Form 8-K - Current report

18 Januar 2024 - 11:10PM

Edgar (US Regulatory)

0001039684false00010396842024-01-172024-01-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

| | | | | |

| Date of report (Date of earliest event reported) | January 17, 2024 |

ONEOK, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Oklahoma | | 001-13643 | | 73-1520922 |

| (State or other jurisdiction | | (Commission | | (IRS Employer |

| of incorporation) | | File Number) | | Identification No.) |

100 West Fifth Street; Tulsa, OK

(Address of principal executive offices)

74103

(Zip code)

(918) 588-7000

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, par value of $0.01 | OKE | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.☐

The information disclosed in these Items 7.01 and 9.01, including Exhibit 99.1 hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the Exchange Act), or otherwise subject to the liabilities under that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act except as expressly set forth by specific reference in such filing.

| | | | | | | | |

| Item 7.01 | | Regulation FD Disclosure |

| | |

| | On January 17, 2024, we announced that our board of directors declared a quarterly cash dividend of 99 cents per share of common stock, an increase of 3.7% from the previous quarter, resulting in an annualized dividend of $3.96 per share. The dividend is payable February 14, 2024, to shareholders of record at the close of business January 30, 2024. A copy of the news release is attached as Exhibit 99.1 and is incorporated herein by reference.

On January 17, 2024, we announced that our board of directors authorized a $2.0 billion share repurchase program. |

| | |

| Item 8.01 | | Other Events |

| | |

| | On January 17, 2024, we announced that our board of directors declared a quarterly cash dividend of 99 cents per share of common stock, an increase of 3.7% from the previous quarter, resulting in an annualized dividend of $3.96 per share. The dividend is payable February 14, 2024, to shareholders of record at the close of business January 30, 2024.

On January 17, 2024, our board of directors authorized a share repurchase program for the repurchase of up to $2.0 billion of the our outstanding common stock. We expect for shares to be acquired from time to time in open-market transactions or through privately negotiated transactions at our discretion, subject to market conditions and other factors. The share repurchase program is effective immediately and will terminate upon completion of the repurchase of $2.0 billion of common stock, in all cases plus or minus 10 percent to allow for final share settlement, or on January 1, 2029, whichever occurs first. |

| | |

| Item 9.01 | | Financial Statements and Exhibits |

| | |

| (d) | Exhibits |

| | |

Exhibit Number | | Description |

| | |

| 99.1 | | |

| | |

| 104 | | Cover page interactive data file (embedded within the Inline XBRL document and contained in Exhibit 101). |

SIGNATURE

Pursuant to the requirements of the Exchange Act, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | | | | | | | |

| | | ONEOK, Inc. |

| | | |

| Date: | January 18, 2024 | By: | /s/ Walter S. Hulse III |

| | | Walter S. Hulse III

Chief Financial Officer, Treasurer and

Executive Vice President, Investor Relations and Corporate Development |

-more- News ONEOK Increases Quarterly Dividend and Announces Share Repurchase Program Raises Quarterly Dividend 3.7% Authorizes $2 Billion Share Repurchase Program Combination of Dividends and Share Repurchases to Target 75% to 85% of Cash Flow From Operations After Capital Expenditures TULSA, Okla. – Jan. 17, 2024 – The board of directors of ONEOK, Inc. (NYSE: OKE) today increased its quarterly dividend to 99 cents per share, an increase of 3.7%. This increase results in an annualized dividend of $3.96 per share. The dividend is payable Feb. 14, 2024, to shareholders of record at the close of business Jan. 30, 2024. For future dividend increases, ONEOK expects to target an annual dividend growth rate ranging between 3% to 4%. ONEOK’s board has also authorized a $2 billion share repurchase program and targets it to be largely utilized over the next four years. This program will complement the dividend growth rate as a key pillar of shareholder return in the future. The combination of common dividends and share repurchases is expected to trend towards a target of approximately 75% to 85% of forecasted cash flow from operations after capital expenditures over the next four years, allowing ONEOK to continue pursuing additional high-return growth opportunities, debt reduction or share repurchases. ONEOK has also opportunistically repurchased approximately $300 million of face value of its outstanding notes at a discount to par value during the fourth quarter of 2023 and finished the year with approximately $340 million of cash on hand. ONEOK remains committed to its previously stated target debt-to-EBITDA ratio of approximately 3.5 times. January 17, 2024 Analyst Contact: Megan Patterson 918-561-5325 Media Contact: Brad Borror 918-588-7582 Exhibit 99.1

ONEOK Increases Quarterly Dividend and Announces Share Repurchase Program January 17, 2024 Page 2 -more- “ONEOK is poised to generate substantial cash flow from operations in the coming years,” said Pierce H. Norton II, ONEOK president and chief executive officer. “Our commitment to capital-growth opportunities continues as our highest priority in our capital allocation strategy. This priority, combined with dividend growth and share repurchases, reinforces our commitment to maximizing total shareholder return and our belief that ONEOK represents a highly compelling investment opportunity,” added Norton. ------------------------------------------------------------------------------------------------------------------- At ONEOK (NYSE: OKE), we deliver energy products and services vital to an advancing world. We are a leading midstream operator that provides gathering, processing, fractionation, transportation and storage services. Through our more than 50,000-mile pipeline network, we transport the natural gas, natural gas liquids (NGLs), refined products and crude that help meet domestic and international energy demand, contribute to energy security and provide safe, reliable and responsible energy solutions needed today and into the future. As one of the largest diversified energy infrastructure companies in North America, ONEOK is delivering energy that makes a difference in the lives of people in the U.S. and around the world. ONEOK is an S&P 500 company headquartered in Tulsa, Oklahoma. For information about ONEOK, visit the website: www.oneok.com. For the latest news about ONEOK, find us on LinkedIn, Facebook, X and Instagram. Some of the statements contained and incorporated in this news release are forward-looking statements as defined under federal securities laws. The forward-looking statements relate to our anticipated financial performance (including projected levels of quarterly and annual dividends), liquidity, market conditions and other matters. We make these forward-looking statements in reliance on the safe harbor protections provided under federal securities laws and other applicable laws. Forward-looking statements include the items identified in the preceding paragraph, the information concerning possible or assumed future results of our operations and other statements contained or incorporated in this news release identified by words such as "anticipate," "believe," "continue," "could," "estimate," "expect," "forecast," "goal," "guidance," "intend," "may," "might," “outlook,” "plan," "potential," "project," "scheduled," "should," “target,” "will," "would" and other words and terms of similar meaning. One should not place undue reliance on forward-looking statements. Known and unknown risks, uncertainties and other factors may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by forward-looking statements. Those factors may affect our operations, markets, products, services and prices. These and other risks are described in greater detail in Item 1A, Risk Factors, in our most recent Annual Report on Form 10-K and in the other filings that we make with the Securities and Exchange Commission (SEC), which are available on the SEC’s website at www.sec.gov. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by these factors. Any such forward-looking statement speaks only as of the date on which such statement is made, and, other than as required under securities laws, we undertake no obligation to update publicly any forward-looking statement whether as a result of new information, subsequent events or change in circumstances, expectations or otherwise. ###

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

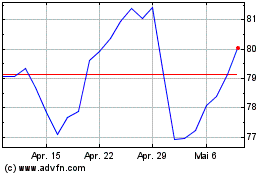

ONEOK (NYSE:OKE)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

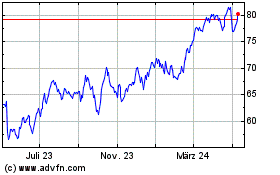

ONEOK (NYSE:OKE)

Historical Stock Chart

Von Mai 2023 bis Mai 2024