Coloplast A/S - Interim Financial Report, Q1 2023/24

09 Februar 2024 - 7:30AM

Coloplast A/S - Interim Financial Report, Q1 2023/24

Q1 2023/24Interim financial results, Q1

2023/241 October 2023 - 31 December 2023

Coloplast delivered a solid Q1 with 8% organic growth

and an EBIT margin1) of 28%. Reported revenue in DKK grew 8% with

4%-points contribution from Kerecis (underlying growth of around

35%), offset by negative impact from currencies.

- Organic growth rates by business area: Ostomy Care 8%,

Continence Care 8%, Voice and Respiratory Care 7%, Advanced Wound

Care 9% (Advanced Wound Dressings 9%) and Interventional Urology

5%.

- Solid start in Chronic Care, driven by broad-based growth in

Emerging markets and Europe. The Ostomy Care business in China

posted mid-single digit growth, in line with expectations. Growth

in Continence Care was driven by the intermittent catheters

portfolio, including contribution from LujaTM, the new male

intermittent catheter with a Micro-hole Zone Technology, which is

now launched in ten markets.

- Growth in Voice and Respiratory Care was driven by continued

good momentum with high-single digit growth in both laryngectomy

and tracheostomy, partly held back by product rationalisation.

- Strong quarter in Advanced Wound Dressings, driven by

broad-based growth across regions from a lower baseline in Q1 last

year.

- Kerecis is off to a good start, in line with plan. Underlying

growth in Q1 was around 35%, reflecting continued market share

gains. The EBIT margin excl. PPA amortisation was around 10%.

- Interventional Urology was up against a high baseline in Q1

last year, with growth in the quarter driven by Men’s Health in the

US and Endourology.

- Coloplast is launching Biatain® Silicone Fit in the US, a new

silicone foam dressing for pressure injury prevention and wound

management, and Peristeen® Light in Europe, a new transanal

irrigation device for people with bowel disorders.

- EBIT1) was DKK 1,822 million, a 3% increase from last year. The

EBIT margin1,2) was 28%, against 29% last year, and includes around

100 basis points negative impact from Kerecis, in line with

expectations. Currencies also had a negative impact on the EBIT

margin.

- ROIC after tax before special items was 15% against 20% last

year, negatively impacted by the acquisition of Kerecis.

FY 2023/24 – unchanged organic revenue growth and EBIT margin

guidance

- The organic revenue growth is still expected around 8% and

continues to assume good momentum across business areas and

regions. Reported growth in DKK is now expected to be around 11%,

from previously around 12%, and assumes around 1%-point negative

impact from currencies, mostly the USD and ARS. The impact from the

acquisition of Kerecis to reported growth is still expected around

4%-points (11 months).

- The reported EBIT margin before special items is still expected

to be 27-28%. The EBIT margin includes around 100 basis points

dilution from Kerecis (incl. around DKK 100 million in PPA

amortisation) and negative impact from currencies.

- Capital expenditures are still expected around DKK 1.4 billion.

The effective tax rate is still expected to be around 22%.

“We deliver a good start to the year with 8% organic growth and

a 28% EBIT margin in Q1, which is in line with our financial

guidance. I want to highlight a strong first quarter in our Chronic

Care business, which delivered broad-based growth, as well as a

good start to the year for our newest member of the Coloplast

family, Kerecis. I am also pleased with our profitability

performance in Q1. Finally, we have now kicked off a year of

product launches that will help drive our future growth. This

quarter, we are launching Biatain Silicone Fit for pressure injury

prevention and wound management in the US, as well as Peristeen®

Light for people with bowel disorders in Europe. I believe both

products will make a significant difference to people living with

intimate healthcare needs,” says Kristian Villumsen, President and

CEO of Coloplast.

1) before special items of DKK 15 million in Q1 2023/24 2)

before special items of DKK 13 million in Q1 2022/23

Conference call

Coloplast will host a conference call on Friday, 9 February 2024

at 11.00 CET. The call is expected to last about one hour.To

actively participate in the Q&A session please sign up ahead of

the conference call on the link here to receive an e-mail with

dial-in details: Register hereAccess the conference call webcast

directly here: Coloplast - Q1 2023/24 conference call

For further information, please contact

Investors and analystsAnders

Lonning-SkovgaardExecutive Vice President, CFOTel. +45 4911

1111

Aleksandra DimovskaSenior Director, Investor RelationsTel. +45

4911 1800 / +45 4911 2458Email: dkadim@coloplast.com

Kristine Husted MunkSenior Manager, Investor RelationsTel. +45

4911 1800 / +45 4911 3266Email: dkkhu@coloplast.com

Press and mediaPeter MønsterSr. Media Relations

ManagerTel. +45 4911 2623Email: dkpete@coloplast.com

AddressColoplast A/SHoltedam 1DK-3050

HumlebaekDenmarkCompany reg. (CVR) no. 69749917

Websitewww.coloplast.com

This announcement is available in a Danish and an

English-language version. In the event of discrepancies, the

English version shall prevail.

Coloplast was founded on passion, ambition, and commitment. We

were born from a nurse’s wish to help her sister and the skills of

an engineer. Guided by empathy, our mission is to make life easier

for people with intimate healthcare needs. Over decades, we have

helped millions of people to live a more independent life and we

continue to do so through innovative products and services.

Globally, our business areas include Ostomy Care, Continence Care,

Advanced Wound Care, Interventional Urology and Voice and

Respiratory Care.

The Coloplast logo is a registered trademark of Coloplast A/S. ©

2024-02.All rights reserved Coloplast A/S, 3050 Humlebaek,

Denmark.

- 01_2024_Q1_2023_24_Earnings_release

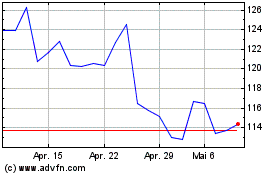

Coloplast AS (TG:CBHD)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Coloplast AS (TG:CBHD)

Historical Stock Chart

Von Nov 2023 bis Nov 2024