false

0001320414

0001320414

2024-11-18

2024-11-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

current

report

Pursuant to Section 13

or 15(d) of the

Securities Exchange

Act of 1934

Date of Report (Date

of earliest event reported): November 18, 2024

SELECT MEDICAL HOLDINGS CORPORATION

(Exact name of registrant

as specified in its charter)

| Delaware | |

001-34465 | |

20-1764048 |

(State or other jurisdiction of

Incorporation) | |

(Commission File

Number) | |

(I.R.S. Employer

Identification No.) |

4714 Gettysburg Road, P.O. Box 2034

Mechanicsburg, PA 17055

(Address of principal executive offices) (Zip Code)

(717) 972-1100

(Registrant’s telephone number, including

area code)

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

SEM |

New York Stock Exchange (NYSE) |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01 | Regulation FD Disclosure |

Select Medical Corporation

(the “Company”), a wholly owned subsidiary of Select Medical Holdings Corporation, intends to offer $850 million in aggregate

principal amount of senior notes due 2032. The senior notes will be issued by the Company and will be unconditionally guaranteed by certain

of the Company’s subsidiaries.

The Company intends to use

the net proceeds of the offering, together with the proceeds from a new incremental term loan and cash on hand, to repay in full the term

loan currently outstanding under its existing credit agreement and to redeem all of its outstanding 6.250% senior notes due 2026.

In connection with the repayment, the Company

intends to amend its existing senior secured credit facilities in order to, among other things:

| · | establish a new incremental term loan under the Company’s

existing senior secured credit agreement in the aggregate principal amount of $750 million; |

| · | extend the tenor of our revolving credit facility to five years from the date the senior notes are issued; |

| · | provide for an incremental revolving commitment in an aggregate

amount of $50 million; and |

| · | make certain other changes to the credit agreement. |

The terms of the amendments

to the Company’s senior secured credit facilities are under discussion. Accordingly, their definitive terms may vary from those

described above.

The senior notes will be issued

through a private placement and resold by initial purchasers to qualified institutional buyers under Rule 144A of the Securities Act of

1933, as amended, and Regulation S. The senior notes will not be registered under the Securities Act and cannot be offered or sold in

the United States absent registration or an applicable exemption from the registration requirements. This does not constitute an offer

to sell or the solicitation of an offer to buy any security in any jurisdiction in which such offer or sale would be unlawful.

Cautionary Note Regarding Forward-Looking Statements

Except for historical information,

all other information in this Form 8-K consists of forward-looking statements. These forward-looking statements involve a number of risks,

uncertainties and other factors, including the contemplated size of a note offering, possible completion of a note offering, the prospective

impact of a note offering, plans to repay certain indebtedness (including the terms and success of such repayment), which may cause the

actual results to be materially different from those expressed or implied in the forward-looking statements. Other important factors that

could cause the statements made in this Form 8-K or the actual results of operations or financial condition of the Company to differ include,

without limitation, that the note offering is subject to market conditions and a number of other conditions and approvals and the final

terms may vary substantially as a result of market and other conditions. There can be no assurance that the note offering will be completed

as described herein or at all. Other important factors are discussed under the caption “Forward-Looking Statements” in the

Company’s Form 10-Q Quarterly Report for the quarter ended September 30, 2024 and in subsequent filings made prior to or after the

date hereof. The Company does not intend to review or revise any particular forward-looking statement in light of future events.

Certain Information

Attached as Exhibit 99.1 to

the report are selected portions of information from an offering memorandum that the Company expects to disclose to investors in connection

with the proposed private placement. There can be no assurance that the placement will be completed as described in the offering memorandum

or at all.

The information in this report

(including Exhibit 99.1) is being furnished pursuant to Item 7.01 and shall not be deemed to be “filed” for purposes of Section

18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor

shall it be deemed to be incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act.

On November 18, 2024, Select

Medical Holdings Corporation issued a press release announcing the Company had commenced an offering of $850 million aggregate principal

amount of senior notes due 2032. A copy of the press release is attached hereto as Exhibit 99.2 and is incorporated herein by reference.

| Item 9.01 | Financial

Statements and Exhibits. |

(d) Exhibits.

* The information in this Item 9.01 shall not

be deemed to be “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liability of that section,

and shall not be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except as shall be expressly

set forth by specific reference in such filing.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

SELECT MEDICAL HOLDINGS CORPORATION |

| |

|

| |

|

| Date: November 18, 2024 |

By: |

/s/ Michael E. Tarvin |

| |

|

Michael E. Tarvin |

| |

|

Senior Executive Vice President, General Counsel

and Secretary |

Exhibit 99.1

Cautionary Note Regarding Forward-Looking Statements

This offering memorandum contains

forward-looking statements within the meaning of the federal securities laws. Statements that are not historical facts, including statements

about our beliefs and expectations, are forward-looking statements. Forward-looking statements include statements preceded by, followed

by or that include the words “may,” “could,” “would,” “should,” “believe,”

“expect,” “anticipate,” “plan,” “target,” “estimate,” “project,”

“intend” and similar expressions. These statements include, among others, statements regarding our expected business outlook,

anticipated financial and operating results, our business strategy and means to implement our strategy, our objectives, the amount and

timing of capital expenditures, the likelihood of our success in expanding our business, financing plans, budgets, working capital needs

and sources of liquidity.

Forward-looking statements

are only predictions and are not guarantees of performance. These statements are based on our management’s beliefs and assumptions,

which in turn are based on currently available information. Important assumptions relating to the forward-looking statements include,

among others, assumptions regarding our services, the expansion of our services, competitive conditions and general economic conditions.

These assumptions could prove inaccurate. Forward-looking statements also involve known and unknown risks and uncertainties, which could

cause actual results to differ materially from those contained in any forward-looking statement. Many of these factors are beyond our

ability to control or predict. Such factors include, but are not limited to, the following:

| · | changes in government reimbursement for our services and/or new payment policies may result in a reduction

in revenue, an increase in costs, and a reduction in profitability; |

| · | adverse economic conditions including an inflationary environment could cause us to continue to experience

increases in the prices of labor and other costs of doing business resulting in a negative impact on our business, operating results,

cash flows, and financial condition; |

| · | shortages in qualified nurses, therapists, physicians, or other licensed providers, and/or the inability

to attract or retain qualified healthcare professionals could limit our ability to staff our facilities; |

| · | shortages in qualified health professionals could cause us to increase our dependence on contract labor,

increase our efforts to recruit and train new employees, and expand upon our initiatives to retain existing staff, which could increase

our operating costs significantly; |

| · | public threats such as a global pandemic, or widespread outbreak of an infectious disease, similar to

the COVID-19 pandemic, could negatively impact patient volumes and revenues, increase labor and other operating costs, disrupt global

financial markets, and/or further legislative and regulatory actions which impact healthcare providers, including actions that may impact

the Medicare program; |

| · | the failure of our Medicare-certified long term care hospitals or inpatient rehabilitation facilities

to maintain their Medicare certifications may cause our revenue and profitability to decline; |

| · | the failure of our Medicare-certified long term care hospitals and inpatient rehabilitation facilities

operated as “hospitals within hospitals” to qualify as hospitals separate from their host hospitals may cause our revenue

and profitability to decline; |

| · | a government investigation or assertion that we have violated applicable regulations may result in sanctions

or reputational harm and increased costs; |

| · | acquisitions or joint ventures may prove difficult or unsuccessful, use significant resources, or expose

us to unforeseen liabilities; |

| · | our plans and expectations related to our acquisitions and our ability to realize anticipated synergies; |

| · | failure to complete or achieve some or all the expected benefits of the potential separation of Concentra; |

| · | private third-party payors for our services may adopt payment policies that could limit our future revenue

and profitability; |

| · | the failure to maintain established relationships with the physicians in the areas we serve could reduce

our revenue and profitability; |

| · | competition may limit our ability to grow and result in a decrease in our revenue and profitability; |

| · | the loss of key members of our management team could significantly disrupt our operations; |

| · | the effect of claims asserted against us could subject us to substantial uninsured liabilities; |

| · | a security breach of our or our third-party vendors’ information technology systems may subject

us to potential legal and reputational harm and may result in a violation of the Health Insurance Portability and Accountability Act of

1996 or the Health Information Technology for Economic and Clinical Health Act; and |

| · | other factors discussed under the heading “Risk factors” herein or incorporated by reference

from our annual report on Form 10-K for the year ended December 31, 2023, filed with the SEC on February 22, 2024. |

Except as required by applicable law, including

the securities laws of the United States and the rules and regulations of the SEC, we are under no obligation to publicly update

or revise any forward-looking statements, whether as a result of any new information, future events or otherwise. You should not place

undue reliance on our forward-looking statements. Although we believe that the expectations reflected in forward-looking statements are

reasonable, we cannot guarantee future results or performance.

SUMMARY

UNAUDITED PRO FORMA CONSOLIDATED FINANCIAL INFORMATION

The

summary unaudited pro forma consolidated financial data below has been derived from our unaudited pro forma consolidated financial information

included in the section of this offering memorandum entitled “Unaudited Pro Forma Consolidated Financial Information.” The

unaudited pro forma consolidated financial information has been derived from our historical unaudited

condensed consolidated statement of operations for the nine months ended September 30, 2024, our historical audited consolidated

statement of operations for the year ended December 31, 2023, and our historical unaudited condensed consolidated balance sheet at

September 30, 2024.

The unaudited pro forma consolidated

financial data below is only a summary and should be read in conjunction with the section of this offering memorandum entitled “Unaudited

Pro Forma Consolidated Financial Information.” The unaudited pro forma consolidated financial data is based upon available information

and assumptions that we believe are reasonable and supportable. The summary unaudited pro forma consolidated financial data is for illustrative

and informational purposes only. The summary unaudited pro forma consolidated financial data may not necessarily reflect what our financial

condition, results of operations or cash flows would have been had we completed the divestiture of our Concentra segment during the periods

presented. In addition, the summary unaudited pro forma consolidated financial data may not necessarily reflect what our financial condition,

results of operations and cash flows may be in the future.

Pro Forma Consolidated Statement of Operations

Data

| | |

For the Nine Months Ended

September 30, | | |

Year ended December 31, | |

| (Dollars in thousands) | |

2024 | | |

2023 | |

| Revenue | |

$ | 3,874,541 | | |

$ | 4,825,977 | |

| Costs and expenses: | |

| | | |

| | |

| Cost of services, exclusive of depreciation and amortization | |

| 3,379,931 | | |

| 4,254,369 | |

| General and administrative | |

| 144,103 | | |

| 170,193 | |

| Depreciation and amortization | |

| 106,583 | | |

| 135,691 | |

| Total costs and expenses | |

| 3,630,617 | | |

| 4,560,253 | |

| Other operating income | |

| 3,300 | | |

| 1,518 | |

| Income from operations | |

| 247,224 | | |

| 267,242 | |

| Other income and expense: | |

| | | |

| | |

| Loss on early retirement of debt | |

| — | | |

| (35,353 | ) |

| Equity in earnings of unconsolidated subsidiaries | |

| 53,481 | | |

| 41,339 | |

| Interest (expense) income | |

| (63,274 | ) | |

| 18,454 | |

| Income before income taxes | |

| 237,431 | | |

| 291,682 | |

| Income tax expense | |

| 61,928 | | |

| 69,568 | |

| Net income | |

| 175,503 | | |

| 222,114 | |

| Less: Net income attributable to non-controlling interests | |

| 51,306 | | |

| 51,444 | |

| Net income attributable to Holdings | |

$ | 124,197 | | |

$ | 170,670 | |

Pro Forma Consolidated Balance Sheet Data

| | |

| |

| (Dollars in thousands) | |

As of September 30, 2024 | |

| Total assets | |

$ | 5,510,682 | |

| Total liabilities | |

$ | 3,511,470 | |

| Total equity | |

$ | 1,986,879 | |

Pro Forma Credit Statistics

| (Dollars in thousands) | |

As of or for the Twelve

Months Ended September 30, 2024(1) | |

| Cash interest expense(2) | |

$ | 104,844 | |

| Total debt(3) | |

$ | 1,658,721 | |

| Net debt(4) | |

$ | 1,631,399 | |

| Net senior secured debt(5) | |

$ | 732,678 | |

| Ratio of Pro Forma Adjusted EBITDA to Pro Forma cash interest expense(6) | |

| 4.83 | x |

| Ratio of net senior secured debt to Pro Forma Adjusted EBITDA(6) | |

| 1.45 | x |

| Ratio of net debt to Pro Forma Adjusted EBITDA(6) | |

| 3.22 | x |

(1) As of September 30, 2024, after

giving pro forma effect to the incurrence of indebtedness in an aggregate principal amount equal to $1,600.00 million pursuant to the

Refinancing Transactions.

(2) Calculated to give pro forma effect to

the interest expense on the approximately $1,600.0 million of indebtedness expected to be incurred in connection with the Refinancing

Transactions, as well as existing Other Debt of $48.7 million, as if such indebtedness had been incurred as of October 1, 2023 at

an estimated weighted average interest rate of approximately 6.4%, excluding debt issuance costs and original issue discount. A variance

of 1/8% of the weighted average interest rate estimate would result in a $2.0 million change in annual cash interest expense associated

with the $1,600.0 million of indebtedness expected to be incurred.

(3) Consists of $1,600.0 million of indebtedness

(including the Notes offered hereby) expected to be incurred pursuant to the Refinancing Transactions, $10.0 million of indebtedness outstanding

under our revolving credit facility, and $48.7 million of indebtedness comprised primarily of notes payable, insurance financing arrangements

and finance leases.

(4) Consists of total debt principal less

pro forma cash of approximately $27.3 million as of September 30, 2024.

(5) Consists of total senior secured debt

principal less pro forma cash of approximately $27.3 million as of September 30, 2024.

(6) Pro Forma Adjusted EBITDA for the trailing

twelve months ended September 30, 2024, is $506.2 million which is calculated as Historical Select Medical Holdings Corporation trailing

twelve month Adjusted EBITDA of $873.8 million less Concentra Adjusted EBITDA of $367.6 million.

Other Pro Forma Data (Non-GAAP)

| | |

Nine Months Ended September 30 | | |

Year Ended December 31, | |

| (Dollars in thousands) | |

2024 | | |

2023 | |

| Pro Forma Adjusted EBITDA(1) | |

$ | 394,402 | | |

$ | 446,091 | |

| Pro Forma Adjusted EBITDA margin(1) | |

| 10.2 | % | |

| 9.2 | % |

| (1) | We believe that the presentation of Pro Forma Adjusted EBITDA and Pro Forma Adjusted EBITDA margin, as

defined herein, are important to investors because Pro Forma Adjusted EBITDA and Pro Forma Adjusted EBITDA margin, or equivalents thereto,

are commonly used as an analytical indicator of performance by investors within the healthcare industry. Pro Forma Adjusted EBITDA and

Pro Forma Adjusted EBITDA margin are used by management to evaluate financial performance of, and determine resource allocation for, each

of our operating segments. However, Pro Forma Adjusted EBITDA and Pro Forma Adjusted EBITDA margin are not measures of financial performance

under GAAP. Items excluded from Pro Forma Adjusted EBITDA and Pro Forma Adjusted EBITDA margin are significant components in understanding

and assessing financial performance. Pro Forma Adjusted EBITDA and Pro Forma Adjusted EBITDA margin should not be considered in isolation,

or as an alternative to, or substitute for, net income, net income margin, income from operations, cash flows generated by operations,

investing or financing activities, or other financial statement data presented in the consolidated financial statements as indicators

of financial performance or liquidity. Because Pro Forma Adjusted EBITDA and Pro Forma Adjusted EBITDA margin are not measurements determined

in accordance with GAAP and are thus susceptible to varying definitions, Pro Forma Adjusted EBITDA and Pro Forma Adjusted EBITDA margin

as presented may not be comparable to other similarly titled measures of other companies. |

The following table reconciles

Pro Forma Adjusted EBITDA and Pro Forma Adjusted EBITDA margin to Pro Forma Net income and should be referenced when we discuss Pro Forma

Adjusted EBITDA and Pro Forma Adjusted EBITDA margin. For a reconciliation of Pro Forma Net income to Net income, see “Unaudited

Pro Forma Consolidated Financial Information.”

| | |

Nine Months Ended September 30, | | |

Year Ended December 31, | |

| (Dollars in thousands) | |

2024 | | |

2023 | |

| Reconciliation of Pro Forma Adjusted EBITDA to Pro Forma Net income | |

| | | |

| | |

| Pro Forma Net Income | |

$ | 175,503 | | |

$ | 222,114 | |

| Pro Forma Income tax expense | |

| 61,928 | | |

| 69,568 | |

| Pro Forma Interest expense | |

| 63,274 | | |

| (18,454 | ) |

| Pro Forma Equity in losses of unconsolidated subsidiaries | |

| (53,481 | ) | |

| (41,339 | ) |

| Pro Forma Loss on early retirement of debt | |

| – | | |

| 35,353 | |

| Pro Forma Income from Operations | |

| 247,224 | | |

| 267,242 | |

| Pro Forma Stock compensation expense | |

| 38,899 | | |

| 43,158 | |

| Pro Forma Depreciation and amortization | |

| 106,583 | | |

| 135,691 | |

| Pro Forma Separation transaction costs | |

| 1,696 | | |

| – | |

| Pro Forma Adjusted EBITDA | |

$ | 394,402 | | |

$ | 446,091 | |

| Pro Forma Adjusted EBITDA margin | |

| 10.2 | % | |

| 9.2 | % |

| Pro Forma Net Income Margin | |

| 4.5 | % | |

| 4.6 | % |

CAPITALIZATION

The following table sets forth

our consolidated cash and cash equivalents and capitalization as of September 30, 2024:

| · | on a pro forma basis as derived from our historical audited consolidated financial statements incorporated

by reference into this offering memorandum and giving effect to the Separation; and |

| · | on a pro forma as adjusted basis to give effect to the Separation and to the Refinancing Transactions. |

The

cash and capitalization information in the following table may not necessarily reflect what our cash and capitalization would have been

had we completed the Separation as of September 30, 2024. In addition, the cash and capitalization information in the following

table may not necessarily reflect what our cash and capitalization may be in the future. The pro forma information set forth in the table

below is illustrative only and will adjust based on the actual terms of this offering determined at the time of the pricing of this offering.

The following table should

be read in conjunction with the sections of this offering memorandum entitled “Summary Unaudited Pro Forma Consolidated Financial

Data,” “Use of Proceeds” and “Unaudited Pro Forma Consolidated Financial Information” as well as our historical

audited consolidated financial statements included elsewhere in this offering memorandum.

| | |

As of September 30, 2024 | |

| (Dollars and share amounts in thousands) (unaudited) | |

Pro Forma | | |

Pro Forma

As Adjusted | |

| Cash and cash equivalents | |

$ | 54,646 | | |

$ | 27,322 | |

| Debt: | |

| | | |

| | |

| Existing Select Term Loan | |

| 372,982 | | |

| – | |

| New Select Term Loan | |

| – | | |

| 750,000 | |

| Senior secured revolving facility(1) | |

| 10,000 | | |

| 10,000 | |

| Total senior secured principal | |

$ | 382,982 | | |

$ | 760,000 | |

| 2026 Notes | |

| 1,225,000 | | |

| – | |

| Notes offered hereby(2) | |

| – | | |

| 850,000 | |

| Other debt(3) | |

| 48,721 | | |

| 48,721 | |

| Total debt principal outstanding | |

$ | 1,656,703 | | |

$ | 1,658,721 | |

| Unamortized discount | |

| 9,346 | | |

| (1,875 | ) |

| Unamortized debt issuance costs | |

| (6,654 | ) | |

| (24,775 | ) |

| Total debt | |

$ | 1,659,395 | | |

$ | 1,632,071 | |

| | |

| | | |

| | |

| Total stockholders’ equity | |

| 1,688,127 | | |

| 1,688,127 | |

| Total capitalization | |

| 3,347,522 | | |

| 3,320,198 | |

| | |

| | | |

| | |

| Total net debt principal outstanding | |

| 1,602,057 | | |

| 1,631,399 | |

| Total net senior secured principal | |

| 328,336 | | |

| 732,678 | |

(1) The

revolving loan under our senior secured credit facilities provides for borrowings of up to $600.0 million of which $546.6 million was

available as of September 30, 2024, for working capital and general corporate purposes (after given effect to the Refinancing Transactions

and to $43.4 million of outstanding letters of credit at September 30, 2024).

(2) Represents

the aggregate principal amount of the notes being offered and does not reflect initial purchaser discounts and debt issuance costs.

(3) Other

debt consists primarily of borrowings to finance insurance programs, indebtedness to sellers of acquired businesses and other miscellaneous

borrowings.

UNAUDITED

PRO FORMA CONSOLIDATED FINANCIAL INFORMATION

The following

unaudited pro forma consolidated statements of operations for the nine months ended September 30, 2024, and for the year ended December 31,

2023, are presented as if the Separation and the Refinancing Transactions occurred as of January 1, 2023. The adjustments in the

“Transaction Accounting Adjustments” column in the unaudited pro forma condensed consolidated statements of operations for

the nine months ended September 30, 2024, and for the year ended December 31, 2023, give effect to the Separation as if it occurred

as of January 1, 2023. The adjustments in the “Refinancing Transaction Adjustments” column in the unaudited pro forma

condensed consolidated statements of operations for the nine months ended September 30, 2024, and for the year ended December 31,

2023, give effect to the Refinancing Transactions as if the Refinancing Transactions occurred as of January 1, 2023. The following

unaudited pro forma consolidated balance sheet as of September 30, 2024 is presented as if Separation and the Refinancing Transactions

occurred on September 30, 2024.

The following

unaudited pro forma consolidated financial information has been derived from our historical consolidated financial statements as of and

for the year ended December 31, 2023 and the interim unaudited period ended September 30, 2024. The unaudited pro forma consolidated

financial information and the accompanying notes should be read in conjunction with (i) the audited consolidated financial statements,

the accompanying notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included

in our Annual Report on Form 10-K for the year ended December 31, 2023, and (ii) the unaudited consolidated financial statements,

the accompanying notes, and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”

included in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2024.

The

following unaudited pro forma financial information is based on information currently available, including certain assumptions and estimates.

They are intended for informational purposes only, and do not purport to represent what our financial position and results of operations

actually would have been had the Separation occurred on the dates indicated, or to project our financial

position or results of operations for any future date or period. The adjustments included with the “Concentra Discontinued Operations”

column of the unaudited pro forma condensed consolidated financial information is the current estimates on a discontinued operations basis

and could change as our finalized discontinued operations accounting to be reported in future periods once the Separation occurs.

The preliminary financial

data included in this offering memorandum has been prepared by, and is the responsibility of, Select’s management. PricewaterhouseCoopers

LLP has not audited, reviewed, examined, compiled, nor applied agreed-upon procedures with respect to the preliminary financial data.

Accordingly, PricewaterhouseCoopers LLP does not express an opinion or any other form of assurance with respect thereto.

Unaudited Pro Forma Condensed Consolidated

Statement of Operations

For the Nine Months Ended September 30,

2024

(in thousands, except per share data)

| | |

Select

Medical Holdings

Corporation Historical (As

Reported) | | |

Concentra

Discontinued

Operations

(Note a) | | |

Continuing

Operations | | |

Transaction

Accounting

Adjustments | | |

Refinancing

Transactions Impact | | |

Pro

Forma Select

Medical Holdings

Corporation | |

| Revenue | |

$ | 5,309,692 | | |

$ | (1,435,151 | ) | |

$ | 3,874,541 | | |

$ | — | | |

$ | — | | |

$ | 3,874,541 | |

| Costs and expenses: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cost of services, exclusive of

depreciation and amortization | |

| 4,516,553 | | |

| (1,136,622 | ) | |

| 3,379,931 | | |

| — | | |

| — | | |

| 3,379,931 | |

| General and administrative | |

| 145,672 | | |

| (1,569 | ) | |

| 144,103 | | |

| — | | |

| — | | |

| 144,103 | |

| Depreciation

and amortization | |

| 158,151 | | |

| (51,568 | ) | |

| 106,583 | | |

| — | | |

| — | | |

| 106,583 | |

| Total costs

and expenses | |

| 4,820,376 | | |

| (1,189,759 | ) | |

| 3,630,617 | | |

| — | | |

| — | | |

| 3,630,617 | |

| Other operating

income | |

| 3,584 | | |

| (284 | ) | |

| 3,300 | | |

| — | | |

| — | | |

| 3,300 | |

| Income from operations | |

| 492,900 | | |

| (245,676 | ) | |

| 247,224 | | |

| — | | |

| — | | |

| 247,224 | |

| Other income and expense: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loss on early retirement of debt | |

| (10,939 | ) | |

| — | | |

| (10,939 | ) | |

| 10,939 | (b) | |

| — | | |

| — | |

| Equity in earnings of unconsolidated

subsidiaries | |

| 49,805 | | |

| 3,676 | | |

| 53,481 | | |

| — | | |

| — | | |

| 53,481 | |

| Interest

expense | |

| (143,309 | ) | |

| 43,255 | | |

| (100,054 | ) | |

| 35,965 | (b) | |

| 815 | (d) | |

| (63,274 | ) |

| Income before income taxes | |

| 388,457 | | |

| (198,745 | ) | |

| 189,712 | | |

| 46,904 | | |

| 815 | | |

| 237,431 | |

| Income tax

expense | |

| 95,509 | | |

| (46,241 | ) | |

| 49,268 | | |

| 12,444 | (c) | |

| 216 | (e) | |

| 61,928 | |

| Net income | |

| 292,948 | | |

| (152,504 | ) | |

| 140,444 | | |

| 34,460 | | |

| 599 | | |

| 175,503 | |

| Less: Net

income attributable to non-controlling interests | |

| 62,860 | | |

| (11,554 | ) | |

| 51,306 | | |

| — | | |

| — | | |

| 51,306 | |

| Net income

attributable to Select Medical Holdings Corporation | |

$ | 230,088 | | |

$ | (140,950 | ) | |

$ | 89,138 | | |

$ | 34,460 | | |

$ | 599 | | |

$ | 124,197 | |

| Earnings per common share: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted | |

$ | 1.78 | | |

| | | |

| | | |

| | | |

| | | |

$ | 0.96 | |

| Weighted average shares outstanding | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted | |

| 129,192 | | |

| | | |

| | | |

| | | |

| | | |

| 129,192 | |

See accompanying notes to Unaudited Pro Forma

Condensed Consolidated Financial Information

Unaudited Pro Forma Condensed Consolidated

Statement of Operations

For the Year Ended December 31, 2023

(in thousands, except per share data)

| | |

Select

Medical Holdings

Corporation Historical (As

Reported) | | |

Concentra

Discontinued

Operations

(Note a) | | |

Continuing

Operations | | |

Transaction

Accounting

Adjustments | | |

Refinancing

Transactions

Impact | | |

Pro

Forma Select

Medical Holdings

Corporation | |

| Revenue | |

$ | 6,664,058 | | |

$ | (1,838,081 | ) | |

$ | 4,825,977 | | |

$ | — | | |

$ | — | | |

$ | 4,825,977 | |

| Costs and expenses: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cost of services, exclusive of

depreciation and amortization | |

| 5,732,017 | | |

| (1,477,648 | ) | |

| 4,254,369 | | |

| — | | |

| — | | |

| 4,254,369 | |

| General and administrative | |

| 170,193 | | |

| — | | |

| 170,193 | | |

| — | | |

| — | | |

| 170,193 | |

| Depreciation

and amortization | |

| 208,742 | | |

| (73,051 | ) | |

| 135,691 | | |

| — | | |

| — | | |

| 135,691 | |

| Total costs

and expenses | |

| 6,110,952 | | |

| (1,550,699 | ) | |

| 4,560,253 | | |

| — | | |

| — | | |

| 4,560,253 | |

| Other operating

income | |

| 1,768 | | |

| (250 | ) | |

| 1,518 | | |

| | | |

| | | |

| 1,518 | |

| Income from operations | |

| 554,874 | | |

| (287,632 | ) | |

| 267,242 | | |

| — | | |

| — | | |

| 267,242 | |

| Other income and expense: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loss on early retirement of debt | |

| (14,692 | ) | |

| — | | |

| (14,692 | ) | |

| (10,939 | )(b) | |

| (9,722 | )(d) | |

| (35,353 | ) |

| Equity in earnings of unconsolidated

subsidiaries | |

| 40,813 | | |

| 526 | | |

| 41,339 | | |

| — | | |

| — | | |

| 41,339 | |

| Interest

(expense) income | |

| (198,639 | ) | |

| 44,474 | | |

| (154,165 | ) | |

| 169,668 | (b) | |

| 2,951 | (d) | |

| 18,454 | |

| Income before income taxes | |

| 382,356 | | |

| (242,632 | ) | |

| 139,724 | | |

| 158,729 | | |

| (6,771 | ) | |

| 291,682 | |

| Income tax

expense | |

| 82,625 | | |

| (53,372 | ) | |

| 29,253 | | |

| 42,111 | (c) | |

| (1,796 | )(e) | |

| 69,568 | |

| Net income | |

| 299,731 | | |

| (189,260 | ) | |

| 110,471 | | |

| 116,618 | | |

| (4,975 | ) | |

| 222,114 | |

| Less: Net

income attributable to non-controlling interests | |

| 56,240 | | |

| (4,796 | ) | |

| 51,444 | | |

| — | | |

| — | | |

| 51,444 | |

| Net income

attributable to Select Medical Holdings Corporation | |

$ | 243,491 | | |

$ | (184,464 | ) | |

$ | 59,027 | | |

$ | 116,618 | | |

$ | (4,975 | ) | |

$ | 170,670 | |

| Earnings per share: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted | |

$ | 1.91 | | |

| | | |

| | | |

| | | |

| | | |

$ | 1.34 | |

| Weighted average shares outstanding | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted | |

| 127,706 | | |

| | | |

| | | |

| | | |

| | | |

| 127,706 | |

See accompanying notes to Unaudited Pro Forma

Condensed Consolidated Financial Information

Unaudited Pro Forma Condensed Consolidated

Balance Sheet

As of September 30, 2024

(in thousands)

| | |

Select Medical Holdings

Corporation Historical

(As Reported) | | |

Concentra Discontinued

Operations

(Note a) | | |

Refinancing

Transaction

Adjustments | | |

Pro Forma Select Medical

Holdings Corporation | |

| ASSETS | |

| | | |

| | | |

| | | |

| | |

| Current Assets: | |

| | | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 191,468 | | |

$ | (136,822 | ) | |

$ | (27,324 | )(d) | |

$ | 27,322 | |

| Accounts receivable | |

| 1,060,007 | | |

| (232,202 | ) | |

| — | | |

| 827,805 | |

| Prepaid income taxes | |

| 8,669 | | |

| (1,505 | ) | |

| — | | |

| 7,164 | |

| Other current assets | |

| 144,053 | | |

| (23,041 | ) | |

| — | | |

| 121,012 | |

| Total Current Assets | |

| 1,404,197 | | |

| (393,570 | ) | |

| (27,324 | ) | |

| 983,303 | |

| Operating lease right-of-use assets | |

| 1,321,045 | | |

| (430,133 | ) | |

| — | | |

| 890,912 | |

| Property and equipment, net | |

| 1,040,383 | | |

| (191,099 | ) | |

| — | | |

| 849,284 | |

| Goodwill | |

| 3,555,022 | | |

| (1,234,707 | ) | |

| — | | |

| 2,320,315 | |

| Identifiable intangible assets, net | |

| 312,565 | | |

| (209,171 | ) | |

| — | | |

| 103,394 | |

| Other assets | |

| 369,449 | | |

| (5,975 | ) | |

| — | | |

| 363,474 | |

| Total Assets | |

$ | 8,002,661 | | |

$ | (2,464,655 | ) | |

$ | (27,324 | ) | |

$ | 5,510,682 | |

| LIABILITIES AND EQUITY | |

| | | |

| | | |

| | | |

| | |

| Current Liabilities: | |

| | | |

| | | |

| | | |

| | |

| Overdrafts | |

$ | 14,173 | | |

$ | — | | |

$ | — | | |

$ | 14,173 | |

| Current operating lease liabilities | |

| 249,832 | | |

| (74,411 | ) | |

| — | | |

| 175,421 | |

| Current portion of long-term debt and notes payable | |

| 42,785 | | |

| (9,737 | ) | |

| 7,500 | (d) | |

| 40,548 | |

| Accounts payable | |

| 170,711 | | |

| (21,030 | ) | |

| — | | |

| 149,681 | |

| Accrued and other liabilities | |

| 768,203 | | |

| (147,956 | ) | |

| — | | |

| 620,247 | |

| Total Current Liabilities | |

| 1,245,704 | | |

| (253,134 | ) | |

| 7,500 | | |

| 1,000,070 | |

| Non-current operating lease liabilities | |

| 1,163,406 | | |

| (391,037 | ) | |

| — | | |

| 772,369 | |

| Long-term debt, net of current portion | |

| 3,098,957 | | |

| (1,472,610 | ) | |

| (34,824 | )(d) | |

| 1,591,523 | |

| Non-current deferred tax liability | |

| 95,557 | | |

| (22,454 | ) | |

| — | | |

| 73,103 | |

| Other non-current liabilities | |

| 98,593 | | |

| (24,188 | ) | |

| — | | |

| 74,405 | |

| Total Liabilities | |

| 5,702,217 | | |

| (2,163,423 | ) | |

| (27,324 | ) | |

| 3,511,470 | |

| Redeemable non-controlling interests | |

| 30,455 | | |

| (18,122 | ) | |

| — | | |

| 12,333 | |

| Stockholders’ Equity: | |

| | | |

| | | |

| | | |

| | |

| Common stock | |

| 130 | | |

| — | | |

| — | | |

| 130 | |

| Capital in excess of par | |

| 858,741 | | |

| — | | |

| — | | |

| 858,741 | |

| Retained earnings | |

| 1,056,320 | | |

| (227,064 | ) | |

| — | | |

| 829,256 | |

| Total Stockholders’ Equity | |

| 1,915,191 | | |

| (227,064 | ) | |

| — | | |

| 1,688,127 | |

| Non-controlling interests | |

| 354,798 | | |

| (56,046 | ) | |

| — | | |

| 298,752 | |

| Total Equity | |

| 2,269,989 | | |

| (283,110 | ) | |

| — | | |

| 1,986,879 | |

| Total Liabilities and Equity | |

$ | 8,002,661 | | |

$ | (2,464,655 | ) | |

$ | (27,324 | ) | |

$ | 5,510,682 | |

See accompanying notes to Unaudited Pro Forma

Condensed Consolidated Financial Information

Notes to Unaudited Pro Forma Condensed Consolidated

Financial Information

Concentra Discontinued

Operations:

| (a) | Reflects the anticipated discontinued operations of Concentra, including associated assets, liabilities,

and equity and results of operations in accordance with ASC 205-20, Presentation of Financial Statements - Discontinued Operations as

currently estimated. |

Transaction

Accounting Adjustments:

| (b) | Reflects the estimated reduced interest expense of $82.0 million for the nine months ended September 30,

2024 and $123.7 million for the year ended December 31, 2023, respectively, as a result of the payments made with the cash proceeds

received in connection with the Concentra Separation to reduce long-term debt obligations. Additionally, the estimated reduced interest

expense for the year-ended December 31, 2023 reflects a reclassification of a $46.0 million gain on the interest rate cap cash flow

hedge from accumulated other comprehensive income into interest expense for forecasted transactions that were probable not to occur as

of that date, which was reported in the historical results for the nine months ended September 30, 2024. |

As a result of the repayments, a loss

on extinguishment of debt related to the write-off of unamortized deferred financing fees of $10.9 million for the year ended December 31,

2023 is also reflected, which was reported in the historical results for the nine months ended September 30, 2024.

| (c) | Reflects the tax effects of the Transaction Accounting Adjustments to pre-tax book income at the applicable

statutory income tax rates. |

Refinancing Transaction Adjustments:

| (d) | Reflects the impacts of the Refinancing Transactions, which include the estimated reduced interest expense

of $0.8 million for the nine months ended September 30, 2024 and $2.9 million for the year ended December 31, 2023, respectively,

as a result of lower interest rates on the refinanced debt. With respect to the Refinancing Transactions, the pro forma financial information

includes the following assumptions: |

| · | Refinancing Term Loans in an aggregate principal amount of $750.0 million bearing interest at a rate equal

to SOFR + 2.00% and an original issue discount of $1.9 million; |

| · | $850.0 million of Senior Notes due 2032 bearing interest at a rate equal to 6.25%; and |

| · | Estimated debt issuance costs of $24.3 million. |

The net proceeds of this offering, together

with the proceeds from the Refinancing Term Loans and $27.3 million of cash on hand, will be used to repay in full the Existing Select

Term Loan, to redeem all of the 2026 Notes (including an estimated call premium of $12.8 million) and to pay fees and expenses related

to the foregoing. The Refinancing Transactions are assumed to qualify for debt extinguishment accounting resulting in a $9.7 million loss

on early retirement of debt (inclusive of the $12.8 million call premium noted above) and the capitalization of new debt issuance costs.

A variance of 1/8% of the weighted average

interest rate estimate would result in a $2.0 million change in annual cash interest expense associated with the $1,600.0 million of indebtedness

expected to be incurred.

| (e) | Reflects the tax effects of the Refinancing Transaction Adjustments to pre-tax book income at the applicable

statutory income tax rates. |

Exhibit 99.2

| FOR IMMEDIATE

RELEASE |

4714 Gettysburg Road

Mechanicsburg, PA 17055

NYSE Symbol: SEM |

Select Medical Holdings Corporation Announces

Offering of $850 Million

of Senior Notes by Select Medical Corporation

MECHANICSBURG, PENNSYLVANIA

– November 18, 2024 – Select Medical Holdings Corporation (“Holdings”) (NYSE: SEM), today announced that

Select Medical Corporation (“Select”) has commenced a private offering (the “Offering”), subject to market and

other customary conditions, of $850 million in aggregate principal amount of senior notes due 2032 (the “notes”). The notes

will be senior unsecured obligations of Select and will be guaranteed by certain of Select’s existing and future domestic subsidiaries.

Concurrently with the consummation

of the Offering, Select intends to amend its existing senior secured credit agreement to, among other things, establish a new incremental

term loan which will refinance Select’s existing term loans, extend the maturity date of Select’s existing revolving credit

facility, and provide for an incremental revolving commitment.

Select intends to use the

net proceeds of the Offering, together with the proceeds from the proposed new incremental term loan and cash on hand, to repay in full

the term loans currently outstanding under Select’s existing senior secured credit agreement, to redeem all of Select’s outstanding

6.250% senior notes due 2026 and to pay fees and expenses related to the foregoing.

The notes and related guarantees

have not been and will not be registered under the Securities Act of 1933, as amended (the “Securities Act”) or the securities

laws of any other jurisdiction and may not be offered or sold in the United States absent registration or an applicable exemption from

the registration requirements. Accordingly, the notes and related guarantees are being offered and sold only to persons reasonably believed

to be qualified institutional buyers in reliance on Rule 144A under the Securities Act and to certain non “U.S. persons”

in transactions outside the United States in compliance with Regulation S under the Securities Act.

This press release does not

constitute an offer to sell or a solicitation of an offer to buy, nor will there be any sale of, the notes in any jurisdiction in which

such offer, solicitation or sale would be unlawful. Any offer of the notes will be made only by means of a private offering memorandum.

This press release is being issued pursuant to and in accordance with Rule 135c under the Securities Act. This press release shall

not constitute a notice of redemption with respect to the 6.250% senior notes due 2026.

Cautionary Statement Regarding Forward-Looking

Statements

This release contains forward-looking

statements. Forward-looking statements use words such as “expect,” “anticipate,” “outlook,” “intend,”

“plan,” “confident,” “believe,” “will,” “should,” “would,” “potential,”

“positioning,” “proposed,” “planned,” “objective,” “likely,” “could,”

“may,” and words of similar meaning, as well as other words or expressions referencing future events, conditions or circumstances.

Statements that describe or relate to Holdings’ plans, goals, intentions, strategies, financial outlook, Holdings’ expectations

regarding the aggregate principal amount of the notes to be sold or the intended use of proceeds from the offering of the notes, and statements

that do not relate to historical or current fact, are examples of forward-looking statements. Forward-looking statements are based on

our current beliefs, expectations and assumptions, which may not prove to be accurate, and involve a number of known and unknown risks

and uncertainties, many of which are out of the Holdings’ control. Forward-looking statements are not guarantees of future performance

and there are a number of important factors that could cause actual outcomes and results to differ materially from the results contemplated

by such forward-looking statements. Additional information concerning these and other factors can be found in Holdings’ filings

with the U.S. Securities and Exchange Commission, including Holdings’ most recent annual report on Form 10-K, most recent quarterly

report on Form 10-Q and current reports on Form 8-K. Any forward-looking statement speaks only as of the date on which it is

made. Holdings does not undertake any obligation to publicly update or revise any forward-looking statements, whether as a result of new

information, future events or otherwise.

Investor inquiries:

Joel T. Veit

Senior Vice President and Treasurer

717-972-1100

ir@selectmedicalcorp.com

SOURCE: Select Medical Holdings Corporation

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

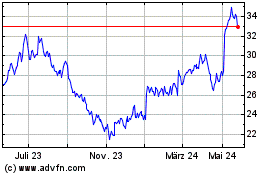

Select Medical (NYSE:SEM)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

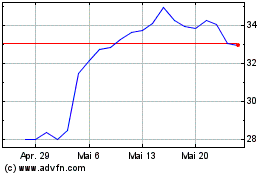

Select Medical (NYSE:SEM)

Historical Stock Chart

Von Jan 2024 bis Jan 2025