0001108426false00011084262024-03-062024-03-06

| | | | | |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| FORM | 8-K |

| |

| CURRENT REPORT |

| Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934 |

| |

| | | | | | | | |

| Date of Report (Date of earliest event reported) | March 6, 2024 | |

| (February 29, 2024) | |

| | | | | | | | | | | | | | |

Name of Registrant, State of Incorporation, Address Of Principal Executive Offices, Telephone Number, Commission File No., IRS Employer Identification No. |

PNM Resources, Inc.

(A New Mexico Corporation)

414 Silver Ave. SW

Albuquerque, New Mexico 87102-3289

Telephone Number - (505) 241-2700

Commission File No. - 001-32462

IRS Employer Identification No. - 85-0468296

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | | | | |

| | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 40.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4 (c) under the Exchange Act (17 CFR 40.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | |

Registrant | Title of each class | Trading Symbol(s) | Name of exchange on which registered |

PNM Resources, Inc. | Common Stock, no par value | PNM | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On February 29, 2024, the Compensation and Human Capital Committee (the “Compensation Committee”) of the Board of Directors (the “Board”) of PNM Resources, Inc. (the “Company”) approved certain compensatory arrangements in which the Company’s named executive officers participate and also recommended that the full Board approve certain other compensatory plans and arrangements in which the Company’s named executive officers participate. On March 1, 2024, the full Board (or the independent directors, in the case of certain actions relating specifically to the Company’s Chairman and Chief Executive Officer) approved the Compensation Committee’s recommendations. The plans and arrangements that were approved at such meetings are described in more detail below.

Approval of 2024 Officer Annual Incentive Plan

The Compensation Committee approved the Company’s 2024 Officer Annual Incentive Plan (the “Annual Incentive Plan”), which provides for a one-year performance period that began on January 1, 2024 and will end on December 31, 2024. Pursuant to the Annual Incentive Plan, the Company’s named executive officers are eligible to receive performance cash awards if the Company achieves during 2024 (i) certain levels of Incentive Earnings Per Share (as defined below) and (ii) specified goals. Any awards must be approved by the Compensation Committee (and the independent directors of the Board, in the case of any award payable to the Company’s Chairman and Chief Executive Officer) and if earned will be paid on or before March 15, 2025.

Additional terms of the Annual Incentive Plan are as follows:

•To ensure that any awards payable under the Annual Incentive Plan can be funded by the Company’s earnings, no awards will be made unless the Company achieves a threshold Incentive Earnings Per Share target.

•“Incentive Earnings Per Share” equals Company’s diluted earnings per share for the fiscal year ending December 31, 2024, as reported in the Company’s Annual Report on Form 10-K, adjusted to exclude certain items that do not factor into ongoing earnings.

•Awards are payable at threshold, target and maximum levels based upon a percentage of the named executive officers’ respective base salaries. For the Company’s Chairman and Chief Executive Officer, award opportunities under the Annual Incentive Plan range from 57.5% to 230%. Award opportunities range from 35% to 140% for the Company’s President and Chief Operating Officer, from 30% to 120% for the Company’s Senior Vice President, Chief Financial Officer and Treasurer, and from 27.5% to 110% for the Company’s other Senior Vice Presidents. Actual awards under the Annual Incentive Plan (if any) will generally be determined as follows:

◦The overall award pool will be determined based on the Company’s actual Incentive Earnings Per Share during 2024. As noted above, if the Company does not achieve at least a threshold level of Incentive Earnings Per Share as specified in the Annual Incentive Plan, no awards will be paid to the named executive officers regardless of the Company’s achievement levels with respect to the other goals specified pursuant to the Annual Incentive Plan. This award pool (if any) will be allocated to individual named executive officers in accordance with the provisions of the Annual Incentive Plan (each named executive officer’s allocated amount of the award pool being his or her “Allocated Pool Amount”).

◦The Compensation Committee (and the independent directors of the Board, in the case of any award payable to the Company’s Chairman and Chief Executive Officer) will determine individual awards (if any) (each named executive officer’s individual award being his or her “Individual Award Amount”) based on achievement levels with respect to the corporate goals specified in the Annual Incentive Plan.

◦Each named executive officer will receive the lesser of his or her (i) Allocated Pool Amount or (ii) Individual Award Amount.

◦The Annual Incentive Plan provides for the payment of partial or pro rata awards in certain events involving the hiring, departure, promotion, demotion or transfer of officers eligible to participate in the Annual Incentive Plan. In the event that the plan is modified (to reduce awards) following a change in control with respect to the Company, a minimum award is provided in certain instances.

Approval of 2024 Long-Term Incentive Plan

On March 1, 2024, the Board approved the Company’s 2024 Long-Term Incentive Plan (the “LTIP”), which provides for a three-year performance period that began on January 1, 2024 and will end on December 31, 2026 (the “LTIP Performance Period”). Pursuant to the LTIP, the Company’s named executive officers are eligible to receive (following the conclusion of the LTIP Performance Period) performance share awards and time-vested restricted stock rights awards under the Company’s 2023 Performance Equity Plan, or a successor equity plan. Any awards must be approved by the Compensation Committee (and the independent directors of the Board, in the case of any award payable to the Company’s Chairman and Chief Executive Officer).

The total award opportunities available to the named executive officers under the LTIP are allocated as follows:

•70% are allocated to performance share awards, which will be granted based on the Company’s level of attainment of an Earnings Growth Goal, a Relative TSR Goal, and a funds from operations (“FFO”)/Debt Ratio Goal over the LTIP Performance Period; and

•30% are allocated to time-vested restricted stock rights awards, which will be granted depending on the named executive officer’s position, as well as the discretion of the Compensation Committee and Board, following the end of the LTIP Performance Period, subject to the named executive officer’s continuing employment on the date the time-vested restricted stock rights awards are granted. If granted, the time-vested stock rights would vest in the following manner: (i) 33% on March 7, 2028; (ii) 34% on March 7, 2029; and (iii) 33% on March 7, 2030.

Each named executive officer’s performance share award opportunity (at threshold, target and maximum levels) is based on his or her base salary in effect on January 1, 2024. For the Company’s Chairman and Chief Executive Officer, the award opportunities for the performance share awards component of the LTIP range from 101.5% to 406%. Award opportunities for the performance share awards component of the LTIP range from 57.75% to 231% for the Company’s President and Chief Operating Officer and from 29.75% to 119% for the Company’s other Senior Vice Presidents.

Award opportunities for the time-vested restricted stock rights component of the LTIP are 87% of base salary for the Company’s Chairman and Chief Executive Officer, 49.5% of base salary for the Company’s President and Chief Operating Officer, and 25.5% of base salary for the Company’s Senior Vice Presidents. In addition to the factors described above, the number of restricted stock rights actually granted to the named executive officers will depend on their base salaries on the grant date and the per share price of the Company’s common stock on the grant date, which is anticipated to be in early March 2027.

The LTIP provides for the payment of partial or pro rata performance share awards, and vesting of time-vested restricted stock rights, in certain events involving the hiring, departure, promotion, demotion or transfer of officers eligible to participate in the LTIP. Further, the LTIP provides for vesting of time-vested restricted stock rights if any named executive officer has a separation from service due to death, disability, impaction, qualifying change in control termination, or retirement.

As noted above, the Company’s level of attainment (threshold, target or maximum) of each of the Earnings Growth Goal, the Relative TSR Goal, and the FFO/Debt Ratio Goal over the LTIP Performance Period will determine each named executive officer’s actual performance share award. The Earnings Growth, the Relative TSR, and the FFO/Debt Ratio Goals are defined and calculated in accordance with the LTIP and are substantially similar to the goals under the prior long-term incentive plan awards. The 2024 LTIP includes a Relative TSR Goal, which is similar to the 2021 and earlier long-term incentive plan awards. The 2022 and 2023 long-term incentive plan awards did not include a Relative TSR Goal.

Amendment of the 2023 Long-Term Incentive Plan

The Compensation Committee recommended to the Board and, on March 1, 2024, the Board approved an amendment to the 2023 Long-Term Incentive Plan (“2023 LTIP”) to (1) provide for a full (rather than pro-rata) earned performance share award upon a named executive officer’s termination in connection with a qualifying change in control, and (2) provide for a pro-rata payment of the earned performance share award upon termination of employment due to retirement for the Company’s Chairman and Chief Executive Officer and the Senior Vice President and General Counsel, which is consistent with the Company’s past practices and the terms of the 2023 LTIP for the other named executive officers.

Note Regarding Non-GAAP Financial Measures

Certain performance measures described above (including Incentive Earnings Per Share under the Annual Incentive Plan and FFO/Debt Ratio, Relative TSR and Earnings Growth under the LTIP) are not financial measures determined under U.S. generally accepted accounting principles (“GAAP”). These non-GAAP financial measures have been established solely for purposes of measuring performance under the applicable plan or arrangement. Such measures (and any corresponding targets) have no effect on, and are not necessarily identical to, any earnings guidance that may be announced by the Company. Consistent with the rules and regulations promulgated by the Securities and Exchange Commission and the Company’s past practice, the Company’s definitive proxy statements for future Annual Meetings of Stockholders will include detailed information about how such performance measures are calculated, as well as any required reconciliation(s) to corresponding GAAP financial measure(s).

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | |

| PNM RESOURCES, INC. |

| |

| (Registrant) |

| |

| |

| Date: March 6, 2024 | /s/ Gerald R. Bischoff |

| Gerald R. Bischoff |

| Vice President and Corporate Controller |

| (Officer duly authorized to sign this report) |

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

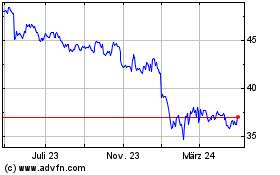

PNM Resources (NYSE:PNM)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

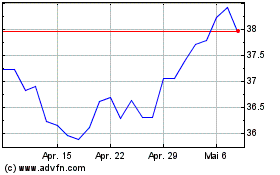

PNM Resources (NYSE:PNM)

Historical Stock Chart

Von Apr 2023 bis Apr 2024