Consistent, stable financial performance as we ramp up our investments in growth; underlying EBITDA of $12.1 billion and interim ordinary dividend of 177 US cents per share

31 Juli 2024 - 12:08AM

Business Wire

Rio Tinto (LSE:RIO) (ASX:RIO):

- Underlying EBITDA of $12.1 billion. Net cash generated from

operating activities of $7.1 billion.

- Profit after tax attributable to owners of Rio Tinto (referred

to as "net earnings" throughout this release) of $5.8 billion.

- Underlying earnings of $5.8 billion, leading to an interim

ordinary dividend of $2.9 billion, a 50% payout.

Six months ended 30 June

2024

2023

Change

Net cash generated from operating

activities (US$ millions)

7,056

6,975

1%

Purchases of property, plant and equipment

and intangible assets (US$ millions)

4,018

3,001

34%

Free cash flow1 (US$ millions)

2,843

3,769

(25)%

Consolidated sales revenue (US$

millions)

26,802

26,667

1%

Underlying EBITDA1 (US$ millions)

12,093

11,728

3%

Profit after tax attributable to owners of

Rio Tinto (net earnings) (US$ millions)

5,808

5,117

14%

Underlying earnings per share (EPS)1 (US

cents)

354.3

352.9

--%

Ordinary dividend per share (US cents)

177.0

177.0

--%

Underlying return on capital employed

(ROCE)1

19%

20%

At 30 June 2024

At 31 Dec 2023

Net debt1 (US$ millions)

5,077

4,231

20%

Rio Tinto Chief Executive Jakob Stausholm said: "Rio Tinto is

both consistently very profitable and growing. This is being driven

by the disciplined investments we are making to strengthen our

operations and progress major projects for profitable organic

growth.

“Our overall copper equivalent production is on track to grow by

around 2% this year, and our ambition is to deliver around 3% of

compound annual growth from 2024 to 2028 from existing operations

and projects.

"We are at an inflection point in our growth, with a step change

from our aluminium business and consistent production at our

Pilbara iron ore operations. We have considerable growth in cash

flow from the ramp-up of the underground copper mine at Oyu Tolgoi,

and more value to come as our Simandou investment and Rincon

lithium project proceed at pace. We are also solving some of our

most complex challenges through technology and partnerships, such

as the renewable power solutions announced for Boyne and NZAS.

"Our strengthened operations along with stable pricing for our

commodities have allowed us to again deliver robust financial

results, with underlying EBITDA of $12.1 billion. We recorded free

cash flow of $2.8 billion, as we invested in growth, and underlying

earnings of $5.8 billion, after taxes and government royalties of

$4.4 billion. Return on capital employed was a healthy 19%.

"Our strong balance sheet enables us to continue to maintain our

practice of a 50% interim payout with a $2.9 billion ordinary

dividend, as we continue to invest with discipline to shape Rio

Tinto into an even stronger company."

The 2024 Half Year Results release is available here

1 This financial performance indicator is a non-IFRS (as defined

below) measure which is reconciled to directly comparable IFRS

financial measures (non-IFRS measures). It is used internally by

management to assess the performance of the business and is

therefore considered relevant to readers of this document. It is

presented here to give more clarity around the underlying business

performance of the Group’s operations. For more information on our

use of non-IFRS financial measures in this report, see the section

entitled “Alternative performance measures” (APMs) and the detailed

reconciliations on pages 62 to 69. Our financial results are

prepared in accordance with IFRS — see page 34 for further

information.

This announcement is authorised for release to the market by Rio

Tinto’s Group Company Secretary.

LEI: 213800YOEO5OQ72G2R82

Classification: 3.1 Additional regulated information required to

be disclosed under the laws of a Member State

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240730240735/en/

Please direct all enquiries to

media.enquiries@riotinto.com

Media Relations, United Kingdom Matthew

Klar M +44 7796 630 637 David Outhwaite M

+44 7787 597 493

Media Relations, Australia Matt Chambers

M +61 433 525 739 Alyesha Anderson M +61 434

868 118 Michelle Lee M +61 458 609 322

Media Relations, Americas Simon Letendre

M +1 514 796 4973 Malika Cherry M +1 418 592

7293 Vanessa Damha M +1 514 715 2152

Investor Relations, United Kingdom David

Ovington M +44 7920 010 978 Laura Brooks M

+44 7826 942 797

Investor Relations, Australia Tom Gallop

M +61 439 353 948 Amar Jambaa M +61 472 865

948

Rio Tinto plc 6 St James’s Square London SW1Y 4AD United

Kingdom T +44 20 7781 2000 Registered in England No.

719885

Rio Tinto Limited Level 43, 120 Collins Street Melbourne

3000 Australia T +61 3 9283 3333 Registered in Australia ABN

96 004 458 404

riotinto.com

Category: General

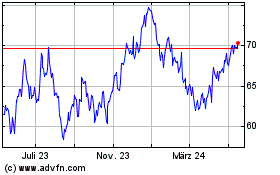

Rio Tinto (NYSE:RIO)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

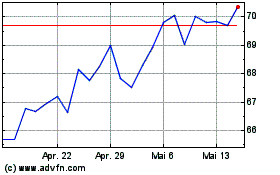

Rio Tinto (NYSE:RIO)

Historical Stock Chart

Von Dez 2023 bis Dez 2024