S&P Global 1Q Net Down, Revenue Up; Slower Bond Issuance Weighs

27 April 2023 - 2:05PM

Dow Jones News

By Rob Curran

S&P Global Inc.'s first-quarter earnings declined 36% as a

prior-year gain affected comparisons and rising interest rates took

a toll on its debt-rating operations.

The New York credit-ratings, data and research provider logged

net income of $795 million, or $2.47 a share, down from $1.24

billion, or $4.47 a share, in the year-ago period. The first

quarter of 2022 included a gain on the sale of S&P Global's

CUSIP unit.

Stripping out certain items, S&P Global posted earnings of

$3.15 a share.

Revenue rose 32% to $3.16 billion, jolted higher by the

acquisition of rival data firm IHS Markit Inc.

Revenue at S&P Global's ratings unit dropped 5% to $824

million, weighed by slower debt issuance. The historic jump in

interest rates and turmoil in the banking sector have hampered

debt-market activity in recent months. Some economists argue that a

slow-moving credit crunch is in process, with lending and bond

issuance set to be further constricted.

Revenue at the company's commodity research unit rose 40% to

$508 million, bolstered by the IHS Markit acquisition.

Write to Rob Curran at rob.curran@wsj.com

(END) Dow Jones Newswires

April 27, 2023 07:50 ET (11:50 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

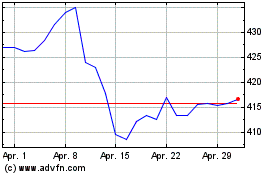

S&P Global (NYSE:SPGI)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

S&P Global (NYSE:SPGI)

Historical Stock Chart

Von Apr 2023 bis Apr 2024