Emera Announces Upsizing of Previously Announced Offering of Preferred Shares

15 September 2021 - 8:41PM

Emera Incorporated (

“Emera” or the

“Company”) (TSX:EMA) announced today that it has

agreed to increase the size of its previously announced offering

and issue 9,000,000 Cumulative Redeemable First Preferred Shares,

Series L (the

“Series L Preferred

Shares”) at a price of $25.00 per share for aggregate

gross proceeds of $225,000,000 on a bought deal basis to a

syndicate of underwriters in Canada led by TD Securities Inc. and

CIBC Capital Markets.

The holders of Series L Preferred Shares will be

entitled to receive fixed cumulative preferential cash dividends at

an annual rate of $1.15 per share, payable quarterly, as and when

declared by the board of directors of the Company yielding 4.60%

per annum. The initial dividend, if declared, will be payable on

November 15, 2021 and will be $0.1638 per share, based on an

anticipated closing date of September 24, 2021.

The Series L Preferred Shares will not be

redeemable by the Company prior to November 15, 2026. On or after

November 15, 2026 the Company may redeem all or any part of the

then outstanding Series L Preferred Shares, at the Company's option

without the consent of the holder, by the payment of: $26.00 per

share if redeemed before November 15, 2027; $25.75 per share if

redeemed on or after November 15, 2027 but before November 15,

2028; $25.50 per share if redeemed on or after November 15, 2028

but before November 15, 2029; $25.25 per share if redeemed on or

after November 15, 2029 but before November 15, 2030; and $25.00

per share if redeemed on or after November 15, 2030, together, in

each case, with all accrued and unpaid dividends up to but

excluding the date fixed for redemption. The Series L Preferred

Shares do not have a fixed maturity date and are not redeemable at

the option of the holders of Series L Preferred Shares.

The offering is subject to the receipt of all

necessary regulatory and stock exchange approvals. The net proceeds

of the offering will be used for general corporate purposes.

The Series L Preferred Shares will be offered to

the public in Canada by way of prospectus supplement to Emera's

short form base shelf prospectus dated March 12, 2021. The

securities referred to herein have not been and will not be

registered under the United States Securities Act of 1933, as

amended, and may not be offered or sold in the United States absent

registration or an applicable exemption from registration

requirements.

This media release shall not constitute an offer

to sell or the solicitation of an offer to buy, nor shall there be

any offer, solicitation or sale of the securities in any province,

state or jurisdiction in which such offer, solicitation or sale

would be unlawful.

Forward Looking Information

This news release contains forward‐looking

information within the meaning of applicable securities laws.

including statements concerning the anticipated sale and

distribution of preferred shares, the volume and timing of the sale

and distribution of preferred shares and Emera’s intended use of

the net proceeds of the offering of preferred shares. Undue

reliance should not be placed on this forward‐looking information,

which applies only as of the date hereof. By its nature,

forward‐looking information requires Emera to make assumptions and

is subject to inherent risks and uncertainties. These statements

reflect Emera management’s current beliefs and are based on

information currently available to Emera management. There is a

risk that predictions, forecasts, conclusions and projections that

constitute forward‐looking information will not prove to be

accurate, that Emera’s assumptions may not be correct and that

actual results may differ materially from such forward‐looking

information. Additional detailed information about these

assumptions, risks and uncertainties is included in Emera’s

securities regulatory filings, including under the heading

“Enterprise Risk and Risk Management” in Emera’s annual

Management’s Discussion and Analysis, and under the heading

“Principal Financial Risks and Uncertainties” in the notes to

Emera’s annual financial statements, copies of which are available

electronically under Emera’s profile on SEDAR at www.sedar.com.

About Emera

Emera is a geographically diverse energy and

services company headquartered in Halifax, Nova Scotia with

approximately $31 billion in assets and 2020 revenues of more than

$5.5 billion. The Company primarily invests in electricity

generation and electricity and gas transmission and distribution

with a strategic focus on transformation from high carbon to low

carbon energy sources. Emera has investments in Canada, the United

States and in four Caribbean countries. Emera’s common and

preferred shares are listed on the Toronto Stock Exchange and trade

respectively under the symbol EMA, EMA.PR.A, EMA.PR.B, EMA.PR.C,

EMA.PR.E, EMA.PR.F, EMA.PR.H and EMA.PR.J. Depositary receipts

representing common shares of Emera are listed on the Barbados

Stock Exchange under the symbol EMABDR and on The Bahamas

International Securities Exchange under the symbol EMAB. Additional

Information can be accessed at www.emera.com or at

www.sedar.com.

For more information, please contact:

Emera Inc.Investor

Relations:Dave Bezanson, VP, Investor Relations &

Pensions902‐474‐2126dave.bezanson@emera.com

Media: 902‐222‐2683 media@emera.com

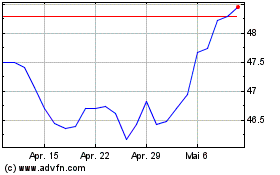

Emera (TSX:EMA)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

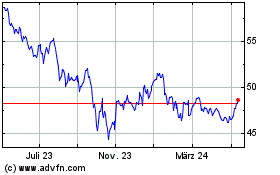

Emera (TSX:EMA)

Historical Stock Chart

Von Nov 2023 bis Nov 2024