TFI International Inc. (NYSE and TSX: TFII), a North American

leader in the transportation and logistics industry, today

announced its results for the third quarter ended September 30,

2022. All amounts are shown in U.S. dollars.

“TFI International continued to perform

throughout the quarter even as broader macro uncertainty spread,

producing robust financial results including a 69% year-over-year

increase in adjusted operating income despite non-recurring

charges, and a 73% increase in free cash flow,” said Alain Bédard,

Chairman, President and Chief Executive Officer. “This resiliency

in the face of challenging industrywide conditions directly

reflects our end-market and business line diversity including

favorable exposure to large industrial end markets and only about a

third of our revenues derived from retail channels. In addition, it

reflects our team’s proven ability to constantly adjust to the

ever-changing landscape by never losing sight of our longstanding

operating principals. Our ability to rapidly adjust capacity to

match shifting demand is just one driver of the strong operating

ratios reported today across our business segments. What’s most

encouraging is the self-help nature of the opportunities ahead,

with multiple internal initiatives to enhance efficiencies by

replicating our past successes throughout our network. While

operationally we continue to excel, we’ve also maintained our focus

on strategic capital allocation, completing attractive tuck-in

acquisitions while continuing to repurchase shares, and today we

are pleased to announce yet another increase to our quarterly

dividend. Our talented team looks forward to sharing more on our

operating philosophies, our strategic direction and our ongoing

quest to create long-term shareholder value at our upcoming

Investor Day.”

|

Financial highlights |

Three months endedSeptember 30 |

|

|

Nine months endedSeptember 30 |

|

|

(in millions of U.S. dollars, except per share

data) |

2022 |

|

2021* |

|

|

2022 |

|

2021* |

|

|

Total revenue |

|

2,242.0 |

|

|

2,094.0 |

|

|

|

6,855.8 |

|

|

5,079.5 |

|

|

Revenue before fuel surcharge |

|

1,857.3 |

|

|

1,870.3 |

|

|

|

5,740.6 |

|

|

4,580.4 |

|

|

Adjusted EBITDA1 |

|

348.2 |

|

|

296.4 |

|

|

|

1,120.1 |

|

|

758.0 |

|

|

Operating income |

|

318.4 |

|

|

191.6 |

|

|

|

929.2 |

|

|

764.3 |

|

|

Net cash from operating activities |

|

337.8 |

|

|

211.2 |

|

|

|

723.3 |

|

|

665.0 |

|

|

Net income |

|

245.2 |

|

|

131.6 |

|

|

|

669.7 |

|

|

610.3 |

|

|

EPS - diluted ($) |

|

2.72 |

|

|

1.38 |

|

|

|

7.27 |

|

|

6.40 |

|

|

Adjusted net income1 |

|

181.2 |

|

|

138.9 |

|

|

|

579.9 |

|

|

349.7 |

|

|

Adjusted EPS - diluted1 ($) |

|

2.01 |

|

|

1.46 |

|

|

|

6.29 |

|

|

3.66 |

|

|

Weighted average number of shares ('000s) |

|

88,226 |

|

|

92,982 |

|

|

|

90,267 |

|

|

93,184 |

|

|

* Recasted for adjustments to provisional amounts of UPS Freight

prior year business combination |

|

1 This is a non-IFRS measure. For a reconciliation, please refer to

the “Non-IFRS Financial Measures” section below. |

THIRD QUARTER RESULTS

Total revenue of $2.24 billion was up 7% and,

net of fuel surcharge, revenue of $1.86 billion decrease by 1%

compared to the prior year period.

Operating income of $318.4 million compared to

$191.6 million the prior year period. The sale of CFI resulted in a

$75.7 million gain in the quarter, and the remainder of the

increase is from business acquisitions and organic growth across

the company, despite the impact of a non recurring charge for the

settlement of a legal claim for $11.4

million.

Net income of $245.2 million increased 86% from

$131.6 million in the prior year period, and net income of $2.72

per diluted share increased 97% from $1.38 in the prior year

period. Adjusted net income, a non-IFRS measure, was $181.2

million, or $2.01 per diluted share, up 30% from $138.9 million, or

$1.46 per diluted share, the prior year period.

For the Package and Courier segment, revenue

before fuel surcharge decreased 10% to $120.2 million and operating

income increased 42% to $33.9 million.

For the Less-Than-Truckload segment, revenue

before fuel surcharge decreased 5% to $817.2 million and operating

income increased 5% to $100.5 million.

For the Truckload segment, revenue before fuel

surcharge increased 4% to $510.2 million and operating income

increased 73% to $96.6 million.

For the Logistics segment, revenue before fuel

surcharge increased 4% to $424.1 million and operating income

decreased 13% to $29.0 million, as the current year period includes

a $11.4 million charge related to the settlement of a legal

claim.

NINE-MONTH RESULTS

For the first nine months of 2022, total revenue

of $6.86 billion was up 35% and, net of fuel surcharge, revenue of

$5.74 billion was up 25% compared to the prior year period.

Net income was $669.7 million, or $7.27 per

diluted share, compared to $610.3 million, or $6.40 per diluted

share a year ago, which included a $283.6 million bargain purchase

gain. Adjusted net income was $579.9 million compared to $349.7

million, an 66% increase.

During the first nine months of 2022, revenue

before fuel surcharge grew 56% for Less-Than-Truckload, 13% for

Truckload, 10% for Logistics and declined 10% for Package and

Courier. Operating income was higher across all segments in Q3 in

comparison to the prior year , after the impacts from the bargain

purchase gain recognized in 2021 have been excluded and the

non-recurring legal claim settlement expense of $11.4 million in

the Logistics segment.

|

SEGMENTED RESULTS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions of U.S. dollars) |

Three months ended September 30 |

|

Nine months ended September 30 |

|

|

|

2022 |

|

2021* |

|

2022 |

|

2021* |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

|

Revenue1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Package and Courier |

120.2 |

|

|

|

133.3 |

|

|

|

369.9 |

|

|

|

410.1 |

|

|

|

|

Less-Than-Truckload |

817.2 |

|

|

|

860.8 |

|

|

|

2,522.8 |

|

|

|

1,617.7 |

|

|

|

|

Truckload |

510.2 |

|

|

|

488.6 |

|

|

|

1,583.0 |

|

|

|

1,394.7 |

|

|

|

|

Logistics |

424.1 |

|

|

|

408.1 |

|

|

|

1,313.2 |

|

|

|

1,193.4 |

|

|

|

|

Eliminations |

(14.4 |

) |

|

|

(20.6 |

) |

|

|

(48.2 |

) |

|

|

(35.5 |

) |

|

|

|

|

1,857.3 |

|

|

|

1,870.3 |

|

|

|

5,740.6 |

|

|

|

4,580.4 |

|

|

|

|

|

$ |

|

% ofRev.1 |

|

$ |

|

% ofRev.1 |

|

$ |

|

% ofRev.1 |

|

$ |

|

% ofRev.1 |

|

|

Operating income (loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Package and Courier |

33.9 |

|

28.2 |

% |

23.9 |

|

17.9 |

% |

96.7 |

|

26.2 |

% |

71.7 |

|

17.5 |

% |

|

Less-Than-Truckload |

100.5 |

|

12.3 |

% |

95.9 |

|

11.1 |

% |

382.6 |

|

15.2 |

% |

469.3 |

|

29.0 |

% |

|

Truckload |

96.6 |

|

18.9 |

% |

55.8 |

|

11.4 |

% |

295.0 |

|

18.6 |

% |

168.4 |

|

12.1 |

% |

|

Logistics |

29.0 |

|

6.8 |

% |

33.3 |

|

8.2 |

% |

106.2 |

|

8.1 |

% |

109.9 |

|

9.2 |

% |

|

Corporate |

58.5 |

|

|

|

(17.2 |

) |

|

|

48.6 |

|

|

|

(55.1 |

) |

|

|

|

|

318.4 |

|

17.1 |

% |

191.6 |

|

10.2 |

% |

929.2 |

|

16.2 |

% |

764.3 |

|

16.7 |

% |

|

* Recasted for adjustments to provisional amounts of UPS Freight

prior year business combination |

|

Note: due to rounding, totals may differ slightly from the

sum. |

|

1 Revenue before fuel surcharge. |

CASH FLOW Net cash from

operating activities was $337.8 million during Q3 compared to

$211.2 million the prior year period. The increase was due to

working capital improvements of $55.6 million and from increased

contributions from net income. The Company returned $233.2 million

to shareholders during the quarter, of which $24.4 million was

through dividends and $198.8 million was through share

repurchases.

Net cash from investing activities increased

$518.2 million in Q3 from the comparative prior year period due the

sale of CFI which generated $548.3 million. The funds from the sale

of CFI were used to reduce the Company’s revolving credit facility.

This was offset by cash disbursements of $55.4 million for business

acquisitions.

On September 15, 2022, the Board of Directors of

TFI International declared a quarterly dividend of $0.27 per

outstanding common share paid on October 15, 2022, representing a

17% increase over the $0.23 quarterly dividend declared in Q3

2021.

On October 27, the Board of Directors approved a

quarterly dividend of $0.35 per outstanding common share to be paid

on January 13, 2023 to shareholders on record at the close of

business December 30, 2022. This represents a 30% increase over the

last quarterly dividend.

NORMAL COURSE ISSUER BID

RENEWALTFI International also announced that the Toronto

Stock Exchange (“TSX”) has approved the renewal of TFI

International’s normal course issuer bid (“NCIB”). Under the

renewed NCIB, TFI International may purchase for cancellation a

maximum of 6,370,199 common shares, representing 10% of the

63,701,991 shares forming TFI International’s public float. The

shares may be purchased through the facilities of the TSX and the

New York Stock Exchange and on alternative trading systems over the

twelve-month period from November 2, 2022 to November 1, 2023. As

of October 20, 2022, TFI International had 87,179,763 common shares

issued and outstanding.

Under TFI International’s current NCIB, which

entered into effect on November 2, 2021 and expires on November 1,

2022, TFI International is authorized to purchase up to 8,798,283

shares. As at October 20, 2022, TFI International has repurchased

6,635,855 shares at a volume weighted average purchase price of CAD

$118.01 per share, through the facilities of the TSX and on

alternative trading systems in Canada. All of the repurchased

shares were cancelled by TFI International.

Any shares purchased by TFI International under

the renewed NCIB will be at the market price of the shares at the

time of such purchases. The actual number of shares that may be

purchased and the timing of any such purchases will be determined

by TFI International. Any purchases made by TFI International

pursuant to the renewed NCIB will be made in accordance with the

rules and policies of the TSX or, as applicable, Rule 10b-18 under

the U.S. Securities Exchange Act of 1934, as amended. TSX rules

permit TFI International to purchase daily, through TSX facilities,

a maximum of 69,330 shares under the NCIB, subject to an exception

for a “block purchase” on the TSX once per calendar week.

The Board of Directors of TFI International

believes that, at appropriate times, repurchasing its shares

through the NCIB represents a good use of TFI International’s

financial resources, as such action can protect and enhance

shareholder value when opportunities arise.

In connection with the renewed NCIB, TFI

International has entered into an automatic share purchase plan

with RBC Dominion Securities Inc. in order to allow for purchases

under the NCIB during TFI International’s “black-out” periods, as

permitted by the TSX Company Manual and the Securities Act

(Québec). Outside of these “black-out” periods, TFI International

may repurchase shares at its discretion.

INVESTOR DAYAs previously

announced, TFI International will host an Investor Day at 8:30 a.m.

through 12 p.m. Eastern Time on Thursday, November 10, 2022 at the

New York Stock Exchange in New York City. Those interested in

attending may RSVP to TFIInvestorDayRSVP@icrinc.com as space will

be limited. The Investor Day will also be webcast live and via

replay by visiting the Events section of the Company’s website.

CONFERENCE CALLTFI

International will host a conference call on October 28, 2022, at

8:30 a.m. Eastern Time to discuss these results.Interested parties

can join the call by dialing 877-704-4453. A recording of the call

will be available until midnight, November 11, 2022, by dialing

844-512-2921 or 412-317-6671 and entering passcode 13732590.

ABOUT TFI INTERNATIONALTFI

International Inc. is a North American leader in the transportation

and logistics industry, operating across the United States and

Canada through its subsidiaries. TFI International creates value

for shareholders by identifying strategic acquisitions and managing

a growing network of wholly-owned operating subsidiaries. Under the

TFI International umbrella, companies benefit from financial and

operational resources to build their businesses and increase their

efficiency. TFI International companies service the following

segments:

- Package and Courier;

- Less-Than-Truckload;

- Truckload;

- Logistics.

TFI International Inc. is publicly traded on the

New York Stock Exchange and the Toronto Stock Exchange under symbol

TFII. For more information, visit www.tfiintl.com.

FORWARD-LOOKING STATEMENTSThe

Company may make statements in this report that reflect its current

expectations regarding future results of operations, performance

and achievements. These are “forward-looking” statements and

reflect management’s current beliefs. They are based on information

currently available to management. Words such as “may”, “might”,

“expect”, “intend”, “estimate”, “anticipate”, “plan”, “foresee”,

“believe”, “to its knowledge”, “could”, “design”, “forecast”,

“goal”, “hope”, “intend”, “likely”, “predict”, “project”, “seek”,

“should”, “target”, “will”, “would” or “continue” and words and

expressions of similar import are intended to identify these

forward-looking statements. Such forward-looking statements are

subject to certain risks and uncertainties that could cause actual

results to differ materially from historical results and those

presently anticipated or projected.

The Company wishes to caution readers not to

place undue reliance on any forward-looking statements which

reference issues only as of the date made. The following important

factors could cause the Company’s actual financial performance to

differ materially from that expressed in any forward-looking

statement: the highly competitive market conditions, the Company’s

ability to recruit, train and retain qualified drivers, fuel price

variations and the Company’s ability to recover these costs from

its customers, foreign currency fluctuations, the impact of

environmental standards and regulations, changes in governmental

regulations applicable to the Company’s operations, adverse weather

conditions, accidents, the market for used equipment, changes in

interest rates, cost of liability insurance coverage, downturns in

general economic conditions affecting the Company and its

customers, credit market liquidity, and the Company’s ability to

identify, negotiate, consummate, and successfully integrate

acquisitions.

The foregoing list should not be construed as

exhaustive, and the Company disclaims any subsequent obligation to

revise or update any previously made forward-looking statements

unless required to do so by applicable securities laws.

Unanticipated events are likely to occur. Readers should also refer

to the section “Risks and Uncertainties” at the end of the 2022 Q3

MD&A for additional information on risk factors and other

events that are not within the Company’s control. The Company’s

future financial and operating results may fluctuate as a result of

these and other risk factors.

NON-IFRS FINANCIAL MEASURESThis

press release includes references to certain non-IFRS financial

measures as described below. These non-IFRS measures do not have

any standardized meanings prescribed by International Financial

Reporting Standards (IFRS) as issued by the International

Accounting Standards Board (IASB) and are therefore unlikely to be

comparable to similar measures presented by other companies.

Accordingly, they should not be considered in isolation, in

addition to, not as a substitute for or superior to, measures of

financial performance prepared in accordance with IFRS. The terms

and definitions of the non-IFRS measures used in this press release

and a reconciliation of each non-IFRS measure to the most directly

comparable IFRS measure are provided below.

Adjusted EBITDA: Adjusted EBITDA is calculated

as net income before finance income and costs, income tax expense,

depreciation, amortization, bargain purchase gain, and gain or loss

on sale of land and buildings and assets held for sale. Management

believes adjusted EBITDA to be a useful supplemental measure.

Adjusted EBITDA is provided to assist in determining the ability of

the Company to assess its performance.

|

Adjusted EBITDA |

Three months ended September 30 |

|

Nine months ended September 30 |

|

|

(unaudited, in millions of U.S. dollars) |

2022 |

|

2021* |

|

2022 |

|

2021* |

|

|

Net income |

245.2 |

|

131.6 |

|

669.7 |

|

610.3 |

|

|

Net finance costs |

21.7 |

|

20.5 |

|

63.4 |

|

51.6 |

|

|

Income tax expense |

51.5 |

|

39.4 |

|

196.0 |

|

102.4 |

|

|

Depreciation of property and equipment |

61.2 |

|

62.3 |

|

192.1 |

|

159.7 |

|

|

Depreciation of right-of-use assets |

31.3 |

|

30.6 |

|

94.1 |

|

81.6 |

|

|

Amortization of intangible assets |

14.0 |

|

13.6 |

|

42.4 |

|

41.6 |

|

|

Gain on sale of business |

(75.7 |

) |

- |

|

(75.7 |

) |

- |

|

|

Bargain purchase gain |

- |

|

- |

|

- |

|

(283.6 |

) |

|

Gain on sale of land and buildings and assets held for sale |

(1.1 |

) |

(1.6 |

) |

(62.0 |

) |

(5.5 |

) |

|

Adjusted EBITDA |

348.2 |

|

296.4 |

|

1,120.1 |

|

758.0 |

|

|

* Recasted for adjustments to provisional amounts of UPS Freight

prior year business combination |

|

Note: due to rounding, totals may differ slightly from the

sum. |

|

|

Adjusted net income and adjusted earnings per

share (adjusted “EPS”), basic or dilutedAdjusted net income is

calculated as net income excluding amortization of intangible

assets related to business acquisitions, net change in the fair

value and accretion expense of contingent considerations, net

change in the fair value of derivatives, net foreign exchange gain

or loss, bargain purchase gain, gain or loss on sale of land and

buildings and assets held for sale, gain on sale of business and

directly attributable expenses due to the disposal of the business.

Adjusted earnings per share, basic or diluted, is calculated as

adjusted net income divided by the weighted average number of

common shares, basic or diluted. The Company uses adjusted net

income and adjusted earnings per share to measure its performance

from one period to the next, without the variation caused by the

impact of the items described above. The Company excludes these

items because they affect the comparability of its financial

results and could potentially distort the analysis of trends in its

business performance. Excluding these items does not imply they are

necessarily non-recurring.

|

Adjusted net income |

Three months ended September 30 |

|

Nine months ended September 30 |

|

|

(unaudited, in millions of U.S. dollars, except per share

data) |

2022 |

|

2021* |

|

2022 |

|

2021* |

|

|

Net income for the period |

245.2 |

|

131.6 |

|

669.7 |

|

610.3 |

|

|

Amortization of intangible assets related to business

acquisitions |

12.0 |

|

11.2 |

|

38.0 |

|

37.4 |

|

|

Net change in fair value and accretion expense of contingent

considerations |

0.1 |

|

0.2 |

|

0.1 |

|

0.4 |

|

|

Net foreign exchange loss (gain) |

0.9 |

|

0.2 |

|

1.1 |

|

(0.5 |

) |

|

Gain on sale of business, net of directly attributable

expenses |

(71.8 |

) |

- |

|

(71.8 |

) |

- |

|

|

Bargain purchase gain |

- |

|

- |

|

- |

|

(283.6 |

) |

|

(Gain) loss on sale of land and buildings and assets held for

sale |

(1.0 |

) |

(1.6 |

) |

(61.9 |

) |

(5.3 |

) |

|

Tax impact of adjustments |

(4.1 |

) |

(2.8 |

) |

4.6 |

|

(8.8 |

) |

|

Adjusted net income |

181.2 |

|

138.9 |

|

579.9 |

|

349.7 |

|

|

Adjusted earnings per share - basic |

2.05 |

|

1.49 |

|

6.42 |

|

3.75 |

|

|

Adjusted earnings per share - diluted |

2.01 |

|

1.46 |

|

6.29 |

|

3.66 |

|

|

* Recasted for adjustments to provisional amounts of UPS Freight

prior year business combination |

|

Note: due to rounding, totals may differ slightly from the

sum. |

|

|

Note to readers: Unaudited

condensed consolidated interim financial statements and

Management’s Discussion & Analysis are available on TFI

International’s website at www.tfiintl.com.

For further information:Alain

BédardChairman, President and CEOTFI International

Inc.647-729-4079abedard@tfiintl.com

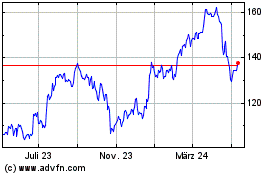

TFI (NYSE:TFII)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

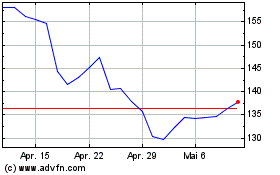

TFI (NYSE:TFII)

Historical Stock Chart

Von Dez 2023 bis Dez 2024