Pinnacle West Capital Corp. (NYSE: PNW) (“Pinnacle West”)

announced the pricing of its offering of $475 million aggregate

principal amount of its 4.75% convertible senior notes due 2027

(the “convertible notes”) in a private placement under the

Securities Act of 1933, as amended (the “Securities Act”). The

offering of the convertible notes was upsized from the previously

announced offering size of $450 million aggregate principal amount

of convertible notes. Pinnacle West also granted the initial

purchasers of the convertible notes an option to purchase, within a

13-day period from, and including, the date on which the

convertible notes are first issued, up to an additional $50 million

aggregate principal amount of the convertible notes. The sale of

the convertible notes is expected to close on June 6, 2024, subject

to the satisfaction of customary closing conditions.

Pinnacle West expects that the net proceeds from the convertible

notes will be approximately $468 million (or $517.4 million if the

initial purchasers exercise their option to purchase additional

convertible notes in full), after deducting the initial purchasers’

discounts and commissions and estimated offering expenses payable

by Pinnacle West. Pinnacle West intends to use the net proceeds

from the offering of the convertible notes for general corporate

purposes, which may include repayment or refinancing of debt,

working capital and investments in its operating subsidiary,

Arizona Public Service Company.

The convertible notes will be senior unsecured obligations of

Pinnacle West, and will mature on June 15, 2027, unless earlier

converted or repurchased in accordance with their terms. The

convertible notes will bear interest at a fixed rate of 4.75% per

year, payable semiannually in arrears on June 15 and December 15 of

each year, beginning on December 15, 2024.

Prior to the close of business on the business day immediately

preceding March 15, 2027, the convertible notes will be convertible

at the option of the holders only under certain conditions.

On or after March 15, 2027, until the close of business on the

business day immediately preceding the maturity date, holders of

the convertible notes may convert all or any portion of their

convertible notes at their option at any time at the conversion

rate then in effect, irrespective of these conditions. Pinnacle

West will settle conversions of the convertible notes by paying

cash up to the aggregate principal amount of the convertible notes

to be converted and paying or delivering, as the case may be, cash,

shares of its common stock, no par value, or a combination of cash

and shares of its common stock, at its election, in respect of the

remainder, if any, of its conversion obligation in excess of the

aggregate principal amount of the convertible notes being

converted.

The conversion rate for the convertible notes will initially be

10.8338 shares of common stock per $1,000 principal amount of

convertible notes (equivalent to an initial conversion price of

approximately $92.30 per share of common stock). The initial

conversion price of the convertible notes represents a premium of

approximately 20% over the last reported sale price of Pinnacle

West’s common stock on The New York Stock Exchange on June 3, 2024.

The conversion rate and the corresponding conversion price will be

subject to adjustment in some events but will not be adjusted for

any accrued and unpaid interest. Pinnacle West may not redeem the

convertible notes prior to the maturity date.

If Pinnacle West undergoes a fundamental change (as defined in

the indenture that will govern the convertible notes), subject to

certain conditions, holders of the convertible notes may require

Pinnacle West to repurchase for cash all or any portion of their

convertible notes at a repurchase price equal to 100% of the

principal amount of the convertible notes to be repurchased, plus

accrued and unpaid interest to, but excluding, the fundamental

change repurchase date (as defined in the indenture that will

govern the convertible notes). In addition, if certain fundamental

changes occur, Pinnacle West may be required, in certain

circumstances, to increase the conversion rate for any convertible

notes converted in connection with such fundamental changes by a

specified number of shares of its common stock.

The offering is being made to persons reasonably believed to be

qualified institutional buyers pursuant to Rule 144A under the

Securities Act. Any offers of the convertible notes will be made

only by means of a private offering memorandum. None of the

convertible notes or any shares of the common stock issuable upon

conversion of the convertible notes have been or are expected to be

registered under the Securities Act or any state securities laws

and, unless so registered, may not be offered or sold in the United

States or to U.S. persons except pursuant to an exemption from, or

in a transaction not subject to, the registration requirements of

the Securities Act and applicable state securities laws.

This press release does not constitute an offer to sell or the

solicitation of an offer to buy these securities, nor will there be

any sale of these securities in any state or jurisdiction in which

such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

state or jurisdiction.

General Information

Pinnacle West Capital Corp., an energy holding company based in

Phoenix, has consolidated assets of nearly $25 billion, about 6,500

megawatts of generating capacity and approximately 6,100 employees

in Arizona and New Mexico. Through its principal subsidiary,

Arizona Public Service Company, the company provides retail

electricity service to approximately 1.4 million Arizona homes and

businesses.

FORWARD-LOOKING STATEMENTS

This press release may contain statements that constitute

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995, including statements

concerning the timing and completion of the offering of the

convertible notes and the anticipated use of proceeds from the

offering. These forward-looking statements are often identified by

words such as “estimate,” “predict,” “may,” “believe,” “plan,”

“expect,” “require,” “intend,” “assume,” “project,” “anticipate,”

“goal,” “seek,” “strategy,” “likely,” “should,” “will,” “could,”

and similar words. Because actual results may differ materially

from expectations, we caution readers not to place undue reliance

on these statements. A number of factors could cause future results

to differ materially from historical results, or from outcomes

currently expected or sought by Pinnacle West or Arizona Public

Service Company (“APS”). These factors include, but are not limited

to, the factors discussed in the most recent Pinnacle West/APS Form

10-K and 10-Q along with other public filings with the Securities

and Exchange Commission, which readers should review carefully

before placing any reliance on our financial statements or

disclosures. Neither Pinnacle West nor APS assumes any obligation

to update these statements, even if our internal estimates change,

except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240604546627/en/

Media Contact: Alan Bunnell (602) 250-3376 Analyst Contact:

Amanda Ho (602) 250-3334

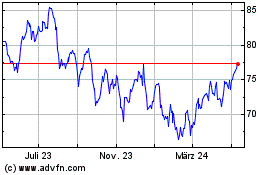

Pinnacle West Capital (NYSE:PNW)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

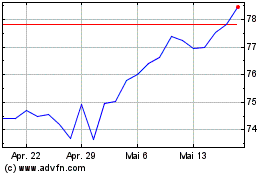

Pinnacle West Capital (NYSE:PNW)

Historical Stock Chart

Von Jan 2024 bis Jan 2025