0000733590falseQ2202312/3100007335902023-01-012023-06-3000007335902023-08-10xbrli:shares00007335902023-06-30iso4217:USD00007335902022-12-310000733590us-gaap:RelatedPartyMember2022-12-310000733590us-gaap:RelatedPartyMember2023-06-30iso4217:USDxbrli:shares0000733590us-gaap:RelatedPartyMember2023-04-012023-06-300000733590us-gaap:RelatedPartyMember2022-04-012022-06-300000733590us-gaap:RelatedPartyMember2023-01-012023-06-300000733590us-gaap:RelatedPartyMember2022-01-012022-06-3000007335902023-04-012023-06-3000007335902022-04-012022-06-3000007335902022-01-012022-06-300000733590tci:NonconvertibleBondsMember2023-04-012023-06-300000733590tci:NonconvertibleBondsMember2022-04-012022-06-300000733590tci:NonconvertibleBondsMember2023-01-012023-06-300000733590tci:NonconvertibleBondsMember2022-01-012022-06-300000733590us-gaap:CommonStockMember2023-03-310000733590us-gaap:AdditionalPaidInCapitalMember2023-03-310000733590us-gaap:RetainedEarningsMember2023-03-310000733590us-gaap:ParentMember2023-03-310000733590us-gaap:NoncontrollingInterestMember2023-03-3100007335902023-03-310000733590us-gaap:RetainedEarningsMember2023-04-012023-06-300000733590us-gaap:ParentMember2023-04-012023-06-300000733590us-gaap:NoncontrollingInterestMember2023-04-012023-06-300000733590us-gaap:CommonStockMember2023-06-300000733590us-gaap:AdditionalPaidInCapitalMember2023-06-300000733590us-gaap:RetainedEarningsMember2023-06-300000733590us-gaap:ParentMember2023-06-300000733590us-gaap:NoncontrollingInterestMember2023-06-300000733590us-gaap:CommonStockMember2022-03-310000733590us-gaap:AdditionalPaidInCapitalMember2022-03-310000733590us-gaap:RetainedEarningsMember2022-03-310000733590us-gaap:ParentMember2022-03-310000733590us-gaap:NoncontrollingInterestMember2022-03-3100007335902022-03-310000733590us-gaap:RetainedEarningsMember2022-04-012022-06-300000733590us-gaap:ParentMember2022-04-012022-06-300000733590us-gaap:NoncontrollingInterestMember2022-04-012022-06-300000733590us-gaap:CommonStockMember2022-06-300000733590us-gaap:AdditionalPaidInCapitalMember2022-06-300000733590us-gaap:RetainedEarningsMember2022-06-300000733590us-gaap:ParentMember2022-06-300000733590us-gaap:NoncontrollingInterestMember2022-06-3000007335902022-06-300000733590us-gaap:CommonStockMember2022-12-310000733590us-gaap:AdditionalPaidInCapitalMember2022-12-310000733590us-gaap:RetainedEarningsMember2022-12-310000733590us-gaap:ParentMember2022-12-310000733590us-gaap:NoncontrollingInterestMember2022-12-310000733590us-gaap:RetainedEarningsMember2023-01-012023-06-300000733590us-gaap:ParentMember2023-01-012023-06-300000733590us-gaap:NoncontrollingInterestMember2023-01-012023-06-300000733590us-gaap:CommonStockMember2021-12-310000733590us-gaap:AdditionalPaidInCapitalMember2021-12-310000733590us-gaap:RetainedEarningsMember2021-12-310000733590us-gaap:ParentMember2021-12-310000733590us-gaap:NoncontrollingInterestMember2021-12-3100007335902021-12-310000733590us-gaap:RetainedEarningsMember2022-01-012022-06-300000733590us-gaap:ParentMember2022-01-012022-06-300000733590us-gaap:NoncontrollingInterestMember2022-01-012022-06-300000733590tci:AmericanRealtyInvestorsIncMemberus-gaap:MajorityShareholderMembertci:RelatedPartyEntitiesMember2023-06-30xbrli:pure0000733590tci:AmericanRealtyInvestorsIncMembertci:RelatedPartyEntitiesMember2023-06-300000733590srt:OfficeBuildingMember2023-06-30tci:propertyutr:sqft0000733590srt:ApartmentBuildingMember2023-06-30tci:apartment0000733590us-gaap:LandAndLandImprovementsMember2023-06-30utr:acre0000733590tci:CommericalPropertyMembertci:RegisRealtyPrimeLLCMember2023-06-300000733590tci:SeriesCBondsMember2023-01-012023-06-30tci:segment0000733590us-gaap:OperatingSegmentsMembertci:MultifamilySegmentMember2023-04-012023-06-300000733590us-gaap:OperatingSegmentsMembertci:MultifamilySegmentMember2022-04-012022-06-300000733590us-gaap:OperatingSegmentsMembertci:MultifamilySegmentMember2023-01-012023-06-300000733590us-gaap:OperatingSegmentsMembertci:MultifamilySegmentMember2022-01-012022-06-300000733590us-gaap:OperatingSegmentsMembertci:CommercialSegmentsMember2023-04-012023-06-300000733590us-gaap:OperatingSegmentsMembertci:CommercialSegmentsMember2022-04-012022-06-300000733590us-gaap:OperatingSegmentsMembertci:CommercialSegmentsMember2023-01-012023-06-300000733590us-gaap:OperatingSegmentsMembertci:CommercialSegmentsMember2022-01-012022-06-300000733590us-gaap:OperatingSegmentsMember2023-04-012023-06-300000733590us-gaap:OperatingSegmentsMember2022-04-012022-06-300000733590us-gaap:OperatingSegmentsMember2023-01-012023-06-300000733590us-gaap:OperatingSegmentsMember2022-01-012022-06-300000733590us-gaap:CorporateNonSegmentMember2023-04-012023-06-300000733590us-gaap:CorporateNonSegmentMember2022-04-012022-06-300000733590us-gaap:CorporateNonSegmentMember2023-01-012023-06-300000733590us-gaap:CorporateNonSegmentMember2022-01-012022-06-300000733590tci:LakeWalesMember2023-03-150000733590tci:LakeWalesMember2023-03-152023-03-150000733590tci:LakeWalesMember2023-01-012023-06-300000733590us-gaap:LandMember2023-04-012023-06-300000733590us-gaap:LandMember2022-04-012022-06-300000733590us-gaap:LandMember2023-01-012023-06-300000733590us-gaap:LandMember2022-01-012022-06-300000733590srt:MultifamilyMember2023-04-012023-06-300000733590srt:MultifamilyMember2022-04-012022-06-300000733590srt:MultifamilyMember2023-01-012023-06-300000733590srt:MultifamilyMember2022-01-012022-06-300000733590us-gaap:CommercialRealEstateMember2023-04-012023-06-300000733590us-gaap:CommercialRealEstateMember2022-04-012022-06-300000733590us-gaap:CommercialRealEstateMember2023-01-012023-06-300000733590us-gaap:CommercialRealEstateMember2022-01-012022-06-300000733590srt:OtherPropertyMember2023-04-012023-06-300000733590srt:OtherPropertyMember2022-04-012022-06-300000733590srt:OtherPropertyMember2023-01-012023-06-300000733590srt:OtherPropertyMember2022-01-012022-06-300000733590tci:ToulonMemberus-gaap:DisposalGroupHeldForSaleOrDisposedOfBySaleNotDiscontinuedOperationsMember2022-01-140000733590tci:ToulonMemberus-gaap:DisposalGroupHeldForSaleOrDisposedOfBySaleNotDiscontinuedOperationsMember2022-01-142022-01-140000733590us-gaap:DisposalGroupHeldForSaleOrDisposedOfBySaleNotDiscontinuedOperationsMember2022-01-142022-01-140000733590tci:ABCLandAndDevelopmentIncMemberus-gaap:NotesReceivableMember2023-06-300000733590tci:ABCLandAndDevelopmentIncMemberus-gaap:NotesReceivableMember2022-12-310000733590tci:ABCLandAndDevelopmentIncMemberus-gaap:NotesReceivableMember2023-01-012023-06-300000733590tci:ABCParadiseLLCMemberus-gaap:NotesReceivableMember2023-06-300000733590tci:ABCParadiseLLCMemberus-gaap:NotesReceivableMember2022-12-310000733590tci:ABCParadiseLLCMemberus-gaap:NotesReceivableMember2023-01-012023-06-300000733590tci:AutumnBreezeMemberus-gaap:NotesReceivableMember2023-06-300000733590tci:AutumnBreezeMemberus-gaap:NotesReceivableMember2022-12-310000733590tci:AutumnBreezeMemberus-gaap:NotesReceivableMember2023-01-012023-06-300000733590tci:BellwetherRidgeMemberus-gaap:NotesReceivableMember2023-06-300000733590tci:BellwetherRidgeMemberus-gaap:NotesReceivableMember2022-12-310000733590tci:BellwetherRidgeMemberus-gaap:NotesReceivableMember2023-01-012023-06-300000733590tci:DominionAtMercerCrossingMemberus-gaap:NotesReceivableMember2023-06-300000733590tci:DominionAtMercerCrossingMemberus-gaap:NotesReceivableMember2022-12-310000733590tci:DominionAtMercerCrossingMemberus-gaap:NotesReceivableMember2023-01-012023-06-300000733590tci:ForestPinesMemberus-gaap:NotesReceivableMember2023-06-300000733590tci:ForestPinesMemberus-gaap:NotesReceivableMember2022-12-310000733590tci:ForestPinesMemberus-gaap:NotesReceivableMember2023-01-012023-06-300000733590tci:LegacyPleasantGroveMemberus-gaap:NotesReceivableMember2023-06-300000733590tci:LegacyPleasantGroveMemberus-gaap:NotesReceivableMember2022-12-310000733590tci:LegacyPleasantGroveMemberus-gaap:NotesReceivableMember2023-01-012023-06-300000733590tci:McKinneyRanchMemberus-gaap:NotesReceivableMember2023-06-300000733590tci:McKinneyRanchMemberus-gaap:NotesReceivableMember2022-12-310000733590tci:McKinneyRanchMemberus-gaap:NotesReceivableMember2023-01-012023-06-300000733590tci:OneRealcoLandHoldingIncMemberus-gaap:NotesReceivableMember2023-06-300000733590tci:OneRealcoLandHoldingIncMemberus-gaap:NotesReceivableMember2022-12-310000733590tci:OneRealcoLandHoldingIncMemberus-gaap:NotesReceivableMember2023-01-012023-06-300000733590tci:ParcAtInglesideMemberus-gaap:NotesReceivableMember2023-06-300000733590tci:ParcAtInglesideMemberus-gaap:NotesReceivableMember2022-12-310000733590tci:ParcAtInglesideMemberus-gaap:NotesReceivableMember2023-01-012023-06-300000733590tci:ParcAtOpelikaMemberus-gaap:NotesReceivableMember2023-06-300000733590tci:ParcAtOpelikaMemberus-gaap:NotesReceivableMember2022-12-310000733590tci:ParcAtOpelikaMemberus-gaap:NotesReceivableMember2023-01-012023-06-300000733590tci:ParcAtWindmillFarmsMemberus-gaap:NotesReceivableMember2023-06-300000733590tci:ParcAtWindmillFarmsMemberus-gaap:NotesReceivableMember2022-12-310000733590tci:ParcAtWindmillFarmsMemberus-gaap:NotesReceivableMember2023-01-012023-06-300000733590tci:PhillipsFoundationForBetterLivingIncMaturingMarch312024Memberus-gaap:NotesReceivableMember2023-06-300000733590tci:PhillipsFoundationForBetterLivingIncMaturingMarch312024Memberus-gaap:NotesReceivableMember2022-12-310000733590tci:PhillipsFoundationForBetterLivingIncMaturingMarch312024Memberus-gaap:NotesReceivableMember2023-01-012023-06-300000733590tci:PlumTreeMemberus-gaap:NotesReceivableMember2023-06-300000733590tci:PlumTreeMemberus-gaap:NotesReceivableMember2022-12-310000733590tci:PlumTreeMemberus-gaap:NotesReceivableMember2023-01-012023-06-300000733590tci:PolkCountyLandMemberus-gaap:NotesReceivableMember2023-06-300000733590tci:PolkCountyLandMemberus-gaap:NotesReceivableMember2022-12-310000733590tci:PolkCountyLandMemberus-gaap:NotesReceivableMember2023-01-012023-06-300000733590tci:RiverviewOnTheParkLandLLCMemberus-gaap:NotesReceivableMember2023-06-300000733590tci:RiverviewOnTheParkLandLLCMemberus-gaap:NotesReceivableMember2022-12-310000733590tci:RiverviewOnTheParkLandLLCMemberus-gaap:NotesReceivableMember2023-01-012023-06-300000733590tci:SpartanLandMemberus-gaap:NotesReceivableMember2023-06-300000733590tci:SpartanLandMemberus-gaap:NotesReceivableMember2022-12-310000733590tci:SpartanLandMemberus-gaap:NotesReceivableMember2023-01-012023-06-300000733590tci:SpyglassOfEnnisMemberus-gaap:NotesReceivableMember2023-06-300000733590tci:SpyglassOfEnnisMemberus-gaap:NotesReceivableMember2022-12-310000733590tci:SpyglassOfEnnisMemberus-gaap:NotesReceivableMember2023-01-012023-06-300000733590tci:SteepleCrestMemberus-gaap:NotesReceivableMember2023-06-300000733590tci:SteepleCrestMemberus-gaap:NotesReceivableMember2022-12-310000733590tci:SteepleCrestMemberus-gaap:NotesReceivableMember2023-01-012023-06-300000733590tci:UnifiedHousingFoundationIncMaturingJune302023AMemberus-gaap:NotesReceivableMember2023-06-300000733590tci:UnifiedHousingFoundationIncMaturingJune302023AMemberus-gaap:NotesReceivableMember2022-12-310000733590tci:UnifiedHousingFoundationIncMaturingJune302023AMemberus-gaap:NotesReceivableMember2023-01-012023-06-300000733590tci:UnifiedHousingFoundationIncMaturingMarch312022Memberus-gaap:NotesReceivableMember2023-06-300000733590tci:UnifiedHousingFoundationIncMaturingMarch312022Memberus-gaap:NotesReceivableMember2022-12-310000733590tci:UnifiedHousingFoundationIncMaturingMarch312022Memberus-gaap:NotesReceivableMember2023-01-012023-06-300000733590tci:UnifiedHousingFoundationIncMaturingMarch312023Memberus-gaap:NotesReceivableMember2023-06-300000733590tci:UnifiedHousingFoundationIncMaturingMarch312023Memberus-gaap:NotesReceivableMember2022-12-310000733590tci:UnifiedHousingFoundationIncMaturingMarch312023Memberus-gaap:NotesReceivableMember2023-01-012023-06-300000733590tci:UnifiedHousingFoundationIncMaturingMay312023Memberus-gaap:NotesReceivableMember2023-06-300000733590tci:UnifiedHousingFoundationIncMaturingMay312023Memberus-gaap:NotesReceivableMember2022-12-310000733590tci:UnifiedHousingFoundationIncMaturingMay312023Memberus-gaap:NotesReceivableMember2023-01-012023-06-300000733590tci:UnifiedHousingFoundationIncMaturingDecember312032Memberus-gaap:NotesReceivableMember2023-06-300000733590tci:UnifiedHousingFoundationIncMaturingDecember312032Memberus-gaap:NotesReceivableMember2022-12-310000733590tci:UnifiedHousingFoundationIncMaturingDecember312032Memberus-gaap:NotesReceivableMember2023-01-012023-06-300000733590tci:UnifiedHousingFoundationIncMaturingMarch312024Memberus-gaap:NotesReceivableMember2023-06-300000733590tci:UnifiedHousingFoundationIncMaturingMarch312024Memberus-gaap:NotesReceivableMember2022-12-310000733590tci:UnifiedHousingFoundationIncMaturingMarch312024Memberus-gaap:NotesReceivableMember2023-01-012023-06-300000733590tci:UnifiedHousingFoundationIncApril302024Memberus-gaap:NotesReceivableMember2023-06-300000733590tci:UnifiedHousingFoundationIncApril302024Memberus-gaap:NotesReceivableMember2022-12-310000733590tci:UnifiedHousingFoundationIncApril302024Memberus-gaap:NotesReceivableMember2023-01-012023-06-300000733590tci:UnifiedHousingFoundationIncMaturingJune302024Memberus-gaap:NotesReceivableMember2023-06-300000733590tci:UnifiedHousingFoundationIncMaturingJune302024Memberus-gaap:NotesReceivableMember2022-12-310000733590tci:UnifiedHousingFoundationIncMaturingJune302024Memberus-gaap:NotesReceivableMember2023-01-012023-06-300000733590us-gaap:NotesReceivableMember2023-06-300000733590us-gaap:NotesReceivableMember2022-12-310000733590us-gaap:PrimeRateMembertci:DominionAtMercerCrossingMemberus-gaap:NotesReceivableMember2023-01-012023-06-300000733590tci:VictoryAbodeApartmentsLLCMemberus-gaap:CorporateJointVentureMember2018-11-160000733590tci:VictoryAbodeApartmentsLLCMemberus-gaap:CorporateJointVentureMembertci:VictoryAbodeApartmentsLLCMember2018-11-160000733590us-gaap:CorporateJointVentureMemberus-gaap:CapitalUnitClassAMembertci:VictoryAbodeApartmentsLLCMember2018-11-160000733590us-gaap:CapitalUnitClassBMemberus-gaap:CorporateJointVentureMembertci:VictoryAbodeApartmentsLLCMember2018-11-160000733590us-gaap:CorporateJointVentureMember2018-11-160000733590us-gaap:CorporateJointVentureMember2018-11-162018-11-160000733590tci:MacquarieGroupMember2018-11-160000733590tci:VictoryAbodeApartmentsLLCMemberus-gaap:CorporateJointVentureMemberus-gaap:DisposalGroupHeldForSaleOrDisposedOfBySaleNotDiscontinuedOperationsMember2022-09-160000733590tci:VAASalePortfolioMemberus-gaap:DisposalGroupHeldForSaleOrDisposedOfBySaleNotDiscontinuedOperationsMember2022-09-162022-09-160000733590tci:VictoryAbodeApartmentsLLCMemberus-gaap:CorporateJointVentureMemberus-gaap:DisposalGroupHeldForSaleOrDisposedOfBySaleNotDiscontinuedOperationsMember2022-11-010000733590tci:VAASalePortfolioMemberus-gaap:DisposalGroupHeldForSaleOrDisposedOfBySaleNotDiscontinuedOperationsMember2022-11-012022-11-010000733590tci:VictoryAbodeApartmentsLLCMemberus-gaap:CorporateJointVentureMembertci:VAASalePortfolioMember2023-03-232023-03-230000733590tci:VictoryAbodeApartmentsLLCMemberus-gaap:CorporateJointVentureMember2023-06-300000733590tci:VictoryAbodeApartmentsLLCMemberus-gaap:CorporateJointVentureMember2022-12-310000733590us-gaap:CorporateJointVentureMember2023-04-012023-06-300000733590us-gaap:CorporateJointVentureMember2022-04-012022-06-300000733590us-gaap:CorporateJointVentureMember2023-01-012023-06-300000733590us-gaap:CorporateJointVentureMember2022-01-012022-06-300000733590tci:VAAHoldbackPortfolioMember2022-11-010000733590tci:BlueLakeVillasMembertci:VAAHoldbackPortfolioMember2022-11-010000733590tci:BlueLakeVillasPhaseIIMembertci:VAAHoldbackPortfolioMember2022-11-010000733590tci:NorthsideOnTravisMembertci:VAAHoldbackPortfolioMember2022-11-010000733590tci:ParcAtDenhamSpringsMembertci:VAAHoldbackPortfolioMember2022-11-010000733590tci:ResidencesAtHollandLakeMembertci:VAAHoldbackPortfolioMember2022-11-010000733590tci:VAAHoldbackPortfolioMembertci:VillasOfParkWestIMember2022-11-010000733590tci:VillasOfParkWestIIMembertci:VAAHoldbackPortfolioMember2022-11-010000733590tci:VAAHoldbackPortfolioMember2023-01-012023-06-300000733590tci:A770SouthPostOakMemberus-gaap:MortgagesMember2023-06-300000733590tci:A770SouthPostOakMemberus-gaap:MortgagesMember2022-12-310000733590us-gaap:MortgagesMembertci:AthensMember2023-06-300000733590us-gaap:MortgagesMembertci:AthensMember2022-12-310000733590tci:BlueLakeVillas1Memberus-gaap:MortgagesMember2023-06-300000733590tci:BlueLakeVillas1Memberus-gaap:MortgagesMember2022-12-310000733590us-gaap:MortgagesMembertci:BlueLakeVillasPhaseII1Member2023-06-300000733590us-gaap:MortgagesMembertci:BlueLakeVillasPhaseII1Member2022-12-310000733590us-gaap:MortgagesMembertci:ChelseaMember2023-06-300000733590us-gaap:MortgagesMembertci:ChelseaMember2022-12-310000733590us-gaap:MortgagesMembertci:EQKPortageLandMember2023-06-300000733590us-gaap:MortgagesMembertci:EQKPortageLandMember2022-12-310000733590us-gaap:MortgagesMembertci:ForestGroveMember2023-06-300000733590us-gaap:MortgagesMembertci:ForestGroveMember2022-12-310000733590us-gaap:MortgagesMembertci:LandingBayouMember2023-06-300000733590us-gaap:MortgagesMembertci:LandingBayouMember2022-12-310000733590us-gaap:MortgagesMembertci:LegacyAtPleasantGroveMember2023-06-300000733590us-gaap:MortgagesMembertci:LegacyAtPleasantGroveMember2022-12-310000733590us-gaap:MortgagesMembertci:NorthsideOnTravis1Member2023-06-300000733590us-gaap:MortgagesMembertci:NorthsideOnTravis1Member2022-12-310000733590us-gaap:MortgagesMembertci:ParcAtDenhamSprings1Member2023-06-300000733590us-gaap:MortgagesMembertci:ParcAtDenhamSprings1Member2022-12-310000733590tci:ParcAtDenhamSpringsPhaseIIMemberus-gaap:MortgagesMember2023-06-300000733590tci:ParcAtDenhamSpringsPhaseIIMemberus-gaap:MortgagesMember2022-12-310000733590us-gaap:MortgagesMembertci:RCMHCEnterprisesMember2023-06-300000733590us-gaap:MortgagesMembertci:RCMHCEnterprisesMember2022-12-310000733590tci:ResidencesAtHollandLake1Memberus-gaap:MortgagesMember2023-06-300000733590tci:ResidencesAtHollandLake1Memberus-gaap:MortgagesMember2022-12-310000733590us-gaap:MortgagesMembertci:VillasAtBonSecourMember2023-06-300000733590us-gaap:MortgagesMembertci:VillasAtBonSecourMember2022-12-310000733590us-gaap:MortgagesMembertci:VillasOfParkWestI1Member2023-06-300000733590us-gaap:MortgagesMembertci:VillasOfParkWestI1Member2022-12-310000733590us-gaap:MortgagesMembertci:VillasOfParkWestII1Member2023-06-300000733590us-gaap:MortgagesMembertci:VillasOfParkWestII1Member2022-12-310000733590us-gaap:MortgagesMembertci:VistaRidgeMember2023-06-300000733590us-gaap:MortgagesMembertci:VistaRidgeMember2022-12-310000733590us-gaap:MortgagesMembertci:WindmillFarmsMember2023-06-300000733590us-gaap:MortgagesMembertci:WindmillFarmsMember2022-12-310000733590us-gaap:MortgagesMember2023-06-300000733590us-gaap:MortgagesMember2022-12-310000733590us-gaap:MortgagesMembertci:WindmillFarmsMember2023-02-280000733590tci:LakeWalesMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-03-152023-03-15tci:extension_option0000733590tci:SeriesABondsMember2022-12-310000733590tci:SeriesABondsMember2022-01-012022-12-310000733590tci:SeriesBBondsMember2022-12-310000733590tci:SeriesBBondsMember2022-01-012022-12-310000733590tci:SeriesCBondsMember2022-12-310000733590tci:SeriesCBondsMember2022-01-012022-12-310000733590tci:BrowningPlaceMembertci:SeriesCBondsMember2022-12-310000733590tci:MayRealtyHoldingsIncMembertci:AmericanRealtyInvestorsIncMembersrt:AffiliatedEntityMember2023-06-300000733590tci:PillarAndRegisMembersrt:AffiliatedEntityMember2023-04-012023-06-300000733590tci:PillarAndRegisMembersrt:AffiliatedEntityMember2022-04-012022-06-300000733590tci:PillarAndRegisMembersrt:AffiliatedEntityMember2023-01-012023-06-300000733590tci:PillarAndRegisMembersrt:AffiliatedEntityMember2022-01-012022-06-300000733590srt:AffiliatedEntityMembertci:RegisMember2023-04-012023-06-300000733590srt:AffiliatedEntityMembertci:RegisMember2022-04-012022-06-300000733590srt:AffiliatedEntityMembertci:RegisMember2023-01-012023-06-300000733590srt:AffiliatedEntityMembertci:RegisMember2022-01-012022-06-300000733590tci:PillarMembersrt:AffiliatedEntityMember2023-04-012023-06-300000733590tci:PillarMembersrt:AffiliatedEntityMember2022-04-012022-06-300000733590tci:PillarMembersrt:AffiliatedEntityMember2023-01-012023-06-300000733590tci:PillarMembersrt:AffiliatedEntityMember2022-01-012022-06-300000733590srt:AffiliatedEntityMembertci:UHFAndPillarMember2023-04-012023-06-300000733590srt:AffiliatedEntityMembertci:UHFAndPillarMember2022-04-012022-06-300000733590srt:AffiliatedEntityMembertci:UHFAndPillarMember2023-01-012023-06-300000733590srt:AffiliatedEntityMembertci:UHFAndPillarMember2022-01-012022-06-300000733590tci:IncomeOpportunityRealtyInvestorsIncMember2023-06-300000733590tci:IncomeOpportunityRealtyInvestorsIncMember2022-06-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2023

or

| | | | | |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ________ to________

Commission File Number 001-09240

TRANSCONTINENTAL REALTY INVESTORS, INC.

(Exact Name of Registrant as Specified in Its Charter)

| | | | | |

| Nevada | 94-6565852 |

(State or Other Jurisdiction of

Incorporation or Organization) | (I.R.S. Employer

Identification No.) |

1603 Lyndon B. Johnson Freeway, Suite 800, Dallas, Texas 75234

(Address of principal executive offices) (Zip Code)

(469) 522-4200

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Exchange Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

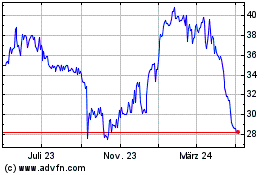

| Common Stock | TCI | NYSE |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). x Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

Large accelerated filer ☐ | Accelerated filer ☐ | Non-accelerated filer ☒ | Smaller reporting company ☒ |

Emerging growth Company ☐ | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes x No.

As of August 10, 2023, there were 8,639,316 shares of common stock outstanding.

TRANSCONTINENTAL REALTY INVESTORS, INC.

FORM 10-Q

TABLE OF CONTENTS

TRANSCONTINENTAL REALTY INVESTORS, INC.

CONSOLIDATED BALANCE SHEETS

(dollars in thousands, except share and par value amounts)

(Unaudited)

| | | | | | | | | | | |

| June 30, 2023 | | December 31, 2022 |

| Assets | | | |

| Real estate | $ | 501,262 | | | $ | 493,821 | |

| Cash and cash equivalents | 58,868 | | | 113,424 | |

| Restricted cash | 10,938 | | | 108,883 | |

| Short-term investments | 136,972 | | | 119,787 | |

Notes receivable (including $66,630 at June 30, 2023 and December 31, 2022 from related parties) | 135,556 | | | 129,304 | |

| Investment in unconsolidated joint venture | 701 | | | 20,904 | |

| Receivables from related parties, net | 146,148 | | | 147,142 | |

Other assets (including $3,985 at June 30, 2023 and $4,040 at December 31, 2022 from related parties) | 91,083 | | | 84,900 | |

| Total assets | $ | 1,081,528 | | | $ | 1,218,165 | |

| Liabilities and Equity | | | |

| Liabilities: | | | |

| Mortgages and other notes payable | $ | 180,830 | | | $ | 184,462 | |

| Bonds payable | — | | | 129,218 | |

Accounts payable and other liabilities (including $1,201 at June 30, 2023 and $599 at December 31, 2022 to related parties) | 52,622 | | | 58,094 | |

| Accrued interest | 2,292 | | | 5,198 | |

| Deferred revenue | 581 | | | 581 | |

| Total liabilities | 236,325 | | | 377,553 | |

| Equity | | | |

| Shareholders' Equity: | | | |

Common stock, $0.01 par value, 10,000,000 shares authorized; 8,639,316 shares issued and outstanding | 86 | | | 86 | |

| Additional paid-in capital | 260,387 | | | 260,387 | |

| Retained earnings | 563,041 | | | 558,994 | |

| Total shareholders' equity | 823,514 | | | 819,467 | |

| Noncontrolling interest | 21,689 | | | 21,145 | |

| Total equity | 845,203 | | | 840,612 | |

| Total liabilities and equity | $ | 1,081,528 | | | $ | 1,218,165 | |

The accompanying notes are an integral part of these consolidated financial statements.

TRANSCONTINENTAL REALTY INVESTORS, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(dollars in thousands, except per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenues: | | | | | | | |

Rental revenues (including $231 and $223 for the three months ended June 30, 2023 and 2022, respectively, and $499 and $479 for the six months ended June 30, 2023 and 2022, respectively, from related parties) | $ | 11,389 | | | $ | 7,259 | | | $ | 22,398 | | | $ | 14,740 | |

| Other income | 850 | | | 511 | | | 1,529 | | | 817 | |

| Total revenue | 12,239 | | | 7,770 | | | 23,927 | | | 15,557 | |

| Expenses: | | | | | | | |

Property operating expenses (including $99 and $110 for the three months ended June 30, 2023 and 2022, respectively, and $199 and $227 for the six months ended June 30, 2023 and 2022, respectively, from related parties) | 7,031 | | | 3,812 | | | 13,137 | | | 7,840 | |

| Depreciation and amortization | 3,200 | | | 2,298 | | | 6,302 | | | 4,647 | |

General and administrative (including $627 and $642 for the three months ended June 30, 2023 and 2022, respectively, and $2,058 and $1,934 for the six months ended June 30, 2023 and 2022, respectively, from related parties) | 3,521 | | | 2,061 | | | 6,404 | | | 4,592 | |

| Advisory fee to related party | 2,000 | | | 2,446 | | | 4,170 | | | 5,451 | |

| Total operating expenses | 15,752 | | | 10,617 | | | 30,013 | | | 22,530 | |

| Net operating loss | (3,513) | | | (2,847) | | | (6,086) | | | (6,973) | |

Interest income (including $5,303 and $3,753 for the three months ended June 30, 2023 and 2022, respectively, and $10,440 and $7,298 for the six months ended June 30, 2023 and 2022, respectively, from related parties) | 8,494 | | | 4,387 | | | 17,322 | | | 9,783 | |

| Interest expense | (2,426) | | | (4,541) | | | (5,513) | | | (9,150) | |

| Gain on foreign currency transactions | 22 | | | 14,132 | | | 993 | | | 17,904 | |

| Loss on early extinguishment of debt | (1,710) | | | — | | | (1,710) | | | (1,639) | |

| Equity in income from unconsolidated joint venture | 25 | | | 1,637 | | | 713 | | | 6,343 | |

| Gain on sale or write-down of assets, net | 188 | | | 3,893 | | | 188 | | | 15,041 | |

| Income tax provision | (204) | | | (40) | | | (1,316) | | | (68) | |

| Net income | 876 | | | 16,621 | | | 4,591 | | | 31,241 | |

| Net income attributable to noncontrolling interest | (346) | | | (160) | | | (544) | | | (278) | |

| Net income attributable to the Company | $ | 530 | | | $ | 16,461 | | | $ | 4,047 | | | $ | 30,963 | |

| | | | | | | |

| Earnings per share - basic and diluted | $ | 0.06 | | | $ | 1.91 | | | $ | 0.47 | | | $ | 3.58 | |

| Weighted average common shares used in computing earnings per share - basic and diluted | 8,639,316 | | | 8,639,316 | | | 8,639,316 | | | 8,639,316 | |

The accompanying notes are an integral part of these consolidated financial statements.

TRANSCONTINENTAL REALTY INVESTORS, INC.

CONSOLIDATED STATEMENTS OF EQUITY

(dollars in thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | | | Additional Paid-in

Capital | | Retained

Earnings | | Total Shareholders' Equity | | Noncontrolling

Interest | | Total Equity |

|

| Three Months Ended June 30, 2023 | | | | | | | | | | | | | | |

| Balance, April 1, 2023 | | $ | 86 | | | | | $ | 260,387 | | | $ | 562,511 | | | $ | 822,984 | | | $ | 21,343 | | | $ | 844,327 | |

| Net income | | — | | | | | — | | | 530 | | | 530 | | | 346 | | | 876 | |

| Balance, June 30, 2023 | | $ | 86 | | | | | $ | 260,387 | | | $ | 563,041 | | | $ | 823,514 | | | $ | 21,689 | | | $ | 845,203 | |

| Three Months Ended June 30, 2022 | | | | | | | | | | | | | | |

| Balance, April 1, 2022 | | $ | 86 | | | | | $ | 260,387 | | | $ | 105,234 | | | $ | 365,707 | | | $ | 20,521 | | | $ | 386,228 | |

| Net income | | — | | | | | — | | | 16,461 | | | 16,461 | | | 160 | | | 16,621 | |

| | | | | | | | | | | | | | |

| Balance, June 30, 2022 | | $ | 86 | | | | | $ | 260,387 | | | $ | 121,695 | | | $ | 382,168 | | | $ | 20,681 | | | $ | 402,849 | |

| Six Months Ended June 30, 2023 | | | | | | | | | | | | | | |

| Balance, January 1, 2023 | | $ | 86 | | | | | $ | 260,387 | | | $ | 558,994 | | | $ | 819,467 | | | $ | 21,145 | | | $ | 840,612 | |

| Net income | | — | | | | | — | | | 4,047 | | | 4,047 | | | 544 | | | 4,591 | |

| Balance, June 30, 2023 | | $ | 86 | | | | | $ | 260,387 | | | $ | 563,041 | | | $ | 823,514 | | | $ | 21,689 | | | $ | 845,203 | |

| Six Months Ended June 30, 2022 | | | | | | | | | | | | | | |

| Balance, January 1, 2022 | | $ | 86 | | | | | $ | 260,387 | | | $ | 90,732 | | | $ | 351,205 | | | $ | 20,403 | | | $ | 371,608 | |

| Net income | | — | | | | | — | | | 30,963 | | | 30,963 | | | 278 | | | 31,241 | |

| | | | | | | | | | | | | | |

| Balance, June 30, 2022 | | $ | 86 | | | | | $ | 260,387 | | | $ | 121,695 | | | $ | 382,168 | | | $ | 20,681 | | | $ | 402,849 | |

The accompanying notes are an integral part of these consolidated financial statements.

TRANSCONTINENTAL REALTY INVESTORS, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(dollars in thousands)

(Unaudited)

| | | | | | | | | | | |

| Six Months Ended June 30, |

| 2023 | | 2022 |

| Cash Flow From Operating Activities: | | | |

| Net income | $ | 4,591 | | | $ | 31,241 | |

| Adjustments to reconcile net income to net cash used in operating activities: | | | |

| Gain on sale or write down of assets | (188) | | | (15,041) | |

| Gain on foreign currency transactions | (993) | | | (17,904) | |

| Loss on early extinguishment of debt | 1,710 | | | 1,639 | |

| Depreciation and amortization | 7,180 | | | 6,363 | |

| Provision for bad debts | 945 | | | 21 | |

| Equity in income from unconsolidated joint venture | (713) | | | (6,343) | |

| | | |

| Changes in assets and liabilities, net of dispositions: | | | |

| Other assets | (8,366) | | | 2,816 | |

| Related party receivables | (5,070) | | | (3,425) | |

| Interest payable | (2,060) | | | (4,574) | |

| Accounts payable and other liabilities | (5,472) | | | (2,310) | |

| Net cash used in operating activities | (8,436) | | | (7,517) | |

| Cash Flow From Investing Activities: | | | |

| Collection of notes receivable | 397 | | | 1,295 | |

| Originations and advances on notes receivable | (6,649) | | | (989) | |

| Purchase of short-term investment | (82,324) | | | (31,500) | |

| Redemption of short-term investments | 65,139 | | | 39,750 | |

| | | |

| Development and renovation of real estate | (6,244) | | | (8,215) | |

| Deferred leasing costs | (197) | | | (922) | |

| Proceeds from sale of assets | 188 | | | 32,875 | |

| | | |

| Distributions from unconsolidated joint venture | 20,916 | | | — | |

| Net cash (used in) provided by investing activities | (8,774) | | | 32,294 | |

| Cash Flow From Financing Activities: | | | |

| | | |

| Payments on mortgages, other notes and bonds payable | (134,840) | | | (39,249) | |

| Debt extinguishment costs | (435) | | | (590) | |

| Deferred financing costs | (16) | | | — | |

| | | |

| Net cash used in financing activities | (135,291) | | | (39,839) | |

| Net decrease in cash, cash equivalents and restricted cash | (152,501) | | | (15,062) | |

| Cash, cash equivalents and restricted cash, beginning of period | 222,307 | | | 72,721 | |

| Cash, cash equivalents and restricted cash, end of period | $ | 69,806 | | | $ | 57,659 | |

The accompanying notes are an integral part of these consolidated financial statements.

TRANSCONTINENTAL REALTY INVESTORS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(dollars in thousands, except per share amounts)

(Unaudited)

1. Organization

As used herein, the terms “the Company”, “we”, “our”, or “us” refer to Transcontinental Realty Investors, Inc., a Nevada corporation, which was formed in 1984. Our common stock is listed on the New York Stock Exchange (“NYSE”) under the symbol “TCI”. We are owned approximately 78% by American Realty Investors, Inc. (“ARL”), whose common stock is listed on the NYSE under the symbol “ARL”, and 7% by the controlling shareholder of ARL.

Our primary business is the acquisition, development and ownership of income-producing residential and commercial real estate properties. In addition, we opportunistically acquire land for future development in in-fill or high-growth suburban markets. From time to time, and when we believe it appropriate to do so, we will also sell land and income-producing properties. We generate revenues by leasing apartment units to residents, and leasing office, industrial and retail space to various for-profit businesses as well as certain local, state and federal agencies. We also generate income from the sales of income-producing properties and land.

Substantially all of our assets are held by our wholly-owned subsidiary, Southern Properties Capital Ltd. (“SPC”), which was formed for the purpose of raising funds by issuing non-convertible bonds that were listed on the Tel Aviv Stock Exchange ("TASE").

At June 30, 2023, our portfolio of properties consisted of:

● Four office buildings comprising in aggregate of approximately 1,056,793 square feet;

● Fourteen multifamily properties, owned directly by us, comprising of 2,328 units; and

● Approximately 1,858 acres of developed and undeveloped land.

Our day to day operations are managed by Pillar Income Asset Management, Inc. (“Pillar”). Pillar's duties include, but are not limited to, locating, evaluating and recommending real estate and real estate-related investment opportunities and arranging debt and equity financing with third party lenders and investors. We have no employees; all of our services are performed by Pillar employees. Three of our commercial properties are managed by Regis Realty Prime, LLC (“Regis”). Regis provides leasing, construction management and brokerage services. Our multifamily properties and one of our commercial properties are managed by outside management companies. Pillar and Regis are considered to be related parties (See Note 14 – Related Party Transactions).

2. Summary of Significant Accounting Policies

Basis of Presentation

The accompanying unaudited consolidated financial statements have been prepared in accordance with the instructions to Form 10-Q and Article 10 of Regulation S-X. Certain information and footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) have been condensed or omitted in accordance with such rules and regulations, although management believes the disclosures are adequate to prevent the information presented from being misleading. In the opinion of management, all adjustments (consisting of normal recurring matters) considered necessary for a fair presentation have been included.

Certain prior year amounts have been reclassified to conform with the current year presentation. These reclassifications had no effect on the reported results of operation. An adjustment has been made to reclassify $519 and $937 interest expense to related parties for the three and six months ended June 30, 2022, respectively, from interest expense to interest income on the consolidated statements of operations.

TRANSCONTINENTAL REALTY INVESTORS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(dollars in thousands, except per share amounts)

(Unaudited)

The consolidated balance sheet at December 31, 2022 was derived from the audited consolidated financial statements at that date, but does not include all of the information and disclosures required by GAAP for complete financial statements. For further information, refer to the consolidated financial statements and notes thereto included in our Annual Report on Form 10-K for the year ended December 31, 2022. Certain 2022 consolidated financial statement amounts have been reclassified to conform to the current presentation.

We consolidate entities in which we are considered to be the primary beneficiary of a variable interest entity (“VIE”) or have a majority of the voting interest of the entity. We have determined that we are a primary beneficiary of the VIE when we have (i) the power to direct the activities of a VIE that most significantly impacts its economic performance, and (ii) the obligations to absorb losses or the right to receive benefits that could potentially be significant to the VIE. In determining whether we are the primary beneficiary, we consider qualitative and quantitative factors, including ownership interest, management representation, ability to control decision and other contractual rights.

We account for entities in which we have less than a controlling financial interest or entities where we are not deemed to be the primary beneficiary under the equity method of accounting. Accordingly, we include our share of the net earnings or losses of these entities in our results of operations.

3. Earnings Per Share

Earnings per share (“EPS”) is computed by dividing net income attributable to the Company by the weighted-average number of common shares outstanding during the period.

The following table details our basic and diluted earnings per common share calculation:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net income | $ | 876 | | | $ | 16,621 | | | $ | 4,591 | | | $ | 31,241 | |

| Net income attributable to noncontrolling interest | (346) | | | (160) | | | (544) | | | (278) | |

| Net income attributable to the Company | $ | 530 | | | $ | 16,461 | | | $ | 4,047 | | | $ | 30,963 | |

| | | | | | | |

Weighted-average common shares outstanding — basic and diluted | 8,639,316 | | | 8,639,316 | | | 8,639,316 | | | 8,639,316 | |

| | | | | | | |

| EPS - attributable to common shares — basic and diluted | $ | 0.06 | | | $ | 1.91 | | | $ | 0.47 | | | $ | 3.58 | |

TRANSCONTINENTAL REALTY INVESTORS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(dollars in thousands, except per share amounts)

(Unaudited)

4. Supplemental Cash Flow Information

The following presents the schedule of interest paid and other supplemental cash flow information:

| | | | | | | | | | | |

| Six Months Ended June 30, |

| 2023 | | 2022 |

| Cash paid for interest | $ | 7,836 | | | $ | 9,839 | |

| Cash - beginning of period | | | |

| Cash and cash equivalents | $ | 113,424 | | | $ | 50,735 | |

| Restricted cash | 108,883 | | | 21,986 | |

| $ | 222,307 | | | $ | 72,721 | |

| Cash - end of period | | | |

| Cash and cash equivalents | $ | 58,868 | | | $ | 38,199 | |

| Restricted cash | 10,938 | | | 19,460 | |

| $ | 69,806 | | | $ | 57,659 | |

| | | |

| | | |

| | | |

| | | |

| Payments on mortgages, other notes and bonds payable | | | |

| Payments on mortgages and other notes payable | $ | 3,664 | | | $ | 16,327 | |

| Payments on bond payable | 131,176 | | | 22,922 | |

| $ | 134,840 | | | $ | 39,249 | |

The following is a schedule of noncash investing and financing activities:

| | | | | | | | | | | |

| Six Months Ended June 30, |

| 2023 | | 2022 |

| | | |

| | | |

| | | |

| Property acquired in exchange for reduction of related party receivable | $ | 5,487 | | | $ | — | |

| Distribution from joint venture applied to Earn Out Obligation | $ | — | | | $ | 7,012 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

5. Operating Segments

Our segments are based on the internal reporting that we review for operational decision-making purposes. We operate in two reportable segments: (i) the acquisition, development, ownership and management of multifamily properties and (ii) the acquisition, ownership and management of commercial properties. The services for our multifamily segment include rental of apartments and other tenant services, including parking and storage space rental. Asset information by segment is not reported because we do not use this measure to assess performance or make decisions to allocate resources. Therefore, depreciation and amortization expense is not allocated among segments. General and administrative expenses, advisory fees, interest income and interest expense are not included in segment profit as our internal reporting addresses these items on a corporate level.

The following table presents our reportable segments for the three and six months ended June 30, 2023 and 2022:

TRANSCONTINENTAL REALTY INVESTORS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(dollars in thousands, except per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Multifamily Segment | | | | | | | |

| Revenues | $ | 7,658 | | | $ | 2,945 | | | $ | 15,031 | | | $ | 6,174 | |

| Operating expenses | (4,478) | | | (1,708) | | | (8,186) | | | (3,429) | |

| Profit from segment | 3,180 | | | 1,237 | | | 6,845 | | | 2,745 | |

| Commercial Segment | | | | | | | |

| Revenues | 3,731 | | | 4,314 | | | 7,367 | | | 8,566 | |

| Operating expenses | (2,553) | | | (2,104) | | | (4,951) | | | (4,411) | |

| Profit from segment | 1,178 | | | 2,210 | | | 2,416 | | | 4,155 | |

| Total profit from segments | $ | 4,358 | | | $ | 3,447 | | | $ | 9,261 | | | $ | 6,900 | |

The table below reflects the reconciliation of total profit from segments to net income for the three and six months ended June 30, 2023 and 2022:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Total profit from segments | $ | 4,358 | | | $ | 3,447 | | | $ | 9,261 | | | $ | 6,900 | |

| Other non-segment items of income (expense) | | | | | | | |

| Depreciation and amortization | (3,200) | | | (2,298) | | | (6,302) | | | (4,647) | |

| General and administrative | (3,521) | | | (2,061) | | | (6,404) | | | (4,592) | |

| Advisory fee to related party | (2,000) | | | (2,446) | | | (4,170) | | | (5,451) | |

| Other income | 850 | | | 511 | | | 1,529 | | | 817 | |

| Interest income | 8,494 | | | 4,387 | | | 17,322 | | | 9,783 | |

| Interest expense | (2,426) | | | (4,541) | | | (5,513) | | | (9,150) | |

| Gain on foreign currency transactions | 22 | | | 14,132 | | | 993 | | | 17,904 | |

| Loss on early extinguishment of debt | (1,710) | | | — | | | (1,710) | | | (1,639) | |

| Income from unconsolidated joint venture | 25 | | | 1,637 | | | 713 | | | 6,343 | |

| Gain on sales or write-down of assets | 188 | | | 3,893 | | | 188 | | | 15,041 | |

| Income tax provision | (204) | | | (40) | | | (1,316) | | | (68) | |

| Net income | $ | 876 | | | $ | 16,621 | | | $ | 4,591 | | | $ | 31,241 | |

6. Lease Revenue

We lease our multifamily properties and commercial properties under agreements that are classified as operating leases. Our multifamily property leases generally include minimum rents and charges for ancillary services. Our commercial property leases generally included minimum rents and recoveries for property taxes and common area maintenance. Minimum rental revenues are recognized on a straight-line basis over the terms of the related leases.

The following table summarizes the components of our rental revenue for the three and six months ended June 30, 2023 and 2022:

TRANSCONTINENTAL REALTY INVESTORS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(dollars in thousands, except per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Fixed component | | $ | 10,922 | | | $ | 6,881 | | | $ | 21,630 | | | $ | 13,877 | |

| Variable component | | 467 | | | 378 | | | 768 | | | 863 | |

| | $ | 11,389 | | | $ | 7,259 | | | $ | 22,398 | | | $ | 14,740 | |

The following table summarizes the future rental payments that are payable to us from non-cancelable leases. The table excludes multifamily leases, which typically have a term of one-year or less:

| | | | | | | | |

| | |

| 2023 | | $ | 10,303 | |

| 2024 | | 8,795 | |

| 2025 | | 8,376 | |

| 2026 | | 8,024 | |

| 2027 | | 7,776 | |

| Thereafter | | 17,387 | |

| | $ | 60,661 | |

7. Real Estate Activity

Below is a summary of our real estate as of June 30, 2023 and December 31, 2022:

| | | | | | | | | | | |

| June 30, 2023 | | December 31, 2022 |

| Land | $ | 108,993 | | | $ | 108,933 | |

| Building and improvements | 370,854 | | | 359,904 | |

| Tenant improvements | 26,435 | | | 25,611 | |

| Construction in progress | 66,999 | | | 65,427 | |

| Total cost | 573,281 | | | 559,875 | |

| Less accumulated depreciation | (72,019) | | | (66,054) | |

| Total real estate | $ | 501,262 | | | $ | 493,821 | |

On March 15, 2023, we entered into a development agreement with Pillar to build a 240 unit multifamily property in Lake Wales, Florida that is expected to be completed in 2025 for a total cost of approximately $55,330. The cost of construction will be funded in part by a $33,000 construction loan (See Note 12 - Mortgages and Other Notes Payable). The development agreement provides for a $1,637 fee that will be paid to Pillar over the construction period. As of June 30, 2023, we have incurred a total of $10,823 in development costs.

Gain on sale or write-down of assets, net for the three and six months ended June 30, 2023 and 2022 consists of the following:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Land(1) | $ | 188 | | | $ | 2,763 | | | $ | 188 | | | $ | 4,752 | |

| Multifamily Properties(2) | — | | | — | | | — | | | 9,603 | |

| Commercial Properties | — | | | 890 | | | — | | | 890 | |

| Other | — | | | 240 | | | — | | | (204) | |

| Total | $ | 188 | | | $ | 3,893 | | | $ | 188 | | | $ | 15,041 | |

TRANSCONTINENTAL REALTY INVESTORS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(dollars in thousands, except per share amounts)

(Unaudited)

(1)Includes the gain on the sale of lots related to our investment in Windmill Farms, Mercer Crossing and other land holdings.

(2)On January 14, 2022, we sold Toulon, a 240 unit multifamily property in Gautier, Mississippi for $26,750, resulting in a gain on sale of $9,364. We used the proceeds to pay off the $14,740 mortgage note payable on the property and for general corporate purposes.

8. Short-term Investments

We have an investment in variable denominated floating rate notes and short-term commercial paper with maturities of less than nine months. The interest rate on the notes was 5.08% and 4.67% at June 30, 2023 and December 31, 2022, respectively.

TRANSCONTINENTAL REALTY INVESTORS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(dollars in thousands, except per share amounts)

(Unaudited)

9. Notes Receivable

The following table summarizes our notes receivable as of June 30, 2023 and December 31, 2022:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Carrying value | | |

| Property/Borrower | | June 30, 2023 | | December 31, 2022 | | Interest Rate | | Maturity Date |

| ABC Land and Development, Inc. | | $ | 4,408 | | | $ | 4,408 | | | 9.50 | % | | 6/30/26 |

| ABC Paradise, LLC | | 1,210 | | | 1,210 | | | 9.50 | % | | 6/30/26 |

| Autumn Breeze(1) | | 2,157 | | | 2,326 | | | 5.00 | % | | 7/1/25 |

| Bellwether Ridge(1) | | 3,798 | | | 3,798 | | | 5.00 | % | | 11/1/26 |

| Dominion at Mercer Crossing(2) | | 6,500 | | | — | | | 9.25 | % | | 6/7/28 |

| Forest Pines(1) | | 6,472 | | | 6,472 | | | 5.00 | % | | 5/1/24 |

| Legacy Pleasant Grove | | 496 | | | 496 | | | 12.00 | % | | 10/23/24 |

| McKinney Ranch | | 3,926 | | | 3,926 | | | 6.00 | % | | 9/15/24 |

| One Realco Land Holding, Inc. | | 1,728 | | | 1,728 | | | 9.50 | % | | 6/30/26 |

| Parc at Ingleside(1) | | 3,759 | | | 3,759 | | | 5.00 | % | | 11/1/26 |

| Parc at Opelika Phase II(1)(3) | | 3,190 | | | 3,190 | | | 10.00 | % | | 1/13/23 |

| Parc at Windmill Farms(1)(3) | | 7,886 | | | 7,886 | | | 5.00 | % | | 11/1/22 |

| Phillips Foundation for Better Living, Inc.(4) | | 182 | | | 182 | | | 12.00 | % | | 3/31/24 |

| Plum Tree(1) | | 1,767 | | | 1,767 | | | 5.00 | % | | 4/26/26 |

| Polk County Land | | 3,000 | | | 3,000 | | | 9.50 | % | | 6/30/26 |

| Riverview on the Park Land, LLC | | 1,045 | | | 1,045 | | | 9.50 | % | | 6/30/26 |

| Spartan Land | | 5,907 | | | 5,907 | | | 12.00 | % | | 1/16/25 |

| Spyglass of Ennis(1)(3) | | 5,179 | | | 5,258 | | | 5.00 | % | | 11/1/22 |

| Steeple Crest(1) | | 6,498 | | | 6,498 | | | 5.00 | % | | 8/1/26 |

| Unified Housing Foundation(4)(5) | | 20,325 | | | 20,325 | | | 12.00 | % | | 6/30/28 |

| Unified Housing Foundation(4)(5) | | 10,096 | | | 10,096 | | | 12.00 | % | | 3/31/24 |

| Unified Housing Foundation(4)(5) | | 6,990 | | | 6,990 | | | 12.00 | % | | 3/31/25 |

| Unified Housing Foundation(4)(5) | | 3,615 | | | 3,615 | | | 12.00 | % | | 5/31/28 |

| Unified Housing Foundation(4)(5) | | 17,172 | | | 17,172 | | | 12.00 | % | | 12/31/32 |

| Unified Housing Foundation(4)(5) | | 6,521 | | | 6,521 | | | 12.00 | % | | 3/31/24 |

| Unified Housing Foundation(4)(5) | | 1,549 | | | 1,549 | | | 12.00 | % | | 4/30/24 |

| Unified Housing Foundation(4)(5) | | 180 | | | 180 | | | 12.00 | % | | 6/30/24 |

| | $ | 135,556 | | | $ | 129,304 | | | | | |

(1)The note is convertible, at our option, into a 100% ownership interest in the underlying development property, and is collateralized by the underlying development property.

(2)The note has an interest rate of prime plus 1.00%.

(3)We are working with the borrower to extend the maturity and/or exercise our conversion option.

(4) The borrower is deemed to be a related party due to our significant investment in the performance of the collateral secured by the notes receivable.

(5) Principal and interest payments on the notes from Unified Housing Foundation, Inc. (“UHF”) are funded from surplus cash flow from operations, sale or refinancing of the underlying properties and are cross collateralized to the extent that any surplus cash available from any of the properties underlying the notes.

TRANSCONTINENTAL REALTY INVESTORS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(dollars in thousands, except per share amounts)

(Unaudited)

10. Investment in Unconsolidated Joint Ventures

On November 16, 2018, our SPC subsidiary formed the Victory Abode Apartments, LLC ("VAA"), a joint venture with the Macquarie Group (“Macquarie”). VAA was formed as a result of a sale of the 50% ownership interest in a portfolio of multifamily properties owned by us in exchange for a 50% voting interest / 49% profit participation interest ("Class A interest") in VAA and a note payable. Concurrent with the Contribution, VAA issued Class B interests with a 2% profits participation interest and no voting rights to the manager of VAA (“Class B Member”).

In connection with the formation of VAA, ten of the initial properties were subject to an earn-out provision ("Earn Out") that provided for a remeasurement of value after a two-year period following the completion of construction. Upon the formation of VAA, we recorded an initial liability ("Earn Out Obligation") of $10,000 for the advance on the Earn Out that we received from Macquarie. Upon remeasurement, the Earn Out Obligation was determined to be approximately $39,600. In accordance with the joint venture operating agreement, the Earn Out Obligation was paid from our share of distributions from VAA in 2022.

On September 16, 2022, VAA sold 45 of its properties (“VAA Sale Portfolio”) for $1,810,700, resulting in a gain on sale of $738,444 to the joint venture. In connection with the sale, we received an initial distribution of $182,848 from VAA, which included the payment of the remaining balance of the Earn Out Obligation.

On November 1, 2022, we received an additional distribution from VAA, which included the full operational control of the remaining seven properties of VAA (“VAA Holdback Portfolio”) (See Note 11 - Acquisitions) and a cash payment of $204,036. We are in the process of negotiating the assumption of the mortgage notes payable on the VAA Holdback Portfolio with the lenders.

On March 23, 2023, we received $17,976 from VAA, which represented the remaining distribution of the proceeds from the sale of the VAA Sale Portfolio.

We used our share of the proceeds from the sale of the VAA Sale Portfolio to invest in short-term investments and real estate, pay down our debt and for general corporate purposes.

The following is a summary of our investment in VAA:

| | | | | | | | | | | | | | |

| | June 30, 2023 | | December 31, 2022 |

| | | | |

| Assets | | | | |

| | | | |

| | | | |

| Cash, cash equivalents and restricted cash | | $ | 1,208 | | | $ | 50,058 | |

| Other assets | | — | | | 2,346 | |

| | $ | 1,208 | | | $ | 52,404 | |

| Liabilities and partners' capital | | | | |

| Liabilities from discontinued operations | | $ | — | | | $ | 8,824 | |

| | | | |

| | | | |

| Other liabilities | | 22 | | | 1,988 | |

| Our share of partners' capital | | 701 | | | 20,904 | |

| Outside partner's capital | | 485 | | | 20,688 | |

| | $ | 1,208 | | | $ | 52,404 | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

TRANSCONTINENTAL REALTY INVESTORS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(dollars in thousands, except per share amounts)

(Unaudited)

The following is a summary of income from VAA:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Revenue | | | | | | | | |

| Rental revenue | | $ | — | | | $ | 4,032 | | | $ | — | | | $ | 7,963 | |

| Other revenue | | — | | | 236 | | | — | | | 378 | |

| Total revenue | | — | | | 4,268 | | | — | | | 8,341 | |

| Expenses | | | | | | | | |

| Operating expenses | | 36 | | | 10,521 | | | (295) | | | 13,142 | |

| Depreciation and amortization | | — | | | 845 | | | — | | | 1,689 | |

| | | | | | | | |

| Interest | | (19) | | | 6,120 | | | (310) | | | 11,834 | |

| Total expenses | | 17 | | | 17,486 | | | (605) | | | 26,665 | |

| (Loss) income from continuing operations | | (17) | | | (13,218) | | | 605 | | | (18,324) | |

| Income from discontinued operations | | 67 | | | 4,512 | | | 821 | | | 7,948 | |

| Net income (loss) | | $ | 50 | | | $ | (8,706) | | | $ | 1,426 | | | $ | (10,376) | |

| Equity in income from unconsolidated joint venture | | $ | 25 | | | $ | 1,637 | | | $ | 713 | | | $ | 6,343 | |

11. Acquisitions

On November 1, 2022, we acquired the remaining 50% ownership interest in the VAA Holdback Portfolio that we did not previously own through a distribution from VAA (See Note 10 – Investment in Unconsolidated Joint Ventures). Prior to the acquisition, we had accounted for the VAA Holdback Portfolio under the equity method of accounting as part of our investment in VAA. The acquisition was completed in order to obtain 100% ownership and control over this well positioned portfolio of multifamily residential properties in southern United States.

The VAA Holdback Portfolio consisted of the following properties:

| | | | | | | | | | | | | | |

| Property | | Location | | Units |

| Blue Lake Villas | | Waxahachie, TX | | 186 | |

| Blue Lake Villas Phase II | | Waxahachie, TX | | 70 | |

| Northside on Travis | | Sherman, TX | | 200 | |

| Parc at Denham Springs | | Denham Spring, LA | | 224 | |

| Residences at Holland Lake | | Weatherford, TX | | 208 | |

| Villas of Park West I | | Pueblo, CO | | 148 | |

| Villas of Park West II | | Pueblo, CO | | 112 | |

| | | | 1,148 | |

TRANSCONTINENTAL REALTY INVESTORS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(dollars in thousands, except per share amounts)

(Unaudited)

The following is a summary of the preliminary allocation of the fair value of the VAA Holdback Portfolio:

| | | | | | | | |

| Real estate | | $ | 219,500 | |

| Other assets | | 4,843 | |

| Total assets acquired | | 224,343 | |

| Mortgage notes payable | | 70,330 | |

| Accounts payable and other liabilities | | 1,624 | |

| Accrued interest | | 190 | |

| Total liabilities assumed | | 72,144 | |

Fair value of acquired net assets (100% ownership) | | $ | 152,199 | |

We have determined that the purchase price represented the fair value of the additional ownership interest in the VAA Holdback Portfolio that was acquired.

| | | | | | | | |

Fair value of existing ownership interest (at 50% ownership) | | $ | 219,500 | |

| Carrying value of investment | | 146,313 | |

| Gain on remeasurement of assets | | $ | 73,187 | |

From November 1, 2022, we have included the VAA Holdback Portfolio in our consolidated financial statements.

TRANSCONTINENTAL REALTY INVESTORS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(dollars in thousands, except per share amounts)

(Unaudited)

12. Mortgages and Other Notes Payable

The following table summarizes our mortgages and other notes payable as of June 30, 2023 and December 31, 2022:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Carrying Value | | Interest

Rate | | Maturity

Date |

| Property/ Entity | | June 30, 2023 | | December 31, 2022 | | |

| 770 South Post Oak | | $ | 11,285 | | | $ | 11,406 | | | 4.40 | % | | 6/1/2025 |

| Athens | | 1,155 | | | 1,155 | | | 4.00 | % | | 8/28/2023 |

| Blue Lake Villas(1) | | 9,588 | | | 9,673 | | | 3.15 | % | | 11/1/2055 |

| Blue Lake Villas Phase II(1) | | 3,386 | | | 3,424 | | | 2.85 | % | | 6/1/2052 |

| Chelsea | | 7,792 | | | 7,875 | | | 3.40 | % | | 12/1/2050 |

| EQK Portage | | 3,350 | | | 3,350 | | | 10.00 | % | | 11/13/2024 |

| Forest Grove | | 7,058 | | | 7,128 | | | 3.75 | % | | 5/5/2024 |

| Landing Bayou | | 14,036 | | | 14,161 | | | 3.50 | % | | 9/1/2053 |

| Legacy at Pleasant Grove | | 12,879 | | | 13,039 | | | 3.60 | % | | 4/1/2048 |

| Northside on Travis(1) | | 11,525 | | | 11,656 | | | 2.50 | % | | 2/1/2053 |

| Parc at Denham Springs(1) | | 16,569 | | | 16,737 | | | 3.75 | % | | 4/1/2051 |

| Parc at Denham Springs Phase II | | 15,699 | | | 15,789 | | | 4.05 | % | | 2/1/2060 |

| RCM HC Enterprises | | 5,086 | | | 5,086 | | | 5.00 | % | | 12/31/2024 |

| Residences at Holland Lake(1) | | 10,524 | | | 10,622 | | | 3.60 | % | | 3/1/2053 |

| Villas at Bon Secour | | 19,216 | | | 19,410 | | | 3.08 | % | | 9/1/2031 |

| Villas of Park West I(1) | | 9,278 | | | 9,373 | | | 3.04 | % | | 3/1/2053 |

| Villas of Park West II(1) | | 8,419 | | | 8,504 | | | 3.18 | % | | 3/1/2053 |

| Vista Ridge | | 9,594 | | | 9,674 | | | 4.00 | % | | 8/1/2053 |

| Windmill Farms(2) | | 4,391 | | | 6,400 | | | 7.75 | % | | 2/28/2024 |

| | $ | 180,830 | | | $ | 184,462 | | | | | |

(1) On November 1, 2022, we agreed to assume the mortgage note payable from our joint venture in connection with the acquisition of the underlying property (See Note 11 - Acquisitions) and are in the process of obtaining lender approval of the assumption.

(2) On February 28, 2023, we extended the maturity of the loan to February 28, 2024 and an interest rate of 7.75%.

Interest payable at June 30, 2023 and December 31, 2022, was $2,292 and $2,004, respectively. We capitalized interest of $0 and $800 for the three months ended June 30, 2023 and 2022, respectively, and $642 and $1,603 during the six months ended June 30, 2023 and 2022, respectively.

On March 15, 2023, we entered into a $33,000 construction loan to finance the development of Lake Wales (See Note 7 - Real Estate Activity) that bears interest at the Secured Overnight Financing Rate ("SOFR") plus 3% and matures on March 15, 2026, with two one-year extension options.

As of June 30, 2023, we were in compliance with all of our loan covenants except for the minimum debt service coverage ratio (“DSCR”) for the loan on 770 South Post Oak. As a result, the lender requires us to lock the surplus cash flow of the property into a designated deposit account controlled by them, until we are in compliance with the DSCR for a period of two consecutive quarters.

All of the above mortgages and other notes payable are collateralized by the underlying property. In addition, we have guaranteed the loans on Athens, Forest Grove, Lake Wales and Villas at Bon Secour.

TRANSCONTINENTAL REALTY INVESTORS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(dollars in thousands, except per share amounts)

(Unaudited)

13. Bonds Payable

We issued nonconvertible bonds ("Bonds") through SPC, which were traded on the TASE. The Bonds were denominated in New Israeli Shekels ("NIS") and provided semiannual principal and interest payments through maturity. The Bonds were subject to a number of covenants, which included restrictions on the distribution of cash from SPC.

In connection with the Bonds, we incurred a gain on foreign currency transactions of $22 and $14,132 for the three months ended June 30, 2023 and 2022, respectively, and $993 and $17,904 for the six months ended June 30, 2023 and 2022, respectively.

The outstanding balance of our Bonds at December 31, 2022 was as follows:

| | | | | | | | | | | | | | | | | | | | | | |

| Bond Issuance | | | | December 31, 2022 | | Interest Rate | | Maturity |

| Series A Bonds(1) | | | | $ | 28,971 | | | 7.30 | % | | 7/31/23 |

| Series B Bonds(1) | | | | 35,806 | | | 6.80 | % | | 7/31/25 |

| Series C Bonds(2) | | | | 66,546 | | | 4.65 | % | | 1/31/23 |

| | | | 131,323 | | | | | |

| Less unamortized deferred issuance costs | | | | (2,105) | | | | | |

| | | | $ | 129,218 | | | | | |

(1) The bonds were collateralized by the assets of SPC.

(2) The bonds were collateralized by a trust deed on Browning Place, a 625,297 square foot office building in Dallas, Texas.

On January 31, 2023, we completed our scheduled bond payment, which included the full repayment of the Series C bonds. On May 4, 2023, we paid off the remaining balances of the Series A and Series B Bonds and withdrew from the TASE.

14. Related Party Transactions

We engage in certain business transactions with related parties, including but not limited to asset acquisition and dispositions of real estate. Transactions involving related parties cannot be presumed to be carried out on an arm’s length basis due to the absence of free market forces that naturally exist in business dealings between two or more unrelated entities. Related party transactions may not always be favorable to our business and may include terms, conditions and agreements that are not necessarily beneficial to or in our best interest.

Pillar and Regis are wholly owned by a subsidiary of May Realty Holdings, Inc., which also owns approximately 90.8% of ARL. Pillar is compensated for advisory services in accordance with an agreement. Regis receives property management fees and leasing commissions in accordance with the terms of its property-level management agreement. In addition, Regis is entitled to receive real estate brokerage commissions in accordance with the terms of a non-exclusive brokerage agreement.

Rental income includes $231 and $223 for the three months ended June 30, 2023 and 2022, respectively, and $499 and $479 for the six months ended June 30, 2023 and 2022, respectively, for office space leased to Pillar and Regis.

Property operating expense includes $99 and $110 for the three months ended June 30, 2023 and 2022, respectively, and $199 and $227 for the six months ended June 30, 2023 and 2022, respectively, for management fees on commercial properties payable to Regis.

General and administrative expense includes $627 and $642 for the three months ended June 30, 2023 and 2022, respectively, and $2,058 and $1,934 for the six months ended June 30, 2023 and 2022, respectively, for employee compensation and other reimbursable costs payable to Pillar.

Advisory fees paid to Pillar were $2,000 and $2,446 for the three months ended June 30, 2023 and 2022, respectively, and $4,170 and $5,451 for the six months ended June 30, 2023 and 2022, respectively.

TRANSCONTINENTAL REALTY INVESTORS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(dollars in thousands, except per share amounts)

(Unaudited)

Notes receivable include amounts held by UHF (See Note 9 – Notes Receivable). UHF is deemed to be a related party due to our significant investment in the performance of the collateral secured by the notes receivable. In addition, we have receivables from Pillar and other related parties. Related party receivables, net represents the net amounts outstanding from Pillar for loans and advances, net of unreimbursed fees, expenses and costs as provided above. Interest income on these notes and related party receivables was $5,303 and $3,753 for the three months ended June 30, 2023 and 2022, respectively, and $10,440 and $7,298 for the six months ended June 30, 2023 and 2022, respectively.

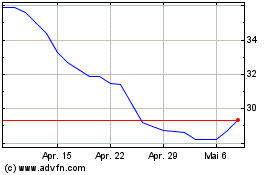

15. Noncontrolling Interests

The noncontrolling interest represents the third party ownership interest in Income Opportunity Realty Investors, Inc. ("IOR"). Shares of IOR are listed on the NYSE American stock exchange under the symbol of IOR. We owned 81.1% in IOR during the three and six months ended June 30, 2023 and 2022.

16. Deferred Income

In previous years, we sold properties to related parties at a gain, and therefore the sales criteria for the full accrual method was not met, and as such, we deferred the gain recognition and accounted for the sales by applying the finance, deposit, installment or cost recovery methods, as appropriate. The gain on these transactions is deferred until the properties are sold to a non-related third party.

As of June 30, 2023 and December 31, 2022, we had deferred gain of $581.

17. Income Taxes

We are part of a tax sharing and compensating agreement with respect to federal income taxes with ARL. In accordance with the agreement, our expense (benefit) in each year is calculated based on the amount of losses absorbed by taxable income multiplied by the maximum statutory tax rate of 21%.

The following table summarizes our income tax provision:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Current | | $ | 204 | | | $ | 40 | | | $ | 1,316 | | | $ | 68 | |

| Deferred | | — | | | — | | | — | | | — | |

| | $ | 204 | | | $ | 40 | | | $ | 1,316 | | | $ | 68 | |

18. Commitments and Contingencies

We believe that we will generate excess cash from property operations in the next twelve months; such excess, however, might not be sufficient to discharge all of our obligations as they become due. We intend to sell income-producing assets, refinance real estate and obtain additional borrowings primarily secured by real estate to meet our liquidity requirements.

19. Subsequent Events

The date to which events occurring after June 30, 2023, the date of the most recent balance sheet, have been evaluated for possible adjustment to the consolidated financial statements or disclosure is August 10, 2023, which is the date on which the consolidated financial statements were available to be issued.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis by management should be read in conjunction with the unaudited Condensed Consolidated Financial Statements and Notes included in this Quarterly Report on Form 10-Q (the “Quarterly Report”) and in our Form 10-K for the year ended December 31, 2022 (the “Annual Report”).

This Report on Form 10-Q contains forward-looking statements within the meaning of the federal securities laws, principally, but not only, under the captions “Business”, “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”. We caution investors that any forward-looking statements in this report, or which management may make orally or in writing from time to time, are based on management’s beliefs and on assumptions made by, and information currently available to, management. When used, the words “anticipate”, “believe”, “expect”, “intend”, “may”, “might”, “plan”, “estimate”, “project”, “should”, “will”, “result” and similar expressions which do not relate solely to historical matters are intended to identify forward-looking statements. These statements are subject to risks, uncertainties, and assumptions and are not guarantees of future performance, which may be affected by known and unknown risks, trends, uncertainties and factors that are beyond our control. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, estimated or projected. We caution you that, while forward-looking statements reflect our good faith beliefs when we make them, they are not guarantees of future performance and are impacted by actual events when they occur after we make such statements. We expressly disclaim any responsibility to update our forward-looking statements, whether as a result of new information, future events or otherwise. Accordingly, investors should use caution in relying on past forward-looking statements, which are based on results and trends at the time they are made, to anticipate future results or trends.

Some of the risks and uncertainties that may cause our actual results, performance or achievements to differ materially from those expressed or implied by forward-looking statements include, among others, the following:

•general risks affecting the real estate industry (including, without limitation, the inability to enter into or renew leases, dependence on tenants’ financial condition, and competition from other developers, owners and operators of real estate);

•risks associated with the availability and terms of construction and mortgage financing and the use of debt to fund acquisitions and developments;

•demand for apartments and commercial properties in our markets and the effect on occupancy and rental rates;

•our ability to obtain financing, enter into joint venture arrangements in relation to or self-fund the development or acquisition of properties;

•risks associated with the timing and amount of property sales and the resulting gains/losses associated with such sales;

•failure to manage effectively our growth and expansion into new markets or to integrate acquisitions successfully

•risks and uncertainties affecting property development and construction (including, without limitation, construction delays, cost overruns, inability to obtain necessary permits and public opposition to such activities);

•risks associated with downturns in the national and local economies, increases in interest rates, and volatility in the securities markets;

•costs of compliance with the Americans with Disabilities Act and other similar laws and regulations;

•potential liability for uninsured losses and environmental contamination; and

•risks associated with our dependence on key personnel whose continued service is not guaranteed.

The risks included here are not exhaustive. Some of the risks and uncertainties that may cause our actual results, performance, or achievements to differ materially from those expressed or implied by forward-looking statements, include among others, the factors listed and described at Part I, Item 1A. “Risk Factors” Annual Report on Form 10-K, which investors should review.

Management's Overview

We are an externally advised and managed real estate investment company that owns a diverse portfolio of income-producing properties and land held for development throughout the Southern United States. Our portfolio of income-producing properties includes residential apartment communities ("multifamily properties"), office buildings and retail properties ("commercial properties"). Our investment strategy includes acquiring existing income-producing properties as well as developing new properties on land already owned or acquired for a specific development project.

Our operations are managed by Pillar Income Asset Management, Inc. (“Pillar”) in accordance with an Advisory Agreement. Pillar’s duties include, but are not limited to, locating, evaluating and recommending real estate and real estate-related investment opportunities. Pillar also arranges our debt and equity financing with third party lenders and investors. We have no employees. Employees of Pillar render services to us in accordance with the terms of the Advisory Agreement. Pillar is considered to be a related party due to its common ownership with American Realty Investors, Inc. (“ARL”), who is our controlling shareholder.

The following is a summary of our recent acquisition, disposition, financing and development activities:

Acquisitions and Dispositions

•On January 14, 2022, we sold Toulon, a 240 unit multifamily property in Gautier, Mississippi for $26.8 million, resulting in a gain on sale of $9.4 million. We used the proceeds to pay off the $14.7 million mortgage note payable on the property and for general corporate purposes.

•On May 17, 2022, we sold Fruitland Park, a 6,722 square foot commercial building in Fruitland Park, Florida for $0.8 million, resulting in a gain on sale of $0.7 million. We used the proceeds for general corporate purposes.

•On September 16, 2022, we sold Sugar Mill Phase III, a 72 unit multifamily property in Baton Rouge, Louisiana for $11.8 million in connection with a sale of properties by VAA (See "Other Developments"), resulting in a gain on sale of $1.9 million. We used the proceeds to pay off the $9.6 million mortgage note payable on the property and for general corporate purposes.

•On November 1, 2022, we acquired seven multifamily properties from VAA (See "Other Developments") with a fair value of $219.5 million.

•During the year ended December 31, 2022, we sold a total of 26.9 acres of land from our holdings in Windmill Farms for $5.1 million in aggregate, resulting in gains on sale of $4.2 million. In addition, we sold 0.9 acres of land from our holdings in Mercer Crossing for $0.7 million, resulting in a gain on sale of $0.2 million.

Financing Activities

•On January 14, 2022, we paid off the $14.7 million loan on Toulon in connection with the sale of the underlying property (See "Acquisitions and Dispositions").

•On March 3, 2022, we extended our loan on Stanford Center to February 26, 2023.

•On September 1, 2022, we extended our $1.2 million loan on Athens to August 28, 2023.

•On September 16, 2022, the $9.6 million loan on Sugar Mill Phase III was paid off in connection with the sale of the underlying property (See "Acquisitions and Dispositions").

•On October 21, 2022, we paid off the $38.5 million loan on Stanford Center from the cash generated from sale of the VAA Sale Portfolio.

•On November 1, 2022, we agreed to assume the $70.3 million mortgage notes payable on the VAA Holdback Portfolio in connection with the distribution of the underlying properties from VAA (See "Other Developments").

•On January 31, 2023, we paid off our $67.5 million of Series C bonds.

•On February 28, 2023, we extended the maturity of our loan on Windmill Farms until February 28, 2024 at a revised interest rate of 7.75%.