0000730263 False 0000730263 2024-02-05 2024-02-05 iso4217:USD xbrli:shares iso4217:USD xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 5, 2024

_______________________________

THOR Industries, Inc.

(Exact name of registrant as specified in its charter)

_______________________________

| Delaware | 1-9235 | 93-0768752 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

601 East Beardsley Avenue

Elkhart, Indiana 46514-3305

(Address of Principal Executive Offices) (Zip Code)

(574) 970-7460

(Registrant's telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

_______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock (Par value $.10 Per Share) | THO | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On February 1, 2024, the Board of Directors (the “Board”) of THOR Industries, Inc. (the “Company”) appointed Jeffrey D. Lorenger as a director of the Company effective the same day.

Mr. Lorenger will serve as a member of the Company’s Environmental, Social, Governance, and Nominating Committee and the Compensation and Development Committee. Mr. Lorenger is the President, Chief Executive Officer, and Chairman of the Board of Directors of HNI Corporation. Mr. Lorenger will hold office until the 2024 Annual Meeting of Shareholders and until his successor is elected and qualified.

Mr. Lorenger will receive compensation as a non-employee director in accordance with the Company’s non-employee director compensation practices described in the Company’s Proxy Statement on Schedule 14A filed with the Securities and Exchange Commission on November 1, 2023. The compensation generally consists of an annual cash retainer of $170,000, payable quarterly, reimbursement of relevant expenses, and an annual award of restricted stock units, which vest on the first anniversary of the date of grant.

The Company is not aware of any arrangements or understandings between Mr. Lorenger and any other person pursuant to which he was selected as director of the Company and he has no direct or indirect material interest in any transaction or proposed transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

A copy of the Company’s press release announcing the appointment of Mr. Lorenger is attached as Exhibit 99.1 hereto and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | THOR Industries, Inc. |

| | | |

| | | |

| Date: February 5, 2024 | By: | /s/ Trevor Q. Gasper |

| | | Trevor Q. Gasper |

| | | Senior Vice President, General Counsel and Secretary |

| | | |

EXHIBIT 99.1

THOR Industries, Inc. Names Jeffrey D. Lorenger to Its Board of

Directors

ELKHART, Ind., Feb. 05, 2024 (GLOBE NEWSWIRE) -- THOR Industries, Inc. (NYSE: THO) announced today the appointment

of Jeffrey D. Lorenger to its Board of Directors, effective February 1, 2024.

Mr. Lorenger, age 58, is the President, Chief Executive Officer, and Chairman of the Board for HNI Corporation, a leading

manufacturer of workplace furnishings and residential building products. Mr. Lorenger has served in his role of President and CEO since

June 2018 and has been Chairman of the HNI Board of Directors since February 2020. Mr. Lorenger has a wide array of experience during

his 25 years at HNI including President of Office Furniture, President of Allsteel, and General Counsel of HNI prior to assuming his current

role.

Mr. Lorenger fills the Board seat recently vacated upon Wilson Jones’ retirement from the Board in December 2023.

With his appointment, THOR’s Board of Directors has nine members.

“We are very pleased to add Jeff to our Board of Directors. Jeff brings a deep understanding of the complexities

of manufacturing and managing independent distribution, and has a diverse background of leadership experience that will serve the Company

and its shareholders well in the years to come,” offered Chairman Andy Graves.

“Jeff’s decades of experience and successful track record in corporate leadership and manufacturing will

provide valuable insight as THOR continues to lead the recreational vehicle industry,” added Bob Martin, THOR President and CEO.

Mr. Lorenger holds three degrees from the University of Iowa, having received a BBA in Marketing, a Juris Doctorate,

and an MBA.

About THOR Industries, Inc.

THOR Industries is the sole owner of operating companies which, combined, represent the world’s largest manufacturer

of recreational vehicles.

For more information on the Company and its products, please go to www.thorindustries.com.

Forward-Looking Statements

This release includes certain statements that are "forward-looking" statements

within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are made based on management's current

expectations and beliefs regarding future and anticipated developments and their effects upon THOR, and inherently involve uncertainties

and risks. These forward-looking statements are not a guarantee of future performance. We cannot assure you that actual results will not

differ materially from our expectations. Factors which could cause materially different results include, among others: the impact of inflation

on the cost of our products as well as on general consumer demand; the effect of raw material and commodity price fluctuations, and/or

raw material, commodity or chassis supply constraints; the impact of war, military conflict, terrorism and/or cyber-attacks, including

state-sponsored or ransom attacks; the impact of sudden or significant adverse changes in the cost and/or availability of energy or fuel,

including those caused by geopolitical events, on our costs of operation, on raw material prices, on our suppliers, on our independent

dealers or on retail customers; the dependence on a small group of suppliers for certain components used in production, including chassis;

interest rate fluctuations and their potential impact on the general economy and, specifically, on our profitability and on our independent

dealers and consumers; the ability to ramp production up or down quickly in response to rapid changes in demand while also managing costs

and market share; the level and magnitude of warranty and recall claims incurred; the ability of our suppliers to financially support

any defects in their products; legislative, regulatory and tax law and/or policy developments including their potential impact on our

independent dealers, retail customers or on our suppliers; the costs of compliance with governmental regulation; the impact of an adverse

outcome or conclusion related to current or future litigation or regulatory investigations; public perception of and the costs related

to environmental, social and governance matters; legal and compliance issues including those that may arise in conjunction with recently

completed transactions; lower consumer confidence and the level of discretionary consumer spending; the impact of exchange rate fluctuations;

restrictive lending practices which could negatively impact our independent dealers and/or retail consumers; management changes; the success

of new and existing products and services; the ability to maintain strong brands and develop innovative products that meet consumer demands;

the ability to efficiently utilize existing production facilities; changes in consumer preferences; the risks associated with acquisitions,

including: the pace and successful closing of an acquisition, the integration and financial impact thereof, the level of achievement of

anticipated operating synergies from acquisitions, the potential for unknown or understated liabilities related to acquisitions, the potential

loss of existing customers of acquisitions and our ability to retain key management personnel of acquired companies; a shortage of necessary

personnel for production and increasing labor costs and related employee benefits to attract and retain production personnel in times

of high demand; the loss or reduction of sales to key independent dealers, and stocking level decisions of our independent dealers; disruption

of the delivery of units to independent dealers or the disruption of delivery of raw materials, including chassis, to our facilities;

increasing costs for freight and transportation; the ability to protect our information technology systems from data breaches, cyber-attacks

and/or network disruptions; asset impairment charges; competition; the impact of losses under repurchase agreements; the impact of the

strength of the U.S. dollar on international demand for products priced in U.S. dollars; general economic, market, public health and political

conditions in the various countries in which our products are produced and/or sold; the impact of changing emissions and other related

climate change regulations in the various jurisdictions in which our products are produced, used and/or sold; changes to our investment

and capital allocation strategies or other facets of our strategic plan; and changes in market liquidity conditions, credit ratings and

other factors that may impact our access to future funding and the cost of debt.

These and other risks and uncertainties are discussed more fully in our Quarterly Report on Form 10-Q for the quarter ended October

31, 2023 and in Item 1A of our Annual Report on Form 10-K for the year ended July 31, 2023.

We disclaim any obligation or undertaking to disseminate any updates or revisions to any forward-looking statements contained in this release

or to reflect any change in our expectations after the date hereof or any change in events, conditions or circumstances on which any statement

is based, except as required by law.

Contact

Mike Cieslak, CFA

mcieslak@thorindustries.com

(574) 294-7724

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/2f656274-9134-46ce-b173-96a61f0a86d0

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

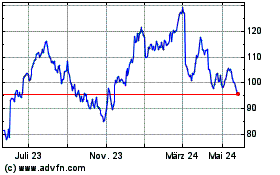

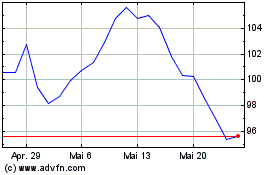

Thor Industries (NYSE:THO)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Thor Industries (NYSE:THO)

Historical Stock Chart

Von Dez 2023 bis Dez 2024