Dundee Precious Metals Inc. (TSX: DPM) (“DPM” or

“the Company”) is pleased to announce a maiden Mineral Resource

Estimate of 1.78 million ounces for its 100% owned Čoka Rakita gold

project in eastern Serbia, where DPM announced a high-grade

discovery in January 2023.

Highlights

- Strong maiden Mineral Resource estimate:

Inferred Mineral Resource estimate (“MRE”) of 9.79 million tonnes

(“Mt”) at a grade of 5.67 grams per tonne (“g/t”) for 1.78 million

ounces of gold. The maiden MRE was completed after only one full

year of drilling on the project and is based on approximately

80,723 metres of drilling in 173 holes.

- Higher-grade core of

mineralization: The MRE contains a significant portion of

gold ounces within a continuous high-grade core of mineralization

that amounts to 2.81 Mt at a grade of 10.12 g/t Au for 0.914

million ounces of gold. Once sufficient drilling has been completed

to upgrade the Mineral Resource confidence, this higher-grade core

has the potential to drive strong economics by accessing higher

than average grades during the early years of a mine plan.

- Upside exploration potential: DPM is

continuing its drilling program focused on extending the limits of

Čoka Rakita, which remains open to the northeast and to southwest,

and is also aggressively pursuing additional skarn targets on the

Čoka Rakita licence as well as on three additional licences to the

north and the south.

- Advancing to a preliminary economic assessment

(“PEA”): Based on the favourable size and quality of the

MRE, DPM will continue to accelerate the project and expects to

complete a PEA on the project in the second quarter of 2024,

targeting a throughput rate of 850,000 tonnes per annum.

- Attractive organic growth opportunity: Čoka

Rakita benefits from good infrastructure, including nearby existing

roads and power lines. The project is located in close regional

proximity to DPM’s existing operations in Bulgaria and is a strong

fit with the Company’s underground mining and processing expertise,

with metallurgical test work demonstrating gold recoveries of

approximately 90% by gravity concentration and conventional

flotation.

“The initial Mineral Resource estimate marks a

significant milestone for DPM’s future growth and confirms Čoka

Rakita’s potential as an attractive, high-quality gold project,”

said David Rae, President and Chief Executive Officer of Dundee

Precious Metals.

“Since we announced the initial discovery only

11 months ago, Čoka Rakita has rapidly grown into a 1.8 million

ounce deposit, a remarkable achievement over such a short period of

time, and we plan to continue aggressively exploring at Čoka Rakita

and the surrounding licences to generate new discoveries.

“We are continuing to accelerate the project

through our development pipeline, including advancing a PEA which

is targeted for completion in the second quarter of 2024. We are

excited by Čoka Rakita’s potential in a region where we have had a

presence for many years and where we have developed strong

relationships with local stakeholders.”

Maiden Mineral Resource Estimate

The Inferred MRE is comprised of 1.78 million

ounces of gold contained within 9.79 million tonnes grading 5.67

g/t Au (Table 1) and assumes an underground mining scenario.

Gold-rich skarn mineralization is hosted within

carbonate rich sandstones and conglomerates, located on the hanging

wall of a sill-like body and abutting a monzonite intrusive body to

the west. The mineralization forms a shallow-dipping tabular

mineralized body located between 250 and 450 metres below surface,

measuring 650 metres long, up to 350 metres wide, and with variable

thickness from less than 20 metres in the margins to more than 100

metres in the core of the mineralized zone. Coarse gold is often

observed in areas of intense retrograde skarn alternation and is

found mainly in proximity to syn-mineral diorites within the

higher-grade core of the deposit. The current MRE has been

conducted on the portion of the prospect where gold-rich skarn

mineralization occurs.

The drillhole database was handed over as of

November 16, 2023. A total of 173 drill holes totalling 80,723

metres were included in the estimation of the Mineral Resource. The

current drillhole spacing within the mineralized domains is

approximately 30 metres by 30 metres in the core of the system,

with an up to 60-metre by 60-metre grid on the periphery. Gold

grades within skarn domains have been determined systematically

using a screen fire assaying technique, which is preferred for

mineralization with coarse gold. Grade capping was applied to

composites to limit the influence of anomalously high-grade

values.

Mineral resource domains were created within

volumes of moderate to intense skarn alteration and guided by

economic composites at a 1 g/t Au cut-off value. Detailed lithology

and structural models were developed and used to constrain domain

extents, as well as to incorporate post-mineralization diorite

sills which cut across the mineralization. Block grade estimates

have been undertaken for Au, Ag, Cu, S and As using ordinary

kriging at a 10mE x 10mN x 10mZ parent block size with sub-celling

to honour domain volumes.

A break-even cut-off value of 2 g/t Au and a

minimum width constraint of 5 metres by 5 metres by 2.5 metres was

used to define optimized mineable shapes using Datamine’s Mineable

Shape Optimiser (“MSO”). These shapes were subsequently smoothed

and used to constrain continuous zones of mineralization for

reporting the final Mineral Resource statement.

The application of MSO shapes at the MRE stage

provides a robust estimate for the purposes of a PEA, and a higher

confidence in the potential for the conversion of Mineral Resources

into mineable tonnes and grades for the purposes of a mine plan for

the PEA. Mineral Resources that are not Mineral Reserves do not

have demonstrated economic viability. The MSO shapes have been used

to ensure Mineral Resources demonstrate reasonable prospects for

eventual economic extraction.

Material within the reporting MSO constraints

(smoothed) was classified as Inferred Mineral Resources according

to Mineral Resource confidence categories defined in the CIM

Definition Standards for Mineral Resources and Mineral Reserves.

Data quality and quantity, geological and grade continuity, and

confidence in the grade, density and reasonable prospects for

eventual economic extraction (“RPEEE”) criteria were considered

when classifying the MRE. Given the relatively continuous and

stratified mineralization style at Čoka Rakita, the Company has

reason to expect that the majority of Inferred Mineral Resources

could be upgraded to Indicated Mineral Resources with infill

drilling.

Table 1: Čoka Rakita Mineral Resource

Estimate

|

Čoka Rakita Mineral Resource Estimate(Effective

date November 16, 2023) |

|

Resource Category |

Tonnes(Mt) |

Gold Grade (g/t) |

Contained Gold (K oz.) |

Silver grade(g/t) |

Contained silver (K oz.) |

|

Inferred |

9.79 |

5.67 |

1,783 |

1.21 |

382 |

|

Total |

9.79 |

5.67 |

1,783 |

1.21 |

382 |

|

1) |

The cut-off value of 2 g/t assumes $1,700 gold price, 90% gold

recovery, US$79/t operating cost, US$7/t sustaining capital cost,

as well as offsite and royalty costs. |

|

2) |

Mineral Resources are reported within smoothed MSO shapes generated

at a 2 g/t Au cutoff, to ensure Mineral Resources meet reasonable

prospects for eventual economic extraction. The smoothing process

allows for blocks below the cut-off to included within the final

shapes in order to emulate the internal dilution that would be

experienced during underground mining as per CIM Estimation of

Mineral Resources and Mineral Reserves Best Practices Guidelines

prepared by the CIM Mineral Resource & Mineral Reserve

Committee and adopted by the CIM Council on November 29, 2019. |

|

3) |

CSA Global are not aware of any legal, political, environmental, or

other risk factors that might materially affect the estimate of

Mineral Resources. |

|

|

|

Higher-Grade Core of

Mineralization

Within the core of the Čoka Rakita deposit is a

zone of continuous higher-grade mineralization hosted within

intense retrograde skarn alteration. By digitizing an outline of

spatially contiguous blocks within the Mineral Resource that have

an estimated grade value higher than approximately 5 g/t Au and

including internal dilution, the block model reports 2.81 Mt at a

grade of 10.12 g/t Au for 0.914 million ounces of gold. Once

sufficient drilling has been completed to upgrade the Mineral

Resource confidence, this higher-grade core has the potential to

drive strong economics by accessing higher than average grades

during the early years of a mine plan.

When reported within the smoothed MSO

constraints used to report the MRE, the block model sensitivity to

cut-off grade is shown in Table 2. This table does not constitute a

Mineral Resource statement and is shown to illustrate the grade and

tonnage sensitivity to grade cut-off value.

Due to the presence of coarse gold and the

confidence level of Inferred Mineral Resources, there is inherent

uncertainty in the level of mining selectivity that can be achieved

as the cut-off grade is increased. Further drilling, and

potentially bulk sampling, is required to assess the short-range

grade continuity of the higher-grade mineralization.

Table 2: Čoka Rakita Mineral Resource Grade Tonnage

Sensitivity Tabulation

|

Čoka Rakita Inferred Mineral Resource Grade Tonnage

Sensitivity |

|

Cut-off (g/t) |

Tonnes (Mt) |

Gold Grade (g/t) |

Contained Gold (Moz.) |

|

0 |

9.79 |

5.67 |

1.78 |

|

1 |

9.51 |

5.81 |

1.78 |

|

2 |

8.55 |

6.28 |

1.73 |

|

3 |

6.42 |

7.54 |

1.56 |

|

4 |

4.55 |

9.22 |

1.35 |

|

5 |

3.46 |

10.72 |

1.19 |

|

6 |

2.76 |

12.02 |

1.07 |

|

7 |

2.26 |

13.28 |

0.97 |

|

8 |

1.86 |

14.55 |

0.87 |

|

9 |

1.56 |

15.72 |

0.79 |

|

10 |

1.32 |

16.85 |

0.71 |

|

1) |

Mineral Resources are reported within smoothed MSO shapes generated

at a 2 g/t Au cut-off, to ensure the mineral resources meet

reasonable prospects for eventual economic extraction. All blocks

that fall within that constraint are reported within the MRE.

Accordingly, the cut-off value of 0 g/t corresponds to the MRE

statement. |

|

|

|

Exploration Potential

DPM is planning an aggressive exploration

program for 2024 including:

- Approximately 30,000 metres of infill, hydrological and

geotechnical drilling, with the goal of re-classifying the current

Mineral Resource to the Indicated Mineral Resource category. This

also includes infill drilling to test the extents of Čoka Rakita,

which remains open to the northeast and to southwest; and

- 55,000 metres of additional exploration drilling at existing

skarn targets and to test for manto-like copper-gold skarn

identified across four licences held by DPM, including Čoka Rakita,

Potaj Čuka, Pešter Jug, and Umka.

Exploration and evaluation expenditures for the

above drilling programs, PEA and related technical work is expected

to be US$30 to US$35 million in 2024, which will be updated in

early Q1 2024 as part of the Company’s detailed 2024 guidance and

updated three-year outlook.

Attractive Organic Growth Opportunity

With a sizeable maiden MRE and significant

additional exploration potential, Čoka Rakita is an attractive

organic growth opportunity that DPM will be prioritizing for

advancement.

The project is located approximately 35

kilometres from the city of Bor in Serbia, is proximal to existing

roads and power lines and is approximately 320 kilometres northwest

of DPM’s Chelopech mine in Bulgaria which will allow easy access to

existing technical support functions. The project is a strong fit

with the Company’s underground mining and processing expertise,

with metallurgical testwork demonstrating gold recoveries of

approximately 90% by gravity concentration and conventional

flotation.

As previously reported on November 15, 2023,

metallurgical testwork confirmed the viability of a combined

gravity concentration and flotation circuit at different target

grades (Table 3).

Table 3: Summarized Metallurgical Test

Results

|

|

METCRA23-01 |

METCRA23-02 |

METCRA23-03 |

|

Feed grade (g/t) |

3.12 |

5.3 |

10.4 |

|

EGRG recovery (%) |

55.6 |

49 |

61.8 |

|

Gravity + flotation recovery (%) |

87.5 |

88.5 |

91.2 |

|

Bond ball mill work index (kWh/t) |

13.4 |

13.2 |

13.3 |

|

Abrasion Index |

0.123 |

0.138 |

0.154 |

Next Steps

In parallel to its exploration and infill

drilling activities, DPM has advanced activities to accelerate the

project, including initiating geotechnical and hydrogeological

drilling, the next phase of metallurgical testwork, evaluating

locations for potential site infrastructure, as well as stakeholder

engagement and permitting activities.

The Company has already commenced certain

scoping level activities and expects to complete a PEA on the

project in the second quarter of 2024, targeting a throughput rate

of 850,000 tonnes per annum.

The next phase of metallurgical testwork will

focus on the variability at Čoka Rakita to ascertain the

metallurgical and comminution performance of the different subtypes

of mineralization present, including testing on more copper-rich

areas of the prospect.

Permitting preparation activities are underway,

with good support and engagement from key regional and national

authorities.

Stakeholder Engagement

Consistent with its approach across all

operations and projects, DPM seeks to build and maintain strong

partnerships with local communities and governments. The Company

has had a local presence in Serbia since 2004 and has developed

strong relationships in the region and will continue to proactively

engage with all stakeholders as the project advances.

Planning for the project will be highly focused

on ensuring responsible environmental management and social

development in-line with industry best practices. DPM is committed

to working closely with local communities around the Čoka Rakita

project to understand and support local development opportunities,

with a focus on maximizing benefits of the project for Serbia.

Figure 1. Cross section through the

block model of Čoka Rakita, showing blocks coloured by Au

g/t. Section line 4895859mN with 30 metre window clipping, looking

north.

Figure 2. Tilted slice along high-grade skarn

mineralization displaying new drilling intercepts and the ongoing

infill drilling at Čoka Rakita.

View the interactive 3D model on VRIFY, which will provide a

more accurate representation of the spatial position of the

drillholes, available at:

https://vrify.com/decks/14641

Figure 3. Overview map of Čoka Rakita

exploration licence outlining the progress of the scout drilling

campaign, including ongoing holes.

Figure 4. Overview map of tenements and

regional targets around Čoka Rakita.

Technical Information and Technical Report

Filing

The MRE for Čoka Rakita and other scientific and

technical information which supports this news release was prepared

by DPM with review and guidance at various stages provided by Maria

O’Connor, MAIG (Membership ID: 5931), Technical Director Mineral

Resources, Environmental Resources Management (ERM, trading as CSA

Global) in accordance with Canadian regulatory requirements set out

in National Instrument 43-101 Standards for Disclosure for Mineral

Projects (“NI 43-101”). Maria O’Connor is a Qualified Person (“QP”)

for Mineral Resources as defined under NI 43-101 and is independent

of the Company.

Ross Overall, Director, Corporate Technical

Services, of the Company, who is a QP, as defined under NI 43-101,

and Paul Ivascanu, General Manager, Exploration of the Company,

have reviewed and approved the contents of this news release.

A technical report for the Čoka Rakita gold

project, prepared in accordance with NI 43-101, will be filed under

the Company’s profile on SEDAR+ at www.sedarplus.ca within 45 days

of this news release. Readers are encouraged to read the technical

report in its entirety, including all qualifications, assumptions,

exclusions and risks that relate to the Mineral Resource.

The MRE and related information in this news

release may not be comparable to similar information made public by

U.S. companies, subject to the reporting and disclosure

requirements under the United States federal securities laws and

the rules and regulations thereunder.

About Dundee Precious Metals Inc.

Dundee Precious Metals Inc. is a Canadian-based

international gold mining company with operations and projects

located in Bulgaria, Namibia, Serbia and Ecuador. The Company’s

purpose is to unlock resources and generate value to thrive and

growth together. This overall purpose is supported by a foundation

of core values, which guides how the Company conducts its business

and informs a set of complementary strategic pillars and objectives

related to ESG, innovation, optimizing our existing portfolio, and

growth. The Company’s resources are allocated in-line with its

strategy to ensure that DPM delivers value for all of its

stakeholders. DPM’s shares are traded on the Toronto Stock Exchange

(symbol: DPM).

For further information please contact:

|

David RaePresident and Chief Executive OfficerTel:

(416) 365-5092drae@dundeeprecious.com |

Jennifer CameronDirector, Investor RelationsTel:

(416) 219-6177jcameron@dundeeprecious.com |

| |

|

Cautionary Note Regarding Forward-Looking

Statements

This news release contains “forward looking

statements” or “forward looking information” (collectively,

“Forward Looking Statements”) that involve a number of risks and

uncertainties. Forward Looking Statements are statements that are

not historical facts and are generally, but not always, identified

by the use of forward looking terminology such as “plans”,

“targets”, “expects”, “is expected”, “budget”, “scheduled”,

“estimates”, “forecasts”, “outlook”, “intends”, “anticipates”,

“believes”, or variations of such words and phrases or that state

that certain actions, events or results “may”, “could”, “would”,

“might” or “will” be taken, occur or be achieved, or the negative

of any of these terms or similar expressions. The Forward Looking

Statements in this news release relate to, among other things; the

estimation of Mineral Resources and the realization of such mineral

estimates; expectations with respect to updating the Inferred

Mineral Resources to Indicated Mineral Resources with infill

drilling; targeted annual throughput for the PEA; timing for a PEA;

planned drilling and exploration program and the timing and success

of such activities, planned metallurgical test work; upside

potential, opportunities for growth and expected next steps;

expected benefits of existing infrastructure and DPM’s existing

underground expertise; potential gold recoveries; and the price of

gold, copper, and silver, and other commodities. Forward Looking

Statements are based on certain key assumptions and the opinions

and estimates of management and the QPs, as of the date such

statements are made, and they involve known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of the Company to be materially

different from any other future results, performance or

achievements expressed or implied by the Forward Looking

Statements. In addition to factors already discussed in this news

release, such factors include, among others, risks relating to the

Company’s business, including possible variations in ore grade and

recovery rates; uncertainties inherent to the conclusions of

economic evaluations and economic studies; changes in project

parameters, including schedule and budget, as plans continue to be

refined; uncertainties with respect to actual results of current

exploration activities; uncertainties inherent to the estimation of

Mineral Resources, which may not be fully realized; uncertainties

inherent with conducting business in foreign jurisdictions where

corruption, civil unrest, political instability and uncertainties

with the rule of law may impact the Company’s activities; the

impact of the conflict in the Ukraine and health emergencies,

including resulting changes to the Company’s supply chain and costs

of supplies; product shortages; delivery and shipping issues;

closures and/or failure of plant, equipment or processes to operate

as anticipated; employees and contractors become infected with

pathogens or being affected by the war; lost work hours; labour

force shortages; fluctuations in metal and acid prices, toll rates

and foreign exchange rates; limitation on insurance coverage;

accidents, labour disputes and other risks of the mining industry;

delays in obtaining governmental approvals or financing or in the

completion of development or construction activities; actual

results of current and planned reclamation activities; opposition

by social and non-government organizations to mining projects and

smelting operations; unanticipated title disputes; claims or

litigation; cyber attacks and other cybersecurity risks; as well as

those risk factors discussed or referred to in any other documents

(including without limitation the Company’s most recent Annual

Information Form) filed from time to time with the securities

regulatory authorities in all provinces and territories of Canada

and available on SEDAR+ at www.sedarplus.ca. The reader has been

cautioned that the foregoing list is not exhaustive of all factors

which may have been used. Although the Company has attempted to

identify important factors that could cause actual actions, events

or results to differ materially from those described in Forward

Looking Statements, there may be other factors that cause actions,

events or results not to be anticipated, estimated or intended.

There can be no assurance that Forward Looking Statements will

prove to be accurate, as actual results and future events could

differ materially from those anticipated in such statements. The

Company’s Forward Looking Statements reflect current expectations

regarding future events and speak only as of the date hereof.

Unless required by securities laws, the Company undertakes no

obligation to update Forward Looking Statements if circumstances or

management’s estimates or opinions should change. Accordingly,

readers are cautioned not to place undue reliance on Forward

Looking Statements.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/29399306-ba7f-4e65-8f47-e2867d4ed769

https://www.globenewswire.com/NewsRoom/AttachmentNg/dd4233de-f4b9-4291-9be2-559af4c0ebb6

https://www.globenewswire.com/NewsRoom/AttachmentNg/33da2b56-2809-4a65-b697-1713e2fe1f18

https://www.globenewswire.com/NewsRoom/AttachmentNg/a22db5cc-c056-4b1e-bd63-371fb858f6b4

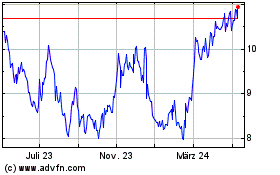

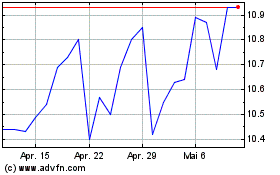

Dundee Precious Metals (TSX:DPM)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Dundee Precious Metals (TSX:DPM)

Historical Stock Chart

Von Apr 2023 bis Apr 2024