UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE

ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the Month of

May 2024

Commission File Number: 001-38652

X Financial

(Exact name of registrant as specified in its charter)

7-8F, Block A, Aerospace Science

and Technology Plaza

No. 168, Haide Third Avenue, Nanshan District

Shenzhen, 518067, the People’s Republic of China

+86-755-86282977

(Address of principal executive offices)

Indicate by

check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. Form 20-F x

Form 40-F ¨

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation ST Rule 101(b)(1): Not Applicable

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation ST Rule 101(b)(7): Not Applicable

EXHIBIT

INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

X

Financial |

| |

|

| |

By: |

/s/ Yue (Justin) Tang |

| |

Name: |

Yue (Justin) Tang |

| |

Title: |

Chairman and Chief Executive Officer |

Date: May 30, 2024

Exhibit 99.1

X Financial Reports First Quarter 2024 Unaudited

Financial Results

SHENZHEN,

China, May 30, 2024 /PRNewswire/ -- X Financial (NYSE: XYF) (the “Company” or “we”), a leading

online personal finance company in China, today announced its unaudited financial results for the first quarter ended March 31, 2024.

First Quarter 2024 Operational Highlights

| | |

Three Months Ended

March 31, 2023 | | |

Three Months Ended

December 31, 2023 | | |

Three Months Ended

March 31, 2024 | | |

QoQ | | |

YoY | |

| Total loan amount facilitated and originated (RMB in million) | |

| 24,088 | | |

| 26,134 | | |

| 21,505 | | |

| (17.7 | )% | |

| (10.7 | )% |

| Number of active borrowers | |

| 1,523,738 | | |

| 1,603,760 | | |

| 1,369,410 | | |

| (14.6 | )% | |

| (10.1 | )% |

| · | The total loan amount facilitated and originated1

in the first quarter of 2024 was RMB21,505 million, compared with RMB24,088 million in the same period of 2023. |

| · | Total number of active borrowers2

was 1,369,410 in the first quarter of 2024, compared with 1,523,738 in the same period of 2023. |

| | |

As of March 31, 2023 | | |

As of December 31, 2023 | | |

As of March 31, 2024 | |

| Total outstanding loan balance (RMB in million) | |

| 41,531 | | |

| 48,847 | | |

| 43,812 | |

| Delinquency rates for all outstanding loans that are past due for 31-60 days | |

| 1.05 | % | |

| 1.57 | % | |

| 1.61 | % |

| Delinquency rates for all outstanding loans that are past due for 91-180 days | |

| 2.40 | % | |

| 3.12 | % | |

| 4.37 | % |

| · | The total outstanding loan balance3

as of March 31, 2024 was RMB43,812 million, compared with RMB41,531 million as of March 31, 2023. |

| · | The delinquency rate for all outstanding loans that are past due for 31-60 days4

as of March 31, 2024 was 1.61%, compared with 1.05% as of March 31, 2023. |

| · | The delinquency rate for all outstanding loans that are past due for 91-180 days5

as of March 31, 2024 was 4.37%, compared with 2.40% as of March 31, 2023. |

1

Represents the total amount of loans that the Company facilitated and originated during the relevant period.

2

Represents borrowers who made at least one transaction on the Company’s platform during the relevant period.

3

Represents the total amount of loans outstanding for loans that the Company facilitated and originated at the end of the relevant period.

Loans that are delinquent for more than 60 days are charged-off and are excluded in the outstanding loan balance, except for Xiaoying

Housing Loan. As Xiaoying Housing Loan is a secured loan product and the Company is entitled to payment by exercising its rights to the

collateral, the Company does not exclude Xiaoying Housing Loan delinquent for more than 60 days in the outstanding loan balance.

4

Represents the balance of the outstanding principal and accrued outstanding interest for loans that were 31 to 60 days past due as a percentage

of the total balance of outstanding principal and accrued outstanding interest for loans that the Company facilitated and originated as

of a specific date. Loans that are delinquent for more than 60 days are charged-off and excluded in the calculation of delinquency rate

by balance. Xiaoying Housing Loan was launched in 2015 and ceased in 2019, and all the outstanding loan balance of housing loan as of

March 31, 2023, December 31, 2023 and March 31, 2024 were overdue more than 60 days. To make the delinquency rate by balance comparable,

the Company excludes Xiaoying Housing Loan in the calculation of delinquency rate.

5 To make the delinquency rate by balance comparable to

the peers, the Company also defines the delinquency rate as the balance of the outstanding principal and accrued outstanding interest

for loans that were 91 to 180 days past due as a percentage of the total balance of outstanding principal and accrued outstanding interest

for the loans that the Company facilitated and originated as of a specific date. Loans that are delinquent for more than 180 days are

excluded in the calculation of delinquency rate by balance, except for Xiaoying Housing Loan. All the outstanding loan balance of housing

loan as of March 31, 2023, December 31, 2023 and March 31,

2024 were overdue more than 180 days. To make the delinquency rate by balance comparable, the Company excludes Xiaoying Housing

Loan in the calculation of delinquency rate.

First Quarter 2024 Financial Highlights

| (In thousands, except for share and per share data) | |

Three Months Ended

March 31, 2023 | | |

Three Months Ended

December 31, 2023 | | |

Three Months Ended

March 31, 2024 | | |

QoQ | | |

YoY | |

| | |

RMB | | |

RMB | | |

RMB | | |

| | |

| |

| Total net revenue | |

1,004,934 | | |

1,192,664 | | |

1,207,974 | | |

1.3 | % | |

20.2 | % |

| Total operating costs and expenses | |

(677,151 | ) | |

(938,472 | ) | |

(831,433 | ) | |

(11.4 | )% | |

22.8 | % |

| Income from operations | |

327,783 | | |

254,192 | | |

376,541 | | |

48.1 | % | |

14.9 | % |

| Net income | |

284,346 | | |

188,968 | | |

363,139 | | |

92.2 | % | |

27.7 | % |

| Non-GAAP adjusted net income | |

306,525 | | |

230,782 | | |

322,205 | | |

39.6 | % | |

5.1 | % |

| | |

| | |

| | |

| | |

| | |

| |

| Net income per ADS—basic | |

5.94 | | |

3.90 | | |

7.44 | | |

90.8 | % | |

25.3 | % |

| Net income per ADS—diluted | |

5.82 | | |

3.84 | | |

7.32 | | |

90.6 | % | |

25.8 | % |

| | |

| | |

| | |

| | |

| | |

| |

| Non-GAAP adjusted net income per ADS—basic | |

6.36 | | |

4.74 | | |

6.60 | | |

39.2 | % | |

3.8 | % |

| Non-GAAP adjusted net income per ADS—diluted | |

6.24 | | |

4.68 | | |

6.54 | | |

39.7 | % | |

4.8 | % |

| · | Total net revenue in the first quarter of 2024 was RMB1,208.0 million (US$167.3 million), representing

an increase of 20.2% from RMB1,004.9 million in the same period of 2023. |

| · | Income from operations in the first quarter of 2024 was RMB376.5 million (US$52.2 million), compared with

RMB327.8 million in the same period of 2023. |

| · | Net income in the first quarter of 2024 was RMB363.1 million (US$50.3 million), compared with RMB284.3

million in the same period of 2023. |

| · | Non-GAAP6 adjusted

net income in the first quarter of 2024 was RMB322.2 million (US$44.6 million), compared with RMB306.5 million in the same period of

2023. |

| · | Net

income per basic and diluted American depositary share (“ADS”)7

in the first quarter of 2024 was RMB7.44 (US$1.03) and RMB7.32 (US$1.01), compared with RMB5.94 and RMB5.82, respectively,

in the same period of 2023. |

| · | Non-GAAP adjusted net income per basic and adjusted diluted ADS in the first quarter of 2024 was RMB6.60

(US$0.91) and RMB6.54 (US$0.91), compared with RMB6.36 and RMB6.24, respectively, in the same period of 2023. |

Mr. Kent

Li, President of the Company, commented, “We are pleased to start 2024 with a solid financial performance in the first quarter.

We continued to implement our strategy of proactively and dynamically adjusting loan volumes based on close monitoring of asset quality

dynamics and this, again, proved effective in securing our profitability. As a result, despite a year-over-year and quarter-over-quarter

decline in the loan volume, both our top and bottom lines increased on a yearly and quarterly basis, with notable improvements in profits.”

“In the first quarter, the total loan amount

facilitated and originated decreased by 11% year-over-year and 18% quarter-over-quarter to RMB22 billion, in line with our guidance. Our

total outstanding loan balance was RMB44 billion at the end of March 2024. Delinquency rates for outstanding loans past due for 31-60

days and 91-180 days were 1.61% and 4.37%, respectively, at the end of the quarter, compared to 1.05% and 2.40% a year ago. The increase

in overdue loans as a percentage of total outstanding loans is primarily due to lower outstanding loan balances at this quarter end as

a result of the proactive control of loans facilitated and originated that we initiated in the fourth quarter of last year. Excluding

the impact of the reduced loan volume, asset quality begun to stabilize during this quarter. We remain committed to closely monitor borrowers

through the entire credit cycle, continuously strengthening our risk control system, and taking all necessary measures to mitigate risks.”

6

The Company uses in this press release the following non-GAAP financial measures: (i) adjusted net income (loss), (ii) adjusted net income

(loss) per basic ADS, and (iii) adjusted net income (loss) per diluted ADS, each of which excludes share-based compensation expense, impairment

losses on financial investments, income (loss) from financial investments and impairment losses on long-term investments. For more information

on non-GAAP financial measure, please see the section of “Use of Non-GAAP Financial Measures Statement” and the table captioned

“Unaudited Reconciliations of GAAP and Non-GAAP Results” set forth at the end of this press release.

7

Each American depositary share (“ADS”) represents six Class A ordinary shares.

“We are confident in our future profitable

growth. With stabilized asset quality, we have clearer visibility on the loan volume for 2024 under our current strategy and expect the

total loan amount facilitated and originated for the full year to be around RMB100 billion. Our commitment to sustainable profitability

and shareholder value creation is unwavering.”

Mr. Frank Fuya Zheng, Chief Financial Officer

of the Company, added, “We are very pleased with the solid financial results we achieved in the first quarter. Total net revenue

was RMB1.2 billion, up 20% year-over-year and 1% quarter-over-quarter despite the decline in loan volumes. Thanks to our strict risk controls

and improved operational efficiency, net income increased by 28% year-over-year and 92% quarter-over-quarter to RMB363 million. This once

again demonstrates the effectiveness of our strategy, strong execution, and commitment to ensuring long-term profitability. Beginning

this quarter, we combined borrower acquisition costs from origination and servicing expenses, indirect expenses of the borrower acquisitions

from general and administrative expenses and sales and marketing expenses into borrower acquisitions and marketing expenses within total

operating costs and expenses to provide a clearer breakdown of the Company’s expenses for investors. Going forward, we will continue

to improve asset quality while optimizing borrower acquisition costs to drive sustainable profitability.”

“Our

board of directors has authorized a new program to repurchase up to $20 million worth of our shares which will be effective from June 1,

2024 through November 30, 2025. We are confident in our position as a public company and will drive long-term returns for

our shareholders.”

First Quarter 2024 Financial Results

Total

net revenue in the first quarter of 2024 increased by 20.2% to RMB1,208.0 million (US$167.3 million) from RMB1,004.9 million

in the same period of 2023, primarily due to growth in various disaggregated revenue compared with the same period of 2023. Please refer

to analysis of disaggregation of revenue.

| | |

Three Months Ended March 31, | | |

| |

| (In thousands, except for share and per share data) | |

2023 | | |

2024 | | |

YoY | |

| | |

RMB | | |

% of Revenue | | |

RMB | | |

% of Revenue | | |

| |

| Loan facilitation service | |

| 580,604 | | |

| 57.8 | % | |

| 614,150 | | |

| 50.8 | % | |

| 5.8 | % |

| Post-origination service | |

| 121,273 | | |

| 12.1 | % | |

| 152,742 | | |

| 12.6 | % | |

| 25.9 | % |

| Financing income | |

| 254,056 | | |

| 25.3 | % | |

| 334,628 | | |

| 27.7 | % | |

| 31.7 | % |

| Guarantee income | |

| - | | |

| 0.0 | % | |

| 32,926 | | |

| 2.7 | % | |

| 100.0 | % |

| Other revenue | |

| 49,001 | | |

| 4.8 | % | |

| 73,528 | | |

| 6.2 | % | |

| 50.1 | % |

| Total net revenue | |

| 1,004,934 | | |

| 100.0 | % | |

| 1,207,974 | | |

| 100.0 | % | |

| 20.2 | % |

Loan

facilitation service fees in the first quarter of 2024 increased by 5.8% to RMB614.2 million (US$85.1 million) from RMB580.6

million in the same period of 2023, primarily due to a decrease in the impact from expected prepayment risk this quarter compared with

the same period of 2023.

Post-origination

service fees in the first quarter of 2024 increased by 25.9% to RMB152.7 million (US$21.2 million) from RMB121.3 million in

the same period of 2023, primarily due to the cumulative effect of increased volume of loans facilitated in the previous quarters. Revenues

from post-origination services are recognized on a straight-line basis over the term of the underlying loans as the services are being

provided.

Financing

income in the first quarter of 2024 increased by 31.7% to RMB334.6 million (US$46.3 million) from RMB254.1 million in the same

period of 2023, primarily due to an increase in average loan balances compared with the same period of 2023.

Guarantee

income in the first quarter of 2024 was RMB32.9 million (US$4.6 million), primarily due to an increase in guarantee income

arising from financing guarantee business operated by a subsidiary which holds the financing guarantee license and commenced the financing

guarantee business in second half of 2023.

Other

revenue in the first quarter of 2024 increased by 50.1% to RMB73.5 million (US$10.2 million), compared with RMB49.0

million in the same period of 2023, primarily due to an increase in referral service fee for introducing borrowers to other platforms.

Origination

and servicing expenses in the first quarter of 2024 increased by 14.8% to RMB426.5 million (US$59.1 million) from RMB371.5

million in the same period of 2023, primarily due to the increase in collection expenses resulting from the cumulative effect of increased

volume of loans facilitated and provided in the previous quarters compared with the same period of 2023.

Borrower

acquisitions and marketing expenses in the first quarter of 2024 decreased by 8.7% to RMB248.4 million (US$34.4 million) from

RMB271.9 million in the same period of 2023, primarily due to the decrease in the borrower acquisition costs compared with the same period

of 2023.

Provision

for loans receivable in the first quarter of 2024 was RMB61.5 million (US$8.5 million), compared with RMB20.4 million in the

same period of 2023, primarily due to an increase in loans receivable held by the Company as a result of the cumulative effect of increased

volume of loans facilitated and provided in the previous quarters compared with the same period of 2023.

Provision

for contingent guarantee liabilities in the first quarter of 2024 was RMB47.9 million (US$6.6 million), primarily due to the

increase in guarantee liability arising from financing guarantee business operated by a subsidiary which holds the financing guarantee

license and commenced the financing guarantee business in second half of 2023.

Income

from operations in the first quarter of 2024 was RMB376.5 million (US$52.2 million), compared with RMB327.8 million in the same period

of 2023.

Income

before income taxes and gain from equity in affiliates in the first quarter of 2024 was RMB426.1 million (US$59.0 million),

compared with RMB330.6 million in the same period of 2023.

Income

tax expense in the first quarter of 2024 was RMB65.0 million (US$9.0 million), compared with RMB52.6 million in the same period

of 2023.

Net

income in the first quarter of 2024 was RMB363.1 million (US$50.3 million), compared with RMB284.3 million in the same period

of 2023.

Non-GAAP

adjusted net income in the first quarter of 2024 was RMB322.2 million (US$44.6 million), compared with RMB306.5 million in

the same period of 2023.

Net

income per basic and diluted ADS in the first quarter of 2024 was RMB7.44 (US$1.03), and RMB7.32 (US$1.01), compared with RMB5.94

and RMB5.82, respectively, in the same period of 2023.

Non-GAAP

adjusted net income per basic and diluted ADS in the first quarter of 2024 was RMB6.60 (US$0.91), and RMB6.54 (US$0.91), compared

with RMB6.36 and RMB6.24 respectively, in the same period of 2023.

Cash

and cash equivalents was RMB1,413.1 million (US$195.7 million) as of March 31, 2024, compared with RMB1,195.4 million

as of December 31, 2023.

Recent Development

Share Repurchase Plan

The

Company today announced that its board of directors (the “Board”) authorized a new program to repurchase up to $20 million

of its Class A shares and its Class A ordinary shares in the form of American depositary shares (together “the Shares”).

This new share repurchase program, effective from June 1, 2024 through November 30, 2025, is in addition to the existing share

repurchase plan approved in March 2022, and as further amended in September 2022 and November 2022, which has approximately

$5.5 million remaining. The Company did not repurchase any shares during the first quarter of 2024.

Under

the new share repurchase program, the Company may repurchase the Shares from time to time through various means, including open market

transactions, privately negotiated transactions, and through other legally permissible means, depending on market conditions and in accordance

with applicable rules and regulations. The manner, timing and amount of any share repurchases will be determined by the Company's

management in its discretion based on its evaluation of various factors.

Changes in the Board of Directors

On May 27, 2024, the Board approved the following

changes to the composition of the Board.

Mr. Shengwen

Rong has resigned from his respective positions as an independent non-executive director and chairman of the Audit Committee of

the Board due to personal reason.

Mr. Zheng

Xue has been appointed as the chairman of the Audit Committee of the Board to fill the vacancy resulting from Mr. Shengwen

Rong’s resignation. Mr. Zheng Xue has resigned from his position as the chairman of the Nominating and Corporate Governance

Committee of the Board.

Mr. Zheng

Wan has been appointed as an independent non-executive director of the Board to fill the vacancy resulting from Mr. Shengwen

Rong’s resignation. Mr. Zheng Wan has also been appointed as the chairman of the Nominating and Corporate Governance Committee

of the Board to fill the vacancy resulting from Mr. Zheng Xue’s resignation.

Mr. Zheng Wan has served as a Group Director

of M&A Integration at Cadence Design Systems Inc. since 2022. Mr. Zheng Wan served as a Director of M&A Integration at Snap

Inc. from 2016 to 2018 and from 2020 to 2022. Mr. Zheng Wan served as a Global Director of M&A Integration at Airbnb Inc. from

2018 to 2020. Between 2006 and 2017, Mr. Zheng Wan served in multiple capacities at Google Inc., including as Finance Manager of

Internal Audit and Risk Consulting, Corporate Development Manager, and Financial Planning & Analysis Manager. Mr. Zheng

Wan received a master degree in political science from University of Utah in 2001 and an MBA degree from Duke University in 2004.

Business Outlook

The

Company expects the total loan amount facilitated and originated for the second quarter of 2024 to be between RMB23.0 billion and

RMB24.5 billion. For the full year of 2024, the Company expects the total loan amount facilitated and originated to be between RMB90 billion

and RMB110 billion.

This forecast reflects the Company’s current

and preliminary views, which are subject to changes.

Conference Call

X Financial’s management team will host

an earnings conference call at 7:00 AM U.S. Eastern Time on May 31, 2024 (7:00 PM Beijing / Hong Kong Time on May 31, 2024).

Dial-in details for the earnings conference call

are as follows:

| United States: |

1-888-346-8982 |

| Hong Kong: |

852-301-84992 |

| Mainland China: |

4001-201203 |

| International: |

1-412-902-4272 |

| Passcode: |

X Financial |

Please dial in ten minutes before the call is

scheduled to begin and provide the passcode to join the call.

A replay of the conference call may be accessed

by phone at the following numbers until June 7, 2024:

| United States: |

1-877-344-7529 |

| International: |

1-412-317-0088 |

| Passcode: |

1086048 |

Additionally,

a live and archived webcast of the conference call will be available at http://ir.xiaoyinggroup.com.

About X Financial

X

Financial (NYSE: XYF) (the "Company") is a leading online personal finance company in China. The Company is committed to connecting

borrowers on its platform with its institutional funding partners. With its proprietary big data-driven technology, the Company has established

strategic partnerships with financial institutions across multiple areas of its business operations, enabling it to facilitate and originate

loans to prime borrowers under a risk assessment and control system.

For more

information, please visit: http://ir.xiaoyinggroup.com.

Use of Non-GAAP Financial Measures Statement

In evaluating our business, we consider and use

non-GAAP measures as supplemental measures to review and assess our operating performance. We present the non-GAAP financial measures

because they are used by our management to evaluate our operating performance and formulate business plans. We believe that the use of

the non-GAAP financial measures facilitates investors’ assessment of our operating performance and help investors to identify underlying

trends in our business that could otherwise be distorted by the effect of certain income or expenses that we include in income (loss)

from operations and net income (loss). We also believe that the non-GAAP measures provide useful information about our core operating

results, enhance the overall understanding of our past performance and future prospects and allow for greater visibility with respect

to key metrics used by our management in its financial and operational decision-making.

We

use in this press release the following non-GAAP financial measures: (i) adjusted net income (loss), (ii) adjusted net

income (loss) per basic ADS, and (iii) adjusted net income (loss) per diluted ADS, each of which excludes share-based compensation

expense, impairment losses on financial investments, income (loss) from financial investments and impairment losses on long-term investments.

These non-GAAP financial measures have limitations as analytical tools, and when assessing our operating

performance, investors should not consider them in isolation, or as a substitute for the financial information prepared and presented

in accordance with U.S. GAAP.

We mitigate these limitations by reconciling the

non-GAAP financial measures to the most directly comparable U.S. GAAP financial measures, which should be considered when evaluating our

performance. We encourage you to review our financial information in its entirety and not rely on a single financial measure.

For more information

on these non-GAAP financial measures, please see the table captioned “Reconciliations of GAAP and Non-GAAP results” set forth

at the end of this press release.

Exchange Rate Information

This announcement contains translations of certain

RMB amounts into U.S. dollars at specified rates solely for the convenience of the reader. Unless otherwise noted, all translations from

RMB to U.S. dollars are made at a rate of RMB7.2203 to US$1.00, the exchange rate set forth in the H.10 statistical release of the Board

of Governors of the Federal Reserve System as of March 29, 2024.

Disclaimer

Safe Harbor Statement

This announcement contains forward-looking statements

within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are made under

the "safe harbor" provisions of the U.S. Private Securities Litigation Reform Act of 1995. These statements can be identified

by terminology such as "will," "expects," "anticipates," "future," "intends," "plans,"

"believes," "estimates," "potential," "continue," "ongoing," "targets," "guidance"

and similar statements. The Company may also make written or oral forward-looking statements in its periodic reports to the U.S. Securities

and Exchange Commission (the "SEC"), in its annual report to shareholders, in press releases and other written materials and

in oral statements made by its officers, directors or employees to third parties. Any statements that are not historical facts, including

statements about the Company’s beliefs and expectations, are forward-looking statements that involve factors, risks and uncertainties

that could cause actual results to differ materially from those in the forward-looking statements. Such factors and risks include, but

not limited to the followings: the Company’s goals and strategies; its future business development, financial condition and results

of operations; the expected growth of the credit industry, and marketplace lending in particular, in China; the demand for and market

acceptance of its marketplace’s products and services; its ability to attract and retain borrowers and investors on its marketplace;

its relationships with its strategic cooperation partners; competition in its industry; and relevant government policies and regulations

relating to the corporate structure, business and industry. Further information regarding these and other risks, uncertainties or factors

is included in the Company’s filings with the SEC. All information provided in this announcement is current as of the date of this

announcement, and the Company does not undertake any obligation to update such information, except as required under applicable law.

Use of Projections

This announcement also contains certain financial

forecasts (or guidance) with respect to the Company’s projected financial results. The Company’s independent auditors have

not audited, reviewed, compiled or performed any procedures with respect to the projections or guidance for the purpose of their inclusion

in this announcement, and accordingly, they did not express an opinion or provide any other form assurance with respect thereto for the

purpose of this announcement. This guidance should not be relied upon as being necessarily indicative of future results. The assumptions

and estimates underlying the prospective financial information are inherently uncertain and are subject to a wide variety of significant

business, economic and competitive risks and uncertainties that could actual results to differ materially from those contained in the

prospective financial information. Accordingly, there can be no assurance that the prospective results are indicative of the future performance

of the Company, or that actual results will not diff materially from those set forth in the prospective financial information. Inclusion

of the prospective financial information in this announcement should not be regarded as a representation by any person that the results

contained in the prospective financial information will actually be achieved. You should review this information together with the Company’s

historical information.

For more information, please contact:

X Financial

Mr. Frank Fuya Zheng

E-mail: ir@xiaoying.com

Christensen IR

In China

Mr. Rene Vanguestaine

Phone: +86-178-1749 0483

E-mail: rene.vanguestaine@christensencomms.com

In US

Ms. Linda Bergkamp

Phone: +1-480-614-3004

Email: linda.bergkamp@christensencomms.com

| X Financial | |

| | |

| | |

| |

| Unaudited Condensed Consolidated Balance Sheets | |

| | |

| | |

| |

| | |

| | |

| | |

| |

| (In thousands, except for share and per share data) | |

As

of December 31, 2023 | | |

As of March 31, 2024 | | |

As of March 31, 2024 | |

| | |

| RMB | | |

| RMB | | |

| USD | |

| ASSETS | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

| 1,195,352 | | |

| 1,413,065 | | |

| 195,707 | |

| Restricted cash, net | |

| 749,070 | | |

| 776,500 | | |

| 107,544 | |

| Accounts receivable and contract assets, net | |

| 1,659,588 | | |

| 1,600,970 | | |

| 221,732 | |

| Loans receivable from Xiaoying Credit Loans and other loans, net | |

| 4,947,833 | | |

| 5,339,591 | | |

| 739,525 | |

| Deposits to institutional cooperators, net | |

| 1,702,472 | | |

| 1,595,967 | | |

| 221,039 | |

| Prepaid expenses and other current assets, net | |

| 48,767 | | |

| 27,619 | | |

| 3,825 | |

| Deferred tax assets, net | |

| 135,958 | | |

| 163,441 | | |

| 22,636 | |

| Long-term investments | |

| 493,411 | | |

| 496,179 | | |

| 68,720 | |

| Property and equipment, net | |

| 8,642 | | |

| 9,552 | | |

| 1,323 | |

| Intangible assets, net | |

| 36,810 | | |

| 37,033 | | |

| 5,129 | |

| Loan receivable from Xiaoying Housing Loans, net | |

| 8,657 | | |

| 8,657 | | |

| 1,199 | |

| Financial investments | |

| 608,198 | | |

| 618,404 | | |

| 85,648 | |

| Other non-current assets | |

| 55,265 | | |

| 51,665 | | |

| 7,156 | |

| TOTAL ASSETS | |

| 11,650,023 | | |

| 12,138,643 | | |

| 1,681,183 | |

| | |

| | | |

| | | |

| | |

| LIABILITIES | |

| | | |

| | | |

| | |

| Payable to investors and institutional funding partners at amortized cost | |

| 3,584,041 | | |

| 3,770,872 | | |

| 522,259 | |

| Guarantee liabilities | |

| 61,907 | | |

| 94,955 | | |

| 13,151 | |

| Deferred guarantee income | |

| 46,597 | | |

| 103,665 | | |

| 14,357 | |

| Short-term borrowings | |

| 565,000 | | |

| 434,500 | | |

| 60,178 | |

| Accrued payroll and welfare | |

| 86,771 | | |

| 31,128 | | |

| 4,311 | |

| Other tax payable | |

| 289,819 | | |

| 270,968 | | |

| 37,529 | |

| Income tax payable | |

| 446,500 | | |

| 469,476 | | |

| 65,022 | |

| Accrued expenses and other current liabilities | |

| 595,427 | | |

| 607,901 | | |

| 84,193 | |

| Dividend payable | |

| 59,226 | | |

| 59,226 | | |

| 8,203 | |

| Other non-current liabilities | |

| 37,571 | | |

| 33,688 | | |

| 4,666 | |

| Deferred tax liabilities | |

| 30,040 | | |

| 39,775 | | |

| 5,509 | |

| TOTAL LIABILITIES | |

| 5,802,899 | | |

| 5,916,154 | | |

| 819,378 | |

| | |

| | | |

| | | |

| | |

| Commitments and Contingencies | |

| | | |

| | | |

| | |

| Equity: | |

| | | |

| | | |

| | |

| Common shares | |

| 207 | | |

| 207 | | |

| 29 | |

| Treasury stock | |

| (111,520 | ) | |

| (106,682 | ) | |

| (14,775 | ) |

| Additional paid-in capital | |

| 3,196,942 | | |

| 3,200,857 | | |

| 443,314 | |

| Retained earnings | |

| 2,692,018 | | |

| 3,055,157 | | |

| 423,134 | |

| Other comprehensive income | |

| 69,477 | | |

| 72,950 | | |

| 10,103 | |

| Total X Financial shareholders' equity | |

| 5,847,124 | | |

| 6,222,489 | | |

| 861,805 | |

| Non-controlling interests | |

| - | | |

| - | | |

| - | |

| TOTAL EQUITY | |

| 5,847,124 | | |

| 6,222,489 | | |

| 861,805 | |

| | |

| | | |

| | | |

| | |

| TOTAL LIABILITIES AND EQUITY | |

| 11,650,023 | | |

| 12,138,643 | | |

| 1,681,183 | |

| X

Financial |

|

|

|

| Unaudited

Condensed Consolidated Statements of Comprehensive Income |

| | |

Three

Months Ended March 31, | |

| (In thousands, except for share and per

share data) | |

2023 | | |

2024 | | |

2024 | |

| | |

RMB | | |

RMB | | |

USD | |

| Net revenues | |

| | | |

| | | |

| | |

| Loan facilitation service | |

| 580,604 | | |

| 614,150 | | |

| 85,059 | |

| Post-origination service | |

| 121,273 | | |

| 152,742 | | |

| 21,155 | |

| Financing income | |

| 254,056 | | |

| 334,628 | | |

| 46,345 | |

| Guarantee income | |

| - | | |

| 32,926 | | |

| 4,560 | |

| Other revenue | |

| 49,001 | | |

| 73,528 | | |

| 10,184 | |

| Total net revenue | |

| 1,004,934 | | |

| 1,207,974 | | |

| 167,303 | |

| | |

| | | |

| | | |

| | |

| Operating costs and expenses: | |

| | | |

| | | |

| | |

| Origination

and servicing1 | |

| 371,484 | | |

| 426,547 | | |

| 59,076 | |

| Borrower

acquisitions and marketing1 | |

| 271,942 | | |

| 248,374 | | |

| 34,399 | |

| General

and administrative1 | |

| 38,068 | | |

| 38,474 | | |

| 5,329 | |

| (Reversal of) provision for accounts receivable and contract

assets | |

| (940 | ) | |

| 8,655 | | |

| 1,199 | |

| Provision for loans receivable | |

| 20,377 | | |

| 61,540 | | |

| 8,523 | |

| Provision for contingent guarantee liabilities | |

| - | | |

| 47,893 | | |

| 6,633 | |

| Change

in fair value of financial guarantee derivative2 | |

| (24,299 | ) | |

| - | | |

| - | |

| Fair

value adjustments related to Consolidated Trusts2 | |

| 553 | | |

| - | | |

| - | |

| Reversal of provision for credit losses for deposits and other financial assets | |

| (34 | ) | |

| (50 | ) | |

| (7 | ) |

| Total operating costs and expenses | |

| 677,151 | | |

| 831,433 | | |

| 115,152 | |

| | |

| | | |

| | | |

| | |

| Income from operations | |

| 327,783 | | |

| 376,541 | | |

| 52,151 | |

| Interest income (expenses), net | |

| (1,999 | ) | |

| (4,291 | ) | |

| (594 | ) |

| Foreign exchange gain (loss) | |

| 3,018 | | |

| (424 | ) | |

| (59 | ) |

| Income (loss) from financial investments | |

| (9,514 | ) | |

| 50,246 | | |

| 6,959 | |

| Other income, net | |

| 11,332 | | |

| 4,046 | | |

| 560 | |

| | |

| | | |

| | | |

| | |

| Income before income taxes and gain from equity in affiliates | |

| 330,620 | | |

| 426,118 | | |

| 59,017 | |

| | |

| | | |

| | | |

| | |

| Income tax expense | |

| (52,563 | ) | |

| (65,025 | ) | |

| (9,006 | ) |

| Gain from equity in affiliates, net of tax | |

| 6,289 | | |

| 2,046 | | |

| 283 | |

| Net income | |

| 284,346 | | |

| 363,139 | | |

| 50,294 | |

| Less: net income attributable to non-controlling interests | |

| - | | |

| - | | |

| - | |

| Net income attributable to X Financial shareholders | |

| 284,346 | | |

| 363,139 | | |

| 50,294 | |

| | |

| | | |

| | | |

| | |

| Net income | |

| 284,346 | | |

| 363,139 | | |

| 50,294 | |

| Other comprehensive income, net of tax of nil: | |

| | | |

| | | |

| | |

| Gain from equity in affiliates | |

| 2 | | |

| 30 | | |

| 4 | |

| Income from financial investments | |

| - | | |

| 2,225 | | |

| 308 | |

| Foreign currency translation adjustments | |

| (7,261 | ) | |

| 1,218 | | |

| 169 | |

| Comprehensive income | |

| 277,087 | | |

| 366,612 | | |

| 50,775 | |

| Less: comprehensive income attributable to non-controlling

interests | |

| - | | |

| - | | |

| - | |

| Comprehensive income attributable to X Financial shareholders | |

| 277,087 | | |

| 366,612 | | |

| 50,775 | |

| | |

| | | |

| | | |

| | |

| Net income per share—basic | |

| 0.99 | | |

| 1.24 | | |

| 0.17 | |

| Net income per share—diluted | |

| 0.97 | | |

| 1.22 | | |

| 0.17 | |

| | |

| | | |

| | | |

| | |

| Net income per ADS—basic | |

| 5.94 | | |

| 7.44 | | |

| 1.03 | |

| Net income per ADS—diluted | |

| 5.82 | | |

| 7.32 | | |

| 1.01 | |

| | |

| | | |

| | | |

| | |

| Weighted average number of ordinary shares outstanding—basic | |

| 288,027,062 | | |

| 293,788,724 | | |

| 293,788,724 | |

| Weighted average number of ordinary shares outstanding—diluted | |

| 294,330,508 | | |

| 296,894,415 | | |

| 296,894,415 | |

1 Starting in the first quarter of

2024, management has concluded to separate expenses related to borrower acquisitions from origination and servicing expenses and indirect

expenses of the borrower acquisitions from general and administrative expenses to a single line item as these expenses become more and

more significant and thus deemed to be useful to financial statement users. Furtherly, management has determined to embed the sales and

marketing expenses, which is not considered as material, in other line item. In conclusion, management has decided to combine these two

line items into one captioned borrower acquisitions and marketing expenses. Management has correspondingly conformed prior period presentation

to current period presentation to enhance comparability. This change in presentation does not affect any subtotal line on the face of

consolidated statements of comprehensive income.

| | |

Three

Months Ended March 31, 2023 | | |

| |

| (In

thousands, except for share and per share data) | |

before

re-grouping | | |

after

re-grouping | | |

Changes | |

| | |

RMB | | |

RMB | | |

RMB | |

| Origination and

servicing | |

| 633,809 | | |

| 371,484 | | |

| (262,325 | ) |

| Borrower acquisitions and marketing | |

| - | | |

| 271,942 | | |

| 271,942 | |

| Sales and marketing | |

| 2,038 | | |

| - | | |

| (2,038 | ) |

| General and administrative | |

| 45,647 | | |

| 38,068 | | |

| (7,579 | ) |

2 Starting in the first quarter of

2024, management has considered the facts that fair value change related to financial guarantee services and Consolidated Trusts are

generated from ordinary course of businesses, and has concluded to reclass the amount to captions above total operating costs and expenses.

Prior to the reclassification, management classified all amount of fair value changes to captions below total operating costs and expenses.

This reclassification does not have impact on net income for any prior periods presented.

| X Financial | |

| | |

| | |

| |

| Unaudited Reconciliations of GAAP and Non-GAAP Results | |

| | |

| |

| | |

| | |

| | |

| |

| | |

Three Months Ended

March 31, | |

| (In thousands, except for share and per share data) | |

2023 | | |

2024 | | |

2024 | |

| | |

RMB | | |

RMB | | |

USD | |

| GAAP net income | |

| 284,346 | | |

| 363,139 | | |

| 50,294 | |

| Less: Income (loss) from financial investments (net of tax of nil) | |

| (9,514 | ) | |

| 50,246 | | |

| 6,959 | |

| Less: Impairment losses on financial investments (net of tax of nil) | |

| - | | |

| - | | |

| - | |

| Less: Impairment losses on long-term investments (net of tax) | |

| - | | |

| - | | |

| - | |

| Add: Share-based compensation expenses (net of tax of nil) | |

| 12,665 | | |

| 9,312 | | |

| 1,290 | |

| Non-GAAP adjusted net income | |

| 306,525 | | |

| 322,205 | | |

| 44,625 | |

| | |

| | | |

| | | |

| | |

| Non-GAAP adjusted net income per share—basic | |

| 1.06 | | |

| 1.10 | | |

| 0.15 | |

| Non-GAAP adjusted net income per share—diluted | |

| 1.04 | | |

| 1.09 | | |

| 0.15 | |

| | |

| | | |

| | | |

| | |

| Non-GAAP adjusted net income per ADS—basic | |

| 6.36 | | |

| 6.60 | | |

| 0.91 | |

| Non-GAAP adjusted net income per ADS—diluted | |

| 6.24 | | |

| 6.54 | | |

| 0.91 | |

| | |

| | | |

| | | |

| | |

| Weighted average number of ordinary shares outstanding—basic | |

| 288,027,062 | | |

| 293,788,724 | | |

| 293,788,724 | |

| Weighted average number of ordinary shares outstanding—diluted | |

| 294,330,508 | | |

| 296,894,415 | | |

| 296,894,415 | |

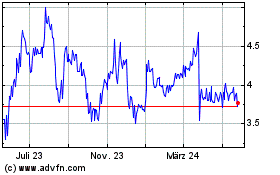

X Financial (NYSE:XYF)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

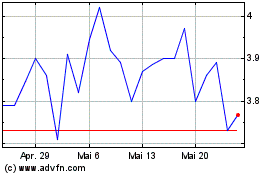

X Financial (NYSE:XYF)

Historical Stock Chart

Von Dez 2023 bis Dez 2024