MAG Silver Corp Announces C$75 Million Bought Deal Financing

26 Juni 2014 - 9:43PM

Marketwired Canada

MAG Silver Corp., (TSX:MAG)(NYSE MKT:MVG) (the "Company"or "MAG"") has announced

today that it has entered into an agreement with a syndicate of underwriters led

by BMO Capital Markets and Raymond James under which the underwriters have

agreed to buy on a bought deal basis 7,320,000 common shares (the "Common

Shares"), at a price of C$10.25 per Common Share for gross proceeds of

C$75,030,000 (the "Offering"). The Company has granted the Underwriters an

option, exercisable at the offering price for a period of 30 days following the

closing of the Offering, to purchase up to an additional 15% of the Offering to

cover over-allotments, if any. The Offering is expected to close on or about

July 16, 2014 and is subject to the Company receiving all necessary regulatory

approvals.

The net proceeds of the Offering will be used to fund exploration and

development of the Company's Juanicipio project in Zacatecas State, Mexico and

for working capital and general corporate purposes.

The Common Shares will be offered by way of a short-form prospectus in all of

the provinces of Canada, excluding Quebec, and will be offered in the United

States pursuant to a registration statement filed under the Canada/U.S.

multi-jurisdictional disclosure system, and on a private placement basis in

certain jurisdictions outside Canada and the United States pursuant to

applicable prospectus exemptions. A registration statement relating to these

securities has been filed with the United States Securities and Exchange

Commission but has not yet become effective. The securities may not be sold nor

may offers to buy be accepted in the United States prior to the time the

registration statement becomes effective. This news release shall not constitute

an offer to sell or the solicitation of an offer to buy nor shall there be any

sale of the Common Shares in any jurisdiction in which such offer, solicitation

or sale would be unlawful prior to registration or qualification under the

securities laws of that jurisdiction.

A written prospectus relating to the Offering may be obtained upon request in

Canada by contacting BMO Capital Markets, Mississauga Distribution Centre C/O

The Data Group of Companies, 300A Kennedy Road South Brampton, Ontario L6W 4V2,

by telephone at 905-696-8884 x4338 or by email at kennedywarehouse@datagroup.ca,

and in the United States by contacting BMO Capital Markets Corp., Attn: Equity

Syndicate Department, 3 Times Square, New York, NY 10036, or by telephone at

(800) 414-3627 or by email at bmoprospectus@bmo.com.

About MAG Silver Corp.

MAG Silver Corp. (TSX:MAG)(NYSE MKT:MVG) is focused on advancing two significant

projects located within the Mexican Silver Belt. Our mission is to become one of

the premier companies in the silver mining industry. Currently, we are advancing

the underground decline towards the high grade Valdecanas Silver vein and

delineating the Desprendido and Juanicipio discoveries in Zacatecas State, all

within the joint venture between MAG (44%) and Fresnillo PLC (56%). In addition,

we are negotiating surface access in order to further delineate our district

scale, 100% owned Cinco de Mayo property in Chihuahua state, where two new

silver, lead, zinc discoveries are opening up further growth opportunities for

MAG.

Neither the Toronto Stock Exchange nor the NYSE MKT has reviewed or accepted

responsibility for the accuracy or adequacy of this press release, which has

been prepared by management.

This release includes certain statements that may be deemed to be

"forward-looking statements" within the meaning of the US Private Securities

Litigation Reform Act of 1995. All statements in this release, other than

statements of historical facts are forward looking statements, including

statements that address timing of the closing of the Offering and proposed use

of proceeds of the Offering. Forward-looking statements are often, but not

always, identified by the use of words such as "seek", "anticipate", "plan",

"continue", "estimate", "expect", "may", "will", "project", "predict",

"potential", "targeting", "intend", "could", "might", "should", "believe" and

similar expressions. These statements involve known and unknown risks,

uncertainties and other factors that may cause actual results or events to

differ materially from those anticipated in such forward-looking statements.

Although MAG believes the expectations expressed in such forward-looking

statements are based on reasonable assumptions, such statements are not

guarantees of future performance and actual results or developments may differ

materially from those in the forward-looking statements. Factors that could

cause actual results to differ materially from those in forward-looking

statements include, but are not limited to, delays in obtaining regulatory

approvals required in connection with the Offering, changes in commodities

prices, changes in mineral production performance, exploitation and exploration

successes, continued availability of capital and financing, and general

economic, market or business conditions, political risk, currency risk and

capital cost inflation. In addition, forward-looking statements are subject to

various risks, including that data is incomplete and considerable additional

work will be required to complete further evaluation, including but not limited

to drilling, engineering and socio-economic studies and investment. The reader

is referred to the Company's filings with the SEC and Canadian securities

regulators for disclosure regarding these and other risk factors. There is no

certainty that any forward looking statement will come to pass and investors

should not place undue reliance upon forward-looking statements.

FOR FURTHER INFORMATION PLEASE CONTACT:

MAG Silver Corp.

Michael J. Curlook

VP Investor Relations and Communications

(604) 630-1399 or Toll free: (866) 630-1399

(604) 681-0894 (FAX)

info@magsilver.com

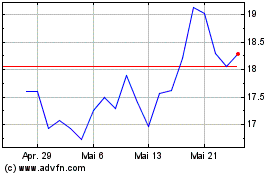

MAG Silver (TSX:MAG)

Historical Stock Chart

Von Mär 2025 bis Apr 2025

MAG Silver (TSX:MAG)

Historical Stock Chart

Von Apr 2024 bis Apr 2025