High Arctic Energy Services Inc. (TSX: HWO) "High Arctic" or the

"Corporation” is pleased to announce that it has closed the

previously announced sale of High Arctic’s Canadian well servicing

business to Precision Drilling Corporation (“Precision”) by asset

purchase agreement for an aggregate purchase price of $38.2 million

payable in cash (the “Well Servicing Transaction”). Additionally,

the Corporation has closed the previously announced sale of High

Arctic’s Canadian snubbing business to Team Snubbing Services Inc.

(“Team”) by asset purchase agreement for 42% of the post-closing

total outstanding shares in Team and a note receivable of $3.4

million (the “Snubbing Transaction”).

Post-closing High Arctic

retains its Ancillary Services Segment in Canada comprised of the

Nitrogen Pumping business and a smaller Rentals business focused on

pressure control while keeping the HAES Rental Services branding.

High Arctic also retains its snubbing assets in Colorado, USA.

These Ancillary Services businesses will be supported from our

Whitecourt, Alberta facility, and the Corporation will retain a

small corporate headquarters in Calgary, Canada. The Corporation

expects to realize a significant reduction in Canadian overhead and

G&A expenses of about $4.0 million annually.

After Closing, the Company reports a cash

balance of $24.5 million comprised of the initial $10.2 cash

payment from Precision and $14.3 million pre-close cash on hand.

Over the next six months these sale transactions will further

increase cash as the Corporation collects an additional $3.0

million from retained working capital over the next 75 days, and

the final $28.0 million cash payment is received from Precision in

January 2023. Cash balances are offset by mortgage debt of $7.9

million. Upon receipt of the final payment from Precision, the

Company expects to repay about $3.5 million of this mortgage

debt.

The Corporation confirms that no funding is

available under its current undrawn revolving Credit Facility due

to these sale transactions and the arrangement is being cancelled.

High Arctic intends to fund working capital and capital expenditure

needs from cash balances with a view to establish a new arrangement

geared towards its Papua New Guinea (“PNG”) business in due

course.

Mike Maguire, CEO of High Arctic, said, “These

two transactions represent the effective divestment of High

Arctic’s Canadian Production Services and allows our management to

streamline and develop a longer-term strategy for the remaining

Canadian business and focus attention on the growth opportunities

in PNG.

We are excited about the opportunities for our

Drilling Services segment in PNG as the next round of gas

development projects materialize there. The timing of the receipt

of proceeds from the transactions provides the opportunity for

management to evaluate the need and sources for both working and

growth capital in PNG. The Corporation has a history of returning

surplus cash to shareholders and will consider capacity to

distribute funds to shareholders.”

The Well Servicing Transaction

included High Arctic’s Canadian Well Servicing fleet marketed under

the Concord Well Servicing brand comprising of 51 marketable rigs

and 29 inactive and out of service rigs, as well as oilfield rental

equipment associated with well servicing including hydraulic

catwalks purchased in 2021. The consideration included $10.2

million immediately payable at closing and the remaining $28.0

million payable in January 2023.

Title to four Alberta real estate locations

owned by the Corporation will transfer to Precision on final

payment, with High Arctic retaining owned Alberta properties in

Whitecourt and Clairmont. Precision will assume the lease

obligations for High Arctic’s properties in Cold Lake and Acheson.

High Arctic’s Well Servicing employees, and the large majority of

High Arctic’s Canadian field and office support personnel, have

agreed to transfer employment to Precision.

The Snubbing Transaction

includes High Arctic’s Canadian Snubbing fleet comprising 7

marketable packages and 32 inactive and out of service snubbing

units, underbalance hoists and associated support equipment.

Commensurate with the Snubbing Transaction, High Arctic will

appoint two directors to the 5-person board of Team, and an

affiliate of Team will enter into a five-year lease of High

Arctic’s owned property in Clairmont, Alberta on current market

terms. High Arctic’s snubbing employees will transfer employment to

Team.

The Snubbing Transaction consideration comprises

420,000 common voting shares in Team, representing 42% of the

post-closing total outstanding shares, and a convertible promissory

note for $3.4 million with a five-year term, interest accruing at

4.5% from January 1, 2023, and principal repayments commencing July

of 2024.

Mike Maguire, CEO of High Arctic, said, “We are

pleased that most of our affected employees have taken up

employment with Precision and Team, and we are confident that their

capability and focus on quality will benefit their new employers

and set them up for career success.

On behalf of High Arctic’s Board of Directors

and management I acknowledge the work put in by all involved

parties to realize these transactions and thank Paradigm Capital

Inc. who acted as exclusive financial advisor for High Arctic on

the Well Serving Transaction and DLA Piper (Canada) LLP who acted

as legal advisor to High Arctic on both transactions.”

Forward-Looking Statements

This press release contains forward-looking

statements. When used in this document, the words “may”, “would”,

“could”, “will”, “intend”, “plan”, “anticipate”, “believe”, “seek”,

“propose”, “estimate”, “expect”, and similar expressions are

intended to identify forward-looking statements. Such statements

reflect the Corporation’s current views with respect to future

events and are subject to certain risks, uncertainties and

assumptions. Many factors could cause the Corporation’s actual

results, performance or achievements to vary from those described

in this press release.

Should one or more of these risks or

uncertainties materialize, or should assumptions underlying

forward-looking statements prove incorrect, actual results may vary

materially from those described in this press release as intended,

planned, anticipated, believed, estimated or expected. Specific

forward-looking statements in this press release include, but are

not limited to, statements pertaining to the following: collection

of an additional $3.0 million over the next 75 days from retained

working capital, realize a significant reduction in Canadian

overhead and G&A expenses of about $4.0 million, establishing a

new lending arrangement geared towards the Papua New Guinea

business, development of a longer-term strategy for the remaining

Canadian business and the expected market developments and growth

in PNG.

The Corporation’s actual results could differ

materially from those anticipated in these forward-looking

statements as a result of the risk factors set forth above and

elsewhere in this press release.

The forward-looking statements contained in this

press release are expressly qualified in their entirety by this

cautionary statement. These statements are given only as of the

date of this press release. The Corporation does not assume any

obligation to update these forward-looking statements to reflect

new information, subsequent events or otherwise, except as required

by law.

About High Arctic

High Arctic is an energy services provider. High

Arctic is a market leader in Papua New Guinea providing drilling

and specialized well completion services and supplies rental

equipment including rig matting, camps, material handling and

drilling support equipment. In western Canada High Arctic provides

nitrogen services and pressure control equipment on a rental basis

to a number of exploration and production companies.

For further information, please contact:

Lance

MierendorfChief Financial

Officer1.587.318.22181.800.668.7143

High Arctic Energy Services Inc.Suite

2350, 330–5th Avenue SWCalgary, Alberta, Canada T2P 0L4website:

www.haes.caEmail: info@haes.ca

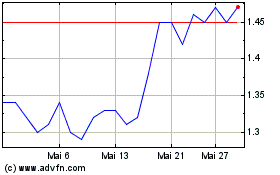

High Arctic Energy Servi... (TSX:HWO)

Historical Stock Chart

Von Jan 2025 bis Feb 2025

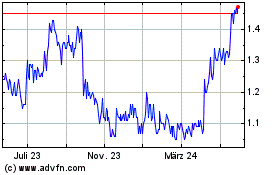

High Arctic Energy Servi... (TSX:HWO)

Historical Stock Chart

Von Feb 2024 bis Feb 2025