SPX Technologies, Inc. (NYSE:SPXC) (“SPX”, the “Company”, “we” or

“our”) today reported results for the first quarter ended March 30,

2024.

Gene Lowe, President and CEO, remarked, “I’m very pleased with

our strong Q1 performance, which included substantial growth in all

of our key profit measures and significant margin expansion in both

segments. During the quarter we continued to see solid demand

across several key markets and our businesses executed well

operationally.”

Mr. Lowe continued, “During Q1, we made significant progress on

several key value creation initiatives, including driving greater

efficiencies in our production facilities and effectively

integrating our recent acquisitions. These enhancements are

strengthening our company and positioning us for further

growth.”

Mr. Lowe commented further, “Looking ahead, we continue to see

overall favorable demand trends and positive operational momentum.

Following the strong start to the year, we are raising our

full-year guidance for Adjusted EPS* to a range of $5.15 to $5.40

from $4.85 to $5.15 previously, with the midpoint implying

year-on-year growth of approximately 23%.”

First Quarter 2024 Overview:

For the first quarter of 2024, the company

reported revenue of $465.2 million and operating income of $64.6

million, compared with revenue of $399.8 million and operating

income of $49.8 million in the first quarter of 2023. Net income

for the first quarter of 2024 was $49.0 million, compared with

$42.8 million in the first quarter of 2023. Diluted income

per share from continuing operations in the first quarter of 2024

was $1.05, compared with $0.84 in the first quarter of 2023. The

increase in revenue, operating income, net income and diluted

income per share from continuing operations were due primarily to

higher revenue in both our HVAC and Detection & Measurement

segments.

Adjusted EBITDA* was $92.0 million, compared with $62.7 million

in the first quarter of 2023, or an increase of 46.7%. Adjusted

earnings per share* in the first quarter of 2024 was $1.25,

compared with $0.93 in the first quarter of 2023. Adjusted

EBITDA* and Adjusted earnings per share* exclude amortization

expense and acquisition-related costs, among other items.

First Quarter Financial Comparisons:

| ($

millions) |

|

Q1 2024 |

|

Q1 2023 |

|

Revenue |

|

$ |

465.2 |

|

$ |

399.8 |

| Consolidated operating

income |

|

|

64.6 |

|

|

49.8 |

| Income from continuing

operations |

|

|

49.2 |

|

|

39.1 |

|

Net Income |

|

|

49.0 |

|

|

42.8 |

| |

|

|

|

|

|

|

| Consolidated segment income* |

|

|

99.8 |

|

|

74.4 |

| Adjusted operating income* |

|

|

84.4 |

|

|

58.3 |

|

Adjusted EBITDA* |

|

|

92.0 |

|

|

62.7 |

| |

|

|

|

|

|

|

* Non-GAAP financial measure. See attached schedules for

reconciliation of each historical non-GAAP measure to the

respective most comparable GAAP financial measure. A

reconciliation of non-GAAP guidance measures is not practicable

and, accordingly, is not included.

HVAC Segment

Revenue for the first quarter of 2024 was $302.4

million, compared with $251.6 million in the first quarter of 2023,

an increase of 20.2%, including a 22.2% increase from the

acquisitions of Ingénia, ASPEQ, and TAMCO, a 1.9% organic revenue*

decline, and a 0.1% unfavorable impact related to currency

fluctuation. The organic decline was due primarily to lower sales

of heating products associated with unseasonably warm temperatures

during the Q1 heating season compared with higher prior-year sales

that were supported by elevated post-pandemic backlog.

Segment income in the first quarter of 2024 was

$68.4 million, or 22.6% of revenue. This compares with segment

income of $47.7 million, or 19.0% of revenue in the first quarter

of 2023. The increase in segment income and 360 basis points

increase in segment income margin were due primarily to the higher

revenues noted above as well as a more favorable product mix.

Detection & Measurement

Segment

Revenue for the first quarter of 2024 was $162.8

million, compared with $148.2 million in the first quarter of 2023,

an increase of 9.9%, including a 9.6% increase in organic revenue*

and a 0.3% favorable impact related to currency fluctuation. The

organic increase was primarily due to higher project sales in our

Communication Technologies platform.

Segment income for the first quarter of 2024 was

$31.4 million, or 19.3% of revenue. This compares with

segment income of $26.7 million, or 18.0% of revenue of in the

first quarter of 2023. The increase in segment income and 130

basis points increase in segment income margin were due to the

higher revenue noted above and the associated operating

leverage.

Financial Update: As of March

30, 2024, SPX Technologies had total outstanding debt of $854.4

million and total cash of $105.5 million. During the first quarter

of 2024, SPX’s net operating cash from continuing operations

totaled $10.7 million. Capital expenditures for continuing

operations for the first quarter of 2024 were $9.9 million.

2024 Guidance Update:

SPX Technologies is increasing full-year 2024

guidance. The company is now targeting consolidated revenue of

$1.965-$2.025 billion ($1.93-$2.00 billion prior), adjusted EBITDA*

of $390-$420 million ($375-$405 million prior), and adjusted

earnings per share* of $5.15-$5.40 ($4.85-$5.15 prior).

Segment and company performance is expected to be as

follows:

|

|

|

Revenue |

|

Segment Income Margin % |

|

HVAC |

|

$1,360-$1,400 million($1,325-$1,375 million prior) |

|

22.25%-23.25%

(21.25%-22.25% prior) |

| Detection & Measurement |

|

$605-$625 million(no change) |

|

20.00%-21.00%(no change) |

|

Total SPX |

|

$1,965-$2,025 million($1,930-$2,000 million prior) |

|

21.60%-22.60%*(21.00%-22.00% prior) |

| |

|

|

|

|

Form 10-Q: The company expects

to file its quarterly report on Form 10-Q for the quarter ended

March 30, 2024 with the Securities and Exchange Commission on or

before May 9, 2024. This press release should be read in

conjunction with that filing, which will be available on the

company's website at www.spx.com, in the Investor Relations

section.

Conference Call: SPX will host

a conference call at 4:45 p.m. (EDT) today to discuss first quarter

results. The call will be simultaneously webcast via the company's

website at www.spx.com and the slide presentation will be

available in the Investor Relations section of the site.

Call Access: To access

the call by phone, please go to this link

https://register.vevent.com/register/BIac05c897d80c4c07b31710938aa97aad and

you will be provided with dial-in details. To avoid delays, we

encourage participants to dial into the conference call fifteen

minutes ahead of the scheduled start time. A replay of the webcast

will also be available for a limited time at www.spx.com.

Upcoming Investor Events:

Company management plans to conduct virtual meetings with investors

during the second quarter of 2024, including virtually at the

Oppenheimer Annual Industrial Growth Conference on May 8th, the UBS

Re-shoring and Infrastructure Conference in New York City on June

4th, and at the William Blair’s Annual Growth Stock Conference in

Chicago on June 6th.

About SPX: SPX Technologies,

Inc. is a diversified, global supplier of highly engineered

products and technologies, holding leadership positions in the HVAC

and detection and measurement markets. Based in Charlotte, North

Carolina, SPX has more than 4,100 employees in 15 countries. SPX is

listed on the New York Stock Exchange under the ticker symbol

“SPXC.” For more information, please visit www.spx.com.

Non-GAAP Presentation: This

press release contains certain non-GAAP financial measures,

including consolidated segment income, adjusted operating income,

adjusted income from continuing operations before income taxes,

adjusted income from continuing operations, adjusted earnings per

share from continuing operations (or, adjusted EPS), EBITDA,

Adjusted EBITDA, and organic revenue growth (decline). These

non-GAAP financial measures do not provide investors with an

accurate measure of, and should not be used as a substitute for,

the comparable financial measures as determined in accordance with

accounting principles generally accepted in the United States

(“GAAP”). The Company believes these non-GAAP financial measures,

when read in conjunction with the comparable GAAP financial

measures, give investors a useful tool to assess and understand the

Company’s overall financial performance, because they exclude items

of income or expense that the Company believes are not reflective

of its ongoing operating performance, allowing for a better

period-to-period comparison of operations of the Company.

Additionally, the Company’s management uses these non-GAAP

financial measures as measures of the Company’s performance. The

Company acknowledges that there are many items that impact a

company’s reported results and the adjustments reflected in these

non-GAAP measures are not intended to present all items that may

have impacted these results. In addition, these non-GAAP measures

are not necessarily comparable to similarly titled measures used by

other companies.

Refer to the tables included in this press

release for the components of each of the non-GAAP financial

measures, and for the reconciliations of historical non-GAAP

financial measures to their respective comparable GAAP measures.

Our non-GAAP financial guidance excludes items, which would be

included in our GAAP financial measures, that we do not consider

indicative of our on-going performance; and are calculated in a

manner consistent with the presentation of the similarly titled

historical non-GAAP measures presented in this press release. These

items include, but are not limited to, acquisition costs, costs

associated with dispositions, and potential non-cash income or

expense items associated with changes in market interest rates and

actuarial or other data related to our pension and postretirement

plans, as the ultimate aggregate amounts associated with these

items are out of our control and/or cannot be reasonably predicted.

Accordingly, a reconciliation of our non-GAAP financial guidance to

the most comparable GAAP financial measures is not practicable.

Full-year guidance excludes changes in the number of shares

outstanding; impacts from future acquisitions, dispositions and

related transaction costs, restructuring costs, incremental impacts

of tariffs and trade tensions on market demand and costs subsequent

to the end of the first quarter, the impact of foreign exchange

rate changes subsequent to the end of the first quarter, and

environmental and litigation charges.

Forward Looking Statements:

Certain statements in this press release are forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended, and are subject to the safe harbor created

thereby. Please read these results in conjunction with the

Company’s documents filed with the Securities and Exchange

Commission, including the Company’s most recent annual report on

Form 10-K. These filings identify important risk factors and other

uncertainties that could cause actual results to differ from those

contained in the forward-looking statements, including the

following: cyclical changes and specific industry events in the

Company’s markets; changes in anticipated capital investment and

maintenance expenditures by customers; availability, limitations or

cost increases of raw materials and/or commodities that cannot be

recovered in product pricing; the impact of competition on profit

margins and the Company’s ability to maintain or increase market

share; inadequate performance by third-party suppliers and

subcontractors for outsourced products, components and services and

other supply-chain risks; the uncertainty with respect to

environmental and other contingent liabilities; the impact of

climate change and any legal or regulatory actions taken in

response there to; cyber-security risks; risks with respect to the

protection of intellectual property, including with respect to the

Company’s digitalization initiatives; the impact of overruns,

inflation and the incurrence of delays with respect to long-term

fixed-price contracts; defects or errors in current or planned

products; the impact of pandemics and governmental and other

actions taken in response; domestic economic, political, legal,

accounting and business developments adversely affecting the

Company’s business, including regulatory changes; changes in

worldwide economic conditions, including as a result of

geopolitical conflicts; uncertainties with respect to the Company’s

ability to identify acceptable acquisition targets; uncertainties

surrounding timing and successful completion of acquisition or

disposition transactions, including with respect to integrating

acquisitions and achieving cost savings or other benefits from

acquisitions; the impact of retained liabilities of disposed

businesses; potential labor disputes; and extreme weather

conditions and natural and other disasters.

Actual results may differ materially from these

statements. The words “guidance,” “believe,” “targeting,” “expect,”

“anticipate,” “project” and similar expressions identify

forward-looking statements. Although the company believes that the

expectations reflected in its forward-looking statements are

reasonable, it can give no assurance that such expectations will

prove to be correct.

Statements in this press release speak only as

of the date of this press release, and SPX disclaims any

responsibility to update or revise such statements, except as

required by law.

SOURCE SPX Technologies, Inc.

Investor and Media

Contacts:Paul Clegg, VP, Investor Relations and

CommunicationsPhone: 980-474-3806E-mail:

spx.investor@spx.com Source: SPX Technologies, Inc.

|

SPX TECHNOLOGIES, INC. AND SUBSIDIARIES |

|

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

(Unaudited; in millions, except per share

amounts) |

| |

|

|

|

| |

Three months ended |

| |

March 30, 2024 |

|

April 1, 2023 |

| |

|

|

|

|

Revenues |

$ |

465.2 |

|

|

$ |

399.8 |

|

| Costs and expenses: |

|

|

|

|

Cost of products sold |

|

282.3 |

|

|

|

249.9 |

|

|

Selling, general and administrative |

|

102.9 |

|

|

|

93.8 |

|

|

Intangible amortization |

|

14.8 |

|

|

|

6.3 |

|

|

Special charges, net |

|

0.6 |

|

|

|

— |

|

|

Operating income |

|

64.6 |

|

|

|

49.8 |

|

| |

|

|

|

| Other income (expense), net |

|

(4.0 |

) |

|

|

2.5 |

|

| Interest expense |

|

(9.8 |

) |

|

|

(2.4 |

) |

| Interest income |

|

0.3 |

|

|

|

0.5 |

|

|

Income from continuing operations before income taxes |

|

51.1 |

|

|

|

50.4 |

|

| Income tax provision |

|

(1.9 |

) |

|

|

(11.3 |

) |

|

Income from continuing operations |

|

49.2 |

|

|

|

39.1 |

|

| |

|

|

|

| Income (loss) from

discontinued operations, net of tax |

|

— |

|

|

|

— |

|

| Gain (loss) on disposition of

discontinued operations, net of tax |

|

(0.2 |

) |

|

|

3.7 |

|

|

Income (loss) from discontinued operations, net of tax |

|

(0.2 |

) |

|

|

3.7 |

|

| |

|

|

|

| Net income |

$ |

49.0 |

|

|

$ |

42.8 |

|

| |

|

|

|

| Basic income per share of

common stock: |

|

|

|

|

Income from continuing operations |

$ |

1.07 |

|

|

$ |

0.86 |

|

|

Income from discontinued operations |

|

— |

|

|

|

0.08 |

|

|

Net income per share |

$ |

1.07 |

|

|

$ |

0.94 |

|

| |

|

|

|

| Weighted-average number of

common shares outstanding — basic |

|

45.828 |

|

|

|

45.382 |

|

| |

|

|

|

| Diluted income per share of

common stock: |

|

|

|

|

Income from continuing operations |

$ |

1.05 |

|

|

$ |

0.84 |

|

|

Income from discontinued operations |

|

— |

|

|

|

0.08 |

|

|

Net income per share |

$ |

1.05 |

|

|

$ |

0.92 |

|

| |

|

|

|

| Weighted-average number of

common shares outstanding — diluted |

|

46.683 |

|

|

|

46.402 |

|

| |

|

|

|

|

|

|

|

|

SPX TECHNOLOGIES, INC. AND SUBSIDIARIES |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

(Unaudited; in millions) |

| |

|

|

|

| |

March 30, 2024 |

|

December 31, 2023 |

| ASSETS |

|

|

|

| Current assets: |

|

|

|

|

Cash and equivalents |

$ |

100.5 |

|

|

$ |

99.4 |

|

|

Accounts receivable, net |

|

317.6 |

|

|

|

279.8 |

|

|

Contract assets |

|

32.0 |

|

|

|

16.6 |

|

|

Inventories, net |

|

295.1 |

|

|

|

276.7 |

|

|

Other current assets |

|

34.4 |

|

|

|

37.1 |

|

|

Total current assets |

|

779.6 |

|

|

|

709.6 |

|

| Property, plant and

equipment: |

|

|

|

|

Land |

|

23.2 |

|

|

|

17.9 |

|

|

Buildings and leasehold improvements |

|

118.7 |

|

|

|

73.4 |

|

|

Machinery and equipment |

|

291.9 |

|

|

|

264.4 |

|

| |

|

433.8 |

|

|

|

355.7 |

|

|

Accumulated depreciation |

|

(216.6 |

) |

|

|

(215.2 |

) |

|

Property, plant and equipment, net |

|

217.2 |

|

|

|

140.5 |

|

| Goodwill |

|

844.5 |

|

|

|

704.8 |

|

| Intangibles, net |

|

760.6 |

|

|

|

680.8 |

|

| Other assets |

|

184.3 |

|

|

|

188.9 |

|

| Deferred income taxes |

|

4.0 |

|

|

|

4.0 |

|

| Assets of DBT and Heat

Transfer |

|

9.4 |

|

|

|

11.1 |

|

| TOTAL ASSETS |

$ |

2,799.6 |

|

|

$ |

2,439.7 |

|

| |

|

|

|

| LIABILITIES AND STOCKHOLDERS'

EQUITY |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

151.4 |

|

|

$ |

118.7 |

|

|

Contract liabilities |

|

72.9 |

|

|

|

73.5 |

|

|

Accrued expenses |

|

126.2 |

|

|

|

168.5 |

|

|

Income taxes payable |

|

6.5 |

|

|

|

5.3 |

|

|

Short-term debt |

|

317.0 |

|

|

|

17.9 |

|

|

Current maturities of long-term debt |

|

20.8 |

|

|

|

17.3 |

|

|

Total current liabilities |

|

694.8 |

|

|

|

401.2 |

|

| |

|

|

|

| Long-term debt |

|

516.6 |

|

|

|

523.1 |

|

| Deferred and other income

taxes |

|

109.7 |

|

|

|

77.0 |

|

| Other long-term

liabilities |

|

202.6 |

|

|

|

204.1 |

|

| Liabilities of DBT and Heat

Transfer |

|

38.4 |

|

|

|

39.7 |

|

|

Total long-term liabilities |

|

867.3 |

|

|

|

843.9 |

|

| |

|

|

|

| Stockholders' equity: |

|

|

|

|

Common stock |

|

0.5 |

|

|

|

0.5 |

|

|

Paid-in capital |

|

1,351.6 |

|

|

|

1,353.6 |

|

|

Retained earnings |

|

87.3 |

|

|

|

38.3 |

|

|

Accumulated other comprehensive income |

|

250.9 |

|

|

|

261.1 |

|

|

Common stock in treasury |

|

(452.8 |

) |

|

|

(458.9 |

) |

|

Total stockholders' equity |

|

1,237.5 |

|

|

|

1,194.6 |

|

| TOTAL LIABILITIES AND

STOCKHOLDERS' EQUITY |

$ |

2,799.6 |

|

|

$ |

2,439.7 |

|

| |

|

|

|

|

|

|

|

|

SPX TECHNOLOGIES, INC. AND SUBSIDIARIES |

|

RESULTS OF REPORTABLE SEGMENTS |

|

(Unaudited; in millions) |

| |

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

|

|

|

| |

|

March 30, 2024 |

|

April 1, 2023 |

|

Δ |

|

%/bps |

| HVAC reportable

segment |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Revenues |

|

$ |

302.4 |

|

|

$ |

251.6 |

|

|

$ |

50.8 |

|

|

20.2% |

| Gross profit |

|

|

117.4 |

|

|

|

88.3 |

|

|

|

29.1 |

|

|

|

| Selling, general and

administrative expense |

|

|

49.0 |

|

|

|

40.6 |

|

|

|

8.4 |

|

|

|

| Income |

|

$ |

68.4 |

|

|

$ |

47.7 |

|

|

$ |

20.7 |

|

|

43.4% |

|

as a percent of revenues |

|

|

22.6 |

% |

|

|

19.0 |

% |

|

|

|

360bps |

| |

|

|

|

|

|

|

|

|

| Detection &

Measurement reportable segment |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Revenues |

|

$ |

162.8 |

|

|

$ |

148.2 |

|

|

$ |

14.6 |

|

|

9.9% |

| Gross profit |

|

|

66.4 |

|

|

|

61.6 |

|

|

|

4.8 |

|

|

|

| Selling, general and

administrative expense |

|

|

35.0 |

|

|

|

34.9 |

|

|

|

0.1 |

|

|

|

| Income |

|

$ |

31.4 |

|

|

$ |

26.7 |

|

|

$ |

4.7 |

|

|

17.6% |

|

as a percent of revenues |

|

|

19.3 |

% |

|

|

18.0 |

% |

|

|

|

130bps |

| |

|

|

|

|

|

|

|

|

| Consolidated

Revenues |

|

$ |

465.2 |

|

|

$ |

399.8 |

|

|

$ |

65.4 |

|

|

16.4% |

| Consolidated Operating

Income |

|

|

64.6 |

|

|

|

49.8 |

|

|

|

14.8 |

|

|

29.7% |

|

as a percent of revenues |

|

|

13.9 |

% |

|

|

12.5 |

% |

|

|

|

140bps |

| Consolidated Segment

Income |

|

|

99.8 |

|

|

|

74.4 |

|

|

|

25.4 |

|

|

34.1% |

|

as a percent of revenues |

|

|

21.5 |

% |

|

|

18.6 |

% |

|

|

|

290bps |

| |

|

|

|

|

|

|

|

|

| Consolidated operating

income |

|

$ |

64.6 |

|

|

$ |

49.8 |

|

|

$ |

14.8 |

|

|

|

| Exclude: |

|

|

|

|

|

|

|

|

|

Corporate expense |

|

|

13.9 |

|

|

|

14.6 |

|

|

|

(0.7 |

) |

|

|

|

Acquisition-related and other costs (1) |

|

|

2.6 |

|

|

|

0.6 |

|

|

|

2.0 |

|

|

|

|

Long-term incentive compensation expense |

|

|

3.3 |

|

|

|

3.1 |

|

|

|

0.2 |

|

|

|

|

Amortization of acquired intangible assets |

|

|

14.8 |

|

|

|

6.3 |

|

|

|

8.5 |

|

|

|

|

Special charges, net |

|

|

0.6 |

|

|

|

— |

|

|

|

0.6 |

|

|

|

| Total segment

income |

|

$ |

99.8 |

|

|

$ |

74.4 |

|

|

$ |

25.4 |

|

|

34.1% |

|

as a percent of revenues |

|

|

21.5 |

% |

|

|

18.6 |

% |

|

|

|

290bps |

| |

|

|

|

|

|

|

|

|

|

(1) Represents certain acquisition-related costs incurred of

$2.6 and $0.6 during the three months ended March 30, 2024 and

April 1, 2023, respectively, including additional “Cost of products

sold” related to the step up of inventory (to fair value) acquired

in connection with the Ingénia acquisition of $0.9 during the three

months ended March 30, 2024. |

| |

|

|

|

|

|

|

|

|

|

SPX TECHNOLOGIES, INC. AND SUBSIDIARIES |

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS |

|

(Unaudited; in millions) |

| |

|

|

|

| |

Three months ended |

| |

March 30, 2024 |

|

April 1, 2023 |

| Cash flows from (used

in) operating activities: |

|

|

|

|

Net income |

$ |

49.0 |

|

|

$ |

42.8 |

|

| Less: Gain (loss) from

discontinued operations, net of tax |

|

(0.2 |

) |

|

|

3.7 |

|

| Income from continuing

operations |

|

49.2 |

|

|

|

39.1 |

|

| Adjustments to reconcile

income from continuing operations to net cash from (used in)

operating activities: |

|

|

|

|

Special charges, net |

|

0.6 |

|

|

|

— |

|

|

(Gain) loss on change in fair value of equity security |

|

4.2 |

|

|

|

(3.6 |

) |

|

Deferred and other income taxes |

|

(3.4 |

) |

|

|

(3.5 |

) |

|

Depreciation and amortization |

|

21.0 |

|

|

|

10.7 |

|

|

Pension and other employee benefits |

|

4.2 |

|

|

|

3.5 |

|

|

Long-term incentive compensation |

|

3.3 |

|

|

|

3.1 |

|

|

Other, net |

|

(1.6 |

) |

|

|

(1.5 |

) |

| Changes in operating assets

and liabilities, net of effects from acquisitions and

divestitures: |

|

|

|

|

Accounts receivable and other assets |

|

(29.5 |

) |

|

|

(15.1 |

) |

|

Inventories |

|

(12.0 |

) |

|

|

(21.2 |

) |

|

Accounts payable, accrued expenses and other |

|

(24.9 |

) |

|

|

(10.7 |

) |

|

Cash spending on restructuring actions |

|

(0.4 |

) |

|

|

— |

|

| Net cash from continuing

operations |

|

10.7 |

|

|

|

0.8 |

|

| Net cash used in discontinued

operations |

|

(0.2 |

) |

|

|

(5.2 |

) |

| Net cash from (used in)

operating activities |

|

10.5 |

|

|

|

(4.4 |

) |

| |

|

|

|

| Cash flows from (used

in) investing activities: |

|

|

|

|

Proceeds related to company-owned life insurance policies, net |

|

0.1 |

|

|

|

0.1 |

|

|

Business acquisition, net of cash acquired |

|

(294.1 |

) |

|

|

— |

|

|

Capital expenditures |

|

(9.9 |

) |

|

|

(4.0 |

) |

| Net cash used in continuing

operations |

|

(303.9 |

) |

|

|

(3.9 |

) |

| Net cash used in discontinued

operations |

|

— |

|

|

|

— |

|

| Net cash used in investing

activities |

|

(303.9 |

) |

|

|

(3.9 |

) |

| |

|

|

|

| Cash flows from (used

in) financing activities: |

|

|

|

|

Borrowings under senior credit facilities |

|

557.2 |

|

|

|

20.0 |

|

|

Repayments under senior credit facilities |

|

(279.2 |

) |

|

|

— |

|

|

Borrowings under trade receivables arrangement |

|

65.0 |

|

|

|

47.0 |

|

|

Repayments under trade receivables arrangement |

|

(47.0 |

) |

|

|

— |

|

|

Net repayments under other financing arrangements |

|

(0.3 |

) |

|

|

— |

|

|

Minimum withholdings paid on behalf of employees for net share

settlements, net of proceeds from the exercise of employee stock

options |

|

(3.0 |

) |

|

|

(4.1 |

) |

| Net cash from continuing

operations |

|

292.7 |

|

|

|

62.9 |

|

| Net cash from discontinued

operations |

|

— |

|

|

|

— |

|

| Net cash from financing

activities |

|

292.7 |

|

|

|

62.9 |

|

| Change in cash and equivalents

due to changes in foreign currency exchange rates |

|

1.3 |

|

|

|

1.0 |

|

| Net change in cash and

equivalents |

|

0.6 |

|

|

|

55.6 |

|

| Consolidated cash and

equivalents, beginning of period |

|

104.9 |

|

|

|

157.1 |

|

| Consolidated cash and

equivalents, end of period |

$ |

105.5 |

|

|

$ |

212.7 |

|

| |

|

|

|

|

|

|

|

| |

Three months ended |

| |

March 30, 2024 |

|

April 1, 2023 |

| Components of cash and

equivalents: |

|

|

|

|

Cash and equivalents |

$ |

100.5 |

|

$ |

204.8 |

| Cash and equivalents included

in assets of DBT and Heat Transfer |

|

5.0 |

|

|

7.9 |

| Total cash and

equivalents |

$ |

105.5 |

|

$ |

212.7 |

| |

|

|

|

|

|

|

SPX TECHNOLOGIES, INC. AND SUBSIDIARIES |

|

CASH AND DEBT RECONCILIATION |

|

(Unaudited; in millions) |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

|

|

|

|

|

|

|

| |

|

March 30, 2024 |

|

|

|

|

|

|

|

|

| Beginning cash and

equivalents |

|

$ |

104.9 |

|

|

|

|

|

|

|

|

|

| Cash from continuing

operations |

|

|

10.7 |

|

|

|

|

|

|

|

|

|

| Capital expenditures |

|

|

(9.9 |

) |

|

|

|

|

|

|

|

|

| Proceeds related to

company-owned life insurance policies, net |

|

|

0.1 |

|

|

|

|

|

|

|

|

|

| Business acquisition, net of

cash acquired |

|

|

(294.1 |

) |

|

|

|

|

|

|

|

|

| Borrowings under senior credit

facilities |

|

|

557.2 |

|

|

|

|

|

|

|

|

|

| Repayments under senior credit

facilities |

|

|

(279.2 |

) |

|

|

|

|

|

|

|

|

| Borrowings under trade

receivables agreement |

|

|

65.0 |

|

|

|

|

|

|

|

|

|

| Repayments under trade

receivables agreement |

|

|

(47.0 |

) |

|

|

|

|

|

|

|

|

| Net repayments under other

financing arrangements |

|

|

(0.3 |

) |

|

|

|

|

|

|

|

|

| Minimum withholdings paid on

behalf of employees for net share settlements, net of proceeds from

the exercise of employee stock options |

|

|

(3.0 |

) |

|

|

|

|

|

|

|

|

| Cash used in discontinued

operations |

|

|

(0.2 |

) |

|

|

|

|

|

|

|

|

| Change in cash due to changes

in foreign currency exchange rates |

|

|

1.3 |

|

|

|

|

|

|

|

|

|

| Ending cash and

equivalents |

|

$ |

105.5 |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

Debt at |

|

|

|

|

|

|

|

Debt at |

| |

|

December 31, 2023 |

|

Borrowings |

|

Repayments |

|

Other |

|

March 30, 2024 |

|

Revolving loans |

|

$ |

— |

|

|

$ |

557.2 |

|

$ |

(275.8 |

) |

|

$ |

— |

|

$ |

281.4 |

|

| Term loans |

|

|

541.6 |

|

|

|

— |

|

|

(3.4 |

) |

|

|

— |

|

|

538.2 |

|

| Trade receivables financing

arrangement |

|

|

16.0 |

|

|

|

65.0 |

|

|

(47.0 |

) |

|

|

— |

|

|

34.0 |

|

| Other indebtedness |

|

|

2.4 |

|

|

|

— |

|

|

(0.3 |

) |

|

|

0.3 |

|

|

2.4 |

|

| Less: Deferred financing costs

associated with the term loans |

|

|

(1.7 |

) |

|

|

— |

|

|

— |

|

|

|

0.1 |

|

|

(1.6 |

) |

| Totals |

|

$ |

558.3 |

|

|

$ |

622.2 |

|

$ |

(326.5 |

) |

|

$ |

0.4 |

|

$ |

854.4 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SPX TECHNOLOGIES, INC. AND SUBSIDIARIES |

|

NON-GAAP RECONCILIATION - ORGANIC REVENUE |

|

HVAC AND DETECTION & MEASUREMENT REPORTABLE

SEGMENTS |

|

(Unaudited) |

| |

|

|

|

|

|

| |

|

Three months ended March 30, 2024 |

|

| |

|

HVAC |

|

Detection & Measurement |

|

|

Net Revenue Growth |

|

20.2 |

% |

|

9.9 |

% |

| |

|

|

|

|

|

| Exclude: Foreign Currency |

|

(0.1 |

)% |

|

0.3 |

% |

| |

|

|

|

|

|

| Exclude: Acquisitions |

|

22.2 |

% |

|

— |

% |

| |

|

|

|

|

|

| Organic Revenue Growth

(Decline) |

|

(1.9 |

)% |

|

9.6 |

% |

| |

|

|

|

|

|

|

|

SPX TECHNOLOGIES, INC. AND SUBSIDIARIES |

|

NON-GAAP RECONCILIATION - ADJUSTED OPERATING

INCOME |

|

(Unaudited; in millions) |

| |

|

|

|

|

| |

|

Three months ended |

| |

|

March 30, 2024 |

|

April 1, 2023 |

|

Operating income |

|

$ |

64.6 |

|

|

$ |

49.8 |

|

| |

|

|

|

|

| Include - TSA Income (1) |

|

|

— |

|

|

|

0.1 |

|

| |

|

|

|

|

| Exclude: |

|

|

|

|

|

Acquisition-related and other costs (2) |

|

|

(5.0 |

) |

|

|

(2.1 |

) |

| |

|

|

|

|

|

Amortization of acquired intangible assets |

|

|

(14.8 |

) |

|

|

(6.3 |

) |

| |

|

|

|

|

|

Adjusted operating income |

|

$ |

84.4 |

|

|

$ |

58.3 |

|

|

as a percent of revenues |

|

|

18.1 |

% |

|

|

14.6 |

% |

| |

|

|

|

|

|

(1) Represents transition services income related to the Asbestos

Portfolio Sale for the three months ended April 1, 2023. Amounts

recorded in non-operating income for U.S. GAAP purposes. The

Asbestos Portfolio Sale is described in the Company’s most recent

Form 10-K. |

| |

|

|

|

|

|

(2) For the three months ended March 30, 2024, represents (i)

certain acquisition and strategic/transformation related costs of

$2.4, (ii) integration costs of $1.7, and (iii) inventory step-up

charges of $0.9 related to the Ingénia acquisition. For the three

months ended April 1, 2023, represents (i) certain acquisition and

strategic/transformation related costs of $1.5 and (ii) integration

costs of $0.6. |

| |

|

|

|

|

|

SPX TECHNOLOGIES, INC. AND SUBSIDIARIES |

|

NON-GAAP RECONCILIATION - ADJUSTED EARNINGS PER

SHARE |

|

Three Months Ended March 30, 2024 |

|

(Unaudited; in millions, except per share

values) |

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

GAAP |

|

Adjustments |

|

Adjusted |

|

Segment income |

$ |

99.8 |

|

|

$ |

— |

|

|

$ |

99.8 |

|

|

Corporate expense (1) |

|

(13.9 |

) |

|

|

2.4 |

|

|

|

(11.5 |

) |

|

Acquisition-related costs (2) |

|

(2.6 |

) |

|

|

2.6 |

|

|

|

— |

|

|

Long-term incentive compensation expense |

|

(3.3 |

) |

|

|

— |

|

|

|

(3.3 |

) |

|

Amortization of intangible assets (3) |

|

(14.8 |

) |

|

|

14.8 |

|

|

|

— |

|

|

Special charges, net |

|

(0.6 |

) |

|

|

— |

|

|

|

(0.6 |

) |

| Operating

income |

|

64.6 |

|

|

|

19.8 |

|

|

|

84.4 |

|

| |

|

|

|

|

|

|

Other income (expense), net (4) |

|

(4.0 |

) |

|

|

5.4 |

|

|

|

1.4 |

|

|

Interest expense, net |

|

(9.5 |

) |

|

|

— |

|

|

|

(9.5 |

) |

| Income from continuing

operations before income taxes |

|

51.1 |

|

|

|

25.2 |

|

|

|

76.3 |

|

|

Income tax provision (5) |

|

(1.9 |

) |

|

|

(16.0 |

) |

|

|

(17.9 |

) |

| Income from continuing

operations |

|

49.2 |

|

|

|

9.2 |

|

|

|

58.4 |

|

| |

|

|

|

|

|

| Diluted shares

outstanding |

|

46.683 |

|

|

|

|

|

46.683 |

|

| |

|

|

|

|

|

| Earnings per share

from continuing operations |

$ |

1.05 |

|

|

|

|

$ |

1.25 |

|

| |

|

|

|

|

|

|

(1) Adjustment represents the removal of certain acquisition and

strategic/transformation related costs ($2.4). |

| |

|

(2) Adjustment represents the removal of (i) integration costs of

$1.7 and (ii) an inventory step-up charge related to the Ingénia

acquisition of $0.9 within the HVAC reportable segment. |

| |

|

(3) Adjustment represents the removal of amortization expense

associated with acquired intangible assets of $10.5 and $4.3 within

the HVAC and Detection & Measurement reportable segments,

respectively. |

| |

|

|

|

|

|

|

(4) Adjustment represents the removal of (i) a loss on an equity

security associated with a fair value adjustment ($4.2) and (ii)

non-service pension and postretirement charges ($1.2). |

| |

|

|

|

|

|

|

(5) Adjustment represents the tax impact of items (1) through (4)

and the removal of certain discrete income tax items that are

considered non-recurring. |

| |

|

|

|

|

|

|

SPX TECHNOLOGIES, INC. AND SUBSIDIARIES |

|

NON-GAAP RECONCILIATION - ADJUSTED EARNINGS PER

SHARE |

|

Three Months Ended April 1, 2023 |

|

(Unaudited; in millions, except per share

values) |

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

GAAP |

|

Adjustments |

|

Adjusted |

|

Segment income |

$ |

74.4 |

|

|

$ |

— |

|

|

$ |

74.4 |

|

|

Corporate expense (1) |

|

(14.6 |

) |

|

|

1.6 |

|

|

|

(13.0 |

) |

|

Acquisition-related costs (2) |

|

(0.6 |

) |

|

|

0.6 |

|

|

|

— |

|

|

Long-term incentive compensation expense |

|

(3.1 |

) |

|

|

— |

|

|

|

(3.1 |

) |

|

Amortization of intangible assets (3) |

|

(6.3 |

) |

|

|

6.3 |

|

|

|

— |

|

| Operating

income |

|

49.8 |

|

|

|

8.5 |

|

|

|

58.3 |

|

| |

|

|

|

|

|

|

Other income, net (4) |

|

2.5 |

|

|

|

(2.5 |

) |

|

|

— |

|

|

Interest expense, net |

|

(1.9 |

) |

|

|

— |

|

|

|

(1.9 |

) |

| Income from continuing

operations before income taxes |

|

50.4 |

|

|

|

6.0 |

|

|

|

56.4 |

|

|

Income tax provision (5) |

|

(11.3 |

) |

|

|

(2.0 |

) |

|

|

(13.3 |

) |

| Income from continuing

operations |

|

39.1 |

|

|

|

4.0 |

|

|

|

43.1 |

|

| |

|

|

|

|

|

| Diluted shares

outstanding |

|

46.402 |

|

|

|

|

|

46.402 |

|

| |

|

|

|

|

|

| Earnings per share

from continuing operations |

$ |

0.84 |

|

|

|

|

$ |

0.93 |

|

| |

|

|

|

|

|

|

(1) Adjustment represents the removal of acquisition and

strategic/transformation related expenses ($1.5) and a

reclassification of transition services income ($0.1) from “Other

Income, net.” |

| |

|

(2) Adjustment represents the removal of integration costs of $0.4

and $0.2 within the Detection & Measurement and HVAC reportable

segments, respectively. |

| |

|

(3) Adjustment represents the removal of amortization expense

associated with acquired intangible assets of $4.3 and $2.0 within

the Detection & Measurement and HVAC reportable segments,

respectively. |

| |

|

|

|

|

|

|

(4) Adjustment represents the removal of (i) a gain on an equity

security associated with a fair value adjustment ($3.6), (ii)

non-service pension and postretirement charges ($1.2), as well as

the reclassification of income related to a transition services

agreement ($0.1) to “Corporate expense.” |

| |

|

|

|

|

|

|

(5) Adjustment represents the tax impact of items (1) through

(4). |

| |

|

|

|

|

|

|

SPX TECHNOLOGIES, INC. AND SUBSIDIARIES |

|

NON-GAAP RECONCILIATION - ADJUSTED EBITDA |

|

(Unaudited; in millions) |

| |

|

|

|

|

| |

|

|

|

|

| |

|

Three months ended |

| |

|

March 30, 2024 |

|

April 1, 2023 |

|

Net income |

|

$ |

49.0 |

|

|

$ |

42.8 |

|

| |

|

|

|

|

| Exclude: |

|

|

|

|

|

Income tax provision |

|

|

(1.9 |

) |

|

|

(11.3 |

) |

|

Interest expense, net |

|

|

(9.5 |

) |

|

|

(1.9 |

) |

|

Amortization expense (1) |

|

|

(14.8 |

) |

|

|

(6.3 |

) |

|

Depreciation expense |

|

|

(6.2 |

) |

|

|

(4.4 |

) |

|

Gain (loss) from discontinued operations, net of tax |

|

|

(0.2 |

) |

|

|

3.7 |

|

| EBITDA |

|

|

81.6 |

|

|

|

63.0 |

|

| |

|

|

|

|

| Exclude: |

|

|

|

|

|

Acquisition-related and other costs (2) |

|

|

(5.0 |

) |

|

|

(2.1 |

) |

|

Non-service pension and postretirement charges |

|

|

(1.2 |

) |

|

|

(1.2 |

) |

|

Fair value adjustments on an equity security |

|

|

(4.2 |

) |

|

|

3.6 |

|

| Adjusted

EBITDA |

|

$ |

92.0 |

|

|

$ |

62.7 |

|

|

as a percent of revenues |

|

|

19.8 |

% |

|

|

15.7 |

% |

|

|

|

|

|

|

|

(1) Represents amortization expense associated with acquired

intangible assets recorded within “Intangible amortization.” |

| |

|

|

|

|

|

(2) For the three months ended March 30, 2024 and April 1, 2023,

adjustments represent the removal of acquisition and

strategic/transformation related costs of $2.4 and $1.5,

respectively, and for the three months ended March 30, 2024, the

removal of (i) integration costs of $1.7 within the HVAC reportable

segment and (ii) an inventory step-up charge related to the Ingénia

acquisition of $0.9 within the HVAC reportable segment. For the

three months ended April 1, 2023, adjustment also represents the

removal of integration costs of $0.4 and $0.2 within the Detection

& Measurement and HVAC reportable segments, respectively. |

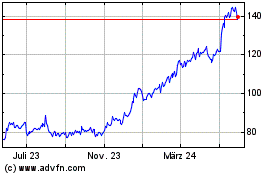

SPX Technologies (NYSE:SPXC)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

SPX Technologies (NYSE:SPXC)

Historical Stock Chart

Von Dez 2023 bis Dez 2024