Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

29 September 2023 - 10:24PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| | | | | |

Filed by the Registrant x |

Filed by a Party other than the Registrant o |

| Check the appropriate box: |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

x | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

| | | | | | | | |

| Priority Income Fund, Inc. |

| (Name of Registrant as Specified In Its Charter) |

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): |

x | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Priority Income Fund, Inc.

10 East 40th Street, 42nd Floor

New York, NY 10016

PROXY STATEMENT SUPPLEMENT

YOUR PROXY IS BEING SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS OF

PRIORITY INCOME FUND, INC.

ANNUAL MEETING OF STOCKHOLDERS

To be held on December 18, 2023

The Board of Directors (the “Board”) of Priority Income Fund, Inc. (the “Company”), is filing and making this supplement available to the Fund’s stockholders in connection with the solicitation by the Board of proxies to be voted at the Fund’s Annual Meeting of Stockholders (the “2023 Annual Meeting”) to be held on Monday, December 18, 2023. The information in this supplement modifies and supplements some of the information included in our proxy statement for the 2023 Annual Meeting (the “Proxy Statement”).

On September 28, 2023, the audit committee (the “Audit Committee”) of the Board of Directors of the Company approved the appointment of Deloitte & Touche LLP (“Deloitte”), as the Company’s independent registered public accounting firm for the fiscal year ending June 30, 2024, effective immediately concurrent with the dismissal of BDO USA, P.C. (“BDO”).

During the Company’s two most recent fiscal years (fiscal years ended June 30, 2023 and 2022), respectively, and the subsequent interim period through September 28, 2023, neither the Company nor anyone on its behalf consulted Deloitte regarding any of the matters set forth in Item 304(a)(2)(i) or (ii) of Regulation S-K.

BDO’s reports on the Company’s consolidated financial statements for the fiscal years ended June 30, 2023 and 2022, respectively, did not contain an adverse opinion or a disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope or accounting principles.

During the Company’s fiscal years ended June 30, 2023 and 2022, respectively, and the subsequent interim period through September 28, 2023, there were no (i) disagreements (within the meaning of Item 304(a)(1)(iv) of Regulation S-K and the related instructions thereto) with BDO on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure that, if not resolved to the satisfaction of BDO, would have caused BDO to make reference thereto in its reports covering the Company’s consolidated financial statements for such periods and (ii) reportable events (as defined in Item 304(a)(1)(v) of Regulation S-K), except for the disclosure of the material weakness in the Company's internal control over financial reporting as disclosed in Part II, Item 9A of the Company's Annual Report on Form 10-K for the year ended June 30, 2022 which was remediated as previously disclosed in the Company’s Annual Report on Form 10-K for the year ended June 30, 2023. The Audit Committee has discussed the subject matter of the above referenced reportable event with BDO and the Company has authorized BDO to respond fully to the inquiries of Deloitte concerning the subject matter of such reportable event.

The Company provided BDO with a copy of the foregoing disclosure in accordance with the requirements of Instruction 2 to Item 304 of Regulation S-K. BDO did not indicate that it believed the foregoing disclosure was incorrect or incomplete.

The Fund expects that a representative of BDO will be present virtually at the Annual Meeting and will have an opportunity to make a statement if the representative so chooses and will be available to respond to appropriate questions.

Except as specifically set forth herein, this Supplement does not modify any other disclosures presented in the Proxy Statement.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

STOCKHOLDER MEETING TO BE HELD ON DECEMBER 18, 2023

The following materials relating to this Proxy Statement are available at https://vote.proxyonline.com/priority/docs/pris.pdf.

• this Proxy Statement; and

• the accompanying Notice of Annual Meeting.

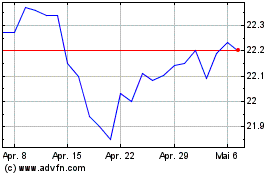

Priority Income (NYSE:PRIF-J)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

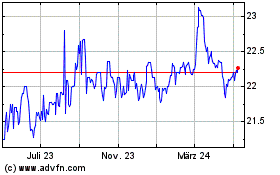

Priority Income (NYSE:PRIF-J)

Historical Stock Chart

Von Mai 2023 bis Mai 2024