Canadian Life Companies Split Corp. Increases Preferred Share Rate

18 September 2024 - 10:29PM

Canadian Life Companies Split Corp. (the “Company”) is pleased to

announce an increase in the Preferred Share dividend rate for the

new six year term effective December 1, 2024. Payments will be made

at the greater of 7.00% (previously 6.50%) or Prime plus 2% with a

maximum of 9.00% (previously 8.00%) based on the $10.00 repayment

value. The new distribution rate represents a potential increase of

$0.10 per annum from the previous maximum rate. Preferred

shareholders have received a total of $11.82 per share in

distributions since inception. The dividend policy for the Class A

Shares will remain at the current targeted rate of $0.10 per month,

or $1.20 per annum.

As previously announced on March 12, 2024 the

Company will extend the termination date a further six year period

from December 1, 2024 to December 1, 2030. In relation to the term

extension and the Preferred Share rate increase, the Company has an

additional retraction right for those shareholders not wishing to

continue holding their investment, allowing existing shareholders

to tender one or both classes of shares and receive a retraction

price based on the November 29, 2024 net asset value per unit.

Alternatively, shareholders may sell their shares for the market

price at any time, potentially at a higher price than would be

achieved through retraction, or shareholders may take no action and

continue to hold their shares.

The Company invests in a portfolio of four

publicly traded Canadian life insurance companies as follows:

Great‐West Lifeco Inc., Industrial Alliance Insurance &

Financial Services Inc., Manulife Financial Corporation and Sun

Life Financial Inc.

Certain statements included in this news release

constitute forward-looking statements, including, but not limited

to, those identified by the expressions “expect”, “intend”, “will”

and similar expressions to the extent they relate to the Company.

The forward-looking statements are not historical facts but reflect

the Company’s current expectations regarding future results or

events. These forward-looking statements are subject to a number of

risks and uncertainties that could cause actual results or events

to differ materially from current expectations. Although the

Company believes that the assumptions inherent in the

forward-looking statements are reasonable, forward-looking

statements are not guarantees of future performance and,

accordingly, readers are cautioned not to place undue reliance on

such statements due to the inherent uncertainty therein. The

Company undertakes no obligation to update publicly or otherwise

revise any forward-looking statement or information whether as a

result of new information, future events or other such factors

which affect this information, except as required by law.

Commissions, trailing commissions, management fees and expenses all

may be associated with mutual fund investments. Investors should

read the prospectus before investing. Mutual funds are not

guaranteed, their values change frequently and past performance may

not be repeated. Please read the Company’s publicly filed documents

which are available at www.sedarplus.com

| Investor

Relations: 1-877-478-2372 |

Local:

416-304-4443 |

www.lifesplit.com |

info@quadravest.com |

Canadian Life Companies ... (TSX:LFE)

Historical Stock Chart

Von Jan 2025 bis Feb 2025

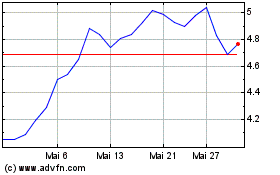

Canadian Life Companies ... (TSX:LFE)

Historical Stock Chart

Von Feb 2024 bis Feb 2025