Current Report Filing (8-k)

07 Februar 2020 - 1:34PM

Edgar (US Regulatory)

0001364885

false

0001364885

2020-02-05

2020-02-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of

earliest event reported): February 6, 2020

Spirit AeroSystems Holdings, Inc.

(Exact name of registrant as specified in

its charter)

|

Delaware

|

|

001-33160

|

|

20-2436320

|

(State or other jurisdiction of

incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

3801 South Oliver, Wichita, Kansas 67210

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including

area code: (316) 526-9000

Not Applicable

(Former name or former address if changed

since last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

¨ Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of

the Act:

|

Title of each

class

|

|

Trading

Symbol(s)

|

|

Name of each

exchange on which registered

|

|

Class A Common Stock, par value $0.01 per share

|

|

SPR

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

|

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

On

February 6, 2020, The Boeing Company (“Boeing”) and Spirit AeroSystems, Inc. (“Spirit”), a wholly owned

subsidiary of Spirit AeroSystems Holdings, Inc. (the “Company”), entered into a Memorandum of Agreement (the “MOA”)

superseding the April 12, 2019 Memorandum of Agreement (the “2019 MOA”) between the parties (except for Sections 15

and 16). The MOA memorializes the production rate agreement disclosed by the Company on January 30, 2020 that has Spirit delivering

216 B737 MAX shipsets to Boeing in 2020.

In

addition, the MOA provides that Boeing will pay $225 million to Spirit in the first quarter of 2020, consisting of (i) $70 million

in support of Spirit’s inventory and production stabilization, of which $10 million will be repaid by Spirit in 2021, and

(ii) $155 million as an incremental pre-payment for costs and shipset deliveries over the next two years. Other terms of the MOA

include extending the repayment date of the $123 million advance received by Spirit under the 2019 MOA to 2022, and extending the

B737 MAX pricing terms through 2033 (previously, pricing was through December 31, 2030).

The

parties will execute amendments to their underlying long-term contracts to incorporate the MOA on or before 60 calendar days following

the B737 MAX U.S. Federal Aviation Administration ungrounding.

The foregoing description of the MOA does not purport to be complete and is qualified in its entirety by reference to the

full text of the MOA, which will be filed as an exhibit to the Company’s Quarterly Report on Form 10-Q for the first quarter

of 2020, subject to certain omissions of confidential portions.

Cautionary Statement Regarding Forward-Looking Statements

This Current Report on Form 8-K contains “forward-looking statements” that may involve many risks and uncertainties.

Forward-looking statements generally can be identified by the use of forward-looking terminology such as “aim,” “anticipate,”

“believe,” “could,” “continue,” “estimate,” “expect,” “goal,”

“forecast,” “intend,” “may,” “might,” “objective,” “outlook,”

“plan,” “predict,” “project,” “should,” “target,” “will,”

“would,” and other similar words, or phrases, or the negative thereof, unless the context requires otherwise. These

statements reflect management's current views with respect to future events and are subject to risks and uncertainties, both known

and unknown. Our actual results may vary materially from those anticipated in forward-looking statements. We caution investors

not to place undue reliance on any forward-looking statements. Important factors that could cause actual results to differ materially

from those reflected in such forward-looking statements and that should be considered in evaluating our outlook include, without

limitation, the timing and conditions surrounding the return to service of the 737 MAX and any related impacts on our production

rate; our reliance on Boeing for a significant portion of our revenues; our ability to execute our growth strategy, including

our ability to timely complete and integrate our announced Asco and Bombardier acquisitions; our ability to accurately estimate

and manage performance, cost, and revenue under our contracts; economic conditions in the industries and markets in which we operate

in the U.S. and globally; our ability to manage our liquidity, borrow additional funds or refinance debt; the on-going review

of our accounting processes and the potential effect on our financial statements; and other factors disclosed in our filings with

the Securities and Exchange Commission. These factors are not exhaustive and it is not possible for us to predict all factors

that could cause actual results to differ materially from those reflected in our forward-looking statements. These factors speak

only as of the date hereof, and new factors may emerge or changes to the foregoing factors may occur that could impact our business.

Except to the extent required by law, we undertake no obligation to, and expressly disclaim any obligation to, publicly update

or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

SIGNATURES

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

SPIRIT AEROSYSTEMS

HOLDINGS, INC.

|

Date: February 7, 2020

|

By:

|

/s/ Stacy Cozad

|

|

|

Name:

|

Stacy Cozad

|

|

|

Title:

|

Senior Vice President, General Counsel, Chief Compliance Officer and Secretary

|

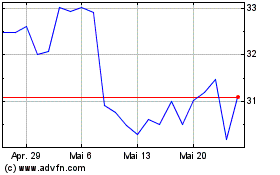

Spirit Aerosystems (NYSE:SPR)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Spirit Aerosystems (NYSE:SPR)

Historical Stock Chart

Von Jul 2023 bis Jul 2024