0001108426false00011084262023-12-262023-12-26

| | | | | |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| FORM | 8-K |

| |

| CURRENT REPORT |

| Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934 |

| |

| | | | | | | | |

| Date of Report (Date of earliest event reported) | December 26, 2023 | |

| (December 22, 2023) | |

| | | | | | | | | | | | | | |

Name of Registrant, State of Incorporation, Address Of Principal Executive Offices, Telephone Number, Commission File No., IRS Employer Identification No. |

PNM Resources, Inc.

(A New Mexico Corporation)

414 Silver Ave. SW

Albuquerque, New Mexico 87102-3289

Telephone Number - (505) 241-2700

Commission File No. - 001-32462

IRS Employer Identification No. - 85-0468296

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | | | | |

| | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 40.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4 (c) under the Exchange Act (17 CFR 40.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | |

Registrant | Title of each class | Trading Symbol(s) | Name of exchange on which registered |

PNM Resources, Inc. | Common Stock, no par value | PNM | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

A copy of the press release discussing the sale of New Mexico Renewable Development LLC (“NMRD”) is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

In accordance with General Instruction B.2 of Form 8-K, the information in this Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific references in such a filing.

Item 8.01. Other Events.

As previously reported, PNMR Development and Management Corporation (“PNMR Development”), a wholly-owned subsidiary of PNM Resources, Inc. (“PNMR”), together with AEP OnSite Partners, LLC (“AEP Onsite”) selected an adviser for the sale of NMRD. NMRD is focused on the acquisition, development, and ownership of renewable energy generation projects, primarily in the state of New Mexico.

On December 22, 2023, PNMR Development and AEP Onsite reached agreement with Exus New Mexico, LLC, a subsidiary of Exus North America Holdings, LLC, for the sale of NMRD and its subsidiaries for approximately $230 million, subject to adjustment to reflect the actual amounts of certain components of working capital at closing, pursuant to a Membership Interest Purchase Agreement, dated December 22, 2023 (“MIPA”).

The parties to the MIPA have each made customary representations, warranties and covenants. The parties have agreed to cooperate with each other and use commercially reasonable efforts to make all filings and obtain all consents, approvals and authorizations of all governmental entities to the extent required by law in connection with the execution, delivery and performance of the MIPA and the consummation of the transactions contemplated thereby, subject to specified limitations. Closing of the proposed NMRD sale is subject to customary conditions, including approval by the Federal Energy Regulatory Commission. The MIPA may be terminated by either party under certain circumstances, including if the sale is not consummated by April 30, 2024.

PNMR expects to use the net proceeds from the sale of NMRD to reduce the future external capital needs at PNMR and support continued investments in regulated rate base at PNMR’s utilities. PNMR Development will provide certain services to NMRD for a transitional period following closing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit Number | | Description |

| 99.1 | | |

| 104 | | Cover page in Inline XBRL format |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | |

| PNM RESOURCES, INC. |

| |

| (Registrant) |

| |

| |

| Date: December 26, 2023 | /s/ Gerald R. Bischoff |

| Gerald R. Bischoff |

| Vice President and Corporate Controller |

| (Officer duly authorized to sign this report) |

Exhibit 99.1

For Immediate Release

December 26, 2023

PNM Resources Announces Sale of Renewable Joint Venture

(ALBUQUERQUE, N.M.) – PNM Resources (NYSE: PNM) has entered into an agreement to sell its 50% ownership interest in its renewable joint venture, New Mexico Renewable Development, LLC (NMRD) to Exus North America Holdings, LLC. PNM Resources and American Electric Power (AEP), which also owns 50% of NMRD, have agreed to sell the NMRD portfolio for approximately $230 million subject to true-up adjustments at close.

PNM Resources’ $115 million share of the approximate gross proceeds will support the funding of regulated capital investments. The sale is expected to close in February 2024.

The NMRD portfolio includes nine operating solar developments totaling 185 MW and six projects under development with an estimated output of 440 MW. PNM Resources reports the earnings from its 50% ownership as part of the Corporate and Other segment.

The sale is subject to regulatory approval by the Federal Energy Regulatory Commission and New Mexico regulatory approvals associated with one of NMRD’s projects. The waiting period for Hart-Scott-Rodino Antitrust Improvements Act of 1976 has expired.

KeyBanc Capital Markets is serving as financial advisor and Foley & Lardner LLP is serving as legal counsel to PNM Resources and AEP.

Background:

PNM Resources (NYSE: PNM) is an energy holding company based in Albuquerque, N.M., with 2022 consolidated operating revenues of $2.2 billion. Through its regulated utilities, PNM and TNMP, PNM Resources provides electricity to more than 800,000 homes and businesses in New Mexico and Texas. PNM serves its customers with a diverse mix of generation and purchased power resources totaling 2.7 gigawatts of capacity, with a goal to achieve 100% emissions-free energy by 2040. For more information, visit the company's website at www.PNMResources.com.

Contacts:

Analysts Media

Lisa Goodman Ray Sandoval

(505) 241-2160 (505) 241-2782

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995

Statements made in this news release for PNM Resources, Inc. (“PNMR” or the “Company”) that relate to future events or expectations, projections, estimates, intentions, goals, targets, and strategies, including the unaudited financial results and earnings guidance, are made pursuant to the Private Securities Litigation Reform Act of 1995. Readers are cautioned that all forward-looking statements are based upon current expectations and estimates and apply only as of the date of this report. PNMR assumes no obligation to update this information. Because actual results may differ materially from those expressed or implied by these forward-

looking statements, PNMR cautions readers not to place undue reliance on these statements. PNMR's business, financial condition, cash flow, and operating results are influenced by many factors, which are often beyond their control, that can cause actual results to differ from those expressed or implied by the forward-looking statements. Additionally, there are risks and uncertainties in connection with the proposed acquisition of the Company by Avangrid, Inc. (the “Merger”) which may adversely affect the Company’s business, future opportunities, employees and common stock, including without limitation, (i) the expected timing and likelihood of completion of the pending Merger, including the timing, receipt and terms and conditions of any remaining required governmental and regulatory approvals of the pending Merger that could reduce anticipated benefits or cause the parties to abandon the transaction, (ii) the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement, (iii) the risk that the parties may not be able to satisfy the conditions to the proposed Merger in a timely manner or at all, and (iv) the risk that the proposed transaction and its announcement could have an adverse effect on the ability of the Company to retain and hire key personnel and maintain relationships with its customers and suppliers, and on its operating results and businesses generally. For a discussion of risk factors and other important factors affecting forward-looking statements, please see the Company’s Form 10-K, Form 10-Q filings and the information included in the Company’s Forms 8-K with the Securities and Exchange Commission, which factors are specifically incorporated by reference herein.

(END)

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

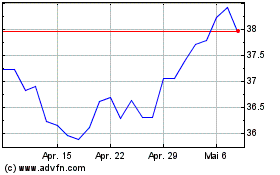

PNM Resources (NYSE:PNM)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

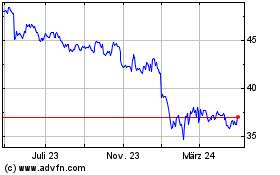

PNM Resources (NYSE:PNM)

Historical Stock Chart

Von Mai 2023 bis Mai 2024