Exchange Income Corporation Announces $75,000,000 Bought Deal Financing of 5.75% Convertible Unsecured Subordinated Debenture...

06 März 2019 - 10:11PM

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR

DISSEMINATION IN THE UNITED STATES.

Exchange Income Corporation (TSX: EIF) (the “Corporation”)

announced today that it has reached an agreement with a syndicate

of underwriters co-led by National Bank Financial Inc., CIBC

Capital Markets and Laurentian Bank Securities Inc., and including

Raymond James Ltd., RBC Capital Markets, Scotiabank, TD Securities

Inc., BMO Capital Markets, Canaccord Genuity Corp.,

Wellington-Altus Private Wealth Inc., AltaCorp Capital Inc.,

Cormark Securities Inc., Industrial Alliance Securities, and

Macquarie Capital Markets Canada Ltd. (the “Underwriters”),

pursuant to which the Corporation will issue on a “bought deal”

basis, subject to regulatory approval, $75,000,000 aggregate

principal amount of convertible unsecured subordinated debentures

(the “Debentures”) at a price of $1,000 per principal amount of

Debentures (the “Offering”). The Corporation has granted to the

Underwriters an over-allotment option to purchase up to an

additional $11,250,000 aggregate principal amount of Debentures at

the same price, exercisable in whole or in part at any time for a

period of up to 30 days following closing of the Offering, to cover

over-allotments. The Corporation intends to use the net proceeds

from the Offering to fund the redemption of certain debentures as

set forth below and to reduce indebtedness under the credit

facility of the Corporation. The Debentures will bear interest from

the date of closing at 5.75% per annum, payable semi-annually in

arrears on March 31 and September 30 each year commencing September

30, 2019. The Debentures will each have a maturity date of March

31, 2026 (the “Maturity Date”).

The Debentures will be convertible at the

holder’s option at any time prior to the close of business on the

earlier of the Maturity Date and the business day immediately

preceding the date specified by the Corporation for redemption of

the Debentures into common shares of the Corporation (“Common

Shares”) at a conversion price of approximately $49.00 per Common

Share, being a conversion rate of 20.4082 Common Shares for each

$1,000 principal amount of Debentures, subject to adjustment as

provided in the indenture governing the Debentures.

The Corporation also announced that it will

issue a notice of redemption to the holders of its currently

outstanding 7 year 6.00% convertible unsecured subordinated

debentures maturing on March 31, 2021 (the "2014 Debentures"). The

Corporation has the right to redeem the 2014 Debentures after March

31, 2019, and subject to all necessary approvals, will redeem all

issued and outstanding 2014 Debentures following the closing of the

Offering on a date to be determined by the Corporation (the

"Redemption Date"). Holders of the 2014 Debentures will have the

option to convert the 2014 Debentures into Common Shares prior to

the Redemption Date at a price of $31.70 per share. The 2014

Debentures are redeemable at a redemption price equal to their

principal amount, plus accrued and unpaid interest thereon up to,

but excluding, the Redemption Date. As of the close of business on

March 6, 2019, there was approximately $28 million principal amount

of 2014 Debentures issued and outstanding.

The Corporation intends to use the net proceeds

of the Offering to fund the redemption of the 2014 Debentures, as

required, and to repay indebtedness under its credit facility. The

redemption of the 2014 Debentures is not conditional upon the

completion of the Offering.

Closing of the Offering is expected to occur on

or about March 26, 2019. The Offering is subject to normal

regulatory approvals, including approval of the Toronto Stock

Exchange of the listing of the Debentures and the Common Shares to

be issued upon conversion of the Debentures. The Debentures will be

offered in each of the provinces of Canada by way of a short form

prospectus, and by way of private placement in the United States to

Qualified Institutional Buyers pursuant to Rule 144A.

About Exchange Income

Corporation

Exchange Income Corporation is a diversified

acquisition-oriented company, focused in two sectors: aerospace

& aviation services and equipment, and manufacturing. The

Corporation uses a disciplined acquisition strategy to identify

already profitable, well-established companies that have strong

management teams, generate steady cash flow, operate in niche

markets and have opportunities for organic growth.

The Corporation currently operates two segments:

Aerospace & Aviation and Manufacturing. The Aerospace &

Aviation segment consists of the operations by Perimeter Aviation,

Keewatin Air, Calm Air International, Bearskin Lake Air Service

(operating as a division of Perimeter Aviation), Custom

Helicopters, Regional One, Provincial Aerospace and Moncton Flight

College, and an investment in Wasaya Group. The Manufacturing

segment consists of the operations of Overlanders Manufacturing,

Water Blast, Stainless Fabrication, WesTower Communications, Ben

Machine and Quest Window Systems. For more information on the

Corporation, please visit www.ExchangeIncomeCorp.ca. Additional

information relating to the Corporation, including all public

filings, is available on SEDAR (www.sedar.com).

Caution Concerning Forward-Looking

Statements

The statements contained in this news release

that are forward-looking are based on current expectations and are

subject to a number of uncertainties and risks, and actual results

may differ materially. These uncertainties and risks include, but

are not limited to, the dependence of Exchange Income Corporation

on the operations and assets currently owned by it, the degree to

which its subsidiaries are leveraged, the fact that cash

distributions are not guaranteed and will fluctuate with the

Corporation’s financial performance, dilution, restrictions on

potential future growth, the risk of shareholder liability,

competitive pressures (including price competition), changes in

market activity, the cyclicality of the industries, seasonality of

the businesses, poor weather conditions, and foreign currency

fluctuations, legal proceedings, commodity prices and raw material

exposure, dependence on key personnel, and environmental, health

and safety and other regulatory requirements. Further information

about these and other risks and uncertainties can be found in the

disclosure documents filed by Exchange Income Corporation with the

securities regulatory authorities, available at www.sedar.com.

| For further information,

please contact: |

| Mike PyleChief Executive OfficerExchange Income

Corporation(204) 982-1850MPyle@eig.ca |

|

Trevor Heisler Investor RelationsNATIONAL Capital

Markets(416) 848-1434theisler@national.ca |

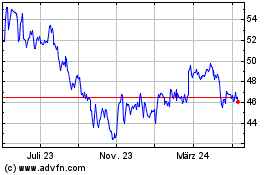

Exchange Income (TSX:EIF)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

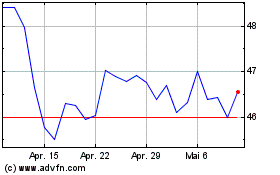

Exchange Income (TSX:EIF)

Historical Stock Chart

Von Jan 2024 bis Jan 2025