TPG RE Finance Trust, Inc. (NYSE: TRTX) (“TRTX” or the

“Company”) reported its operating results for the quarter ended

September 30, 2024.

Regarding third quarter results, Doug Bouquard, Chief Executive

Officer of TRTX, said: “Over the past quarter, TRTX delivered

strong operating earnings, outearned our dividend by more than 115%

and had no risk rating migration while maintaining a stable CECL

reserve. As we seek to continue to take advantage of the attractive

opportunity set within real estate credit, TPG’s integrated global

real estate investing platform team enabled us to originate $204

million of new investments. We believe that this capital deployment

combined with our strong balance sheet and liquidity profile

positions us well to continue to drive long-term shareholder

value.”

THIRD QUARTER 2024 ACTIVITY

- Recognized GAAP net income attributable to common stockholders

of $18.7 million, or $0.23 per common share, based on a diluted

weighted average share count of 81.4 million common shares. Book

value per common share was $11.41 as of September 30, 2024.

- Generated Distributable Earnings of $23.0 million, or $0.28 per

common share, based on a diluted weighted average share count of

81.4 million common shares.

- Declared on September 13, 2024 a cash dividend of $0.24 per

share of common stock which was paid on October 25, 2024 to common

stockholders of record as of September 27, 2024. The Company paid

on September 30, 2024 to stockholders of record as of September 20,

2024 a quarterly dividend on its 6.25% Series C Cumulative

Redeemable Preferred Stock of $0.3906 per share.

- Originated three first mortgage loans with total loan

commitments of $204.0 million, an initial aggregate unpaid

principal balance of $199.8 million, a weighted average interest

rate of Term SOFR plus 3.17%, a weighted average interest rate

floor of 3.33% and a weighted average as-is loan-to-value ratio of

63.3%. Additionally, funded $7.6 million of future funding

obligations associated with previously originated and acquired

loans.

- Received loan repayments of $149.3 million, including three

full loan repayments of $141.1 million, involving the following

property types: 41.5% hotel; 35.8% multifamily; and 22.7%

mixed-use.

- Weighted average risk rating of the Company’s loan portfolio

was 3.0 as of September 30, 2024, unchanged from June 30,

2024.

- Carried at quarter-end an allowance for credit losses of $69.3

million, a decrease of $0.3 million from $69.6 million as of June

30, 2024. The quarter-end allowance equals 205 basis points of

total loan commitments as of September 30, 2024 compared to 208

basis points as of June 30, 2024.

- Ended the quarter with $357.0 million of near-term liquidity:

$211.3 million of cash-on-hand available for investment, net of

$15.0 million held to satisfy liquidity covenants under the

Company’s secured financing agreements; undrawn capacity under

secured financing arrangements of $128.1 million; and undrawn

capacity under asset-specific financing arrangements and secured

revolving credit facility of $2.6 million.

- Increased non-recourse, non-mark-to-market asset specific

financings by $72.0 million. Non-mark-to-market borrowings

represented 79.7% of total borrowings at September 30, 2024.

SUBSEQUENT EVENTS

- Received full loan repayments of two multifamily first mortgage

loans with aggregate total loan commitments and aggregate unpaid

principal balances of $70.6 million and $70.6 million,

respectively. The loans carried a risk rating of 3.0 as of

September 30, 2024.

The Company issued a supplemental presentation detailing its

third quarter 2024 operating results, which can be viewed at

http://investors.tpgrefinance.com/.

CONFERENCE CALL AND WEBCAST INFORMATION

The Company will host a conference call and webcast to review

its financial results with investors and other interested parties

at 9:00 a.m. ET on Wednesday, October 30, 2024. To participate in

the conference call, callers from the United States and Canada

should dial +1 (877) 407-9716, and international callers should

dial +1 (201) 493-6779, ten minutes prior to the scheduled call

time. The webcast may also be accessed live by visiting the

Company’s investor relations website at

http://investors.tpgrefinance.com/event.

REPLAY INFORMATION

A replay of the conference call will be available after 12:00

p.m. ET on Wednesday, October 30, 2024 through 11:59 p.m. ET on

Wednesday, November 13, 2024. To access the replay, listeners may

use +1 (844) 512-2921 (domestic) or +1 (412) 317-6671

(international). The passcode for the replay is 13745416. The

replay will be available on the Company’s website for one year

after the call date.

ABOUT TRTX

TPG RE Finance Trust, Inc. is a commercial real estate finance

company that originates, acquires, and manages primarily first

mortgage loans secured by institutional properties located in

primary and select secondary markets in the United States. The

Company is externally managed by TPG RE Finance Trust Management,

L.P., a part of TPG Real Estate, which is the real estate

investment platform of global alternative asset management firm TPG

Inc. (NASDAQ: TPG). For more information regarding TRTX, visit

https://www.tpgrefinance.com/.

FORWARD-LOOKING STATEMENTS

This earnings release contains “forward-looking statements”

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. These forward-looking statements are subject to various

risks and uncertainties, including, without limitation, statements

relating to the performance of the investments of TPG RE Finance

Trust, Inc. (the “Company” or “TRTX”); global economic trends and

economic conditions, including heightened inflation, slower growth

or recession, changes to fiscal and monetary policy, higher

interest rates, stress to the commercial banking systems of the

U.S. and Western Europe, labor shortages, currency fluctuations and

challenges in global supply chains; the Company's ability to

originate loans that are in the pipeline and under evaluation by

the Company; financing needs and arrangements; and the risks,

uncertainties and factors set forth under the heading “Risk

Factors” in the Company’s Annual Report on Form 10-K for the fiscal

year ended December 31, 2023, as such risk factors may be updated

from time to time in the Company’s periodic filings with the

Securities and Exchange Commission (the “SEC”), which are

accessible on the SEC’s website at www.sec.gov. Forward-looking

statements are generally identifiable by use of forward-looking

terminology such as “may,” “will,” “should,” “potential,” “intend,”

“expect,” “endeavor,” “seek,” “anticipate,” “estimate,” “believe,”

“could,” “project,” “predict,” “continue” or other similar words or

expressions. Forward-looking statements are based on certain

assumptions, discuss future expectations, describe existing or

future plans and strategies, contain projections of results of

operations, liquidity and/or financial condition or state other

forward-looking information. Statements, among others, relating to

the Company’s ability to take advantage of the attractive

opportunity set within real estate credit and drive long-term

shareholder value, are forward-looking statements, and the Company

cannot assure you that it will achieve such results. The ability of

TRTX to predict future events or conditions or their impact or the

actual effect of existing or future plans or strategies is

inherently uncertain. Although the Company believes that such

forward-looking statements are based on reasonable assumptions,

actual results and performance in the future could differ

materially from those set forth in or implied by such

forward-looking statements. You are cautioned not to place undue

reliance on these forward-looking statements, which reflect the

Company’s views only as of the date of this earnings release.

Except as required by law, neither the Company nor any other person

assumes responsibility for the accuracy and completeness of the

forward-looking statements appearing in this earnings release. The

Company does not undertake any obligation to update any

forward-looking statements contained in this earnings release as a

result of new information, future events or otherwise. Past

performance is not indicative nor a guarantee of future returns.

Yield data are shown for illustrative purposes only and have

limitations when used for comparison or for other purposes due to,

among other matters, volatility, credit or other factors.

Non-GAAP Financial Measures Reconciliation

Distributable Earnings

Distributable Earnings is a non-GAAP measure, which we define as

GAAP net income (loss) attributable to our common stockholders,

including realized gains and losses from loan write-offs, loan

sales and other loan resolutions (including conversions to real

estate owned (“REO”)), regardless of whether such items are

included in other comprehensive income or loss, or in GAAP net

income (loss), and excluding (i) non-cash stock compensation

expense, (ii) depreciation and amortization expense, (iii)

unrealized gains (losses) (including credit loss expense (benefit),

net), and (iv) certain non-cash or income and expense items. The

exclusion of depreciation and amortization expense from the

calculation of Distributable Earnings only applies to debt

investments related to real estate to the extent we foreclose upon

the property or properties underlying such debt investments.

We believe that Distributable Earnings provides meaningful

information to consider in addition to our net income (loss) and

cash flow from operating activities determined in accordance with

GAAP. We generally must distribute at least 90% of our net taxable

income annually, subject to certain adjustments and excluding any

net capital gains, for us to continue to qualify as a real estate

investment trust for U.S. federal income tax purposes. We believe

that one of the primary reasons investors purchase our common stock

is to receive our dividends. Because of our investors’ continued

focus on our ability to pay dividends, Distributable Earnings is an

important measure for us to consider when determining our

distribution policy and dividends per common share. Further,

Distributable Earnings helps us to evaluate our performance

excluding the effects of certain transactions and GAAP adjustments

that we believe are not necessarily indicative of our current loan

investment and operating activities.

Distributable Earnings excludes the impact of our credit loss

provision or reversals of our credit loss provision, but only to

the extent that our credit loss provision exceeds any realized

credit losses during the applicable reporting period.

A loan will be written off as a realized loss when it is deemed

non-recoverable or upon a realization event. Such a realized loss

would generally be recognized at the time the loan receivable is

settled, transferred or exchanged, or in the case of foreclosure,

when the underlying property is foreclosed upon or sold.

Non-recoverability may also be concluded by us if, in our

determination, it is nearly certain that all amounts due will not

be collected. A realized loss may equal the difference between the

cash or consideration received or expected to be received, and the

net book value of the loan, reflecting our economics as it relates

to the ultimate realization of the asset.

Distributable Earnings does not represent net income (loss) or

cash generated from operating activities and should not be

considered as an alternative to GAAP net income (loss), an

indication of our GAAP cash flows from operations, a measure of our

liquidity, or an indication of funds available for our cash needs.

In addition, our methodology for calculating Distributable Earnings

may differ from the methodologies employed by other companies to

calculate the same or similar supplemental performance measures,

and accordingly, our reported Distributable Earnings may not be

comparable to the Distributable Earnings reported by other

companies.

Reconciliation of GAAP Net Income Attributable to Common

Stockholders to Distributable Earnings

The table below reconciles GAAP net income attributable to

common stockholders and related diluted per share amounts to

Distributable Earnings and related diluted per share amounts ($ in

thousands, except per share data):

Three Months Ended,

September 30, 2024

Per Diluted Share(1)

Net income attributable to common

stockholders

$

18,676

$

0.23

Depreciation and amortization

3,453

0.04

Non-cash stock compensation expense

1,141

0.01

Credit loss (benefit), net

(301

)

—

Distributable earnings before realized

losses from loan sales and other loan resolutions

$

22,969

$

0.28

Realized loss on loan write-offs, loan

sales and REO conversions

—

—

Distributable earnings

$

22,969

$

0.28

Weighted average common shares

outstanding, diluted

81,365,205

_______________________________

(1)

Numbers presented may not foot due to

rounding.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241029406549/en/

INVESTOR RELATIONS +1 (212) 405-8500

IR@tpgrefinance.com

MEDIA TPG RE Finance Trust, Inc. Courtney Power +1 (415)

743-1550 media@tpg.com

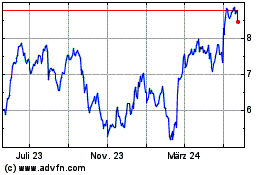

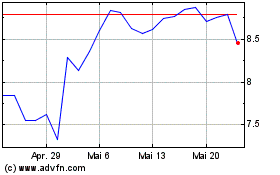

TPG Real Estate Finance (NYSE:TRTX)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

TPG Real Estate Finance (NYSE:TRTX)

Historical Stock Chart

Von Dez 2023 bis Dez 2024