IP recognizes the revenue,

offset a decline in US revenues where tenant turnover drove a

decline in occupancy. Year-to-date we recognized $2.94 million in

lease termination fees offsetting lower lease revenue. We continue

to both renew tenants and lease new space.

FINANCIAL HIGHLIGHTS

- Revenue was down 23% in the quarter due to the bulk sale of 196

lots in the US in Q3-2020 contributing to the 21% decrease in

single-family lots sold and up 13% year-to-date as a result of 30%

increase in Community Development revenue due to revenue from the

sale of paper lots, and raw, commercial and industrial land sales.

Record revenue from Recreational Properties also contributed to the

year-to-date growth. Revenue from single-family lot sales was

stable at $58.95 million year-to-date (YTD-2020 - $58.90

million).

- Funds from operations (FFO) decreased 13% over Q3-2020 and

increased 32% year-to-date. These changes are the result of the

fluctuations in fair value adjustments on REIT units and investment

properties, and changes to non-cash finance charges.

- Net income of $16.56 million in Q3-2021 (Q3-2020 - $7.53

million) and $11.54 million year-to-date (YTD-2020 - $11.58

million) is a result of the swings in non-cash fair value

adjustments on investment properties and REIT units, and increased

finance costs offset by increased revenue. The change in the REIT's

unit price has a counter-intuitive impact on net income as an

increase in unit value decreases net income. These losses are

driven by market forces outside of Melcor's control and are a key

reason we focus on FFO as a truer measure of our financial

performance.

DIVISIONAL OPERATING HIGHLIGHTS

- The

Community Development division has had a busy

construction season to replenish inventory in all regions and is

building 1,721 single-family lots (including duplex and townhome

sites) in 25 new phases of 14 existing communities and 1 new

community, and 3.33 acres for multi-family development. This

includes the launch of a new community known as Cobblestone Creek

in Airdrie, AB. Sales activity remains healthy in all Canadian

markets, including satellite communities such as St. Albert, Spruce

Grove, Airdrie and Cochrane. Year-to-date, we sold 408

single-family lots compared to 290 last year. We continue to move

new communities and additional phases in existing neighbourhoods

through the municipal approval process.Interest in Harmony (Aurora,

CO) also remained strong throughout the quarter as builders move

through their inventory. In 2020, 229 single-family lot sales were

made in Harmony.

- The Property Development team has a total of

104,776 sf in 5 projects (Greenwich, Jensen Lakes Crossing,

Clearview Market, Chestermere Station and Vista Ridge) currently

under construction. Property Development transferred a 16,348 sf

building at The District (Calgary) to Investment Properties in

Q3-2021. A further 18,931 sf is complete and awaiting lease-up and

transfer in 2 projects: Woodbend Market and Clearview Market.

Construction and leasing activity resulted in fair value gains of

$2.27 million (YTD - $1.13 million).

- Total GLA under management has increased 22,865 sf or 1% via

transfers from Property Development. Revenue in

our income-producing divisions (Investment

Properties and REIT) was flat in the

quarter and year-to-date. Tenant retention and new leasing remain

healthy in our Canadian portfolio driving stable occupancy; while

our US portfolio occupancy is down due to soft office conditions.

See the COVID-19 section for rent collection information.The

investment property portfolio fair value increased

$2.14 million in Q3-2021 (YTD - $6.14 million). Gains

realized in the quarter were due to lower capitalization rates

while year-to-date gains also include the sale of Turney

Brownstones in Phoenix, Arizona on July 30, which generated gains

of $2.54 million (US$2.03 million).

- Our

Recreational Properties year-to-date revenue

increased 30% to $9.29 million due to mild spring weather allowing

earlier course opening dates and favourable weather throughout the

season. Comparative 2020 revenues were impacted by COVID-19 related

delays to course openings and restrictions imposed on food and

beverage service throughout the season.

RETURNING VALUE

- We continue to

return value to our shareholders and unitholders:

- We paid a quarterly

dividend of $0.12 per share in September (year to date - $0.32 per

share).

- On November 9,

2021 we declared a quarterly dividend of $0.12 per share, payable

on December 31, 2021 to shareholders of record on

December 15, 2021. The dividend is an eligible dividend for

Canadian tax purposes.

- The REIT increased

the August and September distributions by 14% to $0.04 per unit

compared to $0.035 per unit January through July.

Selected Highlights

|

($000s except as noted) |

Three months ended |

Nine months ended |

|

|

30-Sep-21 |

30-Sep-20 |

Change |

30-Sep-21 |

30-Sep-20 |

Change |

|

Revenue |

56,213 |

|

73,051 |

|

(23.0 |

)% |

165,030 |

|

145,871 |

|

13.1 |

% |

|

Gross margin (%) * |

47.9 |

% |

36.4 |

% |

31.6 |

% |

48.2 |

% |

43.3 |

% |

11.3 |

% |

|

Net income |

16,561 |

|

7,526 |

|

120.1 |

% |

11,542 |

|

11,576 |

|

(0.3 |

)% |

|

Net margin (%) * |

29.5 |

% |

10.3 |

% |

186.4 |

% |

7.0 |

% |

7.9 |

% |

(11.4 |

)% |

|

Funds from operations (FFO) * |

12,516 |

|

14,315 |

|

(12.6 |

)% |

39,016 |

|

29,516 |

|

32.2 |

% |

|

Per Share Data ($) |

|

|

|

|

|

|

|

Basic earnings |

0.50 |

|

0.23 |

|

117.4 |

% |

0.35 |

|

0.35 |

|

— |

% |

|

Diluted earnings |

0.50 |

|

0.23 |

|

117.4 |

% |

0.35 |

|

0.35 |

|

— |

% |

|

Funds from operations * |

0.38 |

|

0.43 |

|

(11.6 |

)% |

1.17 |

|

0.89 |

|

31.5 |

% |

|

Dividends |

0.12 |

|

0.08 |

|

50.0 |

% |

0.32 |

|

0.26 |

|

23.1 |

% |

|

|

|

|

|

|

|

|

|

As at ($000s except share and per share amounts) |

|

30-Sep-21 |

31-Dec-20 |

Change |

|

Total assets |

|

|

|

2,054,109 |

|

2,001,285 |

|

2.6 |

% |

|

Shareholders' equity |

|

|

|

1,077,716 |

|

1,077,429 |

|

— |

% |

| |

|

|

|

|

|

|

|

Total shares outstanding |

|

|

|

32,966,423 |

|

33,091,061 |

|

(0.4 |

)% |

| |

|

|

|

|

|

|

|

Per Share Data ($) |

|

|

|

|

|

|

|

Book value * |

|

|

|

32.69 |

|

32.52 |

|

0.5 |

% |

MD&A and Financial Statements

Information included in this press release is a summary of

results. This press release should be read in conjunction with

Melcor’s consolidated financial statements and management's

discussion and analysis for the three and nine months ended

September 30, 2021, which can be found on the company’s

website at www.Melcor.ca or on SEDAR (www.sedar.com).

About Melcor Developments Ltd.

Melcor is a diversified real estate development and asset

management company that transforms real estate from raw land

through to high-quality finished product in both residential and

commercial built form. Melcor develops and manages mixed-use

residential communities, business and industrial parks, office

buildings, retail commercial centres and golf courses. Melcor owns

a well diversified portfolio of assets in Alberta, Saskatchewan,

British Columbia, Arizona and Colorado.

Melcor has been focused on real estate since 1923. The company

has built over 140 communities and commercial projects across

Western Canada and today manages 4.66 million sf in commercial real

estate assets and 603 residential rental units. Melcor is committed

to building communities that enrich quality of life - communities

where people live, work, shop and play.

Melcor’s headquarters are located in Edmonton, Alberta, with

regional offices throughout Alberta and in Kelowna, British

Columbia and Phoenix, Arizona. Melcor has been a public company

since 1968 and trades on the Toronto Stock Exchange (TSX:MRD).

Forward Looking Statements

In order to provide our investors with an understanding of our

current results and future prospects, our public communications

often include written or verbal forward-looking statements.

Forward-looking statements are disclosures regarding possible

events, conditions, or results of operations that are based on

assumptions about future economic conditions, courses of action and

include future-oriented financial information.

This news release and other materials filed with the Canadian

securities regulators contain statements that are forward-looking.

These statements represent Melcor’s intentions, plans,

expectations, and beliefs and are based on our experience and our

assessment of historical and future trends, and the application of

key assumptions relating to future events and circumstances.

Future-looking statements may involve, but are not limited to,

comments with respect to our strategic initiatives for 2021 and

beyond, future development plans and objectives, targets,

expectations of the real estate, financing and economic

environments, our financial condition or the results of or outlook

of our operations.

By their nature, forward-looking statements require assumptions

and involve risks and uncertainties related to the business and

general economic environment, many beyond our control. There is

significant risk that the predictions, forecasts, valuations,

conclusions or projections we make will not prove to be accurate

and that our actual results will be materially different from

targets, expectations, estimates or intentions expressed in

forward-looking statements. We caution readers of this document not

to place undue reliance on forward-looking statements. Assumptions

about the performance of the Canadian and US economies and how this

performance will affect Melcor’s business are material factors we

consider in determining our forward-looking statements. For

additional information regarding material risks and assumptions,

please see the discussion under Business Environment and Risk in

our annual MD&A and the additional disclosure under Business

Environment and Risk in this MD&A.

Readers should carefully consider these factors, as well as

other uncertainties and potential events, and the inherent

uncertainty of forward-looking statements. Except as may be

required by law, we do not undertake to update any forward-looking

statement, whether written or oral, made by the company or on its

behalf.

Contact Information:

Nicole Forsythe

Director, Corporate Communications

Tel: 1.855.673.6931 x4707

ir@melcor.ca

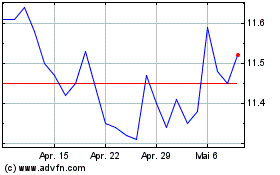

Melcor Developments (TSX:MRD)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Melcor Developments (TSX:MRD)

Historical Stock Chart

Von Jan 2024 bis Jan 2025