UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

Report of Foreign Private

Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange

Act of 1934

For the month of

December, 2023

Commission File Number

1-15106

PETRÓLEO BRASILEIRO

S.A. – PETROBRAS

(Exact name of registrant

as specified in its charter)

Brazilian Petroleum

Corporation – PETROBRAS

(Translation of Registrant's

name into English)

Avenida Henrique Valadares, 28 – 19th floor

20231-030 – Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal

executive office)

Indicate by check mark

whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form

40-F _______

Indicate by check mark

whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

Petrobras approves clawback policy

—

Rio de Janeiro, December 1, 2023

– Petróleo Brasileiro S.A. – Petrobras informs that it has approved a Clawback Policy, in compliance with the regulation

of the Securities and Exchange Commission and the rule issued under the Manual for Companies Listed on the New York Stock Exchange ("NYSE

Clawback Rules"), also applicable to Brazilian issuers that have sponsored American Depositary Receipt (ADR) programs tradable on

the NYSE.

The purpose of the clawback policy

is to describe the procedure for collecting amounts erroneously paid ("Erroneously Awarded Compensation") to members and former

members of the Board of Executive Officers compensated for variable remuneration linked to financial results, in the event of restatement

of financial statements, as well as to disclose detailed information to the SEC when its Clawback Policy is triggered due to the restatement

of its financial statements.

For more information, please see

the full Policy below.

| www.petrobras.com.br/ir

For more information: PETRÓLEO BRASILEIRO S.A. – PETROBRAS | Investors Relations email: petroinvest@petrobras.com.br/acionistas@petrobras.com.br Av. Henrique Valadares, 28 – 19 th floor – 20231-030 – Rio de Janeiro, RJ. Tel.: 55 (21) 3224-1510/9947 | 0800-282-1540

This document may contain forecasts within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities Trading Act of 1934, as amended (Trading Act) that reflect the expectations of the Company's officers. The terms: "anticipates", "believes", "expects", "predicts", "intends", "plans", "projects", "aims", "should," and similar terms, aim to identify such forecasts, which evidently involve risks or uncertainties, predicted or not by the Company. Therefore, future results of the Company's operations may differ from current expectations, and the reader should not rely solely on the information included herein. |

CLAWBACK

2.

GOAL:

To describe the procedure for charging

amounts paid in error (“Compensation Granted Erroneously”) to members and former members of the Executive Board compensated

by variable remuneration linked to financial results, in the event of republication/restatement of financial statements.

2.

SCOPE:

Members and former members of the Executive

Board of Petróleo Brasileiro S.A. (Petrobras), including binding on their beneficiaries, heirs, executors, administrators or other

legal representatives.

3.

DESCRIPTION:

1.

PRINCIPLES:

All company activities must be based on ethics, integrity

and transparency, in compliance with applicable national and international standards

The company strictly complies with all legislation

applicable to its business, whether national or international.

3.2 MOTIVATON

The remuneration strategy for members of the Executive

Board aims to attract, encourage, reward and retain managers to conduct business in a sustainable manner, reconciling the interests of

shareholders and other interested parties.

One of the elements of the remuneration of members

of the Executive Board is variable remuneration, which is defined based on the achievement of corporate and individual goals, defined

and evaluated by the Board of Adminitration. Payment is deferred for five years, as long as its established prerequisites and goals are

met.

All companies with shares on the US stock exchange

must charge overpaid amounts to members and former members of the Executive Board who received incentives (such as variable remuneration),

when the financial statements are rectified, in accordance with Securities and Exchange Commission (SEC) regulations.

Members and former members of the Executive Board are

required to reimburse or return to the Company the compensation paid in error, in accordance with the Clawback Rules (Section 10D of the

Exchange Act and any applicable rules or standards adopted by the SEC thereunder, including the Rule 10D-1 under the Exchange Act, or

by the Listing Manager in accordance with Rule 10D-1 under the Exchange Act, including Section 303A.14 of the New York Stock Exchange

Listed Company Manual, in each case).

| www.petrobras.com.br/ir

For more information: PETRÓLEO BRASILEIRO S.A. – PETROBRAS | Investors Relations email: petroinvest@petrobras.com.br/acionistas@petrobras.com.br Av. Henrique Valadares, 28 – 19 th floor – 20231-030 – Rio de Janeiro, RJ. Tel.: 55 (21) 3224-1510/9947 | 0800-282-1540

This document may contain forecasts within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities Trading Act of 1934, as amended (Trading Act) that reflect the expectations of the Company's officers. The terms: "anticipates", "believes", "expects", "predicts", "intends", "plans", "projects", "aims", "should," and similar terms, aim to identify such forecasts, which evidently involve risks or uncertainties, predicted or not by the Company. Therefore, future results of the Company's operations may differ from current expectations, and the reader should not rely solely on the information included herein. |

The obligation referred to in this item is binding

on the beneficiaries, heirs, executors, administrators or other legal representatives of the members and former members of the Executive

Board.

3.3 COVERAGE PERIOD

It is the period of three full fiscal years of the

Company immediately preceding the date of correction and any transition period that results from a change in the Company's fiscal year

of less than nine months within or immediately after those three full fiscal years.

3.4 PROCESS ADMINISTRATOR

The Board of Administration has designated the People

Committee as the “Administrator”, responsible to manage this process.

Any determinations made by the “Administrator”

will be final and binding on all covered and need not be uniform with respect to each individual.

The People Committee as “Administrator”

authorizes and empowers the Chief Human Resources Officer to take any and all actions necessary to carry out the provisions of this Guideline,

provided that the value recovery measure does not involve the designated officer.

3.5 CHARGE

If there is a need to charge overpaid amounts, it will

be up to the People Committee or the Human Resources Area to define the amount to be returned by members and former members of the Executive

Board and notify them in writing, informing the amount to be paid. An external consultancy may be hired to carry out the calculations,

if necessary.

The company may also charge any and all expenses incurred

to recover the amounts, including legal fees.

The company cannot accept any agreement that exempts

or waives its right to recover any overpayment made as incentives (such as bonuses or share options), when the financial statements are

rectified due to compliance failures.

1Amounts may be recovered using any method, taking

into account the time value of money and the cost to shareholders of delaying recovery.

| www.petrobras.com.br/ir

For more information: PETRÓLEO BRASILEIRO S.A. – PETROBRAS | Investors Relations email: petroinvest@petrobras.com.br/acionistas@petrobras.com.br Av. Henrique Valadares, 28 – 19 th floor – 20231-030 – Rio de Janeiro, RJ. Tel.: 55 (21) 3224-1510/9947 | 0800-282-1540

This document may contain forecasts within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities Trading Act of 1934, as amended (Trading Act) that reflect the expectations of the Company's officers. The terms: "anticipates", "believes", "expects", "predicts", "intends", "plans", "projects", "aims", "should," and similar terms, aim to identify such forecasts, which evidently involve risks or uncertainties, predicted or not by the Company. Therefore, future results of the Company's operations may differ from current expectations, and the reader should not rely solely on the information included herein. |

The Company cannot accept an amount lower than the

overpayment, except in cases permitted by the Clawback Rules.

3.6 EXCEPTIONS

An exception applies when the charge is unfeasible,

in accordance with the good faith determination of the majority of independent members of the Board of Administration, specifically in

the following situations:

(i) the direct expenses paid to third parties to assist

in the execution of the Guideline against a member or former member of the Executive Board would exceed the amount to be recovered, after

the Company has made a reasonable attempt to recover the applicable erroneously awarded remuneration, documented such efforts and filed

them in Stock Exchange office;

(ii) the recovery would violate Brazilian law when

that law was adopted before November 28, 2022, provided that, before concluding that it would be unfeasible to recover any amount of erroneously

arbitrated compensation based on violation of Brazilian law, the Company obtained an formal opinion of a Brazilian lawyer, acceptable

to the United States Stock Exchange, that a recovery would result in such a breach and a copy of the opinion is provided to the Stock

Exchange; or

(iii) recovery would likely cause an updated to the

retirement plan for tax purposes under which benefits are widely available to the Company's employees to not meet the requirements of

26 U.S.C. 401(a)(13) or 26 U.S.C. 411 (a) and regulations contained therein.

3.7 VALIDITY

This Guideline is valid upon its publication and replaces

any agreement concluded before, during or after its validity.

www.petrobras.com.br/ir

For more information:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

| Investors Relations

email: petroinvest@petrobras.com.br/acionistas@petrobras.com.br

Av. Henrique Valadares, 28 – 19 th floor

– 20231-030 – Rio de Janeiro, RJ.

Tel.: 55 (21) 3224-1510/9947 | 0800-282-1540

This document may contain forecasts

within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities Trading

Act of 1934, as amended (Trading Act) that reflect the expectations of the Company's officers. The terms: "anticipates", "believes",

"expects", "predicts", "intends", "plans", "projects", "aims", "should,"

and similar terms, aim to identify such forecasts, which evidently involve risks or uncertainties, predicted or not by the Company. Therefore,

future results of the Company's operations may differ from current expectations, and the reader should not rely solely on the information

included herein.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: December 1, 2023

PETRÓLEO BRASILEIRO S.A–PETROBRAS

By: /s/ Sergio Caetano Leite

______________________________

Sergio Caetano Leite

Chief Financial Officer and Investor Relations

Officer

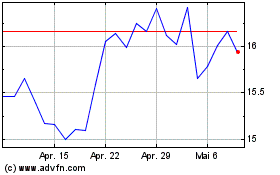

Petroleo Brasileiro ADR (NYSE:PBR.A)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

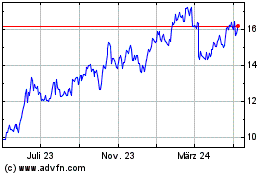

Petroleo Brasileiro ADR (NYSE:PBR.A)

Historical Stock Chart

Von Mai 2023 bis Mai 2024