Canadian Businesses Can Drive Stronger Growth and Reduce Identity Fraud Risks with TruValidate Identity Exchange from TransUnion®

07 Juni 2023 - 12:00PM

TransUnion® (NYSE: TRU) has expanded TruValidate Identity Exchange

across industries in Canada to help financial institutions, credit

card issuers, fintechs, telecommunications providers and other

companies grow their business while combatting fraud with a new

patent-pending, multi-layered approach to risk management and

identity verification. Combining advanced analytics and machine

learning, Identity Exchange is a dynamic solution that proactively

assesses identity fraud risk – for example, during an application

process when consumers are applying for loans, credit cards or

phone contracts – to enable businesses to more confidently approve

authentic customers. Early adopters of the solution have benefitted

from increased acquisition while preventing fraud.

Identity Exchange can help businesses expand their customer

base. New-to-credit (NTC) consumers – such as young Canadians who

are early in their credit journeys, or those who are new to Canada

– often face challenges obtaining credit products, despite being

credit hungry and intentional about managing new credit products

carefully, according to a recent global study by TransUnion. In

Canada, 983,000 consumers opened their first credit product and

became NTC during 2021, with 81% of these opening a credit card as

their first product. When assessing the creditworthiness of a

consumer, confirming their identity is a key first step, and in a

digital journey, credit history is often used. When there is little

to no credit history, businesses may decline the application or be

forced to use more costly manual processes that create friction for

authentic customers to confirm identity. A difficult digital

experience can impact consumers from getting the credit they

need.

With Identity Exchange, businesses can proactively assess

multiple aspects of a customer’s identity, analyzing against

millions of data points, such as credit bureau data, as well as the

unique behaviours of each individual – activity that is

uncharacteristic for an individual (for example, applying for 10

credit cards in 48 hours) – to determine in real-time the

likelihood that the customer is actually a fraudster.

Each business faces unique challenges when it comes to identity

fraud, and as more consumers engage digitally, detecting fraudulent

transactions and verifying identities quickly and accurately is

crucial. TransUnion’s analysis revealed that from 2019 to 2022, the

number of digital transactions rose by 103% in Canada, and fraud

attempts on digital transactions rose by 189%. Fraudsters are

becoming more sophisticated and the traditional “checklist”

approach of only checking individual identity elements is

inadequate because each piece of data may be technically correct on

its own (a legitimate address, phone number, etc.). Instead,

organizations now need to embrace an integrated view of

identity.

“Identity fraud in its various forms is one of the most

challenging issues faced by businesses today – but it is a

preventable crime. Identity Exchange proactively, intelligently and

continuously applies data, creating friction on suspicious

transactions and exposing fraudulent accounts to help mitigate risk

before fraud losses can occur,” said Patrick Boudreau, head of

identity management and fraud solutions at TransUnion Canada. “By

having a clearer picture of who is behind the transaction,

businesses can drive fraudsters away, drive better experiences, and

drive stronger growth.”

About Identity Exchange

Designed with multiple integration options, Identity Exchange

delivers the ability to assess identity risk against a broad set of

data to help drive fraudsters away, drive better experiences, and

drive stronger growth.

To learn more, visit:

transunion.ca/product/identity-exchange

About TransUnion® (NYSE:

TRU)

TransUnion® is a global information and insights company that

makes trust possible in the modern economy. We do this by providing

an actionable picture of each person, stewarded with care, so they

can be reliably represented in the marketplace. As a result,

businesses and consumers can transact with confidence and achieve

great things. We call this Information for Good®.

TransUnion® provides solutions that help create economic

opportunity, great experiences and personal empowerment for

hundreds of millions of people in more than 30 countries. Our

customers in Canada comprise some of the nation’s largest banks and

card issuers, and TransUnion® is a major credit reporting, fraud,

and analytics solutions provider across the finance, retail,

telecommunications, utilities, government, and insurance

sectors.

For more information visit: www.transunion.ca

For more information, please contact:

Hyunjoo KimDirector, Corporate Affairs and

Communicationshyunjoo.kim@transunion.com(289) 962-2376

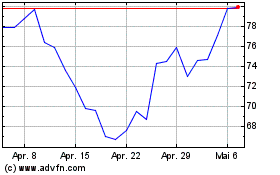

TransUnion (NYSE:TRU)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

TransUnion (NYSE:TRU)

Historical Stock Chart

Von Mai 2023 bis Mai 2024