PenderFund Capital Management Ltd., as manager of the Pender Small

Cap Opportunities Fund (together, “Pender” or “we”), directly or

indirectly controls 1,209,184 common shares of Altius Renewable

Royalties Corp. (TSX:ARR) (OTCQX:ATRWF) (the “Company”).

Further to its press release dated November 5, 2024, Pender

re-affirms its intent to file a written objection and notice of

dissent with respect to all of its common shares of the Company,

and re-affirms its intent to vote all such shares “AGAINST” the

Transaction. We urge fellow Minority Shareholders to vote AGAINST

and exercise DISSENT rights with respect to the Transaction.

On November 11, 2024, Pender sent a letter to the Company’s

legal advisor detailing its serious concerns regarding the process

undertaken by the special committee, as described in the background

to the Transaction in the Company’s management information circular

dated October 18, 2024, including:

- the special committee did not engage independent legal counsel

or explain why;

- the Company’s 58% controlling shareholder that is also the sole

continuing shareholder in the Transaction (the “Continuing

Shareholder”) was made aware of the Transaction within about three

weeks of Northampton’s initial approach, calling into question the

Continuing Shareholder’s influence on the special committee’s

independence and its ability to properly discharge its fiduciary

duties;

- the independent financial advisors to the special committee

were engaged after the key terms of the Transaction had been

largely negotiated among the special committee, Northampton and the

Continuing Shareholder, including the consideration of $12 per

minority share;

- other than the independent financial advisors engaged to

prepare the formal valuation and fairness opinion required by

securities laws, the special committee did not have the benefit of

advice from financial advisors in evaluating Northampton’s offer or

available alternatives thereto; and

- other than generic references to considering strategic

alternatives which were undertaken without the engagement of a

financial advisor and a one-week engagement between May 16 and 23,

2024 in respect of an unsolicited non-binding offer from a

third-party to acquire the minority shares which was rejected by

the special committee without the benefit of advice of a financial

advisor, there was no meaningful market check for available

alternatives.

We are alarmed by what appears to be a flawed process by the

special committee who, as fiduciaries, are duty-bound to consider

and protect the reasonable expectations of, among others, Minority

Shareholders. Based on the extent of the Continuing Shareholder’s

involvement, it appears that the special committee was more

concerned with the Continuing Shareholder’s interests than those of

Minority Shareholders.

We are also deeply troubled by the extent of the lock-up

agreements entered into which render the upcoming special meeting

to consider the Transaction meaningless. With approximately 81% of

the outstanding Common Shares subject to such lock-up agreements,

both the 66 and 2/3% approval and the minority approval (excluding

the shares held by the Continuing Shareholder and other interested

parties whose votes must be excluded under applicable securities

laws) of the arrangement resolution are guaranteed to pass. We

believe the Continuing Shareholder’s early support and involvement

in the Transaction influenced other shareholders to enter into such

lock-up agreements.

Based on the specific circumstances of the Transaction,

practically, the extent of such lock-up agreements and a flawed

process have resulted in the defeat of the fairness checks and

balances enshrined in applicable corporate and securities laws for

statutory arrangements and the deprivation of any meaningful

protection for Minority Shareholders.

Accordingly, we urge fellow Minority Shareholders to vote

AGAINST the Transaction by submitting a duly completed form of

proxy by 1 pm (EST) on November 15, 2024 and to exercise DISSENT

rights with respect to the Transaction by submitting a written

objection by 4 pm (EST) on November 15, 2024. As only registered

shareholders may submit a form of proxy or to exercise dissent

rights, Minority Shareholders who hold their Common Shares in

non-registered form should contact their brokers or intermediaries

as soon as possible before such deadlines to ensure that their

votes AGAINST and DISSENT in respect of the Transaction are timely

voted and exercised.

We are seeking to engage the Company in constructive dialogue on

behalf of all Minority Shareholders with the objective of resolving

these serious concerns and ensuring that our investments in the

Company are fairly valued.

AdvisorsPender has engaged Norton Rose

Fulbright Canada LLP as legal advisor.

About PenderPender was founded in 2003 and is

an independent, employee-owned investment firm located in

Vancouver, British Columbia. Our goal is to protect and grow wealth

for our investors over time. We have a talented investment team of

expert analysts, security selectors and independent thinkers who

actively manage our suite of differentiated investment funds,

exploiting inefficient parts of the investing universe to achieve

our goal.

For more information on Pender, visit www.penderfund.com and

www.fondspender.com.

Please read important disclosures at

www.penderfund.com/disclaimer.

For further information, please contact:Amar

PandyaPortfolio Manager, PenderFund Capital Management

Ltd.apandya@penderfund.com (604) 688-1511Toll Free: (866)

377-4743

Additional InformationThe information contained

in this press release does not and is not meant to constitute a

solicitation of a proxy within the meaning of applicable securities

laws. Notwithstanding the foregoing, Pender is voluntarily

providing the disclosure required under section 9.2(4) of National

Instrument 51-102 – Continuous Disclosure Obligations and Alberta

Securities Commission Blanket Order 51-520 in accordance with

securities laws applicable to public broadcast solicitations.

Any solicitation made by Pender in advance of the special

meeting to be held to consider the Transaction (the “Meeting”) is,

or will be, as applicable, made by Pender, and not by or on behalf

of management of the Company. All costs incurred for any

solicitation will be borne by Pender, provided that, subject to

applicable law, Pender may seek reimbursement from the Company for

out-of-pocket expenses, including proxy solicitation expenses and

legal fees.

Any proxies solicited by Pender may be solicited in reliance

upon the public broadcast exemption to the solicitation

requirements under applicable Canadian corporate and securities

laws, conveyed by way of public broadcast, including press release,

speech or publication, and by any other manner permitted under

applicable Canadian securities laws. In addition, solicitation may

be made by mail, telephone, facsimile, email or other electronic

means as well as by newspaper or other media advertising and in

person by representatives of Pender in accordance with Canadian

securities laws and regulations. All costs incurred for such

solicitation will be borne by Pender. To the extent any dissent

notices are solicited by Pender in connection with the Meeting,

they may be revoked by a failure to follow the strict requirements

provided for under law to exercise dissent rights, or in any other

manner permitted by law or set out in the Circular.

Other than in respect of the Transaction, Pender does not, to

its knowledge, or any of its associates or affiliates, have any

material interest, direct or indirect, in any transaction since the

commencement of the Company’s most recently completed financial

year, or in any proposed transaction which has materially affected

or will materially affect the Company or any of its subsidiaries.

Pender does not, to its knowledge, or any of its associates or

affiliates, have any material interest, direct or indirect, by way

of beneficial ownership of securities or otherwise, in any matter

to be acted upon at any upcoming shareholders meeting (including

the Meeting), other than as set out herein.

Based upon publicly available information, the Company’s head

office is located at 38 Duffy Pl. 2nd Floor, St Johns, Newfoundland

and Labrador, A1B 4M5, Canada. A copy of this press release may be

obtained on the Company's SEDAR+ profile at www.sedarplus.com.

Forward-looking Statements and Forward-looking

Information This news release contains certain

“forward-looking statements” within the meaning of such statements

under applicable securities law. Forward-looking statements are

frequently characterized by words such as “expect” or “proposed”

and other similar words, or statements that certain events or

conditions “may” or “will” occur. These statements are only

predictions. Forward-looking statements are based on the opinions

and estimates of the manager at the date the statements are made,

and are subject to a variety of risks and uncertainties and other

factors that could cause actual events or results to differ

materially from those projected in the forward-looking

statements.

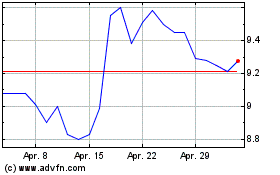

Altius Renewable Royalit... (TSX:ARR)

Historical Stock Chart

Von Mär 2025 bis Apr 2025

Altius Renewable Royalit... (TSX:ARR)

Historical Stock Chart

Von Apr 2024 bis Apr 2025