Form SC 13D/A - General statement of acquisition of beneficial ownership: [Amend]

11 Dezember 2023 - 10:30PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D/A

(Amendment No. 29)

Under the Securities Exchange Act of 1934

TARO PHARMACEUTICAL

INDUSTRIES LTD.

(Name of Issuer)

ORDINARY

SHARES, PAR VALUE NIS 0.0001 PER SHARE

(Title of Class of Securities)

M8737E108

(CUSIP Number)

Mr. Sailesh

T Desai

c/o Sun Pharmaceutical Industries Ltd.

Sun House, Plot No. 201 B/1 Western Express Highway, Goregaon East

Mumbai, Maharashtra, India – 400 063

(Name, Address and Telephone Number of Person

Authorized

to Receive Notices and Communications)

December 10,

2023

(Date of Event Which Requires Filing of this

Statement)

If the filing person has previously filed a statement on Schedule 13G

to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f)

or 240.13d-1(g) check the following box ☐.

Note: Schedules filed in paper format shall include a signed original

and five copies of the schedule, including all exhibits. See Rule § 240.13d-7(b) for other parties to whom copies are to be

sent.

* The remainder of this cover page shall be filled out for a reporting

person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing

information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall

not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise

subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

SCHEDULE 13D/A

| CUSIP No. M8737E108 |

|

Page 2 of 11 Pages |

| 1 |

NAME OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

SUN PHARMACEUTICAL INDUSTRIES LTD.

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See instructions)

(a) ☐

(b) ☐

|

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS (See instructions)

PF

|

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2(d) or 2(e)

☐

|

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

The Republic of India

|

NUMBER OF SHARES BENEFICIALLY OWNED BY

EACH

REPORTING PERSON

WITH |

7 |

SOLE VOTING POWER

0

|

| 8 |

SHARED VOTING POWER

29,497,813*

|

| 9 |

SOLE DISPOSITIVE POWER

0

|

| 10 |

SHARED DISPOSITIVE POWER

29,497,813

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

29,497,813

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See instructions) ☐

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

78.48%*

|

| 14 |

TYPE OF REPORTING PERSON (See instructions)

CO

|

* Includes 3,770,833 Ordinary

Shares acquired by Alkaloida Chemical Company Zrt. (formerly Alkaloida Chemical Company Exclusive Group Limited) (“Alkaloida”),

an indirect subsidiary of Sun Pharmaceutical Industries Ltd. (“Sun”), on May 21, 2007 and 3,016,667 Ordinary Shares acquired

by Alkaloida on May 30, 2007, in each case pursuant to the share purchase agreement dated May 18, 2007 (“Purchase Agreement”),

between Alkaloida and the Issuer, which entitled Alkaloida to acquire a total of 7,500,000 Ordinary Shares; 58,500 Ordinary Shares acquired

by Sun Pharma Holdings, a direct wholly-owned subsidiary of Sun (“Sun Pharma Holdings”), from Sun Pharma Global, Inc., which

merged into Sun on January 1, 2015, through an agreement to sell investments dated March 29, 2014; 3,000,000 Ordinary Shares acquired

by Alkaloida on August 2, 2007, pursuant to Sun’s rights under the warrant, dated May 18, 2007, issued by the Issuer to Sun (the

“Original Warrant”); 3,712,557 Ordinary Shares acquired by Alkaloida on February 19, 2008, from Brandes Investment Partners,

L.P., for and on behalf of certain of its investment advisory clients (“Brandes”); and 797,870 Ordinary Shares acquired by

Alkaloida on June 23, 2008, from Harel Insurance Company Limited (“Harel”).

This amount also includes 3,787,500 Ordinary Shares which Alkaloida

acquired pursuant to a warrant issued to Sun by the Issuer on August 2, 2007 (“Warrant No. 2”), including (i) 3,712,500 Ordinary

Shares issued to Alkaloida on September 24, 2010 and (ii) 75,000 Ordinary Shares issued to Alkaloida on September 27, 2010.

This amount also includes 29,382 Ordinary Shares which Alkaloida directly

acquired on September 14, 2010, upon the closing of the initial offering period of the tender offer to purchase all of the outstanding

Ordinary Shares, pursuant to the Tender Offer Statement on Schedule TO, filed on June 30, 2008, as amended.

This amount also includes an aggregate of 4,739,739 Ordinary Shares

indirectly acquired by Sun pursuant to the letter agreement, dated as of September 20, 2010 (the “Letter Agreement”), among

Sun, Alkaloida, Sun Pharmaceutical Industries, Inc., a Michigan corporation (“Sun Michigan”) (as succeeded by Caraco Pharmaceutical

Laboratories, Ltd., which subsequently changed its name to “Sun Pharmaceutical Industries, Inc.” and converted to become a

Delaware corporation), The Taro Development Corporation, a New York corporation (“TDC”), Dr. Barrie Levitt, Ms. Tal Levitt,

Dr. Jacob Levitt, and Dr. Daniel Moros (such individuals, together with TDC, the “Grantors”). Pursuant to the Letter Agreement:

(i) Alkaloida directly acquired 2,405,925 Ordinary Shares from the Grantors, consummating an option granted by the Grantors to Alkaloida

under an option agreement (the “Option Agreement”), dated May 18, 2007, among the Grantors and Sun (and subsequently assigned

to Alkaloida), (ii) Alkaloida directly acquired an additional 12 Ordinary Shares from the Grantors, and (iii) upon the merger of a subsidiary

of Sun Michigan with and into TDC on October 1, 2010, Sun Michigan indirectly acquired 2,333,802 Ordinary Shares, consummating an option

granted by TDC to Alkaloida (and subsequently assigned to Sun Michigan) under the Option Agreement. TDC directly owns 2,333,802 Ordinary

Shares, including 780 Ordinary Shares which were previously owned by Morley and Company, Inc., a New York corporation, which merged with

and into TDC. In addition, in connection with the consummation of the transactions contemplated by the Option Agreement, Alkaloida acquired

2,600 Founders’ Shares, which control in the aggregate one-third of the voting power of the Issuer.

This amount also includes 5,159,765 Ordinary Shares acquired by Alkaloida

on November 1, 2010 from Franklin Advisors, Inc. and Templeton Asset Management Ltd.

This amount also includes 712,500 Ordinary Shares acquired by Alkaloida

on January 18, 2011 under the Purchase Agreement and 712,500 Ordinary Shares acquired by Alkaloida on January 18, 2011 pursuant to Warrant

No. 2.

** Based on 37,584,631 Ordinary

Shares issued and outstanding as of March 31, 2023. During the year ended March 31, 2022, Sun’s ownership percentage increased 0.71%

to 78.48% due to the repurchase of 341,413 Ordinary Shares by the Issuer during the year.

SCHEDULE 13D/A

| CUSIP No. M8737E108 |

|

Page

3 of 11 Pages |

| 1 |

NAME OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

SUN PHARMA HOLDINGS

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See instructions)

(a) ☐

(b) ☐

|

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS (See instructions)

PF

|

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2(d) or 2(e)

☐

|

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Mauritius

|

NUMBER OF SHARES BENEFICIALLY OWNED BY

EACH

REPORTING PERSON

WITH |

7 |

SOLE VOTING POWER

0

|

| 8 |

SHARED VOTING POWER

27,164,011*

|

| 9 |

SOLE DISPOSITIVE POWER

0

|

| 10 |

SHARED DISPOSITIVE POWER

27,164,011

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

27,164,011

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See instructions) ☐

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

72.27%**

|

| 14 |

TYPE OF REPORTING PERSON (See instructions)

CO

|

* Includes 3,770,833 Ordinary Shares acquired by

Alkaloida on May 21, 2007 and 3,016,667 Ordinary Shares acquired by Alkaloida on May 30, 2007, in each case pursuant to the Purchase

Agreement; 58,500 Ordinary Shares acquired by Sun Pharma Holdings from Sun Pharma Global, Inc., which merged into Sun on January 1, 2015,

through an agreement to sell investments dated March 29, 2014; 3,000,000 Ordinary Shares acquired by Alkaloida on August 2, 2007, pursuant

to Sun’s rights under the Original Warrant; 3,712,557 Ordinary Shares acquired by Alkaloida on February 19, 2008, from Brandes;

and 797,870 Ordinary Shares acquired by Alkaloida on June 23, 2008, from Harel.

This amount also includes 3,787,500 Ordinary Shares which Alkaloida

acquired pursuant to Warrant No. 2, including (i) 3,712,500 Ordinary Shares issued to Alkaloida on September 24, 2010 and (ii) 75,000

Ordinary Shares issued to Alkaloida on September 27, 2010.

This amount also includes 29,382 Ordinary Shares which Alkaloida directly

acquired on September 14, 2010, upon the closing of the initial offering period of the tender offer to purchase all of the outstanding

Ordinary Shares, pursuant to the Tender Offer Statement on Schedule TO, filed on June 30, 2008, as amended.

This amount also includes an aggregate of 2,405,937 Ordinary Shares

directly or indirectly acquired by Alkaloida pursuant to the Letter Agreement. Pursuant to the Letter Agreement, Alkaloida (i) directly

acquired 2,405,925 Ordinary Shares from the Grantors, consummating an option granted by the Grantors to Alkaloida under the Option Agreement,

and (ii) directly acquired an additional 12 Ordinary Shares from the Grantors. In addition, in connection with the consummation of the

transactions contemplated by the Option Agreement, Alkaloida acquired 2,600 Founders’ Shares, which control in the aggregate one-third

of the voting power of the Issuer.

This amount also includes 5,159,765 Ordinary Shares acquired by Alkaloida

on November 1, 2010 from Franklin Advisors, Inc. and Templeton Asset Management Ltd.

This amount also includes 712,500 Ordinary Shares acquired by Alkaloida

on January 18, 2011 under the Purchase Agreement and 712,500 Ordinary Shares acquired by Alkaloida on January 18, 2011 pursuant to Warrant

No. 2.

** Based on 37,584,631 Ordinary Shares issued

and outstanding as of March 31, 2023. During the year ended March 31, 2022, Sun Pharma Holdings’ ownership percentage increased 0.67%

to 72.27% due to the repurchase of 341,413 Ordinary Shares by the Issuer during the year.

SCHEDULE 13D/A

| CUSIP No. M8737E108 |

|

Page

4 of 11 Pages |

| 1 |

NAME OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

ALKALOIDA CHEMICAL COMPANY ZRT (f/k/a ALKALOIDA CHEMICAL COMPANY EXCLUSIVE

GROUP LIMITED)

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See instructions)

(a) ☐

(b) ☐

|

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS (See instructions)

PF

|

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2(d) or 2(e)

☐

|

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

The Republic of Hungary

|

NUMBER OF SHARES BENEFICIALLY OWNED BY

EACH

REPORTING PERSON

WITH |

7 |

SOLE VOTING POWER

0

|

| 8 |

SHARED VOTING POWER

27,105,511*

|

| 9 |

SOLE DISPOSITIVE POWER

0

|

| 10 |

SHARED DISPOSITIVE POWER

27,105,511*

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

27,105,511

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See instructions) ☐

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

72.12%**

|

| 14 |

TYPE OF REPORTING PERSON (See instructions)

CO

|

* Includes 3,770,833 Ordinary

Shares acquired by Alkaloida on May 21, 2007 and 3,016,667 Ordinary Shares acquired by Alkaloida on May 30, 2007, in each case pursuant

to the Purchase Agreement; 3,000,000 Ordinary Shares acquired by Alkaloida on August 2, 2007, pursuant to Sun’s rights under the

Original Warrant; 3,712,557 Ordinary Shares acquired by Alkaloida on February 19, 2008, from Brandes; and 797,870 Ordinary Shares acquired

by Alkaloida on June 23, 2008, from Harel.

This amount also includes 3,787,500 Ordinary Shares which Alkaloida

acquired pursuant to Warrant No. 2, including (i) 3,712,500 Ordinary Shares issued to Alkaloida on September 24, 2010 and (ii) 75,000

Ordinary Shares issued to Alkaloida on September 27, 2010.

This amount also includes 29,382 Ordinary Shares which Alkaloida directly

acquired on September 14, 2010, upon the closing of the initial offering period of the tender offer to purchase all of the outstanding

Ordinary Shares, pursuant to the Tender Offer Statement on Schedule TO, filed on June 30, 2008, as amended.

This amount also includes an aggregate of 2,405,937 Ordinary Shares

directly or indirectly acquired by Alkaloida pursuant to the Letter Agreement. Pursuant to the Letter Agreement, Alkaloida (i) directly

acquired 2,405,925 Ordinary Shares from the Grantors, consummating an option granted by the Grantors to Alkaloida under the Option Agreement,

and (ii) directly acquired an additional 12 Ordinary Shares from the Grantors. In addition, in connection with the consummation of the

transactions contemplated by the Option Agreement, Alkaloida acquired 2,600 Founders’ Shares, which control in the aggregate one-third

of the voting power of the Issuer.

This amount also includes 5,159,765 Ordinary Shares acquired by Alkaloida

on November 1, 2010 from Franklin Advisors, Inc. and Templeton Asset Management Ltd.

This amount also includes 712,500 Ordinary Shares acquired by Alkaloida

on January 18, 2011 under the Purchase Agreement and 712,500 Ordinary Shares acquired by Alkaloida on January 18, 2011 pursuant to Warrant

No. 2.

** Based on 37,584,631 Ordinary

Shares issued and outstanding as of March 31, 2023. During the year ended March 31, 2022, Alkaloida’s ownership percentage increased

0.65% to 72.12% due to the repurchase of 341,413 Ordinary Shares by the Issuer during the year.

SCHEDULE 13D/A

| CUSIP No. M8737E108 |

|

Page

5 of 11 Pages |

| 1 |

NAME OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

SUN PHARMACEUTICAL HOLDINGS USA, INC.*

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See instructions)

(a) ☐

(b) ☐

|

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS (See instructions)

PF

|

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2(d) or 2(e)

☐

|

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

NUMBER OF SHARES BENEFICIALLY OWNED BY

EACH

REPORTING PERSON

WITH |

7 |

SOLE VOTING POWER

0

|

| 8 |

SHARED VOTING POWER

2,333,802**

|

| 9 |

SOLE DISPOSITIVE POWER

0

|

| 10 |

SHARED DISPOSITIVE POWER

2,333,802

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,333,802

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See instructions) ☐

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

6.21%***

|

| 14 |

TYPE OF REPORTING PERSON (See instructions)

CO

|

* Sun Pharmaceutical Holdings

USA, Inc. (“Sun USA”) is an indirectly wholly-owned subsidiary of Sun through two entities (i.e., Sun Pharma (Netherlands)

B.V. and Sun Pharma Holdings (UK) Limited) which may also be deemed to have beneficial ownership.

** Includes 2,333,802 Ordinary

Shares directly owned by TDC, which is an indirect wholly-owned subsidiary of Sun USA.

*** Based on 37,584,631 Ordinary

Shares issued and outstanding as of March 31, 2023. During the year ended March 31, 2022, Sun USA’s ownership percentage increased

0.06% to 6.21% due to the repurchase of 341,413 Ordinary Shares by the Issuer during the year.

SCHEDULE 13D/A

| CUSIP No. M8737E108 |

|

Page

6 of 11 Pages |

| 1 |

NAME OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

SUN PHARMACEUTICAL INDUSTRIES, INC. (f/k/a CARACO PHARMACEUTICAL LABORATORIES,

LTD.)

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See instructions)

(a) ☐

(b) ☐

|

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS (See instructions)

PF

|

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2(d) or 2(e)

☐

|

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

NUMBER OF SHARES BENEFICIALLY OWNED BY

EACH

REPORTING PERSON

WITH |

7 |

SOLE VOTING POWER

0

|

| 8 |

SHARED VOTING POWER

2,333,802*

|

| 9 |

SOLE DISPOSITIVE POWER

0

|

| 10 |

SHARED DISPOSITIVE POWER

2,333,802

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,333,802

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See instructions) ☐

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

6.21%**

|

| 14 |

TYPE OF REPORTING PERSON (See instructions)

CO

|

* Includes 2,333,802 Ordinary

Shares directly owned by TDC, which is a direct wholly-owned subsidiary of Sun Pharmaceutical Industries, Inc.

** Based on 37,584,631 Ordinary Shares issued

and outstanding as of March 31, 2023. During the year ended March 31, 2022, Sun Industries’ ownership percentage increased 0.06%

to 6.21% due to the repurchase of 341,413 Ordinary Shares by the Issuer during the year.

SCHEDULE 13D/A

| CUSIP No. M8737E108 |

|

Page

7 of 11 Pages |

| 1 |

NAME OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

THE TARO DEVELOPMENT CORPORATION

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See instructions)

(a) ☐

(b) ☐

|

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS (See instructions)

PF

|

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2(d) or 2(e)

☐

|

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

New York

|

NUMBER OF SHARES BENEFICIALLY OWNED BY

EACH

REPORTING PERSON

WITH |

7 |

SOLE VOTING POWER

0

|

| 8 |

SHARED VOTING POWER

2,333,802*

|

| 9 |

SOLE DISPOSITIVE POWER

0

|

| 10 |

SHARED DISPOSITIVE POWER

2,333,802*

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,333,802

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See instructions) ☐

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

6.21%**

|

| 14 |

TYPE OF REPORTING PERSON (See instructions)

CO

|

* This amount includes the following Ordinary Shares: TDC directly owns

2,333,802 Ordinary Shares.

** Based on 37,584,631 Ordinary

Shares issued and outstanding as of March 31, 2023. During the year ended March 31, 2022, TDC’s ownership percentage increased 0.06%

to 6.21% due to the repurchase of 341,413 Ordinary Shares by the Issuer during the year.

SCHEDULE 13D/A

| CUSIP No. M8737E108 |

|

Page

8 of 11 Pages |

| 1 |

NAME OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

DILIP S. SHANGHVI

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See instructions)

(a) ☐

(b) ☐

|

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS (See instructions)

PF

|

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2(d) or 2(e)

☐

|

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

The Republic of India

|

NUMBER OF SHARES BENEFICIALLY OWNED BY

EACH

REPORTING PERSON

WITH |

7 |

SOLE VOTING POWER

0

|

| 8 |

SHARED VOTING POWER

29,497,813*

|

| 9 |

SOLE DISPOSITIVE POWER

0

|

| 10 |

SHARED DISPOSITIVE POWER

29,497,813*

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

29,497,813

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See instructions) ☐

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

78.48%**

|

| 14 |

TYPE OF REPORTING PERSON (See instructions)

HC-IN

|

* Includes 3,770,833 Ordinary

Shares acquired by Alkaloida on May 21, 2007 and 3,016,667 Ordinary Shares acquired by Alkaloida on May 30, 2007, in each case pursuant

to the Purchase Agreement; 58,500 Ordinary Shares acquired by Sun Pharma Holdings from Sun Pharma Global, Inc., which merged into Sun

on January 1, 2015, through an agreement to sell investments dated March 29, 2014; 3,000,000 Ordinary Shares acquired by Alkaloida on

August 2, 2007, pursuant to Sun’s rights under the Original Warrant; 3,712,557 Ordinary Shares acquired by Alkaloida on February

19, 2008, from Brandes; and 797,870 Ordinary Shares acquired by Alkaloida on June 23, 2008, from Harel.

This amount also includes 3,787,500 Ordinary Shares which Alkaloida

acquired pursuant to Warrant No. 2, including (i) 3,712,500 Ordinary Shares issued to Alkaloida on September 24, 2010 and (ii) 75,000

Ordinary Shares issued to Alkaloida on September 27, 2010.

This amount also includes 29,382 Ordinary Shares which Alkaloida directly

acquired on September 14, 2010, upon the closing of the initial offering period of the tender offer to purchase all of the outstanding

Ordinary Shares, pursuant to the Tender Offer Statement on Schedule TO, filed on June 30, 2008, as amended.

This amount also includes an aggregate of 4,739,739 Ordinary Shares

indirectly acquired by Sun pursuant to the Letter Agreement. Pursuant to the Letter Agreement: (i) Alkaloida directly acquired 2,405,925

Ordinary Shares from the Grantors, consummating an option granted by the Grantors to Alkaloida under the Option Agreement, (ii) Alkaloida

directly acquired an additional 12 Ordinary Shares from the Grantors, and (iii) upon the merger of a subsidiary of Sun Michigan with and

into TDC on October 1, 2010, Sun Michigan indirectly acquired 2,333,802 Ordinary Shares, consummating an option granted by TDC to Alkaloida

(and subsequently assigned to Sun Michigan) under the Option Agreement. TDC directly owns 2,333,802 Ordinary Shares, including 780 Ordinary

Shares which were previously owned by Morley and Company, Inc., a New York corporation, which merged with and into TDC. In addition, in

connection with the consummation of the transactions contemplated by the Option Agreement, Alkaloida acquired 2,600 Founders’ Shares,

which control in the aggregate one-third of the voting power of the Issuer. This amount also includes 5,159,765 Ordinary Shares acquired

by Alkaloida on November 1, 2010 from Franklin Advisors, Inc. and Templeton Asset Management Ltd.

This amount also includes 712,500 Ordinary Shares acquired by Alkaloida

on January 18, 2011 under the Purchase Agreement and 712,500 Ordinary Shares acquired by Alkaloida on January 18, 2011 pursuant to Warrant

No. 2.

** Based on 37,584,631 Ordinary Shares issued

and outstanding as of March 31, 2023. During the year ended March 31, 2022, Mr. Shanghvi’s ownership percentage increased 0.71%

to 78.48% due to the repurchase of 341,413 Ordinary Shares by the Issuer during the year.

This Amendment No. 29 (this “Amendment”)

amends and supplements the Statement on Schedule 13D originally filed by the Reporting Persons with the Securities and Exchange Commission

on July 3, 2007 (the “Original Schedule 13D”), as amended by the Amendment No. 1 to the Original Schedule 13D, filed on July

25, 2007 (the “Amendment No. 1”); the Amendment No. 2 to the Original Schedule 13D, filed on August 2, 2007 (the “Amendment

No. 2”); the Amendment No. 3 to the Original Schedule 13D, filed on February 19, 2008 (the “Amendment No. 3”); the

Amendment No. 4 to the Original Schedule 13D, filed on May 29, 2008 (the “Amendment No. 4”); the Amendment No. 5 to the Original

Schedule 13D, filed on June 5, 2008 (the “Amendment No. 5”); the Amendment No. 6 to the Original Schedule 13D, filed on June

24, 2008 (the “Amendment No. 6”); the Amendment No. 7 to the Original Schedule 13D, filed on June 25, 2008 (the “Amendment

No. 7”); the Amendment No. 8 to the Original Schedule 13D, filed on December 2, 2009 (the “Amendment No. 8”); the Amendment

No. 9 to the Original Schedule 13D, filed on December 11, 2009 (the Amendment No. 9”); the Amendment No. 10 to the Original Schedule

13D, filed on December 14, 2009 (the “Amendment No. 10”); the Amendment No. 11 to the Original Schedule 13D, filed on December

15, 2009 (the “Amendment No. 11”); the Amendment No. 12 to the Original Schedule 13D, filed on December 17, 2009 (the “Amendment

No. 12”); the Amendment No. 13 to the Original Schedule 13D, filed on December 21, 2009 (the “Amendment No. 13”); the

Amendment No. 14 to the Original Schedule 13D, filed on December 22, 2009 (the “Amendment No. 14”); the Amendment No. 15

to the Original Schedule 13D, filed on December 24, 2009 (the “Amendment No. 15”); the Amendment No. 16 to the Original Schedule

13D, filed on December 31, 2009 (the “Amendment No. 16”); the Amendment No. 17 to the Original Schedule 13D, filed on January

11, 2010 (the “Amendment No. 17”); the Amendment No. 18 to the Original Schedule 13D, filed on September 10, 2010 (the “Amendment

No. 18”); the Amendment No. 19 to the Original Schedule 13D, filed on September 24, 2010 (the “Amendment No. 19”);

the Amendment No. 20 to the Original Schedule 13D, filed on October 5, 2010 (the “Amendment No. 20”); the Amendment No. 21

to the Original Schedule 13D, filed on November 4, 2010 (the “Amendment No. 21”); the Amendment No. 22 to the Original Schedule

13D, filed on January 19, 2011 (the “Amendment No. 22”); the Amendment No. 23 to the Original Schedule 13D, filed on October

18, 2011 (the “Amendment No. 23”); the Amendment No. 24 to the Original Schedule 13D, filed on August 13, 2012 (the “Amendment

No. 24”); the Amendment No. 25 to the Original Schedule 13D, filed on February 8, 2013 (the “Amendment No. 25”); the

Amendment No. 26 to the Original Schedule 13D, filed on November 27, 2013; the Amendment No. 27 to the Original Schedule 13D, filed on

September 8, 2022 (the “Amendment No. 27”); and the Amendment No. 28 to the Original Schedule 13D, filed on May 26, 2023

(the “Amendment No. 28” and, together with the Original Schedule 13D, the Amendment No. 1, to and through the Amendment No.

27, the “Schedule 13D”), with respect to the Ordinary Shares, nominal (par) value NIS 0.0001 per share (the “Ordinary

Shares”), of Taro Pharmaceutical Industries Ltd., a company incorporated under the laws of the State of Israel (the “Issuer”),

whose principal executive offices are located at 14 Hakitor Street, Haifa Bay 26110, Israel. Unless otherwise indicated, each capitalized

term used but not defined herein shall have the meaning assigned to such term in the Schedule 13D.

| ITEM 3. | Source and Amount of Funds or Other Consideration. |

Item 3 of the Schedule 13D is hereby amended and

supplemented to include the following:

The description of the Proposed Transaction set forth in Item

4 below is incorporated by reference in its entirety into this Item 3. It is anticipated that funding for the consideration payable pursuant

to the Proposed Transaction will be obtained through available cash on hand, borrowings, or a combination thereof.

| ITEM 4. | Purpose of Transaction. |

Item 4 of the Schedule 13D is hereby amended and

supplemented to include the following:

As previously disclosed, on May 26, 2023, Sun delivered a

letter (the “May 26 Letter”) to the Board of Directors of the Issuer that contained a non-binding indication of interest

to acquire all of the outstanding shares of the Issuer’s Ordinary Shares, other than any shares held by Sun or its affiliates,

for a purchase price per share of $38.00 in cash (the “Proposed Transaction”). The foregoing summary of the May 26 Letter

is qualified in its entirety by reference to the full text of the May 26 Letter, a copy of which was attached to Amendment No. 28 as

Exhibit 99.57.

Following delivery of the May 26 Letter, Sun engaged in

multiple rounds of price negotiations with a special committee of the Board of Directors of the Issuer (the “Special

Committee”) regarding the terms of the Proposed Transaction. Such negotiations ultimately resulted in Sun communicating to the

members of the Special Committee updated terms of the Proposed Transaction, pursuant to which Sun has proposed to acquire all of the

outstanding shares of the Issuer’s Ordinary Shares, other than any shares held by Sun or its affiliates, for a purchase price

per share of $43.00 in cash (the “Revised Proposal”). On December 10, 2023, the Special Committee confirmed that it

agreed in principle with the Revised Proposal and that it has agreed to negotiate definitive agreements. Negotiations regarding

definitive terms and agreements for a Proposed Transaction are ongoing, and no assurances can be given that a definitive agreement

will be reached, as to the terms of any such definitive agreement, or that the Proposed Transaction will be consummated, and the

Revised Proposal remains subject to further required corporate approvals, execution of definitive documentation and satisfaction of

other customary conditions. The Special Committee is comprised solely of independent directors and the required corporate approvals

with respect to the Proposed Transaction shall include the affirmative approval of the shareholders holding a majority of all the

votes of shareholders, excluding Sun, its affiliates and any other shareholders that have a personal interest in the approval of the

transaction, who participate in the vote.

The Proposed Transaction could result in one or more of the

actions specified in clauses (a)−(j) of Item 4 of Schedule 13D, including the acquisition of additional securities of the Issuer,

a merger or other extraordinary transaction involving the Issuer, a change to the present capitalization of the Issuer, the delisting

of the Issuer’s securities from the New York Stock Exchange, and a class of equity securities of the Issuer becoming eligible for

termination of registration pursuant to Section 12(g)(4) of the Exchange Act. The Reporting Persons may at any time, or from time to time,

amend, pursue, or choose not to pursue the Proposed Transaction; change the terms of the Proposed Transaction, including the price, conditions,

or scope of the transaction; take any appropriate action in or out of the ordinary course of business to facilitate or increase the likelihood

of consummation of the Proposed Transaction.

The Reporting Persons do not intend to provide additional

disclosures regarding the Proposed Transaction unless and until a definitive agreement has been reached, or unless disclosure is otherwise

required under applicable securities laws. Completion of the Proposed Transaction is subject to, among other matters, the negotiation

of a definitive agreement and satisfaction of the conditions negotiated therein, including the approval of the transaction by shareholders

of the Issuer. There is no certainty as to the timetable for the potential execution of any definitive agreement. Furthermore, no legally

binding obligation of the Reporting Persons to participate in the Proposed Transaction will exist unless and until mutually acceptable

definitive documentation has been executed and delivered with respect thereto.

| ITEM 6. | Contracts, Arrangements, Understandings or Relationships with respect to Securities of the Issuer. |

Item 6 of the Schedule 13D is hereby amended and supplemented

by incorporating by reference in its entirety the description of the Proposed Transaction and the other matters set forth in Item 4 above.

SIGNATURE

After reasonable inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated:

December 11, 2023

| |

SUN PHARMACEUTICAL INDUSTRIES LIMITED |

| |

|

| |

|

| |

By: |

/s/ Sailesh T. Desai |

| |

Name: |

Sailesh T. Desai |

| |

Title: |

Whole-time Director |

| |

SUN PHARMA HOLDINGS |

| |

|

| |

|

| |

By: |

/s/ Rajesh K. Shah |

| |

Name: |

Rajesh K. Shah |

| |

Title: |

Director |

| |

ALKALOIDA CHEMICAL COMPANY ZRT. |

| |

|

| |

|

| |

By: |

/s/ Sunil Ajmera |

| |

Name: |

Sunil Ajmera |

| |

Title: |

Director |

| |

SUN PHARMACEUTICAL HOLDINGS USA, INC. |

| |

|

| |

|

| |

By: |

/s/ Erik Zwicker |

| |

Name: |

Erik Zwicker |

| |

Title: |

Secretary |

| |

SUN PHARMACEUTICAL INDUSTRIES, INC. |

| |

|

| |

|

| |

By: |

/s/ Erik Zwicker |

| |

Name: |

Erik Zwicker |

| |

Title: |

Vice President, General Counsel, North America |

| |

THE TARO DEVELOPMENT CORPORATION |

| |

|

| |

|

| |

By: |

/s/ Sudhir V. Valia |

| |

Name: |

Sudhir V. Valia |

| |

Title: |

Director |

| |

|

/s/ Dilip S. Shanghvi |

| |

Name: |

Dilip S. Shanghvi |

[Signature Page to Amendment No. 29 to Schedule

13D]

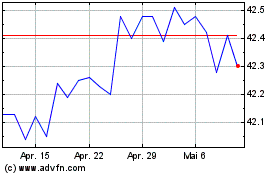

Taro Pharmaceutical Indu... (NYSE:TARO)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Taro Pharmaceutical Indu... (NYSE:TARO)

Historical Stock Chart

Von Dez 2023 bis Dez 2024