Changes in Brokered Deposits at 36 Banks -- WSJ

12 September 2023 - 2:30PM

Dow Jones News

Brokered deposits accounting for more than 10% of domestic

deposits can make regulators wary. The Federal Deposit Insurance

Corp. can charge higher insurance fees to banks that have high

concentrations of brokered deposits.

Brokered Deposits as a Share of All Domestic Deposits, This Year Vs Last Year

2Q 2023 2Q 2022

Domestic Percent Domestic Percent

Deposits Brokered Deposits Brokered

JP Morgan Chase $2.068T 4.39% $2.128T 2.87%

Bank of America $1.879T 1.78% $1.964T 0.04%

Citibank $742.47B 9.54% $753.68B 8.58%

Wells Fargo $1.360T 6.39% $1.442T 0.49%

U.S. Bancorp $526.74B 6.65% $455.31B 6.25%

PNC Bank $434.51B 1.99% $446.68B 0.65%

Truist Financial $418.24B 7.72% $435.44B 5.26%

Goldman Sachs $352.19B 20.63% $343.13B 30.47%

Capital One $367.82B 5.42% $313.95B 1.66%

TD Bank $303.90B 0.71% $356.36B 0.62%

Bank of NY Mellon $193.69B 0.56% $213.70B 0.01%

State Street $164.78B 6.96% $166.58B 6.16%

BMO Harris Bank $202.24B 6.97% $133.33B 2.05%

Citizens Financial $180.71B 4.89% $181.57B 2.46%

First Citizens Bank $141.34B 2.25% $89.43B 1.33%

M&T Bank $165.25B 7.72% $173.07B 2.28%

Fifth Third Bank $169.65B 4.01% $166.58B 2.19%

Morgan Stanley Bank $175.79B 22.22% $169.57B 7.02%

Morgan Stanley Priv Bank $179.78B 20.84% $182.63B 5.11%

KeyCorp $148.18B 5.76% $149.41B 0.09%

Huntington Bank $152.05B 3.32% $148.69B 2.68%

Ally Financial $158.82B 8.61%

$142.59B 4.88%

American Express $135.60B 23.03% $104.57B 22.14%

HSBC Bank $131.84B 13.62% $130.88B 14.35%

Northern Bank $39.50B 0.00% $54.63B 0.00%

Regions Bank $129.40B 1.56% $139.56B 1.05%

Discover $101.21B 20.12% $79.90B 14.46%

Flagstar Bank $88.63B 10.46% $41.38B 10.82%

Santander Bank $77.10B 9.76% $71.87B 0.00%

City National Bank $73.92B 11.40% $79.76B 0.03%

Comerica $67.61B 7.63% $76.90B 0.66%

Zions Bancorp $74.32B 11.37% $79.06B 0.00%

First Horizon $66.59B 5.57% $71.88B 0.78%

Webster Financial $59.03B 5.48% $53.22B 0.24%

East West Bank $53.15B 6.82% $51.58B 6.83%

Western Alliance Bank $51.29B 35.64% $54.03B 6.58%

Source: FDIC

(END) Dow Jones Newswires

September 12, 2023 08:15 ET (12:15 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

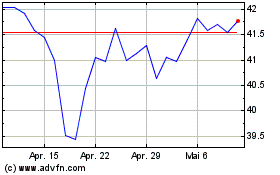

US Bancorp (NYSE:USB)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

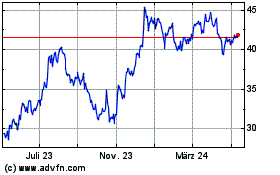

US Bancorp (NYSE:USB)

Historical Stock Chart

Von Apr 2023 bis Apr 2024